Odessa Texas Acknowledgment of Protest

Description

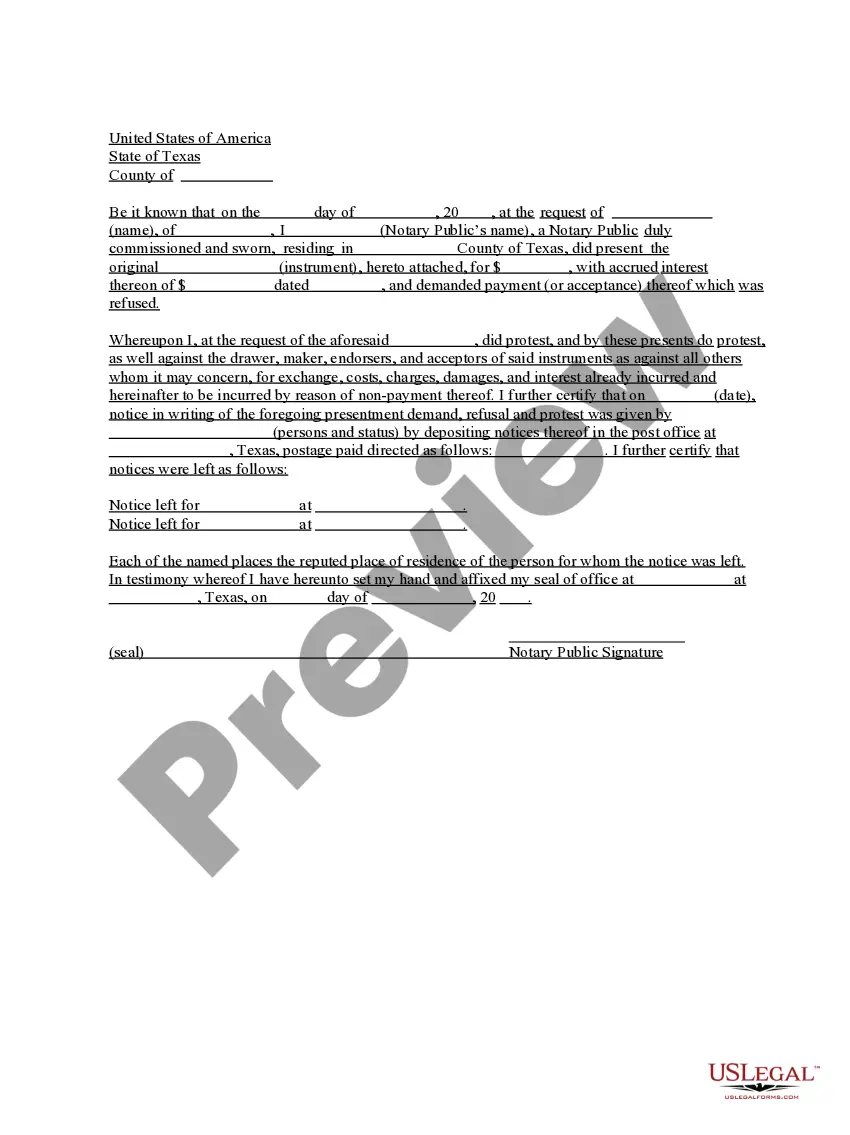

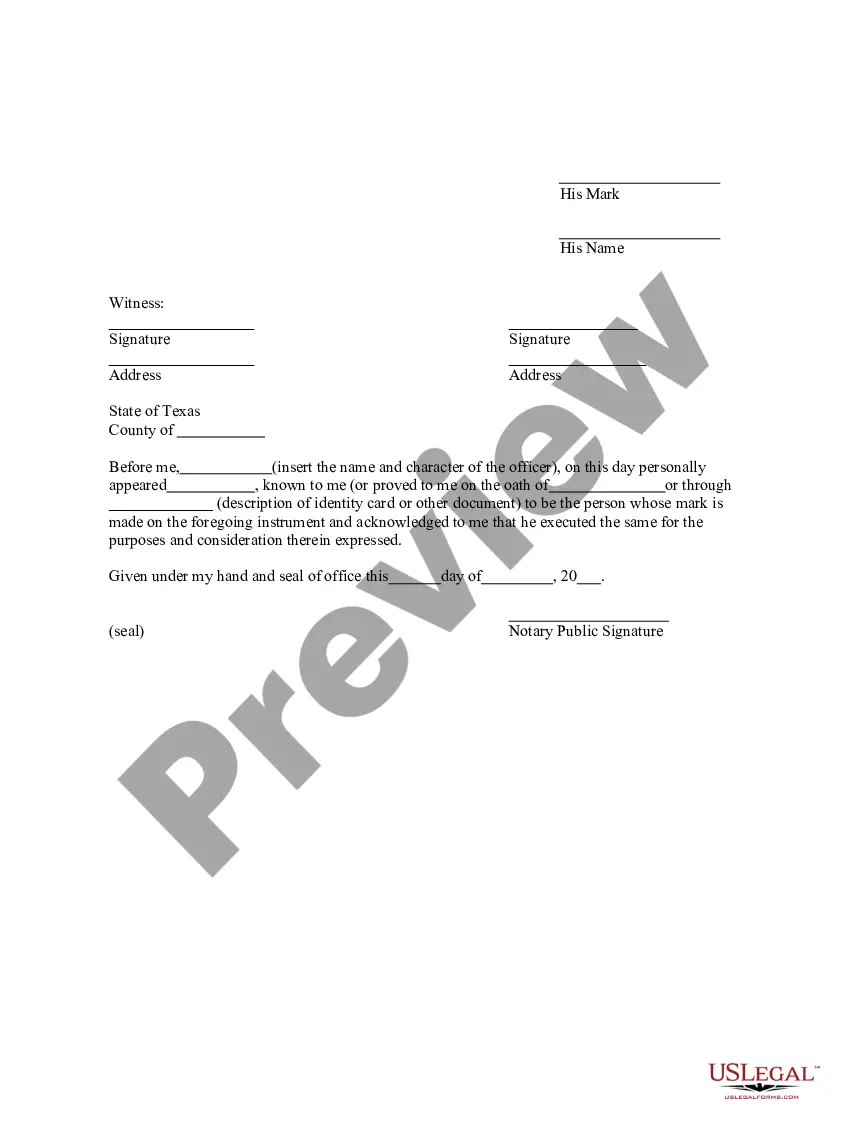

How to fill out Texas Acknowledgment Of Protest?

If you are in search of a pertinent form, it’s challenging to select a superior platform than the US Legal Forms website – arguably the most comprehensive online collections.

Here you can discover a vast array of form examples for business and personal use categorized by types and states or keywords.

With our top-notch search functionality, locating the latest Odessa Texas Acknowledgment of Protest is as simple as 1-2-3.

Complete the payment process. Use your credit card or PayPal account to finalize the registration procedure.

Obtain the template. Choose the file format and download it to your device.

- Moreover, the relevance of each document is validated by a team of professional attorneys who regularly assess the templates on our site and update them according to the latest state and county requirements.

- If you are already acquainted with our platform and possess an account, all you need to do to obtain the Odessa Texas Acknowledgment of Protest is to Log In to your user profile and click the Download button.

- If this is your first time using US Legal Forms, simply follow the instructions below.

- Ensure you have selected the form you desire. Review its details and utilize the Preview feature (if available) to examine its contents. If it does not satisfy your requirements, use the Search option at the top of the page to find the suitable document.

- Confirm your selection. Click the Buy now button. Following that, choose your preferred subscription plan and provide information to create an account.

Form popularity

FAQ

Once the deadline for filing a protest has passed in Texas, your options to contest your property taxes become limited. Unfortunately, there is no standard avenue for protesting after the deadline has passed. However, you can still seek advice on future protests or explore other options regarding your property taxes. US Legal Forms offers resources that can guide you through legitimate ways to approach your property tax concerns in the next cycle.

Yes, as a property owner in Texas, you have the right to protest your property taxes. This process ensures your voice is heard regarding your property's assessed value. By submitting the Odessa Texas Acknowledgment of Protest, you can express your concerns and seek a fair evaluation. Utilizing resources from US Legal Forms can streamline this process and empower you to make your case effectively.

The last day to file a protest in Texas typically falls on May 15, unless an extension is granted. This is a crucial date for property owners in Odessa, as the Odessa Texas Acknowledgment of Protest must be submitted by this deadline to ensure your concerns are formally heard. Knowing this timeframe helps you prepare your case and gather necessary documentation. Consider using US Legal Forms to easily file your protest.

In Texas, it's essential to act quickly if you wish to dispute your property taxes. If you have not submitted an Odessa Texas Acknowledgment of Protest by the deadline, unfortunately, your options to dispute may be limited for the current tax year. Understanding the timelines and requirements can help you avoid missing out on your opportunity. For more information, you can explore resources available on the US Legal Forms platform.

To successfully protest your property taxes in Texas, start by gathering evidence to support your claim of overvaluation. You can file an Odessa Texas Acknowledgment of Protest with your local appraisal district, outlining your reasons for challenging the assessment. Be prepared to present comparable property values and any other relevant data during the hearing. Additionally, consider utilizing platforms like US Legal Forms to access resources that can help streamline your protest process.

In Texas, you have the right to defend yourself under certain circumstances. The state's self-defense laws allow individuals to protect themselves and their property from harm. It’s crucial to understand these laws clearly, as they govern the reasonable use of force. If you are involved in a situation where you must defend yourself, make sure to follow the guidelines outlined in Texas law to avoid legal challenges.

Yes, people have a right to protest in the United States, including Texas. This right is protected under the First Amendment, which guarantees freedom of speech and assembly. However, it's important to ensure that your protest is conducted peacefully and within local regulations. If you're considering the Odessa Texas Acknowledgment of Protest, you can express your concerns effectively while following legal guidelines.

Common reasons to protest property taxes in Texas include discrepancies in assessed value, recent sales information, or changes to the property that impact its worth. If recent sales of similar properties show a lower value, this gives you a solid foundation to protest. The Odessa Texas Acknowledgment of Protest can help you express these concerns formally and effectively.

Winning a property tax protest in Texas involves presenting clear, factual evidence supporting your claim. Gather documents like appraisals, photographs, and local sales data to build your case. Using the Odessa Texas Acknowledgment of Protest correctly helps streamline this process, making it easier to assert your position before the appraisal review board.

To successfully protest property taxes in Texas, you need evidence showcasing the property’s market value. This can include recent comparable sales, photographs of your property, and any repairs or issues that may affect its value. Additionally, you can use the Odessa Texas Acknowledgment of Protest as part of your documentation to ensure your case is well-grounded.