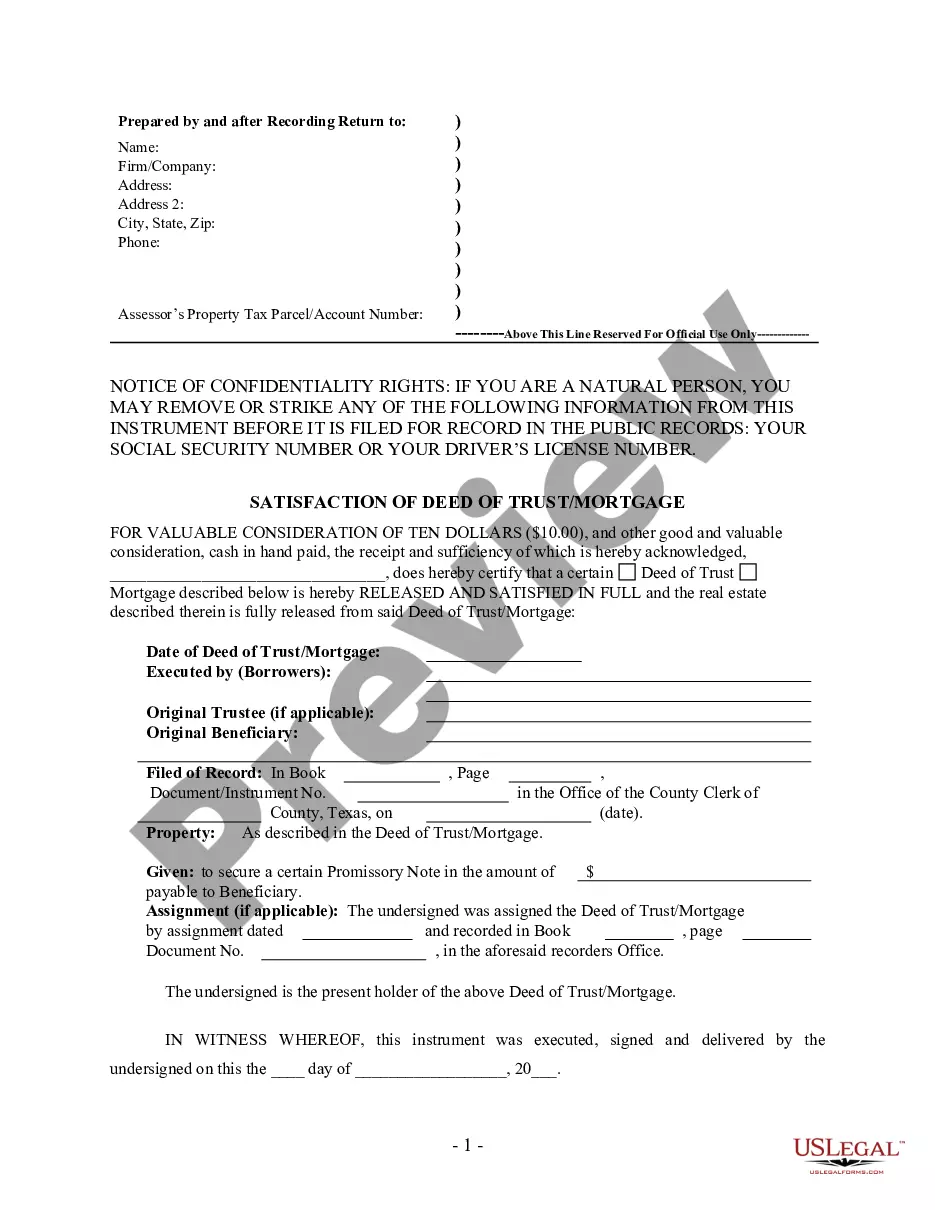

Satisfaction of Deed of Trust - Mortgage - Individual Lender or Holder

Assignments Generally: Lenders, or holders of mortgages or deeds of trust, often assign mortgages or deeds of trust to other lenders, or third parties. When this is done the assignee (person who received the assignment) steps into the place of the original lender or assignor. To effectuate an assignment, the general rules is that the assignment must be in proper written format and recorded to provide notice of the assignment.

Satisfactions Generally: Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy the mortgage or deed of trust of record to show that the mortgage or deed of trust is no longer a lien on the property. The general rule is that the satisfaction must be in proper written format and recorded to provide notice of the satisfaction. If the lender fails to record a satisfaction within set time limits, the lender may be responsible for damages set by statute for failure to timely cancel the lien. Depending on your state, a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance. Some states still recognize marginal satisfaction but this is slowly being phased out. A marginal satisfaction is where the holder of the mortgage physically goes to the recording office and enters a satisfaction on the face of the the recorded mortgage, which is attested by the clerk.

Texas Law

Recording Satisfaction: There are no provisions requiring a Texas creditor to release a fully paid debt, but if creditor fails to do so within 60 days of full payoff, a representative of a title insurance company may record an affidavit which releases the lien described in the affidavit.

Acknowledgment: An assignment or satisfaction must contain a proper Texas acknowledgment, or other acknowledgment approved by Statute.

Texas Statutes

CHAPTER 12. RECORDING OF INSTRUMENTS

Sec. 12.001. INSTRUMENTS CONCERNING PROPERTY.

(a) An instrument concerning real or personal property may be recorded if it has been acknowledged, sworn to with a proper jurat, or proved according to law.

(b) An instrument conveying real property may not be recorded unless it is signed and acknowledged or sworn to by the grantor in the presence of two or more credible subscribing witnesses or acknowledged or sworn to before and certified by an officer authorized to take acknowledgements or oaths, as applicable.

(c) This section does not require the acknowledgement or swearing or prohibit the recording of a financing statement, a security agreement filed as a financing statement, or a continuation statement filed for record under the Business Commerce Code.

(d) The failure of a notary public to attach an official seal to an acknowledgment, a jurat, or other proof taken outside this state but inside the United States or its territories renders the acknowledgment, jurat, or other proof invalid only if the jurisdiction in which the acknowledgment, jurat, or other proof is taken requires the notary public to attach the seal.

Sec. 12.009. MORTGAGE OR DEED OF TRUST MASTER FORM.

(a) A master form of a mortgage or deed of trust may be recorded in any county without acknowledgement or proof. The master form must contain on its face the designation: Master form recorded by (name of person causing the recording).

(b) The county clerk shall index a master form under the name of the person causing the recording and indicate in the index and records that the document is a master mortgage.

(c) The parties to an instrument may incorporate by reference a provision of a recorded master form with the same effect as if the provision were set out in full in the instrument. The reference must state:

(1) that the master form is recorded in the county in which the instrument is offered for record;

(2) the numbers of the book or volume and first page of the records in which the master form is recorded; and

(3) a definite identification of each provision being incorporated.

(d) If a mortgage or deed of trust incorporates by reference a provision of a master form, the mortgagee shall give the mortgagor a copy of the master form at the time the instrument is executed. A statement in the mortgage or deed of trust or in a separate instrument signed by the mortgagor that the mortgagor received a copy of the master form is conclusive evidence of its receipt. On written request the mortgagee shall give a copy of the master form without charge to the mortgagor, the mortgagor's successors in interest, or the mortgagor's or a successor's agent.

(e) The provisions of the Uniform Commercial Code prevail over this section.

12.017. TITLE INSURANCE COMPANY AFFIDAVIT AS RELEASE OF LIEN; CIVIL PENALTY.

(a) In this section:

(1) Mortgage means a deed of trust or other contract lien on an interest in real property.

(2) Mortgagee means:

(A) the grantee of a mortgage;

(B) if a mortgage has been assigned of record, the last person to whom the mortgage has been assigned of record; or

(C) if a mortgage is serviced by a mortgage servicer, the mortgage servicer.

(3) Mortgage servicer means the last person to whom a mortgagor has been instructed by a mortgagee to send payments for the loan secured by a mortgage. A person transmitting a payoff statement is considered the mortgage servicer for the mortgage described in the payoff statement.

(4) Mortgagor means the grantor of a mortgage.

(5) Payoff statement means a statement of the amount of:

(A) the unpaid balance of a loan secured by a mortgage, including principal, interest, and other charges properly assessed under the loan documentation of the mortgage; and

(B) interest on a per diem basis for the unpaid balance.

(6) Title insurance company means a corporation or other business entity authorized to engage in the business of insuring titles to interests in real property in this state.

(7) Authorized title insurance agent, with respect to an Affidavit as Release of Lien under this section, means a person licensed as a title insurance agent under Chapter 2651, Insurance Code, and authorized in writing by a title insurance company by instrument recorded in the real property records in the county in which the property to which the affidavit relates is located to execute one or more Affidavits as Release of Lien in compliance with this section, subject to any terms, limitations, and conditions that are set forth in the instrument executed by the title insurance company.

(b) This section applies only to a mortgage on:

(1) property consisting exclusively of a one-to-four-family residence, including a residential unit in a condominium regime; or

(2) property other than property described by Subdivision (1), if the original face amount of the indebtedness secured by the mortgage on the property is less than $1.5 million.

(c) An authorized officer of a title insurance company or an authorized title insurance agent may, on behalf of the mortgagor or a transferee of the mortgagor who acquired title to the property described in the mortgage, execute an affidavit that complies with the requirements of this section and record the affidavit in the real property records of each county in which the mortgage was recorded.

(d) An affidavit executed under Subsection (c) must be in substantially the following form:

AFFIDAVIT AS RELEASE OF LIEN

Before me, the undersigned authority, on this day personally appeared (insert name of affiant) (Affiant) who, being first duly sworn, upon his/her oath states:

1. My name is (insert name of Affiant), and I am an authorized officer of (insert name of title insurance company or authorized title insurance agent) (Title Company).

2. This affidavit is made on behalf of the mortgagor or a transferee of the mortgagor who acquired title to the property described in the following mortgage:

(describe mortgage, the name of the mortgagor, and the property described in the mortgage)

3. (Insert name of Mortgagee) (Mortgagee) provided a payoff statement with respect to the loan secured by the mortgage.

4. Affiant has ascertained that Title Company delivered to Mortgagee payment of the loan secured by the mortgage in the amount and time and to the location required by the payoff statement.

5. The mortgage relates to:

(A) property consisting exclusively of a one-to-four-family residence, which may include a residential unit in a condominium regime; or

(B) property, other than property described by Paragraph (A) above, for which the original face amount of the indebtedness secured by the mortgage on the property is less than $1.5 million.

6. Pursuant to Section 12.017, Texas Property Code, this affidavit constitutes a full and final release of the mortgage from the property.

Signed this___ day of ___________, ____.

__________________________________________ (signature of affiant)

State of ______________

County of _____________

Sworn to and subscribed to before me on __________ (date) by ____________ (insert name of affiant).

_________________________________ (signature of notarial officer)

(Seal, if any, of notary) __________

___________________________________________________ (printed name)

My commission expires:

______________________

(e) An affidavit filed under Subsection (c) or (f) must include the names of the mortgagor and the mortgagee, the date of the mortgage, and the volume and page or clerk's file number of the real property records where the mortgage is recorded, together with similar information for a recorded assignment of the mortgage.

(f) On or after the date of the payment to which the affidavit relates, the title insurance company or authorized title insurance agent must notify the mortgagee at the location to which the payment is sent that the title insurance company or authorized title insurance agent may file for record at any time the affidavit as a release of lien. If notice required by this section is not provided to the mortgagee, the title insurance company or authorized title insurance agent may not file for record the affidavit as a release of lien. The mortgagee may file a separate affidavit describing the mortgage and property and controverting the affidavit by the title insurance company or authorized title insurance agent as a release of lien on or before the 45th day after the date the mortgagee receives the notice if the mortgagee mails a copy of the mortgagee's affidavit to the title insurance company or authorized title insurance agent within that 45-day period.

(g) An affidavit under Subsection (c) operates as a release of the mortgage described in the affidavit if the affidavit, as provided by this section:

(1) is executed;

(2) is recorded; and

(3) is not controverted by a separate affidavit by the mortgagee in accordance with the requirements of Subsection (f).

(h) The county clerk shall index an affidavit filed under this section in the names of the original mortgagee and the last assignee of the mortgage appearing of record as the grantors and in the name of the mortgagor as grantee.

(i) A person who knowingly causes an affidavit with false information to be executed and recorded under this section is liable for the penalties for filing a false affidavit, including the penalties for commission of offenses under Section 37.02 of the Penal Code. The attorney general may sue to collect the penalty. A person who negligently causes an affidavit with false information to be executed and recorded under this section is liable to a party injured by the affidavit for actual damages. If the attorney general or an injured party bringing suit substantially prevails in an action under this subsection, the court may award reasonable attorney's fees and court costs to the prevailing party.

(j) A title insurance company or authorized title insurance agent that, at any time after payment of the mortgage, files for record an affidavit executed under Subsection (c) may use any recording fee collected for the recording of a release of the mortgage for the purpose of filing the affidavit.

(k) This section does not affect any agreement or obligation of a mortgagee to execute and deliver a release of mortgage.