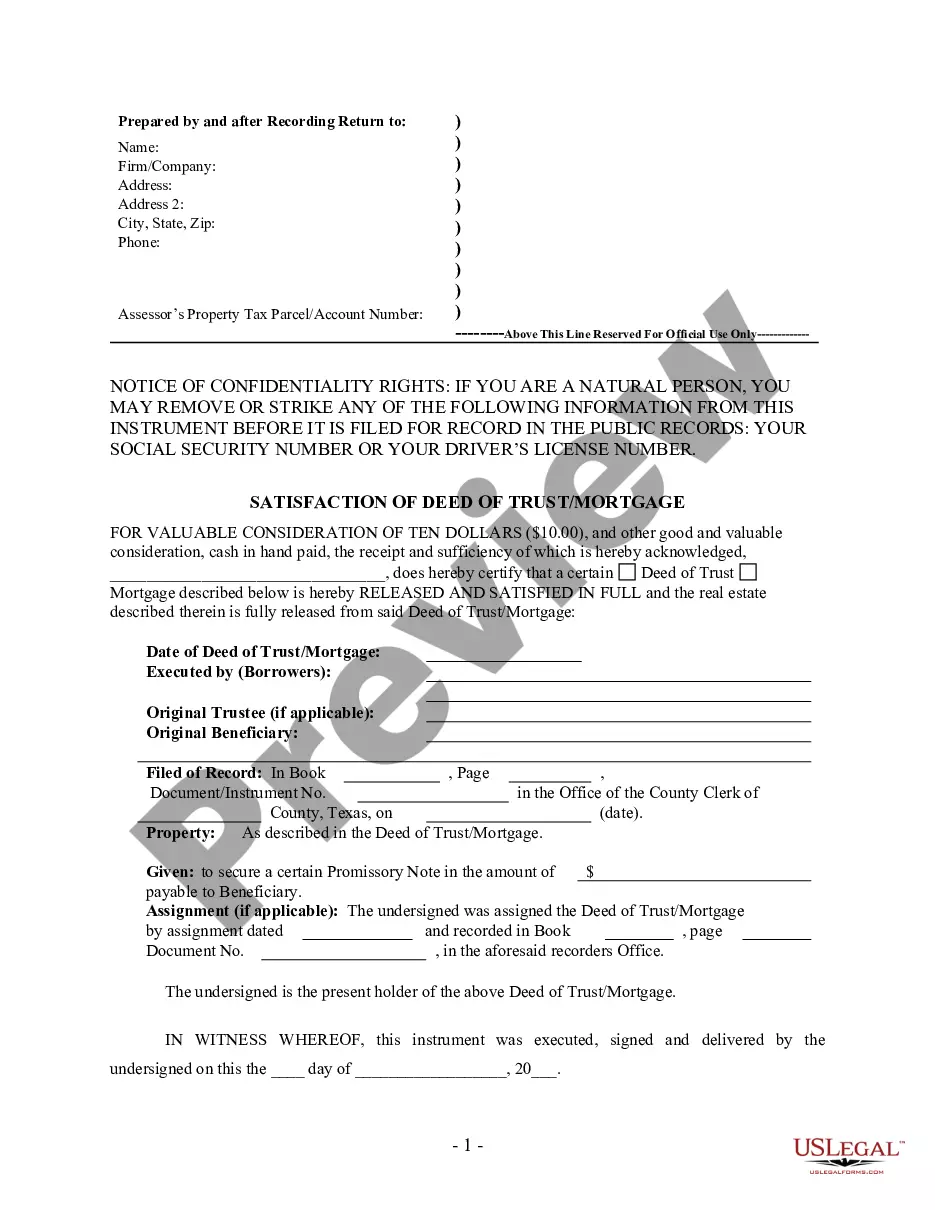

This form is for the satisfaction or release of a deed of trust for the state of Texas byan Individual. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

Killeen, Texas Satisfaction of Deed of Trust — Mortgage – Individual Lender or Holder A Satisfaction of Deed of Trust, also known as a Mortgage, refers to a legal document that acknowledges the repayment of a mortgage loan and releases the borrower from any further obligations under the terms of the original loan agreement. In Killeen, Texas, this document is used by individual lenders or holders to confirm that the debt secured by the Deed of Trust has been fully satisfied. When a borrower successfully pays off their mortgage loan in Killeen, Texas, it is crucial to file a Satisfaction of Deed of Trust with the appropriate county clerk's office. This document ensures that the property's title is clear of any liens or encumbrances resulting from the mortgage, allowing the borrower to have full ownership and providing protection to future buyers or refinances. The Satisfaction of Deed of Trust is typically completed by the individual lender or holder of the mortgage. It includes important information such as the names of the borrower and lender, the date the original Deed of Trust was executed, and details of the original loan, including the loan amount and interest rate. In Killeen, Texas, there may be different types of Satisfaction of Deed of Trust — Mortgage – Individual Lender or Holder, including: 1. Full Satisfaction: This type of Satisfaction of Deed of Trust is recorded when the borrower has fully paid off the mortgage loan, including any outstanding principal, interest, and other applicable fees. It releases the borrower from all obligations associated with the loan, and the lender or holder acknowledges that the mortgage debt has been entirely satisfied. 2. Partial Satisfaction: In some cases, a borrower may make additional payments towards the principal loan amount, effectively reducing the outstanding balance. If an individual lender or holder agrees to release the lien on a portion of the property in exchange for partial payment, a Partial Satisfaction of Deed of Trust can be filed. This document confirms the partial satisfaction of the original mortgage debt. 3. Substitution of Trustee: In certain situations, such as when a lender assigns or transfers the mortgage to another party, a Substitution of Trustee document may be required. This document states the transfer of the Deed of Trust and appoints a new trustee responsible for administering the terms of the mortgage. It is crucial to ensure the accurate completion and filing of the Satisfaction of Deed of Trust in Killeen, Texas. Any discrepancies or errors in this document could result in issues with the property's title, potentially hindering future transactions such as refinancing or selling the property. Understanding the different types of Satisfaction of Deed of Trust — Mortgage – Individual Lender or Holder can help borrowers and lenders navigate the process smoothly, providing necessary legal protection and clarity for all parties involved.Killeen, Texas Satisfaction of Deed of Trust — Mortgage – Individual Lender or Holder A Satisfaction of Deed of Trust, also known as a Mortgage, refers to a legal document that acknowledges the repayment of a mortgage loan and releases the borrower from any further obligations under the terms of the original loan agreement. In Killeen, Texas, this document is used by individual lenders or holders to confirm that the debt secured by the Deed of Trust has been fully satisfied. When a borrower successfully pays off their mortgage loan in Killeen, Texas, it is crucial to file a Satisfaction of Deed of Trust with the appropriate county clerk's office. This document ensures that the property's title is clear of any liens or encumbrances resulting from the mortgage, allowing the borrower to have full ownership and providing protection to future buyers or refinances. The Satisfaction of Deed of Trust is typically completed by the individual lender or holder of the mortgage. It includes important information such as the names of the borrower and lender, the date the original Deed of Trust was executed, and details of the original loan, including the loan amount and interest rate. In Killeen, Texas, there may be different types of Satisfaction of Deed of Trust — Mortgage – Individual Lender or Holder, including: 1. Full Satisfaction: This type of Satisfaction of Deed of Trust is recorded when the borrower has fully paid off the mortgage loan, including any outstanding principal, interest, and other applicable fees. It releases the borrower from all obligations associated with the loan, and the lender or holder acknowledges that the mortgage debt has been entirely satisfied. 2. Partial Satisfaction: In some cases, a borrower may make additional payments towards the principal loan amount, effectively reducing the outstanding balance. If an individual lender or holder agrees to release the lien on a portion of the property in exchange for partial payment, a Partial Satisfaction of Deed of Trust can be filed. This document confirms the partial satisfaction of the original mortgage debt. 3. Substitution of Trustee: In certain situations, such as when a lender assigns or transfers the mortgage to another party, a Substitution of Trustee document may be required. This document states the transfer of the Deed of Trust and appoints a new trustee responsible for administering the terms of the mortgage. It is crucial to ensure the accurate completion and filing of the Satisfaction of Deed of Trust in Killeen, Texas. Any discrepancies or errors in this document could result in issues with the property's title, potentially hindering future transactions such as refinancing or selling the property. Understanding the different types of Satisfaction of Deed of Trust — Mortgage – Individual Lender or Holder can help borrowers and lenders navigate the process smoothly, providing necessary legal protection and clarity for all parties involved.