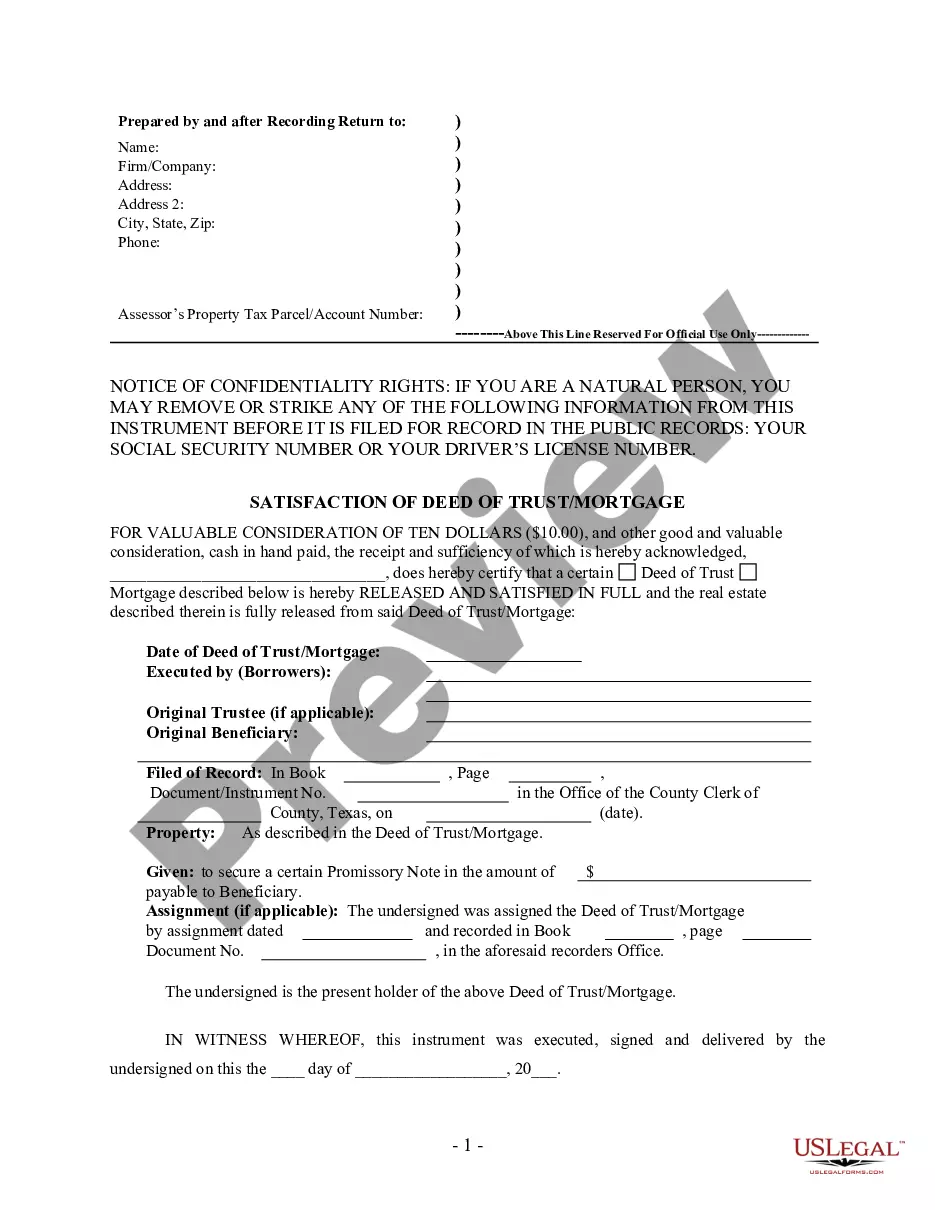

This form is for the satisfaction or release of a deed of trust for the state of Texas byan Individual. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

Title: Understanding Laredo Texas Satisfaction of Deed of Trust Mortgageag— - Individual Lender or Holder Introduction: Laredo, Texas, is known for its vibrant real estate market, and if you're involved in buying or selling property, understanding the intricacies of legal documents such as the Satisfaction of Deed of Trust Mortgageag— - Individual Lender or Holder is crucial. In this article, we will delve into the details of this document, aiming to provide you with a comprehensive overview. Let's explore the purpose, components, and potential variations of the Laredo Texas Satisfaction of Deed of Trust Mortgageag— - Individual Lender or Holder. 1. Purpose: The Satisfaction of Deed of Trust Mortgageag— - Individual Lender or Holder plays a critical role in real estate transactions involving an individual lender or holder. It serves as evidence that the borrower, also referred to as the trust or, has completely repaid the loan secured by the property. This document releases the lien on the property, providing a clear title to the borrower. 2. Components: The Laredo Texas Satisfaction of Deed of Trust Mortgageag— - Individual Lender or Holder consists of several essential elements. These typically include: a) Identification details: The document begins by identifying the parties involved, namely the borrower (trust or) and the lender or holder (individual entity). b) Property details: Clear description of the property being released from the mortgage lien, including address, legal description, and any specific details required for identification. c) Loan information: Detailed information about the loan, including the original loan amount, execution date, maturity date, and any other relevant terms. d) Certification: The document includes a certification section, usually requiring the signature of the lender or holder, affirming that the loan has been satisfied in full. e) Notarization: To ensure the legality of the document, it is typically notarized and signed by an authorized notary public. 3. Types of Laredo Texas Satisfaction of Deed of Trust Mortgageag— - Individual Lender or Holder: While there may not be different types of Satisfaction of Deed of Trust Mortgageag— - Individual Lender or Holder specific to Laredo, Texas, variations may exist based on specific requirements. Some possible variations include: a) Satisfaction of Deed of Trust Mortgageag— - Individual Lender: This is a common type where an individual lender (not a financial institution) holds the mortgage and is the recipient of the satisfied deed of trust. b) Satisfaction of Deed of Trust Mortgageag— - Individual Holder: In some cases, the individual holding the mortgage may not be the original lender but a subsequent assignee who has taken over the mortgage. Conclusion: A thorough understanding of the Laredo Texas Satisfaction of Deed of Trust Mortgageag— - Individual Lender or Holder is essential for smooth real estate transactions. This document acts as proof that the borrower has satisfied their loan, lifting the mortgage lien from the property. By being aware of its purpose, components, and potential variations, buyers, sellers, and lenders in Laredo, Texas can ensure a legally compliant and transparent real estate process.Title: Understanding Laredo Texas Satisfaction of Deed of Trust Mortgageag— - Individual Lender or Holder Introduction: Laredo, Texas, is known for its vibrant real estate market, and if you're involved in buying or selling property, understanding the intricacies of legal documents such as the Satisfaction of Deed of Trust Mortgageag— - Individual Lender or Holder is crucial. In this article, we will delve into the details of this document, aiming to provide you with a comprehensive overview. Let's explore the purpose, components, and potential variations of the Laredo Texas Satisfaction of Deed of Trust Mortgageag— - Individual Lender or Holder. 1. Purpose: The Satisfaction of Deed of Trust Mortgageag— - Individual Lender or Holder plays a critical role in real estate transactions involving an individual lender or holder. It serves as evidence that the borrower, also referred to as the trust or, has completely repaid the loan secured by the property. This document releases the lien on the property, providing a clear title to the borrower. 2. Components: The Laredo Texas Satisfaction of Deed of Trust Mortgageag— - Individual Lender or Holder consists of several essential elements. These typically include: a) Identification details: The document begins by identifying the parties involved, namely the borrower (trust or) and the lender or holder (individual entity). b) Property details: Clear description of the property being released from the mortgage lien, including address, legal description, and any specific details required for identification. c) Loan information: Detailed information about the loan, including the original loan amount, execution date, maturity date, and any other relevant terms. d) Certification: The document includes a certification section, usually requiring the signature of the lender or holder, affirming that the loan has been satisfied in full. e) Notarization: To ensure the legality of the document, it is typically notarized and signed by an authorized notary public. 3. Types of Laredo Texas Satisfaction of Deed of Trust Mortgageag— - Individual Lender or Holder: While there may not be different types of Satisfaction of Deed of Trust Mortgageag— - Individual Lender or Holder specific to Laredo, Texas, variations may exist based on specific requirements. Some possible variations include: a) Satisfaction of Deed of Trust Mortgageag— - Individual Lender: This is a common type where an individual lender (not a financial institution) holds the mortgage and is the recipient of the satisfied deed of trust. b) Satisfaction of Deed of Trust Mortgageag— - Individual Holder: In some cases, the individual holding the mortgage may not be the original lender but a subsequent assignee who has taken over the mortgage. Conclusion: A thorough understanding of the Laredo Texas Satisfaction of Deed of Trust Mortgageag— - Individual Lender or Holder is essential for smooth real estate transactions. This document acts as proof that the borrower has satisfied their loan, lifting the mortgage lien from the property. By being aware of its purpose, components, and potential variations, buyers, sellers, and lenders in Laredo, Texas can ensure a legally compliant and transparent real estate process.