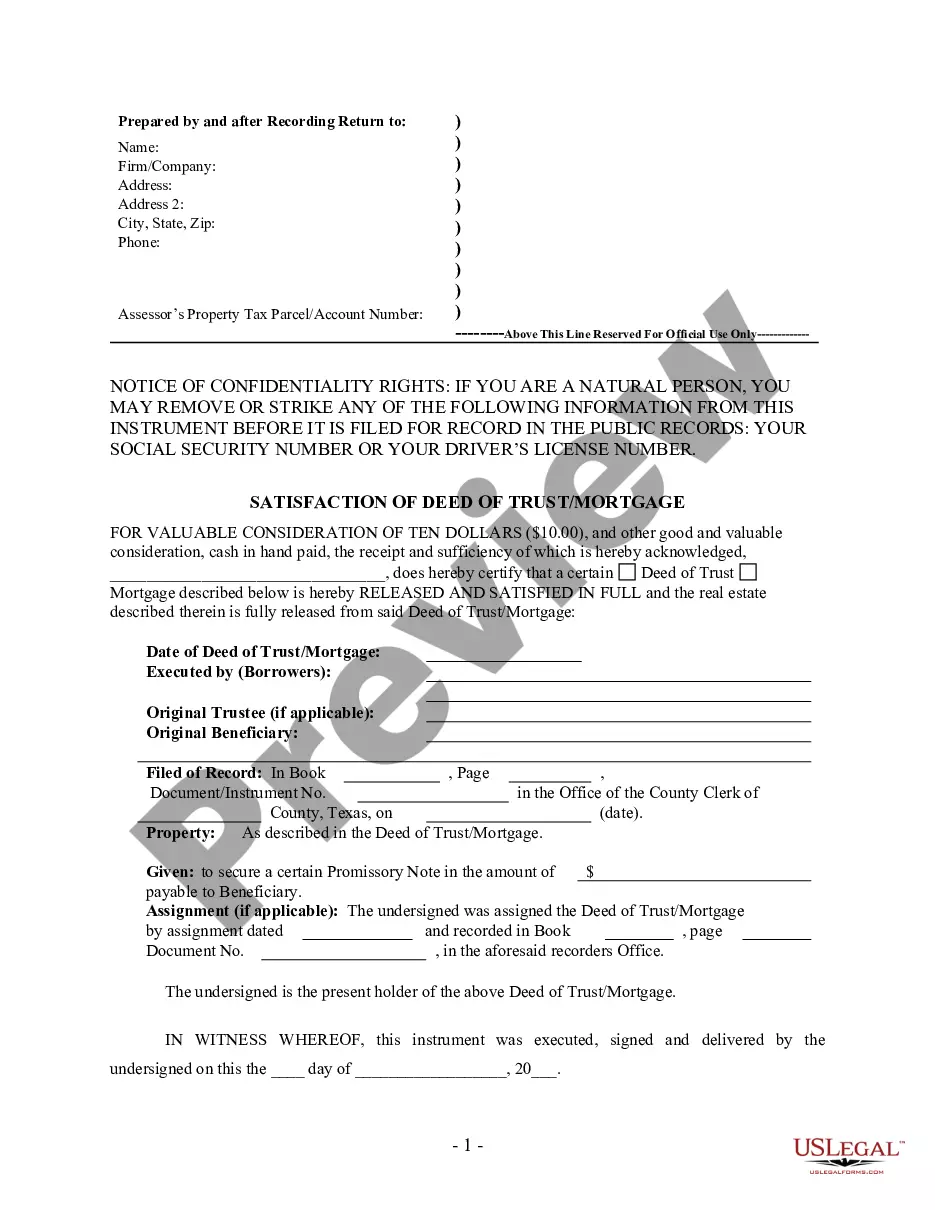

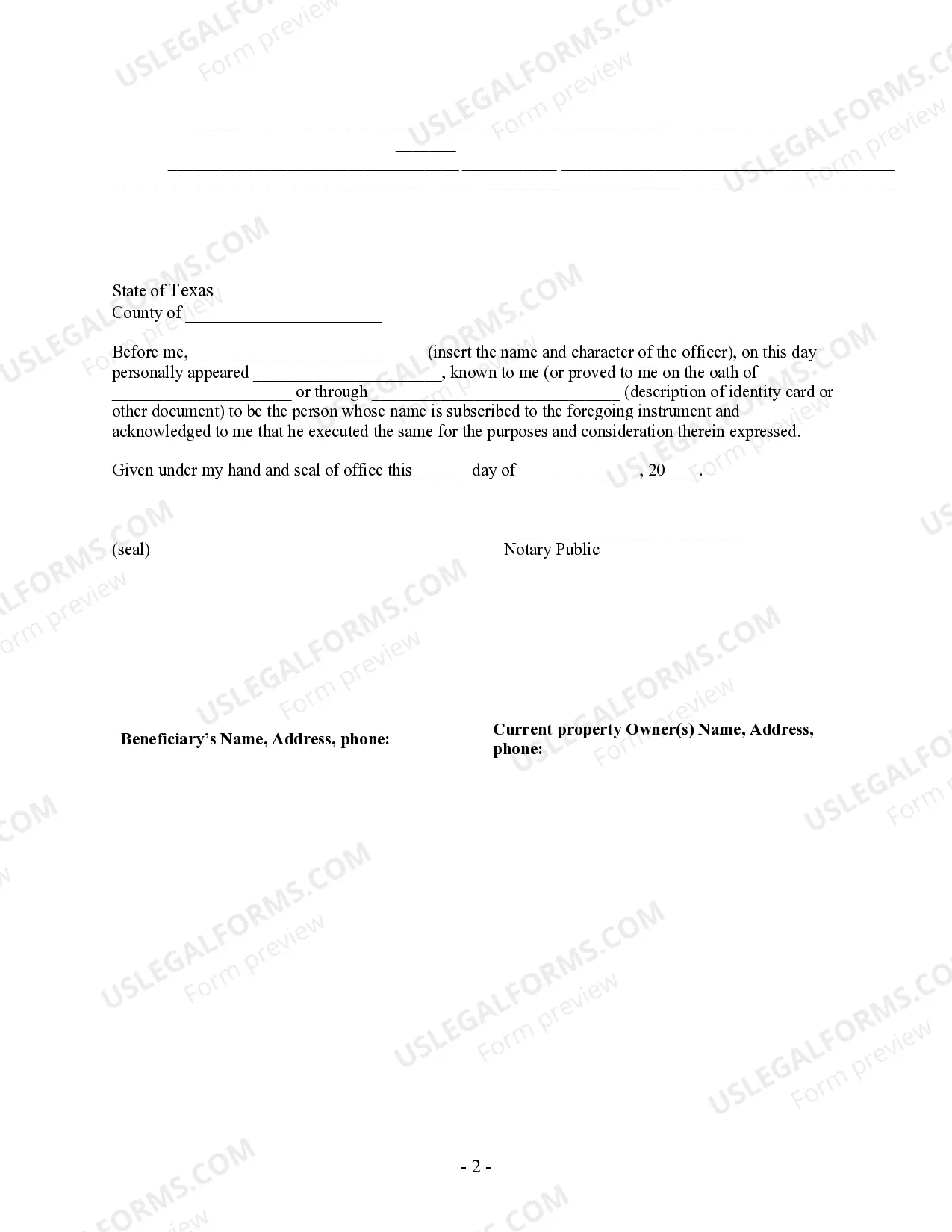

This form is for the satisfaction or release of a deed of trust for the state of Texas byan Individual. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

Title: Understanding the Odessa Texas Satisfaction of Deed of Trust Mortgageag— - Individual Lender or Holder Introduction: The Odessa Texas Satisfaction of Deed of Trust Mortgageag— - Individual Lender or Holder is a crucial legal document that signifies the release of a mortgage and satisfaction of the underlying debt for a property located in Odessa, Texas. This document is typically executed by an individual lender or holder upon completion of mortgage repayment or other agreed-upon conditions. Let's delve deeper into the various aspects of this important document. Key Terms and Definitions: 1. Satisfaction of Deed of Trust: It refers to the legal process through which a mortgage is paid off, releasing the claim/rights of the lender or holder on the property. 2. Individual Lender or Holder: This refers to a private individual or entity who provides funds or extends a loan to a borrower, secure by a mortgage on the property in Odessa, Texas. Types of Odessa Texas Satisfaction of Deed of Trust Mortgageag— - Individual Lender or Holder: 1. Full Satisfaction: This type of satisfaction of deed of trust occurs when the borrower fulfills the entire mortgage repayment, complying with all the terms and conditions outlined in the loan agreement. 2. Partial Satisfaction: If the borrower makes partial payments towards the debt and requests a release of a portion of the property, the individual lender or holder may execute a partial satisfaction of the deed of trust. 3. Due-On-Sale Satisfaction: In cases where the borrower transfers the property to a new owner through a sale or transfer, the individual lender or holder may execute a due-on-sale satisfaction of the deed of trust. 4. Loan Modification Satisfaction: If the borrower and the individual lender or holder agree upon a modification of the original loan terms, such as interest rate or repayment period, a loan modification satisfaction of the deed of trust is executed. 5. Deed in Lieu of Foreclosure Satisfaction: In situations where a borrower is unable to repay the loan and voluntarily transfers the property to the individual lender or holder to avoid foreclosure, the satisfaction of the deed of trust is executed. Importance and Process: The Odessa Texas Satisfaction of Deed of Trust Mortgageag— - Individual Lender or Holder is crucial for both the borrower and the lender/holder. It releases the borrower from the mortgage obligation, allowing them to claim full ownership of the property, while also protecting the lender/holder's rights. To execute the Satisfaction of Deed of Trust, the individual lender or holder typically reviews the mortgage repayment records, verifies that all obligations have been met, and prepares the necessary documentation. This may involve drafting a satisfaction document, getting it notarized, and recording it with the appropriate authority, such as the county clerk's office in Odessa, Texas. Conclusion: The Odessa Texas Satisfaction of Deed of Trust Mortgageag— - Individual Lender or Holder is a legal document that signifies the release of a mortgage and the satisfaction of the underlying debt. Understanding the different types and the process involved allows both the borrower and the individual lender or holder to navigate the requirements efficiently. It is essential to ensure proper completion of this document to safeguard the interests of all parties involved in the mortgage transaction.Title: Understanding the Odessa Texas Satisfaction of Deed of Trust Mortgageag— - Individual Lender or Holder Introduction: The Odessa Texas Satisfaction of Deed of Trust Mortgageag— - Individual Lender or Holder is a crucial legal document that signifies the release of a mortgage and satisfaction of the underlying debt for a property located in Odessa, Texas. This document is typically executed by an individual lender or holder upon completion of mortgage repayment or other agreed-upon conditions. Let's delve deeper into the various aspects of this important document. Key Terms and Definitions: 1. Satisfaction of Deed of Trust: It refers to the legal process through which a mortgage is paid off, releasing the claim/rights of the lender or holder on the property. 2. Individual Lender or Holder: This refers to a private individual or entity who provides funds or extends a loan to a borrower, secure by a mortgage on the property in Odessa, Texas. Types of Odessa Texas Satisfaction of Deed of Trust Mortgageag— - Individual Lender or Holder: 1. Full Satisfaction: This type of satisfaction of deed of trust occurs when the borrower fulfills the entire mortgage repayment, complying with all the terms and conditions outlined in the loan agreement. 2. Partial Satisfaction: If the borrower makes partial payments towards the debt and requests a release of a portion of the property, the individual lender or holder may execute a partial satisfaction of the deed of trust. 3. Due-On-Sale Satisfaction: In cases where the borrower transfers the property to a new owner through a sale or transfer, the individual lender or holder may execute a due-on-sale satisfaction of the deed of trust. 4. Loan Modification Satisfaction: If the borrower and the individual lender or holder agree upon a modification of the original loan terms, such as interest rate or repayment period, a loan modification satisfaction of the deed of trust is executed. 5. Deed in Lieu of Foreclosure Satisfaction: In situations where a borrower is unable to repay the loan and voluntarily transfers the property to the individual lender or holder to avoid foreclosure, the satisfaction of the deed of trust is executed. Importance and Process: The Odessa Texas Satisfaction of Deed of Trust Mortgageag— - Individual Lender or Holder is crucial for both the borrower and the lender/holder. It releases the borrower from the mortgage obligation, allowing them to claim full ownership of the property, while also protecting the lender/holder's rights. To execute the Satisfaction of Deed of Trust, the individual lender or holder typically reviews the mortgage repayment records, verifies that all obligations have been met, and prepares the necessary documentation. This may involve drafting a satisfaction document, getting it notarized, and recording it with the appropriate authority, such as the county clerk's office in Odessa, Texas. Conclusion: The Odessa Texas Satisfaction of Deed of Trust Mortgageag— - Individual Lender or Holder is a legal document that signifies the release of a mortgage and the satisfaction of the underlying debt. Understanding the different types and the process involved allows both the borrower and the individual lender or holder to navigate the requirements efficiently. It is essential to ensure proper completion of this document to safeguard the interests of all parties involved in the mortgage transaction.