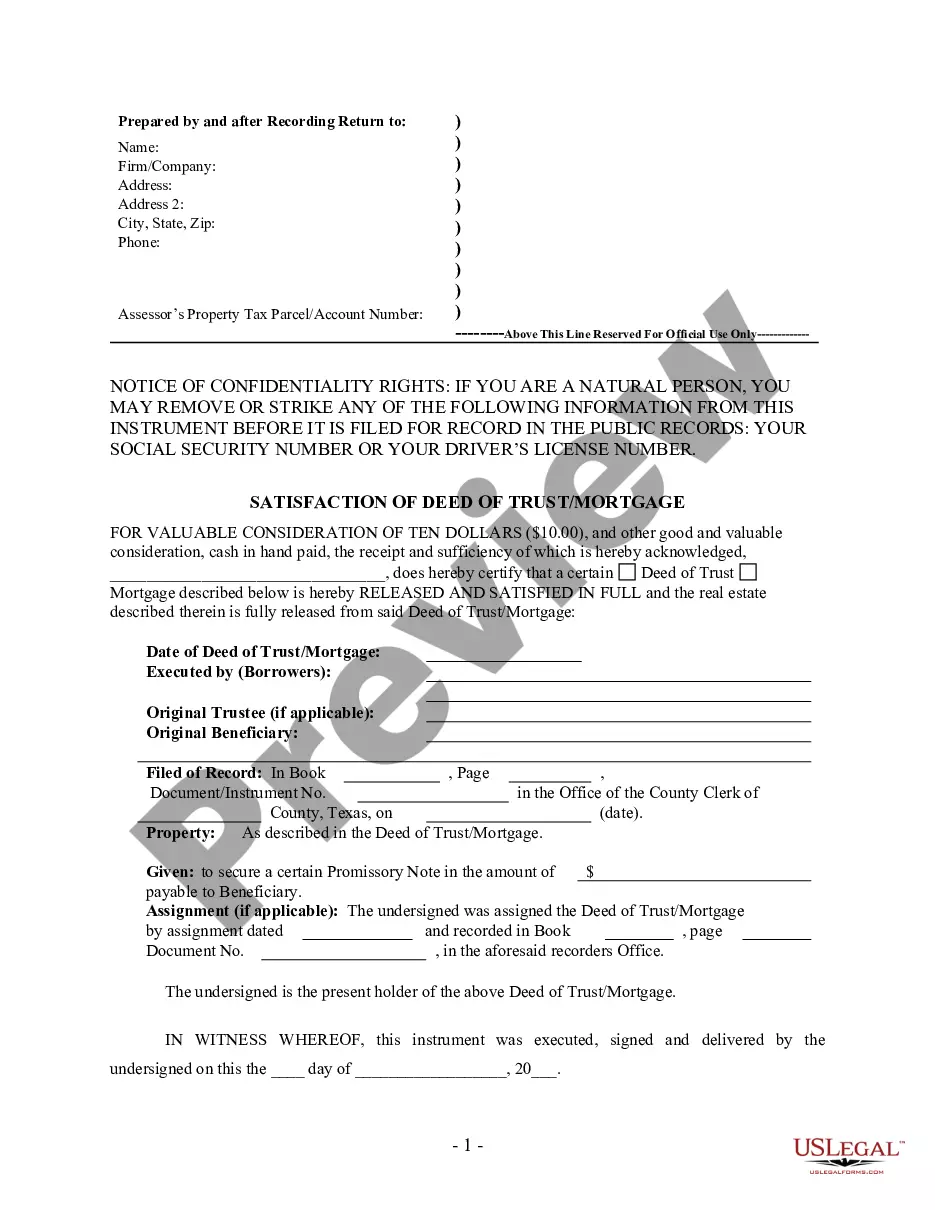

This form is for the satisfaction or release of a deed of trust for the state of Texas byan Individual. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

Title: Comprehensive Guide to Sugar Land Texas Satisfaction of Deed of Trust — Mortgage – Individual Lender or Holder Introduction: A Satisfaction of Deed of Trust, also known as a Satisfaction of Mortgage, is an essential legal document that serves as evidence of the full repayment of a mortgage loan. In Sugar Land, Texas, these satisfactions can be executed by individual lenders or holders. This article aims to provide a detailed description of Sugar Land Texas Satisfaction of Deed of Trust — Mortgage – Individual Lender or Holder, shedding light on its significance and potential variations. Keywords: Sugar Land Texas, Satisfaction of Deed of Trust, Mortgage, Individual Lender, Holder, Repayment, Legal Document, Variations. I. Understanding the Sugar Land Texas Satisfaction of Deed of Trust — Mortgage – Individual Lender or Holder 1. Definition: The Satisfaction of Deed of Trust is a legal document that verifies a mortgage loan's complete repayment, releasing the borrower from any further obligations or liens on the property. 2. Importance: This document acts as proof to the public that the property's debt has been cleared, facilitating future property transactions without any encumbrance. II. Types of Sugar Land Texas Satisfaction of Deed of Trust — Mortgage – Individual Lender or Holder 1. Individual Lender: When an individual loans money to a borrower without involving a formal lending institution, such as private lenders or family members, they can execute the satisfaction of deed of trust themselves. 2. Individual Holder: In certain cases where a mortgage loan has been sold or assigned to an individual holder, this individual holder can issue the satisfaction of deed of trust upon mortgage repayment. III. Process of Executing Sugar Land Texas Satisfaction of Deed of Trust — Mortgage – Individual Lender or Holder 1. Verification of Repayment: The lender or holder must ensure that the borrower has fully repaid the mortgage debt, adhering to the agreed-upon terms and conditions. 2. Prepare the Satisfaction Document: Drafting the Satisfaction of Deed of Trust document, including specific details such as parties involved, loan information, recording data, and legal descriptions. 3. Notarization: The document is signed by the lender or holder in the presence of a notary public, who verifies their identity and acknowledges their signature. 4. Filing with the County Clerk: The original satisfaction document is filed with the county clerk's office where the original deed of trust was recorded. This officially releases the lien on the property. 5. Copy Distribution: Copies of the satisfaction document should be provided to the borrower, county recorder's office, and any other relevant parties involved. IV. Benefits and Implications 1. Enhanced Property Marketability: A satisfaction of deed of trust ensures the property's marketability by removing any associated liens and encumbrances. 2. Legal Protection: It shields both parties, lenders, and borrowers, from any disputes or confusion by having a formal acknowledgment of the mortgage debt's satisfaction. Conclusion: In Sugar Land, Texas, the Satisfaction of Deed of Trust — Mortgage – Individual Lender or Holder plays a crucial role in finalizing mortgage loan repayments. Whether executed by an individual lender or holder, this legal document holds significant importance for all involved parties. By familiarizing oneself with the process and variations of this document, borrowers and lenders can ensure a smooth transition of property ownership and avoid any future complications.Title: Comprehensive Guide to Sugar Land Texas Satisfaction of Deed of Trust — Mortgage – Individual Lender or Holder Introduction: A Satisfaction of Deed of Trust, also known as a Satisfaction of Mortgage, is an essential legal document that serves as evidence of the full repayment of a mortgage loan. In Sugar Land, Texas, these satisfactions can be executed by individual lenders or holders. This article aims to provide a detailed description of Sugar Land Texas Satisfaction of Deed of Trust — Mortgage – Individual Lender or Holder, shedding light on its significance and potential variations. Keywords: Sugar Land Texas, Satisfaction of Deed of Trust, Mortgage, Individual Lender, Holder, Repayment, Legal Document, Variations. I. Understanding the Sugar Land Texas Satisfaction of Deed of Trust — Mortgage – Individual Lender or Holder 1. Definition: The Satisfaction of Deed of Trust is a legal document that verifies a mortgage loan's complete repayment, releasing the borrower from any further obligations or liens on the property. 2. Importance: This document acts as proof to the public that the property's debt has been cleared, facilitating future property transactions without any encumbrance. II. Types of Sugar Land Texas Satisfaction of Deed of Trust — Mortgage – Individual Lender or Holder 1. Individual Lender: When an individual loans money to a borrower without involving a formal lending institution, such as private lenders or family members, they can execute the satisfaction of deed of trust themselves. 2. Individual Holder: In certain cases where a mortgage loan has been sold or assigned to an individual holder, this individual holder can issue the satisfaction of deed of trust upon mortgage repayment. III. Process of Executing Sugar Land Texas Satisfaction of Deed of Trust — Mortgage – Individual Lender or Holder 1. Verification of Repayment: The lender or holder must ensure that the borrower has fully repaid the mortgage debt, adhering to the agreed-upon terms and conditions. 2. Prepare the Satisfaction Document: Drafting the Satisfaction of Deed of Trust document, including specific details such as parties involved, loan information, recording data, and legal descriptions. 3. Notarization: The document is signed by the lender or holder in the presence of a notary public, who verifies their identity and acknowledges their signature. 4. Filing with the County Clerk: The original satisfaction document is filed with the county clerk's office where the original deed of trust was recorded. This officially releases the lien on the property. 5. Copy Distribution: Copies of the satisfaction document should be provided to the borrower, county recorder's office, and any other relevant parties involved. IV. Benefits and Implications 1. Enhanced Property Marketability: A satisfaction of deed of trust ensures the property's marketability by removing any associated liens and encumbrances. 2. Legal Protection: It shields both parties, lenders, and borrowers, from any disputes or confusion by having a formal acknowledgment of the mortgage debt's satisfaction. Conclusion: In Sugar Land, Texas, the Satisfaction of Deed of Trust — Mortgage – Individual Lender or Holder plays a crucial role in finalizing mortgage loan repayments. Whether executed by an individual lender or holder, this legal document holds significant importance for all involved parties. By familiarizing oneself with the process and variations of this document, borrowers and lenders can ensure a smooth transition of property ownership and avoid any future complications.