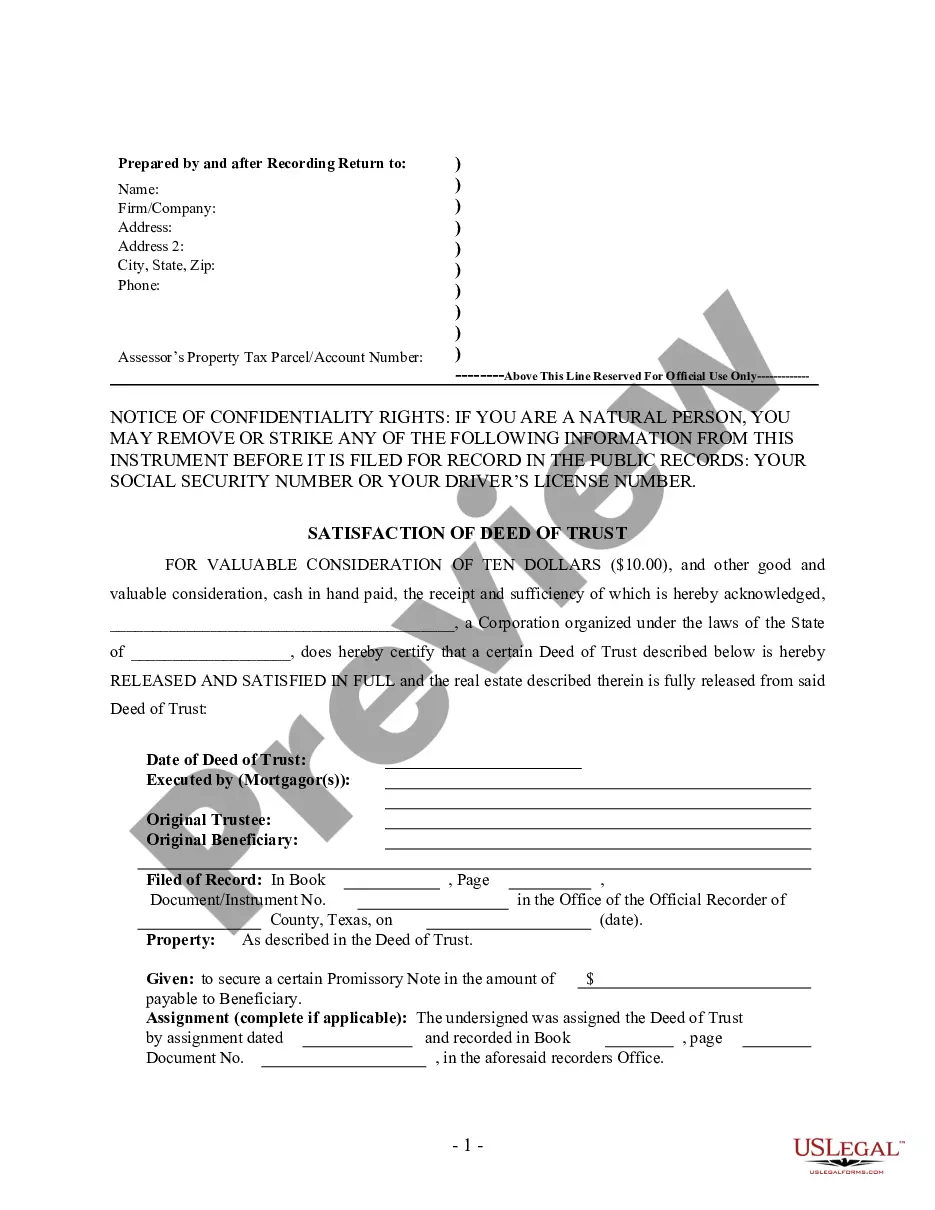

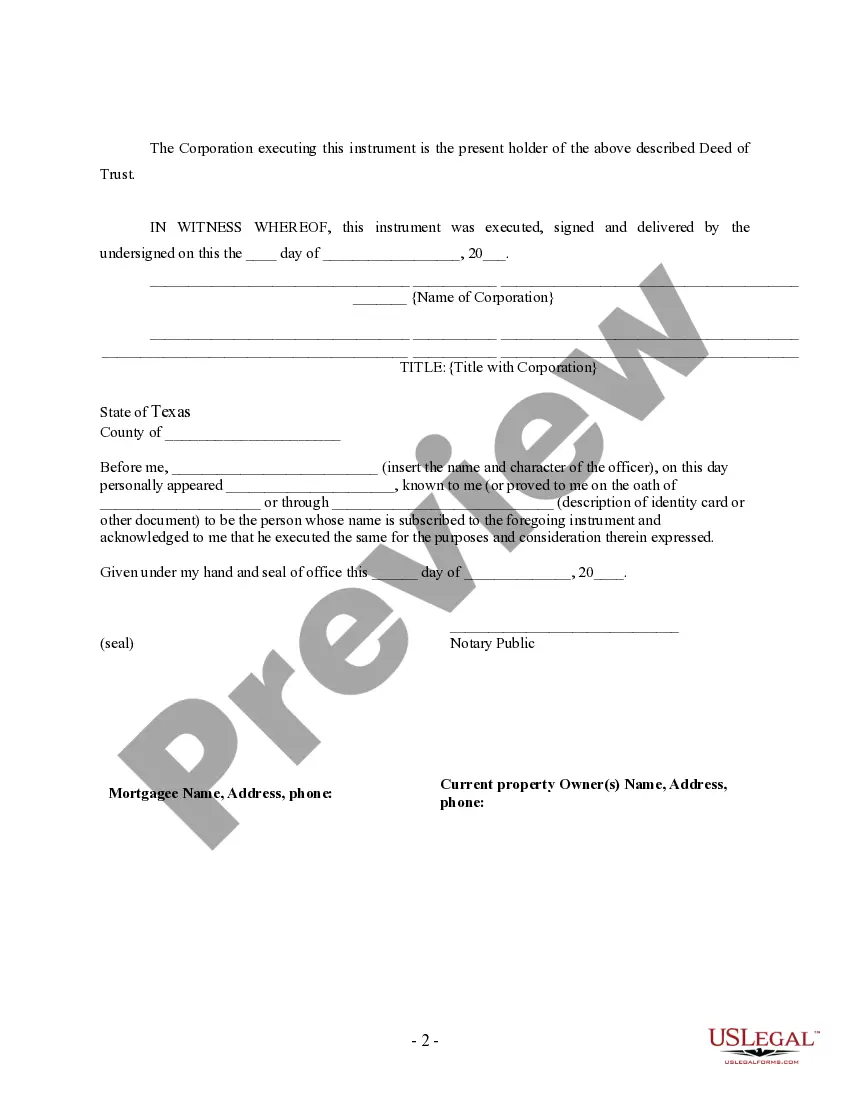

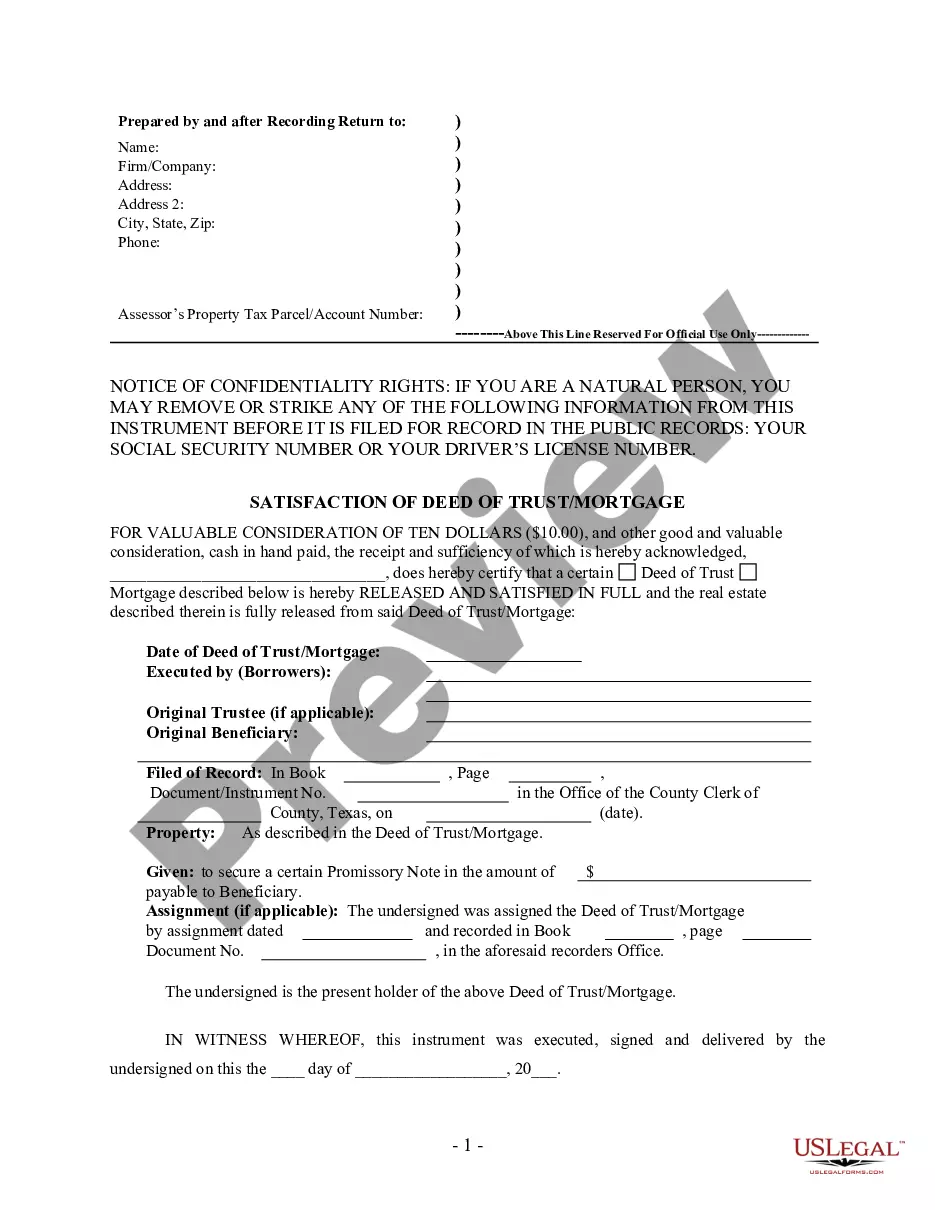

This Release - Satisfaction - Cancellation Deed of Trust - by Corporate Lender is for the satisfaction or release of a mortgage for the state of Texas by a Corporation. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

Title: Brownsville Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender Keywords: Brownsville Texas, satisfaction of deed of trust, mortgage, corporate lender, types Introduction: A Brownsville Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender is a legal document that signifies the complete repayment and satisfaction of a mortgage loan by a corporate lender in Brownsville, Texas. This document is essential for borrowers as it officially releases them from their mortgage obligations and restores full ownership rights to the property. There can be variations of this document, including different types based on specific circumstances. Here, we will explore the main features and importance of a Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender in Brownsville, Texas. 1. Purpose of a Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender: This document serves as unequivocal proof that the mortgage loan has been fully repaid to the corporate lender. It officially releases the borrower from any further payment obligations associated with the mortgage and re-establishes their full ownership rights over the property. 2. Acknowledgment of Payment: The Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender acknowledges that the borrower has fulfilled the terms of the mortgage agreement and fully paid off their debt. This acknowledgment is conveyed by the corporate lender to the relevant authorities, including public land records offices, to update the property's ownership status. 3. Lien Release and Legal Effect: By recording the Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender with the appropriate governmental agency, any liens or claims held against the property are released. This ensures that the property is free of any encumbrances relating to the mortgage, establishing clear ownership for the borrower. 4. Different Types of Brownsville Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender: a) Partial Satisfaction: This type of satisfaction is used when a borrower pays off a portion of the mortgage but still maintains a loan balance. It releases the lien on the property for the partial amount paid, enabling the borrower to exercise certain rights associated with that portion of the loan. b) Full Satisfaction: A full satisfaction is issued when the borrower has successfully repaid the entire mortgage balance. It absolves the borrower from further obligations and eliminates any liens, fully restoring their property rights. c) Subordinate Satisfaction: This type of satisfaction is utilized when a secondary lender or lien holder agrees to release their claim to the property. It implies that the primary mortgage has been fully satisfied, allowing the borrower to control the property without any outstanding encumbrances. Conclusion: A Brownsville Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender is a significant legal document that outlines the complete repayment and release of a mortgage loan by a corporate lender in Brownsville, Texas. It serves to officially release the borrower from their mortgage obligations and re-establish their complete ownership rights over the property. Different types of satisfactions may exist, such as partial satisfaction, full satisfaction, and subordinate satisfaction, depending on specific conditions.Title: Brownsville Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender Keywords: Brownsville Texas, satisfaction of deed of trust, mortgage, corporate lender, types Introduction: A Brownsville Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender is a legal document that signifies the complete repayment and satisfaction of a mortgage loan by a corporate lender in Brownsville, Texas. This document is essential for borrowers as it officially releases them from their mortgage obligations and restores full ownership rights to the property. There can be variations of this document, including different types based on specific circumstances. Here, we will explore the main features and importance of a Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender in Brownsville, Texas. 1. Purpose of a Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender: This document serves as unequivocal proof that the mortgage loan has been fully repaid to the corporate lender. It officially releases the borrower from any further payment obligations associated with the mortgage and re-establishes their full ownership rights over the property. 2. Acknowledgment of Payment: The Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender acknowledges that the borrower has fulfilled the terms of the mortgage agreement and fully paid off their debt. This acknowledgment is conveyed by the corporate lender to the relevant authorities, including public land records offices, to update the property's ownership status. 3. Lien Release and Legal Effect: By recording the Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender with the appropriate governmental agency, any liens or claims held against the property are released. This ensures that the property is free of any encumbrances relating to the mortgage, establishing clear ownership for the borrower. 4. Different Types of Brownsville Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender: a) Partial Satisfaction: This type of satisfaction is used when a borrower pays off a portion of the mortgage but still maintains a loan balance. It releases the lien on the property for the partial amount paid, enabling the borrower to exercise certain rights associated with that portion of the loan. b) Full Satisfaction: A full satisfaction is issued when the borrower has successfully repaid the entire mortgage balance. It absolves the borrower from further obligations and eliminates any liens, fully restoring their property rights. c) Subordinate Satisfaction: This type of satisfaction is utilized when a secondary lender or lien holder agrees to release their claim to the property. It implies that the primary mortgage has been fully satisfied, allowing the borrower to control the property without any outstanding encumbrances. Conclusion: A Brownsville Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender is a significant legal document that outlines the complete repayment and release of a mortgage loan by a corporate lender in Brownsville, Texas. It serves to officially release the borrower from their mortgage obligations and re-establish their complete ownership rights over the property. Different types of satisfactions may exist, such as partial satisfaction, full satisfaction, and subordinate satisfaction, depending on specific conditions.