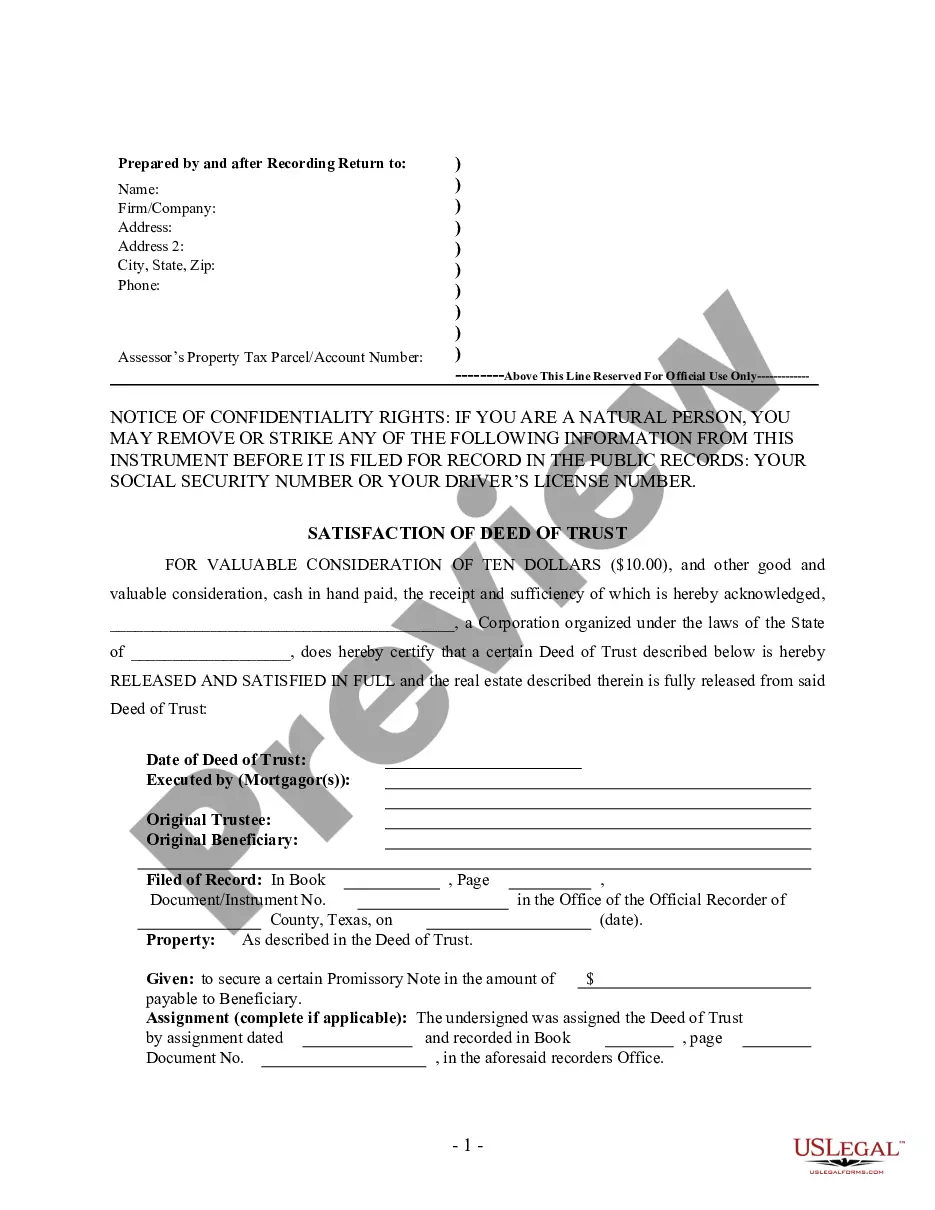

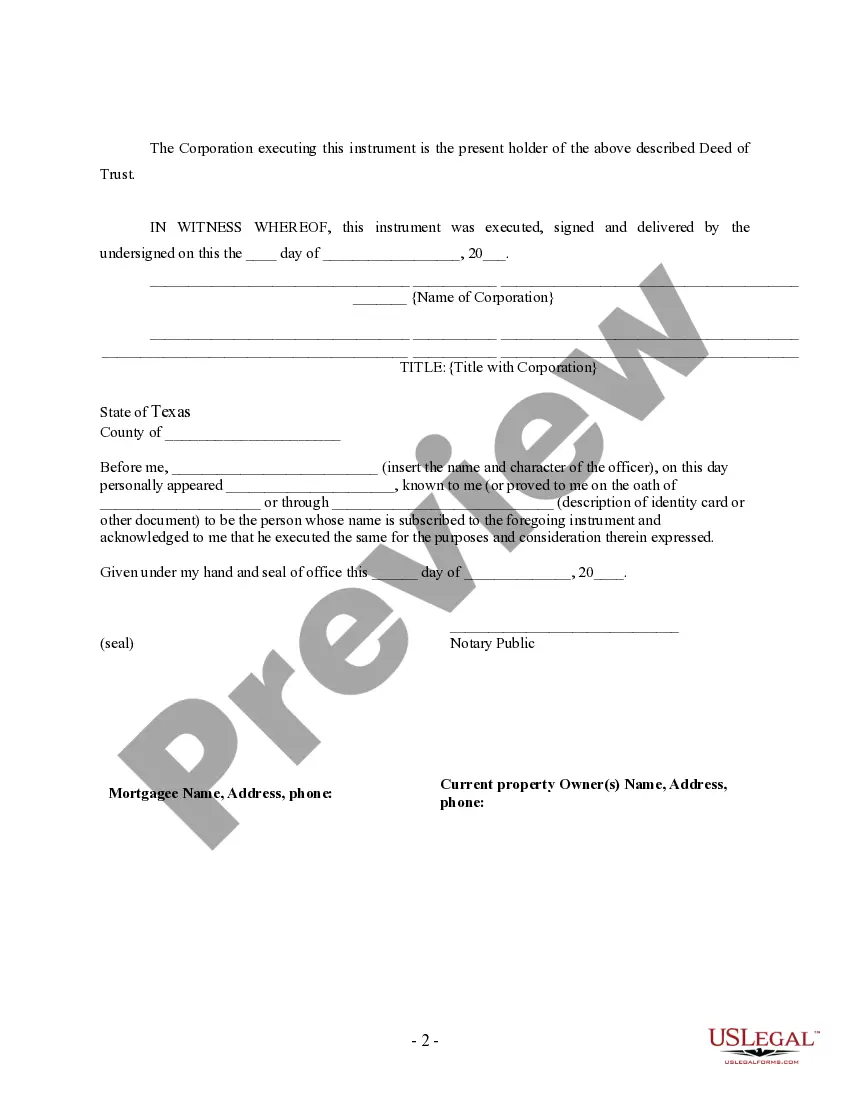

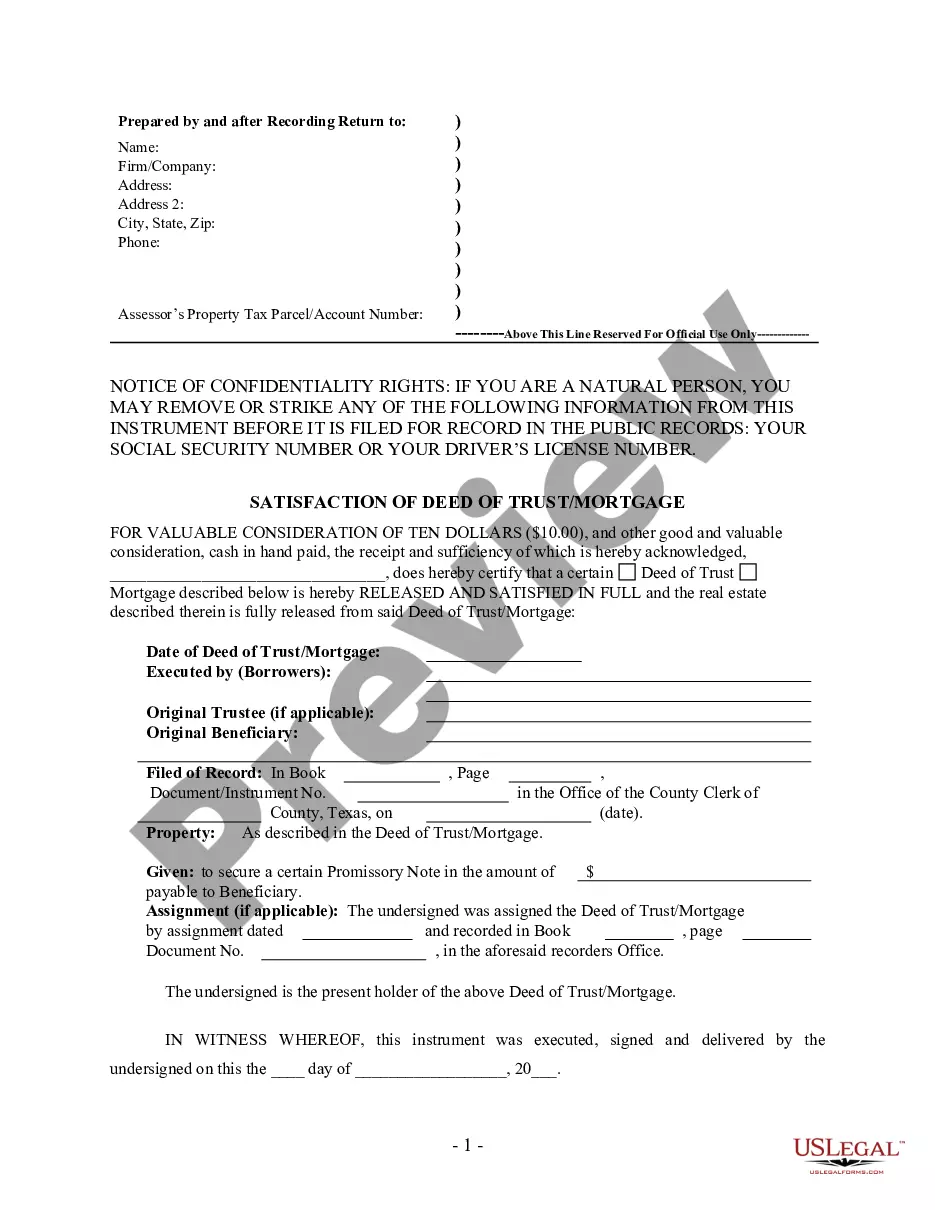

This Release - Satisfaction - Cancellation Deed of Trust - by Corporate Lender is for the satisfaction or release of a mortgage for the state of Texas by a Corporation. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

Title: Exploring the Edinburg, Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender Introduction: In the vibrant city of Edinburg, Texas, homeowners often engage in various real estate transactions, including mortgages and the subsequent satisfaction of deeds of trust. This comprehensive guide will provide you with a detailed understanding of what a Satisfaction of Deed of Trust Mortgageag— - by a Corporate Lender entails, ensuring a smooth and informed process. Read on to explore the different types of these satisfaction agreements commonly encountered in Edinburg, Texas. 1. Definition: Edinburg, Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender refers to the legal documentation used to officially release a mortgage lien on a property. This process signifies that the borrower has fully paid off their mortgage debt, and the lender acknowledges the debt's satisfaction. 2. Process: When a borrower in Edinburg, Texas successfully repays their mortgage, the corporate lender will generate a Satisfaction of Deed of Trust document. This document will then be recorded at the Hidalgo County Clerk's office, effectively eliminating the mortgage lien on the property. 3. Key Components: i. Property Information: The Edinburg, Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender must include accurate details about the property being released from the mortgage lien. These details typically include the property's legal description and the names of the granter and grantee. ii. Borrower and Lender Information: The satisfaction document should also outline the borrower's and lender's names and contact information, establishing the parties involved in the satisfaction agreement. iii. Mortgage Details: This section includes all relevant information regarding the mortgage, such as the mortgage date, the loan amount, and the maturity date. Clear details about the mortgage's satisfaction should be mentioned, indicating the satisfaction date and the full repayment amount. 4. Common Types of Edinburg, Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender: i. Individual Satisfaction of Deed of Trust: This is the most common type of satisfaction, involving an individual borrower and a corporate lender. It signifies the fulfillment of the mortgage commitment between the borrower and the lender. ii. Refinancing Satisfaction of Deed of Trust: When a borrower refinances their mortgage in Edinburg, Texas, a new lender pays off the existing loan. The corporate lender then generates a Satisfaction of Deed of Trust, which releases the original mortgage lien from the property. iii. Loan Modification Satisfaction of Deed of Trust: In certain cases, a borrower and a corporate lender might agree to modify the terms of an existing mortgage. Once the modified terms are fulfilled, a Satisfaction of Deed of Trust is issued. Conclusion: Understanding the Edinburg, Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender is crucial for homeowners in the area. Successfully completing this process allows borrowers to legally discharge their mortgage liens and enjoy full property ownership. Whether it's an individual satisfaction, a refinancing satisfaction, or a loan modification satisfaction, ensuring the accuracy and legality of these documents is paramount to a secure real estate transaction in Edinburg, Texas.Title: Exploring the Edinburg, Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender Introduction: In the vibrant city of Edinburg, Texas, homeowners often engage in various real estate transactions, including mortgages and the subsequent satisfaction of deeds of trust. This comprehensive guide will provide you with a detailed understanding of what a Satisfaction of Deed of Trust Mortgageag— - by a Corporate Lender entails, ensuring a smooth and informed process. Read on to explore the different types of these satisfaction agreements commonly encountered in Edinburg, Texas. 1. Definition: Edinburg, Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender refers to the legal documentation used to officially release a mortgage lien on a property. This process signifies that the borrower has fully paid off their mortgage debt, and the lender acknowledges the debt's satisfaction. 2. Process: When a borrower in Edinburg, Texas successfully repays their mortgage, the corporate lender will generate a Satisfaction of Deed of Trust document. This document will then be recorded at the Hidalgo County Clerk's office, effectively eliminating the mortgage lien on the property. 3. Key Components: i. Property Information: The Edinburg, Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender must include accurate details about the property being released from the mortgage lien. These details typically include the property's legal description and the names of the granter and grantee. ii. Borrower and Lender Information: The satisfaction document should also outline the borrower's and lender's names and contact information, establishing the parties involved in the satisfaction agreement. iii. Mortgage Details: This section includes all relevant information regarding the mortgage, such as the mortgage date, the loan amount, and the maturity date. Clear details about the mortgage's satisfaction should be mentioned, indicating the satisfaction date and the full repayment amount. 4. Common Types of Edinburg, Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender: i. Individual Satisfaction of Deed of Trust: This is the most common type of satisfaction, involving an individual borrower and a corporate lender. It signifies the fulfillment of the mortgage commitment between the borrower and the lender. ii. Refinancing Satisfaction of Deed of Trust: When a borrower refinances their mortgage in Edinburg, Texas, a new lender pays off the existing loan. The corporate lender then generates a Satisfaction of Deed of Trust, which releases the original mortgage lien from the property. iii. Loan Modification Satisfaction of Deed of Trust: In certain cases, a borrower and a corporate lender might agree to modify the terms of an existing mortgage. Once the modified terms are fulfilled, a Satisfaction of Deed of Trust is issued. Conclusion: Understanding the Edinburg, Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender is crucial for homeowners in the area. Successfully completing this process allows borrowers to legally discharge their mortgage liens and enjoy full property ownership. Whether it's an individual satisfaction, a refinancing satisfaction, or a loan modification satisfaction, ensuring the accuracy and legality of these documents is paramount to a secure real estate transaction in Edinburg, Texas.