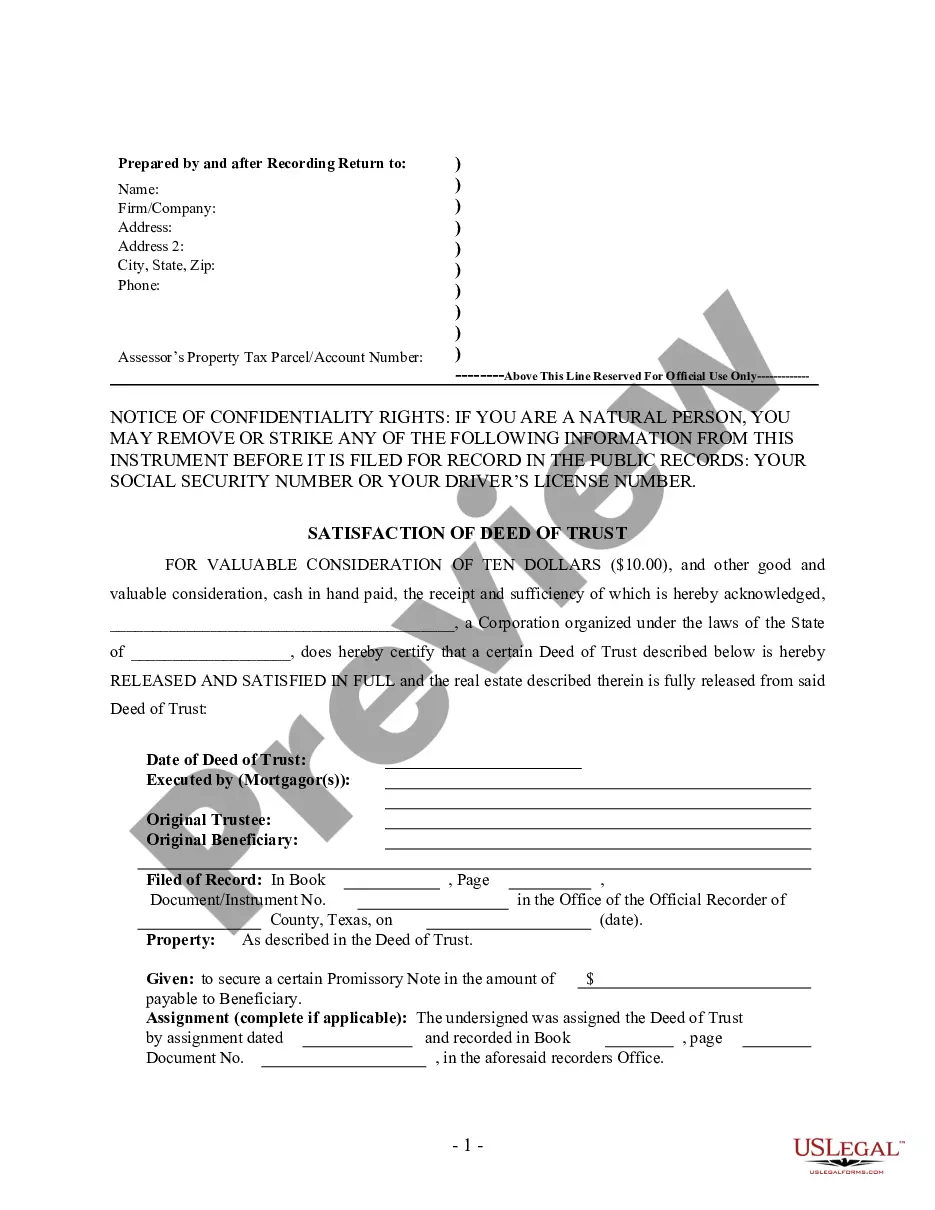

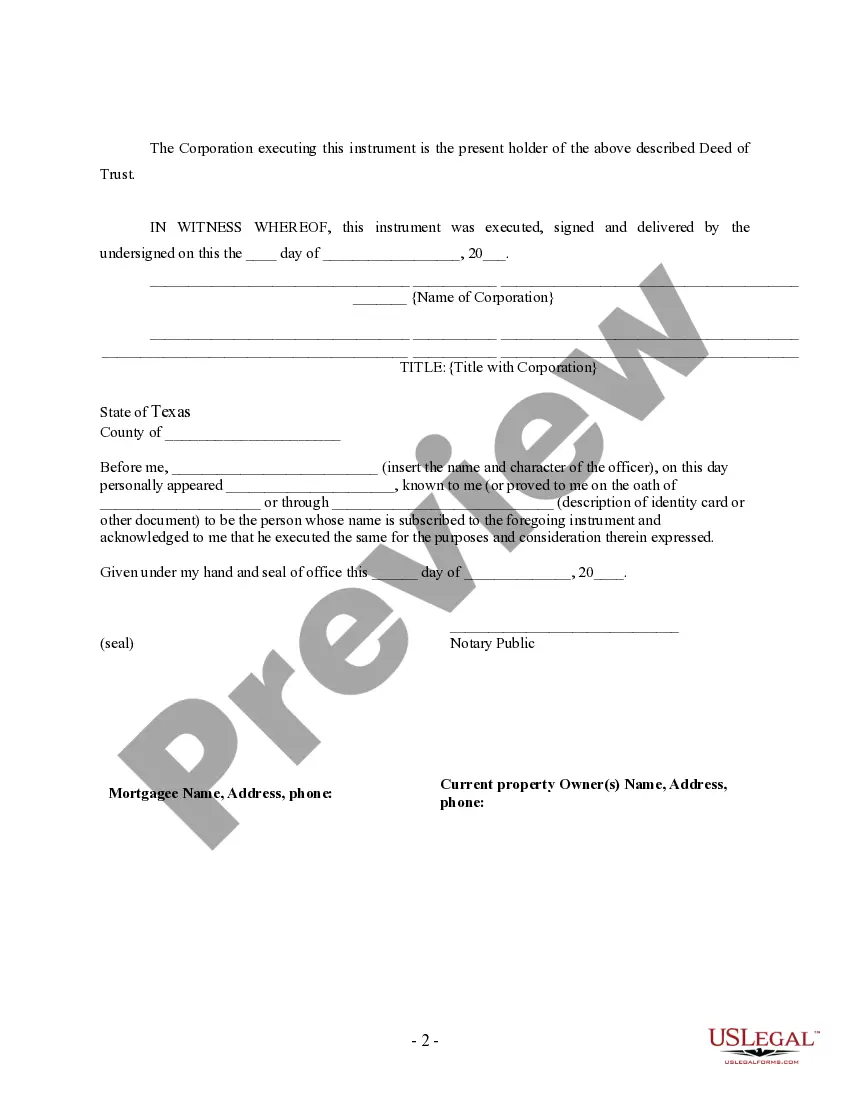

This Release - Satisfaction - Cancellation Deed of Trust - by Corporate Lender is for the satisfaction or release of a mortgage for the state of Texas by a Corporation. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

A League City Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender is a legal document that officially acknowledges the full repayment and satisfaction of a mortgage loan by a corporate entity. This document serves as evidence that the borrower has successfully fulfilled their financial obligations and that the mortgage lien on the property has been released. In League City, Texas, there are different types of Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender, depending on the specific circumstances. Some of these variations may include: 1. Partial Satisfaction: This type of satisfaction is applicable when only a portion of the mortgage loan has been repaid, but the lender agrees to release the lien on a specific part or share of the property, allowing the borrower to refinance or sell that portion. 2. Full Satisfaction: This type of satisfaction is the most common and signifies that the borrower has fully repaid the mortgage loan, and the lender confirms the release of the lien on the property in its entirety. 3. Modification Satisfaction: When a mortgage loan has undergone modifications, such as changes in interest rates or repayment terms, a modification satisfaction is executed to reflect these adjustments and reaffirm the borrower's fulfillment of the modified terms. 4. Satisfaction Upon Transfer: In cases where the mortgage loan has been assumed by another party or transferred to a new lender, a satisfaction of deed of trust is filed by the corporate lender to release the original lien and acknowledge the new lender's rights. Regardless of the type, all League City Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender documents typically contain crucial information, including: — Parties involved: This includes the corporate lender's name and contact information, as well as the borrower's details, such as name, address, and contact information. — Property description: Detailed information regarding the property being mortgaged, such as the address, legal description, and parcel identification number (PIN/Pins), is listed. — Loan details: The original loan amount, terms, interest rate, and other relevant financial particulars are included. — Satisfaction statement: This section confirms that the borrower has fulfilled their obligations under the mortgage loan, and the lender is fully satisfied, thereby releasing the mortgage lien on the property. — Notary acknowledgment: A notary public's seal and signature, attesting to the authenticity of the document and the parties' signatures, are included to ensure legal validity. A League City Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender is an essential legal document that finalizes the completion of a mortgage loan and releases the borrower from the associated lien on their property. It provides vital reassurance to both the borrower and any future potential buyers or lenders that the property is free and clear from any encumbrances resulting from the mortgage loan.A League City Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender is a legal document that officially acknowledges the full repayment and satisfaction of a mortgage loan by a corporate entity. This document serves as evidence that the borrower has successfully fulfilled their financial obligations and that the mortgage lien on the property has been released. In League City, Texas, there are different types of Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender, depending on the specific circumstances. Some of these variations may include: 1. Partial Satisfaction: This type of satisfaction is applicable when only a portion of the mortgage loan has been repaid, but the lender agrees to release the lien on a specific part or share of the property, allowing the borrower to refinance or sell that portion. 2. Full Satisfaction: This type of satisfaction is the most common and signifies that the borrower has fully repaid the mortgage loan, and the lender confirms the release of the lien on the property in its entirety. 3. Modification Satisfaction: When a mortgage loan has undergone modifications, such as changes in interest rates or repayment terms, a modification satisfaction is executed to reflect these adjustments and reaffirm the borrower's fulfillment of the modified terms. 4. Satisfaction Upon Transfer: In cases where the mortgage loan has been assumed by another party or transferred to a new lender, a satisfaction of deed of trust is filed by the corporate lender to release the original lien and acknowledge the new lender's rights. Regardless of the type, all League City Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender documents typically contain crucial information, including: — Parties involved: This includes the corporate lender's name and contact information, as well as the borrower's details, such as name, address, and contact information. — Property description: Detailed information regarding the property being mortgaged, such as the address, legal description, and parcel identification number (PIN/Pins), is listed. — Loan details: The original loan amount, terms, interest rate, and other relevant financial particulars are included. — Satisfaction statement: This section confirms that the borrower has fulfilled their obligations under the mortgage loan, and the lender is fully satisfied, thereby releasing the mortgage lien on the property. — Notary acknowledgment: A notary public's seal and signature, attesting to the authenticity of the document and the parties' signatures, are included to ensure legal validity. A League City Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender is an essential legal document that finalizes the completion of a mortgage loan and releases the borrower from the associated lien on their property. It provides vital reassurance to both the borrower and any future potential buyers or lenders that the property is free and clear from any encumbrances resulting from the mortgage loan.