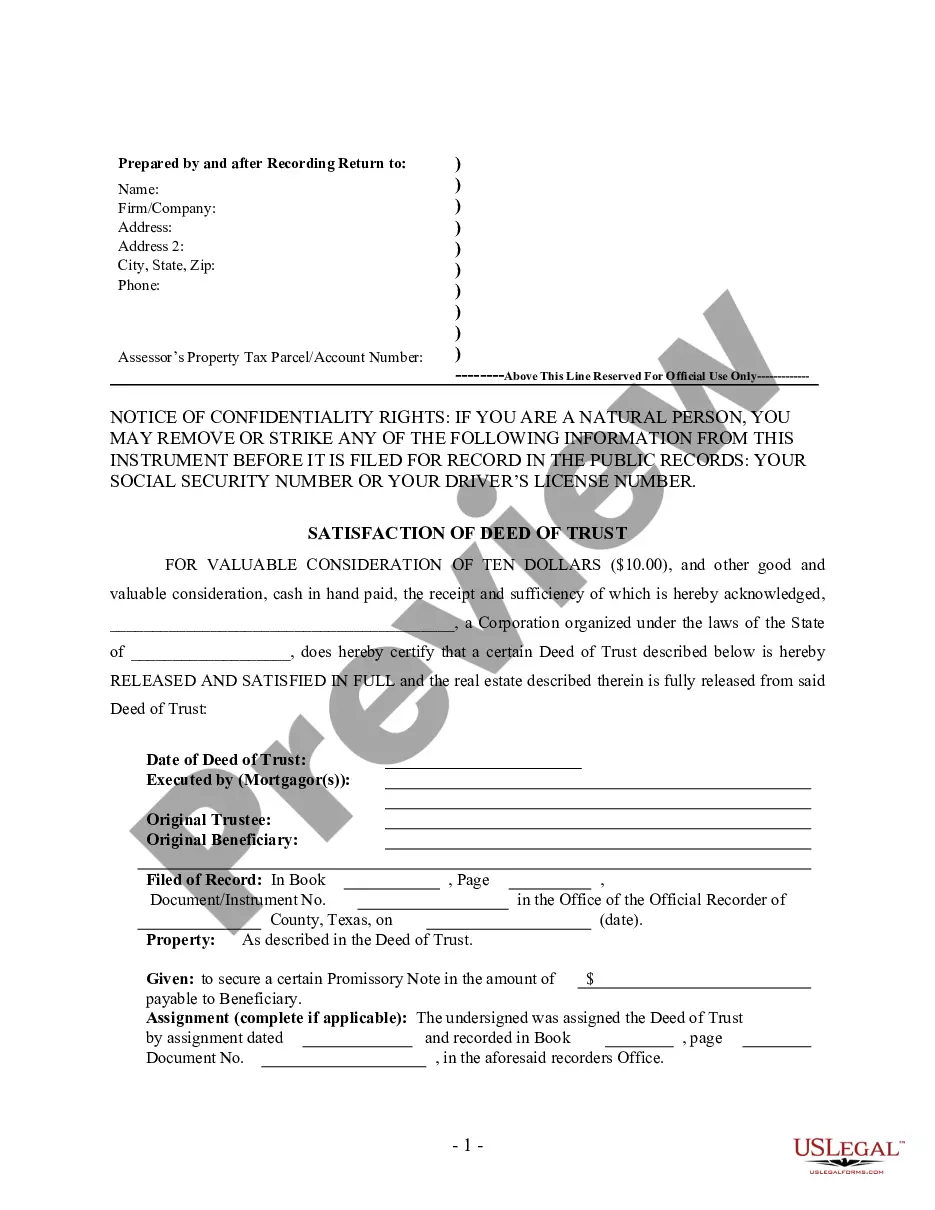

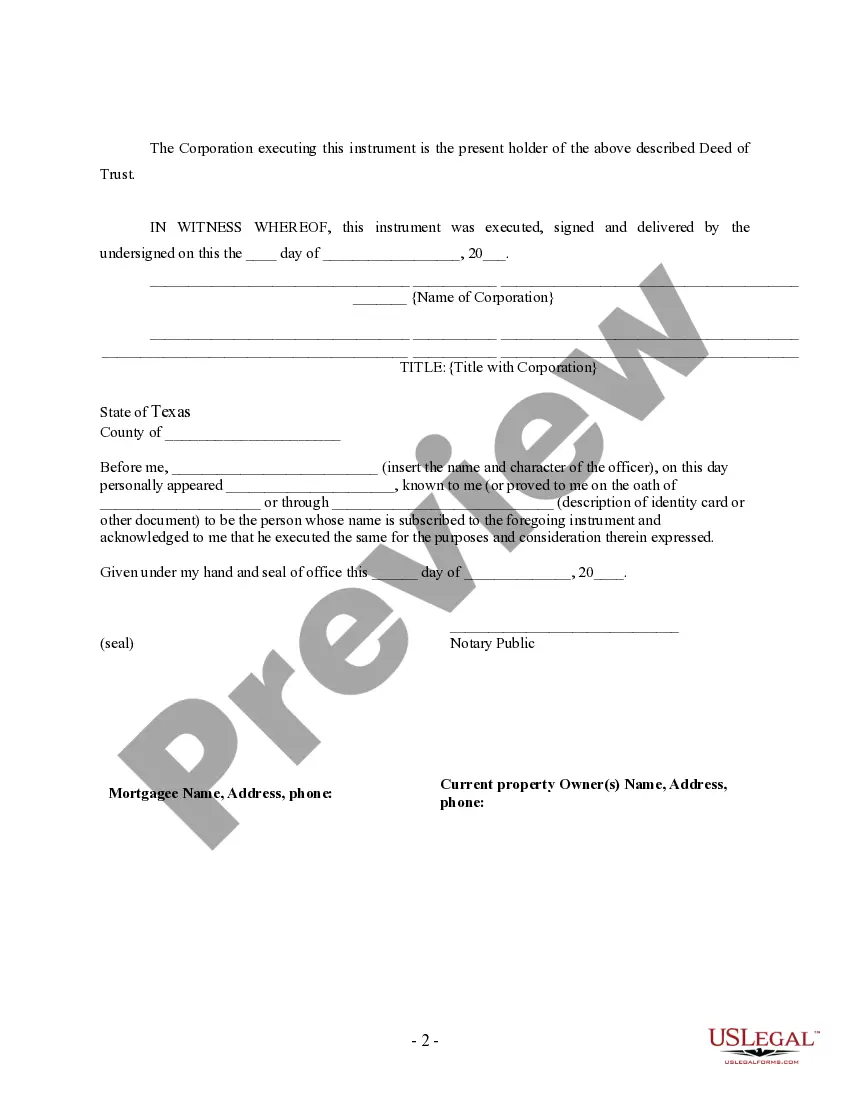

This Release - Satisfaction - Cancellation Deed of Trust - by Corporate Lender is for the satisfaction or release of a mortgage for the state of Texas by a Corporation. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

Title: Understanding McKinney Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender: A Comprehensive Overview Introduction: In McKinney, Texas, a Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender serves as a legal document confirming the discharge or release of a mortgage loan completed by a corporate lender. This document serves as evidence that the debt secured by the property has been paid in full, allowing the borrower to claim clear ownership without any encumbrances. Let's explore the key elements, types, and significance of the McKinney Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender. Keywords: McKinney Texas, Satisfaction of Deed of Trust, Mortgage, Corporate Lender. 1. Definition and Purpose: A McKinney Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender is a legal document, executed by a corporate lender, that releases a borrower from their financial obligations after they have paid off their mortgage debt. It certifies that the loan has been fully satisfied, thereby allowing the borrower to possess a clear title to the property. 2. Key Elements: — Parties Involved: The document typically includes the names and addresses of the borrower (mortgagor), the corporate lender, and any other relevant parties. — Property Description: The document includes a detailed description of the property, including its address, legal description, and any additional important facts about its location. — Loan Details: This section outlines the original loan amount, the original mortgage date, and other essential loan specifics. — Loan Satisfaction Statement: The core element of the document is a statement officially declaring that the mortgage loan has been fully satisfied, along with the date of satisfaction. 3. Types of McKinney Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender: a) Partial Satisfaction: This type is applicable when the borrower has repaid a portion of the mortgage debt, but not the complete amount. It acknowledges the partial satisfaction of the debt while the remaining balance is still outstanding. b) Full Satisfaction: This type is issued when the borrower has completed all payments and the entire mortgage loan has been fully repaid. It signifies the release of the property from the mortgage lien. 4. Significance and Legal Implications: — Proof of Debt Repayment: The Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender serves as conclusive evidence that the mortgage debt has been settled, ensuring that the borrower owns the property outright. — Establishing Clear Title: This document removes the lender's legal claim over the property, allowing the borrower to sell, transfer, or refinance the property without any hindrance in the future. — Recording with County: Filing the Satisfaction of the Deed of Trust with the county clerk's office ensures that it is a matter of public record, safeguarding both the borrower and lender's interests. Conclusion: The McKinney Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender is a crucial legal document that signifies the borrower's successful repayment of a mortgage loan secured by a corporate lender. It provides assurance and proof that the borrower owns the property free from any mortgage encumbrances. Understanding its types and significance can help navigate the process of satisfying a mortgage debt successfully. Keywords: McKinney Texas, Satisfaction of Deed of Trust, Mortgage, Corporate Lender, types, significance, legal implications.Title: Understanding McKinney Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender: A Comprehensive Overview Introduction: In McKinney, Texas, a Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender serves as a legal document confirming the discharge or release of a mortgage loan completed by a corporate lender. This document serves as evidence that the debt secured by the property has been paid in full, allowing the borrower to claim clear ownership without any encumbrances. Let's explore the key elements, types, and significance of the McKinney Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender. Keywords: McKinney Texas, Satisfaction of Deed of Trust, Mortgage, Corporate Lender. 1. Definition and Purpose: A McKinney Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender is a legal document, executed by a corporate lender, that releases a borrower from their financial obligations after they have paid off their mortgage debt. It certifies that the loan has been fully satisfied, thereby allowing the borrower to possess a clear title to the property. 2. Key Elements: — Parties Involved: The document typically includes the names and addresses of the borrower (mortgagor), the corporate lender, and any other relevant parties. — Property Description: The document includes a detailed description of the property, including its address, legal description, and any additional important facts about its location. — Loan Details: This section outlines the original loan amount, the original mortgage date, and other essential loan specifics. — Loan Satisfaction Statement: The core element of the document is a statement officially declaring that the mortgage loan has been fully satisfied, along with the date of satisfaction. 3. Types of McKinney Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender: a) Partial Satisfaction: This type is applicable when the borrower has repaid a portion of the mortgage debt, but not the complete amount. It acknowledges the partial satisfaction of the debt while the remaining balance is still outstanding. b) Full Satisfaction: This type is issued when the borrower has completed all payments and the entire mortgage loan has been fully repaid. It signifies the release of the property from the mortgage lien. 4. Significance and Legal Implications: — Proof of Debt Repayment: The Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender serves as conclusive evidence that the mortgage debt has been settled, ensuring that the borrower owns the property outright. — Establishing Clear Title: This document removes the lender's legal claim over the property, allowing the borrower to sell, transfer, or refinance the property without any hindrance in the future. — Recording with County: Filing the Satisfaction of the Deed of Trust with the county clerk's office ensures that it is a matter of public record, safeguarding both the borrower and lender's interests. Conclusion: The McKinney Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender is a crucial legal document that signifies the borrower's successful repayment of a mortgage loan secured by a corporate lender. It provides assurance and proof that the borrower owns the property free from any mortgage encumbrances. Understanding its types and significance can help navigate the process of satisfying a mortgage debt successfully. Keywords: McKinney Texas, Satisfaction of Deed of Trust, Mortgage, Corporate Lender, types, significance, legal implications.