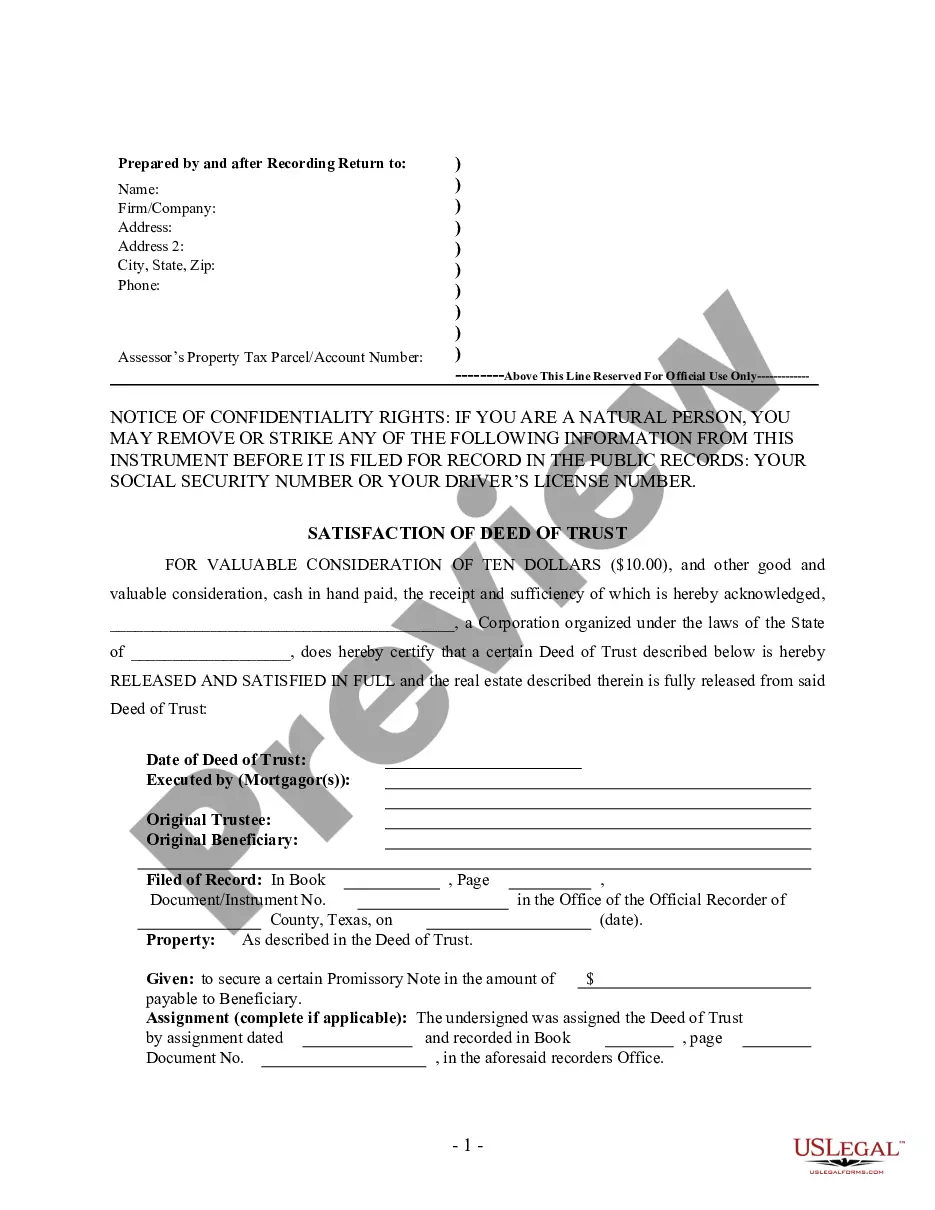

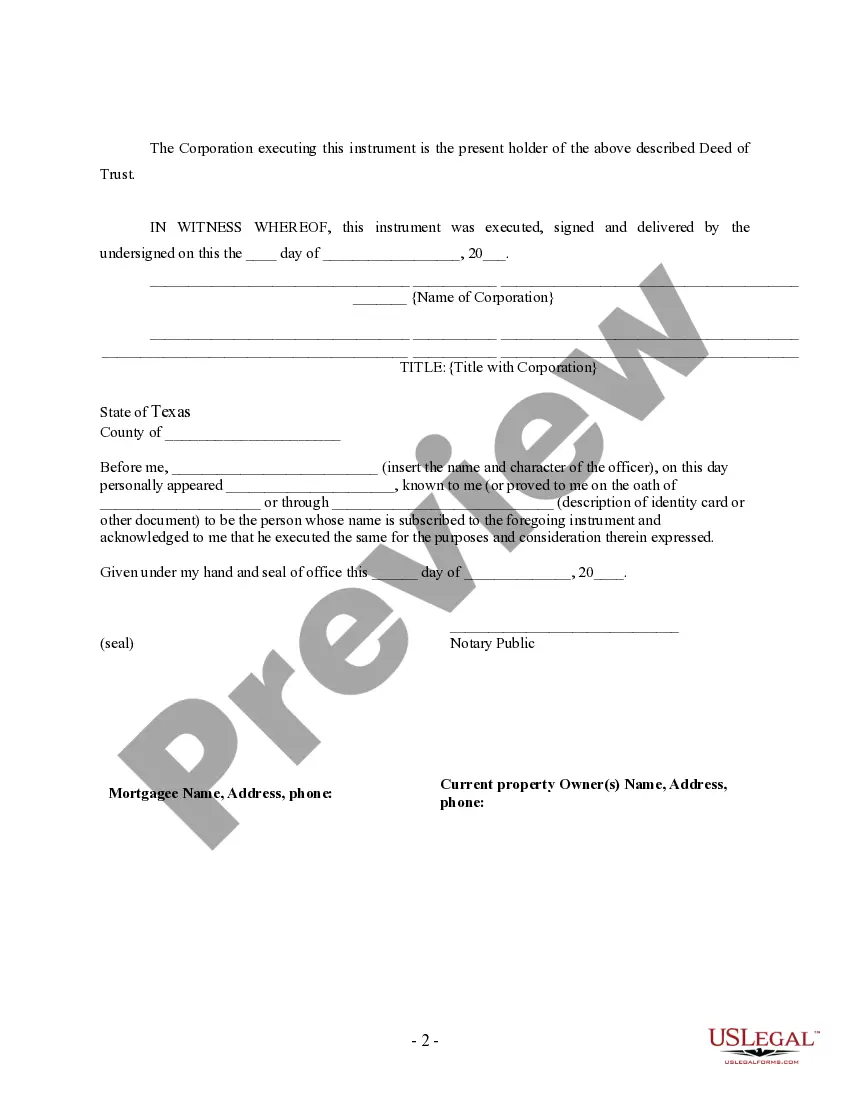

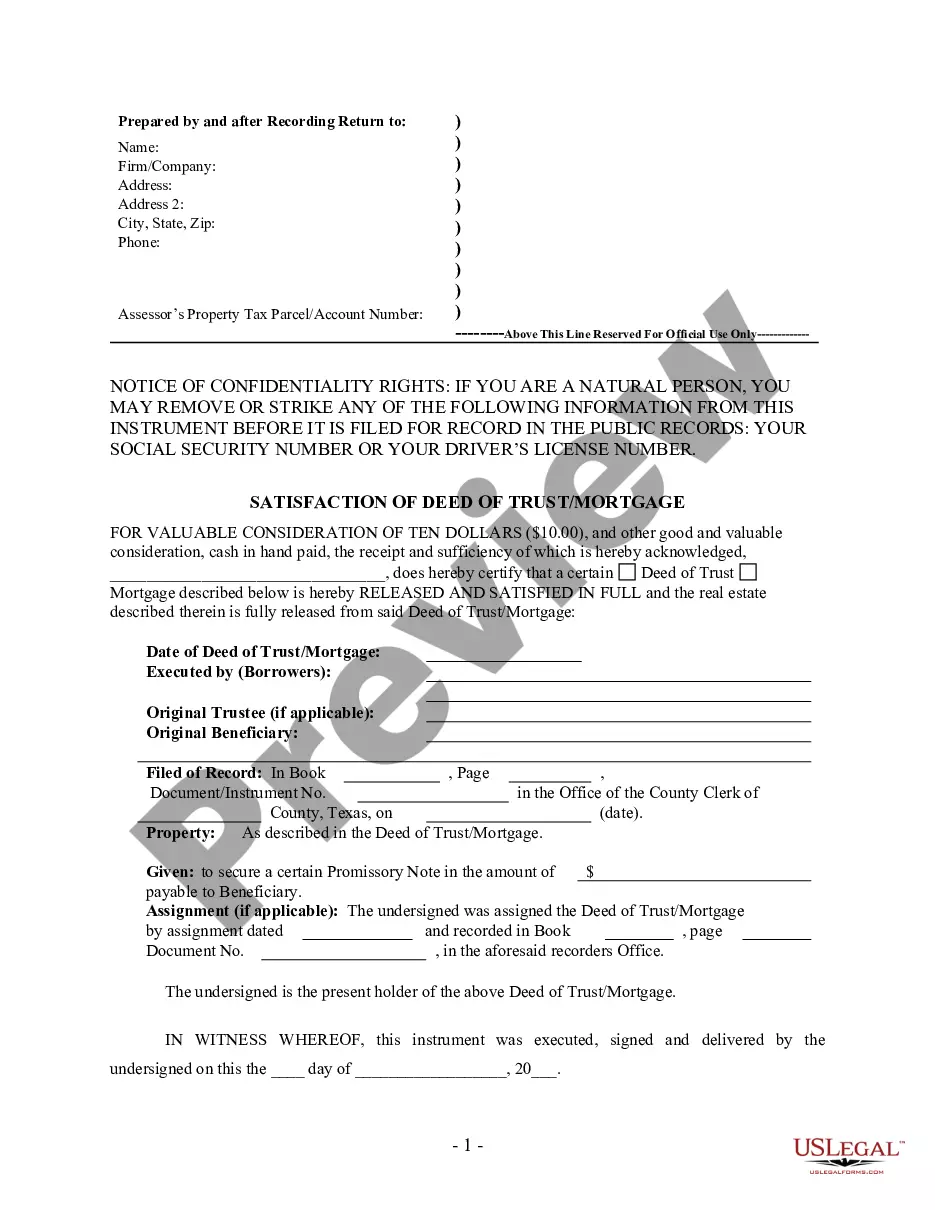

This Release - Satisfaction - Cancellation Deed of Trust - by Corporate Lender is for the satisfaction or release of a mortgage for the state of Texas by a Corporation. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

If you are looking for information about Mesquite Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender, you have come to the right place. In this detailed description, we will cover the key aspects and types of this essential legal document. So, let's begin. A Mesquite Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender is a legal instrument used in the real estate industry when a mortgage or deed of trust on a property is paid off in full. This document is executed by the corporate lender, also known as the mortgage holder or lien holder, to officially release any claim or interest they had on the property. Keywords: Mesquite Texas, Satisfaction of Deed of Trust, Mortgage, Corporate Lender Key Components of the Mesquite Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender: 1. Property Information: The document begins by providing essential details about the property, such as the legal description, address, and parcel number. This information helps in accurately identifying the property associated with the mortgage or deed of trust. 2. Loan Details: This section includes information about the loan, such as the original loan amount, the date the loan was executed, and any modifications made over time. It also mentions the mortgage or deed of trust book and page number where the original document is recorded. 3. Lender Information: Here, the name and contact details of the corporate lender are listed. This could be a financial institution, a bank, or any other lending entity that provided the mortgage loan. 4. Borrower Information: The document identifies the borrower by providing their name and relevant contact information. It is crucial to accurately mention the borrower's details for clarity and reference. 5. Release of Mortgage: This is the most significant part of the Satisfaction of Deed of Trust — Mortgage. It states that the corporate lender, being the holder or assignee of the mortgage or deed of trust, acknowledges and confirms that the loan secured by the mortgage or deed of trust has been paid off in full. It legally declares the satisfaction of the mortgage and acknowledges that the borrower has fulfilled all obligations. Types of Mesquite Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender: While the general purpose of a Satisfaction of Deed of Trust — Mortgage remains the same, there might be specific variations based on the individual cases. Some potential types of Mesquite Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender include: 1. Full Satisfaction: This is the most common type, indicating that the borrower has paid off the mortgage or deed of trust in its entirety. 2. Partial Satisfaction: In some cases, a borrower may pay off only a portion of the mortgage loan. A Partial Satisfaction of Deed of Trust would release the lien on the portion paid while retaining the mortgage on the remaining amount. 3. Release of Lien: This type of Satisfaction of Deed of Trust releases the lien placed on the property by the corporate lender. It may be applicable when the borrower refinances the property or when the mortgage is fully paid but not yet released by the lender. 4. Subordination Agreement: This is not strictly a Satisfaction of Deed of Trust, but it is worth mentioning. A Subordination Agreement allows a lender to subordinate their lien position to another lender. This may be necessary when a borrower seeks to obtain a secondary loan or home equity line of credit. In conclusion, a Mesquite Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender serves as an essential legal document when a mortgage or deed of trust is paid off. It signifies the release of the lender's interest in the property, allowing the borrower to freely manage and sell the property without any encumbrances. Remember, it is always advisable to consult legal professionals or seek advice from relevant authorities for specific requirements or variations of the Satisfaction of Deed of Trust — Mortgage in Mesquite Texas.If you are looking for information about Mesquite Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender, you have come to the right place. In this detailed description, we will cover the key aspects and types of this essential legal document. So, let's begin. A Mesquite Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender is a legal instrument used in the real estate industry when a mortgage or deed of trust on a property is paid off in full. This document is executed by the corporate lender, also known as the mortgage holder or lien holder, to officially release any claim or interest they had on the property. Keywords: Mesquite Texas, Satisfaction of Deed of Trust, Mortgage, Corporate Lender Key Components of the Mesquite Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender: 1. Property Information: The document begins by providing essential details about the property, such as the legal description, address, and parcel number. This information helps in accurately identifying the property associated with the mortgage or deed of trust. 2. Loan Details: This section includes information about the loan, such as the original loan amount, the date the loan was executed, and any modifications made over time. It also mentions the mortgage or deed of trust book and page number where the original document is recorded. 3. Lender Information: Here, the name and contact details of the corporate lender are listed. This could be a financial institution, a bank, or any other lending entity that provided the mortgage loan. 4. Borrower Information: The document identifies the borrower by providing their name and relevant contact information. It is crucial to accurately mention the borrower's details for clarity and reference. 5. Release of Mortgage: This is the most significant part of the Satisfaction of Deed of Trust — Mortgage. It states that the corporate lender, being the holder or assignee of the mortgage or deed of trust, acknowledges and confirms that the loan secured by the mortgage or deed of trust has been paid off in full. It legally declares the satisfaction of the mortgage and acknowledges that the borrower has fulfilled all obligations. Types of Mesquite Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender: While the general purpose of a Satisfaction of Deed of Trust — Mortgage remains the same, there might be specific variations based on the individual cases. Some potential types of Mesquite Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender include: 1. Full Satisfaction: This is the most common type, indicating that the borrower has paid off the mortgage or deed of trust in its entirety. 2. Partial Satisfaction: In some cases, a borrower may pay off only a portion of the mortgage loan. A Partial Satisfaction of Deed of Trust would release the lien on the portion paid while retaining the mortgage on the remaining amount. 3. Release of Lien: This type of Satisfaction of Deed of Trust releases the lien placed on the property by the corporate lender. It may be applicable when the borrower refinances the property or when the mortgage is fully paid but not yet released by the lender. 4. Subordination Agreement: This is not strictly a Satisfaction of Deed of Trust, but it is worth mentioning. A Subordination Agreement allows a lender to subordinate their lien position to another lender. This may be necessary when a borrower seeks to obtain a secondary loan or home equity line of credit. In conclusion, a Mesquite Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender serves as an essential legal document when a mortgage or deed of trust is paid off. It signifies the release of the lender's interest in the property, allowing the borrower to freely manage and sell the property without any encumbrances. Remember, it is always advisable to consult legal professionals or seek advice from relevant authorities for specific requirements or variations of the Satisfaction of Deed of Trust — Mortgage in Mesquite Texas.