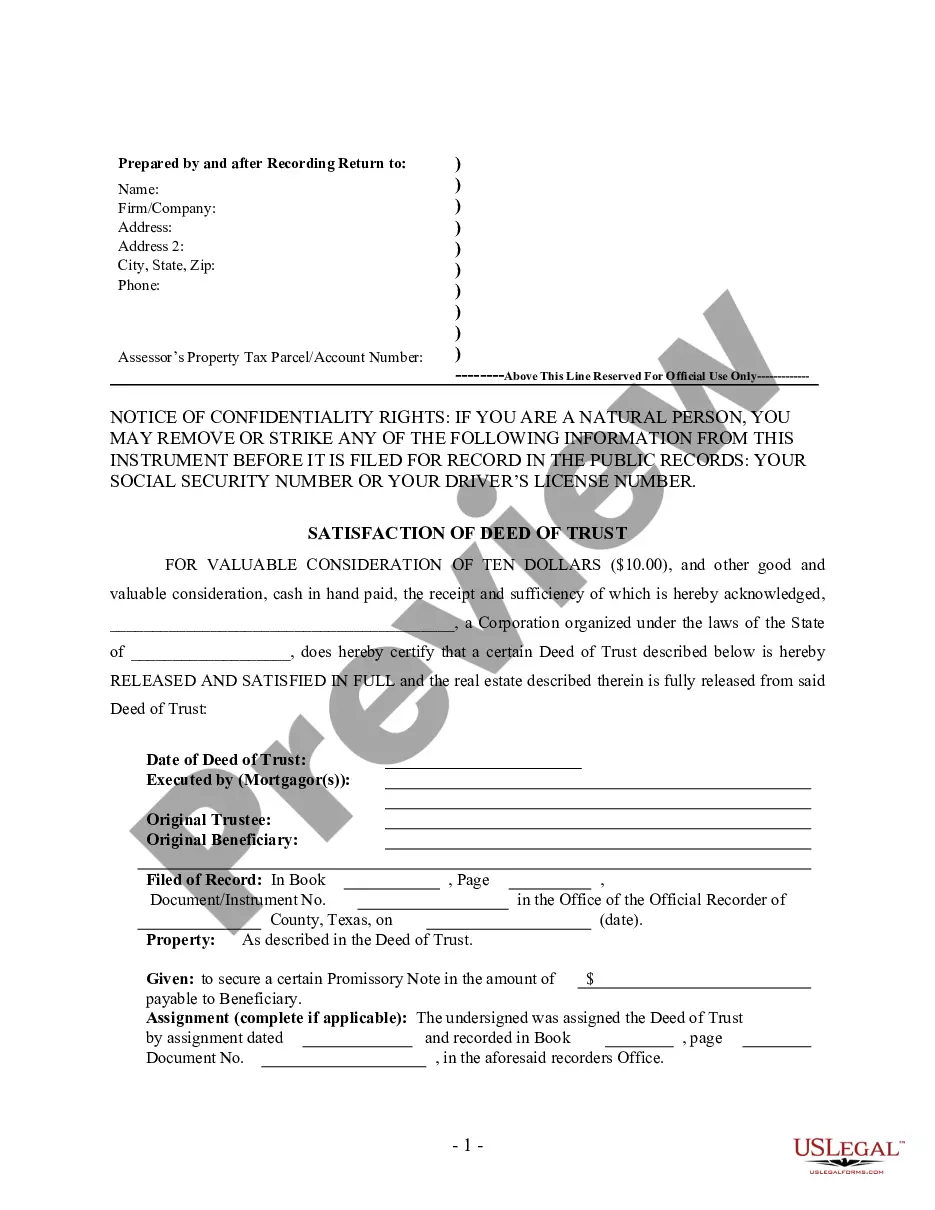

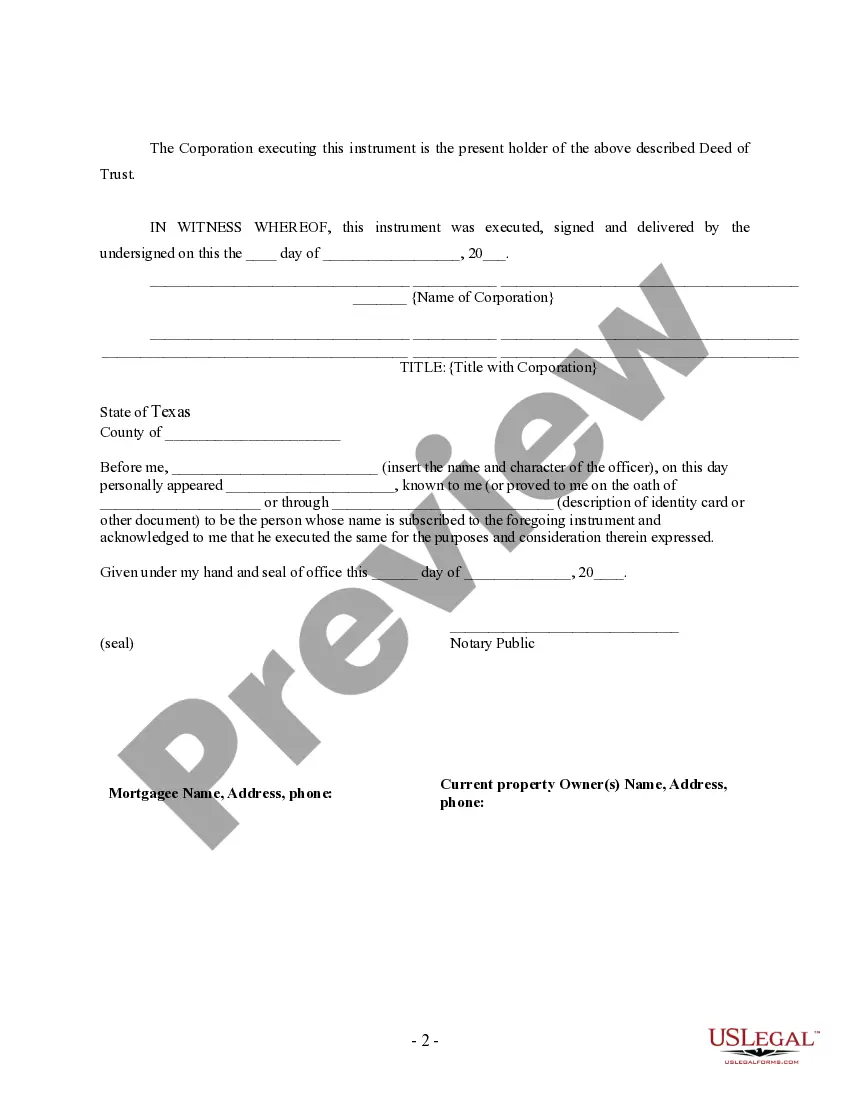

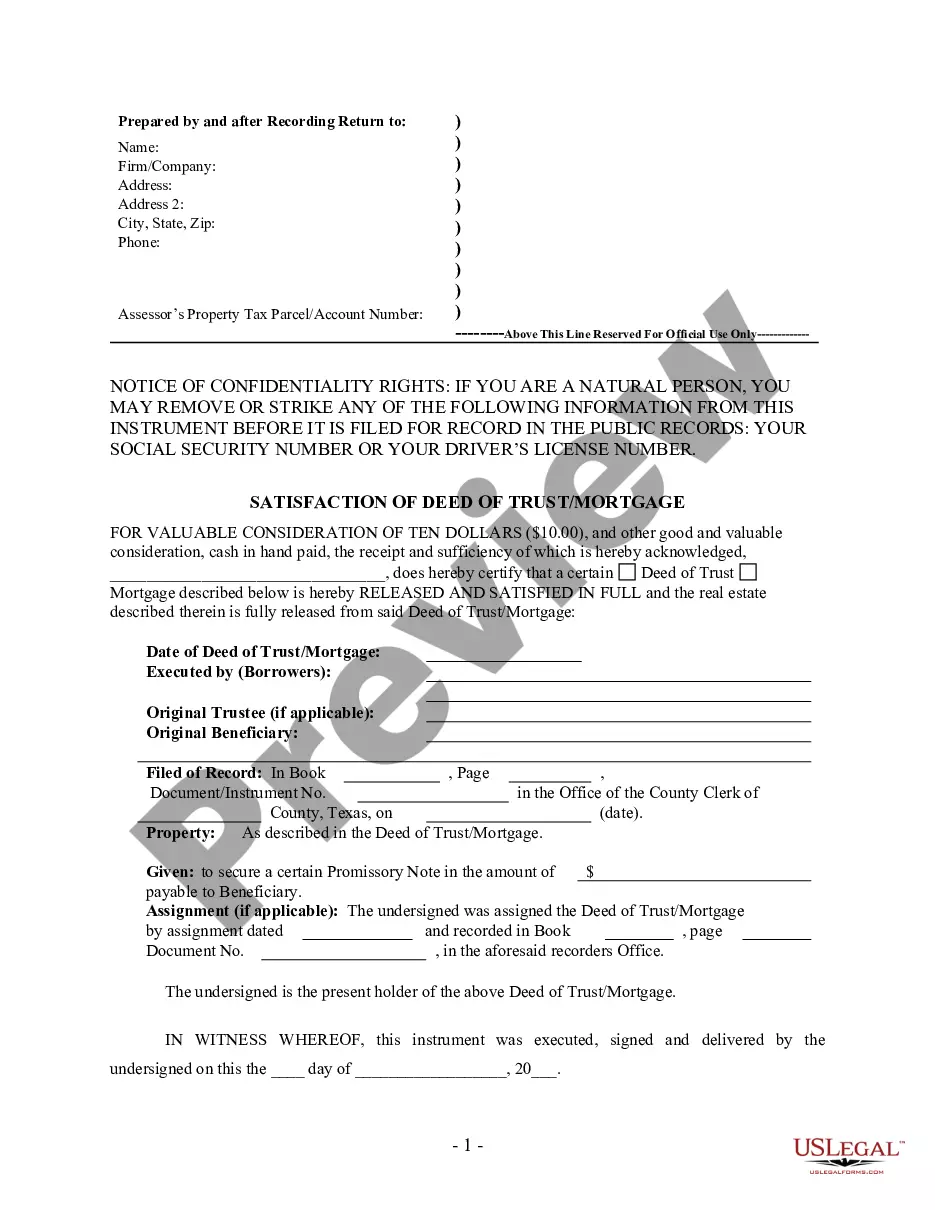

This Release - Satisfaction - Cancellation Deed of Trust - by Corporate Lender is for the satisfaction or release of a mortgage for the state of Texas by a Corporation. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

Title: Pearland Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender: Understanding the Process and Types Introduction: The Pearland Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender is an important legal document that signifies the completion and satisfaction of a mortgage. In this comprehensive guide, we will delve into the details of this document and shed light on its various types, processes, and related keywords. Keywords: Pearland Texas, Satisfaction of Deed of Trust, Mortgage, Corporate Lender 1. Understanding the Pearland Texas Satisfaction of Deed of Trust: — Pearland, Texas's satisfaction of deed of trust is a legal document that serves as proof of the full and timely repayment of a mortgage loan secured by a property located in Pearland, Texas. — The satisfaction of deed of trust is typically issued by the corporate lender upon the completion of mortgage repayment. 2. The Importance and Purpose of Pearland Texas Satisfaction of Deed of Trust — Mortgage— - The satisfaction of deed of trust helps in clearing the title of the property and removing any liens or encumbrances associated with the mortgage. — It acts as a legal confirmation that the borrower has fulfilled their financial obligations, allowing them to possess a clear title without any claims by the lender. 3. Key Elements of Pearland Texas Satisfaction of Deed of Trust — Mortgage— - Identification: The document identifies the lender, borrower, and property details, such as address and legal description. — Loan Information: It specifies the original loan amount, interest rate, and duration of the mortgage. — Satisfaction Clause: The document states that the mortgage has been satisfied, releasing the borrower from any further obligations. — Signature and Notary: The satisfaction of deed of trust must be signed by both the lender and the borrower in the presence of a notary public. 4. Types of Pearland Texas Satisfaction of Deed of Trust — Mortgage— - Full Satisfaction: This type is issued when the mortgage loan is fully repaid, and there are no outstanding balances or payments due. — Partial Satisfaction: When the borrower has repaid a certain portion of the mortgage loan, a partial satisfaction may be issued, releasing the property from a portion of the lien. — Release of Lien: This type is used when a mortgage is being refinanced or transferred to another lender, and the original lender releases their claim to the property. — Certificate of Release: This document is commonly issued when the mortgage is paid off in a lump sum, allowing the borrower to fully own the property without any encumbrances. Conclusion: The Pearland Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender is a crucial document that indicates the completion of a mortgage loan repayment. Whether you're a borrower or a lender, understanding the different types and processes related to this document is essential for a smooth real estate transaction in Pearland, Texas.Title: Pearland Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender: Understanding the Process and Types Introduction: The Pearland Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender is an important legal document that signifies the completion and satisfaction of a mortgage. In this comprehensive guide, we will delve into the details of this document and shed light on its various types, processes, and related keywords. Keywords: Pearland Texas, Satisfaction of Deed of Trust, Mortgage, Corporate Lender 1. Understanding the Pearland Texas Satisfaction of Deed of Trust: — Pearland, Texas's satisfaction of deed of trust is a legal document that serves as proof of the full and timely repayment of a mortgage loan secured by a property located in Pearland, Texas. — The satisfaction of deed of trust is typically issued by the corporate lender upon the completion of mortgage repayment. 2. The Importance and Purpose of Pearland Texas Satisfaction of Deed of Trust — Mortgage— - The satisfaction of deed of trust helps in clearing the title of the property and removing any liens or encumbrances associated with the mortgage. — It acts as a legal confirmation that the borrower has fulfilled their financial obligations, allowing them to possess a clear title without any claims by the lender. 3. Key Elements of Pearland Texas Satisfaction of Deed of Trust — Mortgage— - Identification: The document identifies the lender, borrower, and property details, such as address and legal description. — Loan Information: It specifies the original loan amount, interest rate, and duration of the mortgage. — Satisfaction Clause: The document states that the mortgage has been satisfied, releasing the borrower from any further obligations. — Signature and Notary: The satisfaction of deed of trust must be signed by both the lender and the borrower in the presence of a notary public. 4. Types of Pearland Texas Satisfaction of Deed of Trust — Mortgage— - Full Satisfaction: This type is issued when the mortgage loan is fully repaid, and there are no outstanding balances or payments due. — Partial Satisfaction: When the borrower has repaid a certain portion of the mortgage loan, a partial satisfaction may be issued, releasing the property from a portion of the lien. — Release of Lien: This type is used when a mortgage is being refinanced or transferred to another lender, and the original lender releases their claim to the property. — Certificate of Release: This document is commonly issued when the mortgage is paid off in a lump sum, allowing the borrower to fully own the property without any encumbrances. Conclusion: The Pearland Texas Satisfaction of Deed of Trust Mortgageag— - by Corporate Lender is a crucial document that indicates the completion of a mortgage loan repayment. Whether you're a borrower or a lender, understanding the different types and processes related to this document is essential for a smooth real estate transaction in Pearland, Texas.