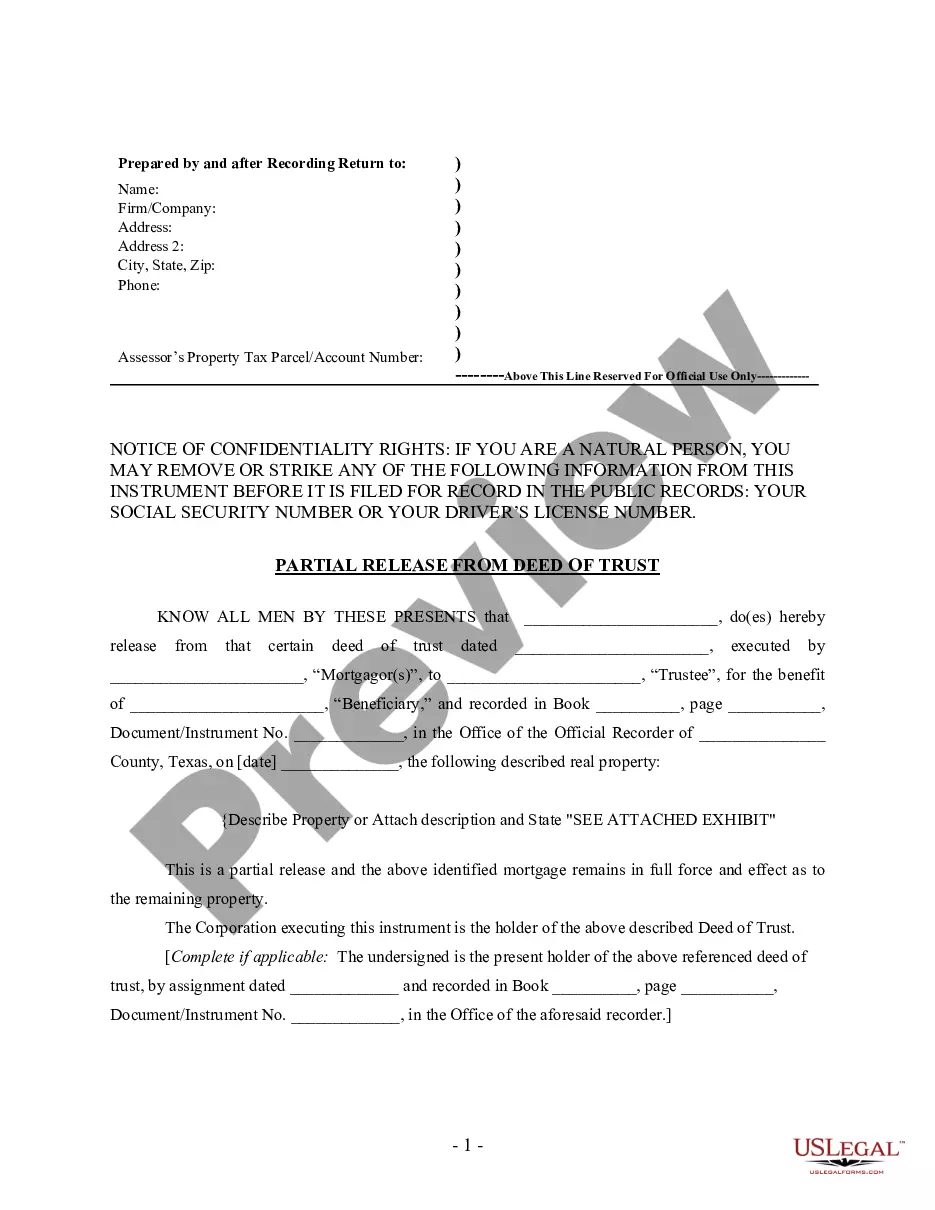

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

A Collin Texas Partial Release of Property from Deed of Trust for Corporation is a legal document that allows a corporation to release a portion of the property covered by a deed of trust. This release ensures that the corporation retains ownership and control over specific portions of the property while allowing them to leverage the remaining portion for various purposes. In Collin, Texas, there are different types of Partial Release of Property from Deed of Trust for Corporations, including: 1. Collateral-Based Partial Release: This type of release allows a corporation to release a specific portion of the property that served as collateral for a loan or mortgage. It is commonly used when the corporation wants to sell or develop a portion of the property while keeping the rest intact. 2. Easement-Based Partial Release: In some cases, a corporation may need to grant an easement over a portion of their property for access or utility purposes. This type of release ensures that the designated portion of the property is no longer encumbered by the deed of trust, allowing the corporation to grant the easement while maintaining ownership over the remaining land. 3. Development-Based Partial Release: When a corporation plans to develop a portion of their property for commercial or residential purposes, they may seek a partial release to separate the development area from the rest of the property covered by the deed of trust. This release permits the corporation to secure financing for the development without putting the entire property at risk. A Collin Texas Partial Release of Property from Deed of Trust for Corporation includes several important elements. Firstly, it identifies the corporation involved and provides the legal description of the property covered by the original deed of trust. The release specifies the exact portion of the property to be released, ensuring clarity and avoiding any potential disputes. Additionally, the release outlines any conditions or requirements that the corporation must meet to obtain the partial release. This may include the repayment of a certain amount of the loan or the satisfaction of other obligations to the lender. It is important for the corporation to carefully review and comply with these conditions to ensure a smooth release process. Once the partial release is executed, it must be recorded in the appropriate county records in Collin, Texas, to provide public notice of the release and protect the corporation's interests. This recording serves as proof that the released portion is no longer encumbered by the original deed of trust. In conclusion, a Collin Texas Partial Release of Property from Deed of Trust for Corporation is a crucial legal document that allows a corporation to release a specific portion of the property covered by a deed of trust. Whether based on collateral, easements, or development plans, this release provides invaluable flexibility to a corporation while safeguarding their ownership rights.A Collin Texas Partial Release of Property from Deed of Trust for Corporation is a legal document that allows a corporation to release a portion of the property covered by a deed of trust. This release ensures that the corporation retains ownership and control over specific portions of the property while allowing them to leverage the remaining portion for various purposes. In Collin, Texas, there are different types of Partial Release of Property from Deed of Trust for Corporations, including: 1. Collateral-Based Partial Release: This type of release allows a corporation to release a specific portion of the property that served as collateral for a loan or mortgage. It is commonly used when the corporation wants to sell or develop a portion of the property while keeping the rest intact. 2. Easement-Based Partial Release: In some cases, a corporation may need to grant an easement over a portion of their property for access or utility purposes. This type of release ensures that the designated portion of the property is no longer encumbered by the deed of trust, allowing the corporation to grant the easement while maintaining ownership over the remaining land. 3. Development-Based Partial Release: When a corporation plans to develop a portion of their property for commercial or residential purposes, they may seek a partial release to separate the development area from the rest of the property covered by the deed of trust. This release permits the corporation to secure financing for the development without putting the entire property at risk. A Collin Texas Partial Release of Property from Deed of Trust for Corporation includes several important elements. Firstly, it identifies the corporation involved and provides the legal description of the property covered by the original deed of trust. The release specifies the exact portion of the property to be released, ensuring clarity and avoiding any potential disputes. Additionally, the release outlines any conditions or requirements that the corporation must meet to obtain the partial release. This may include the repayment of a certain amount of the loan or the satisfaction of other obligations to the lender. It is important for the corporation to carefully review and comply with these conditions to ensure a smooth release process. Once the partial release is executed, it must be recorded in the appropriate county records in Collin, Texas, to provide public notice of the release and protect the corporation's interests. This recording serves as proof that the released portion is no longer encumbered by the original deed of trust. In conclusion, a Collin Texas Partial Release of Property from Deed of Trust for Corporation is a crucial legal document that allows a corporation to release a specific portion of the property covered by a deed of trust. Whether based on collateral, easements, or development plans, this release provides invaluable flexibility to a corporation while safeguarding their ownership rights.