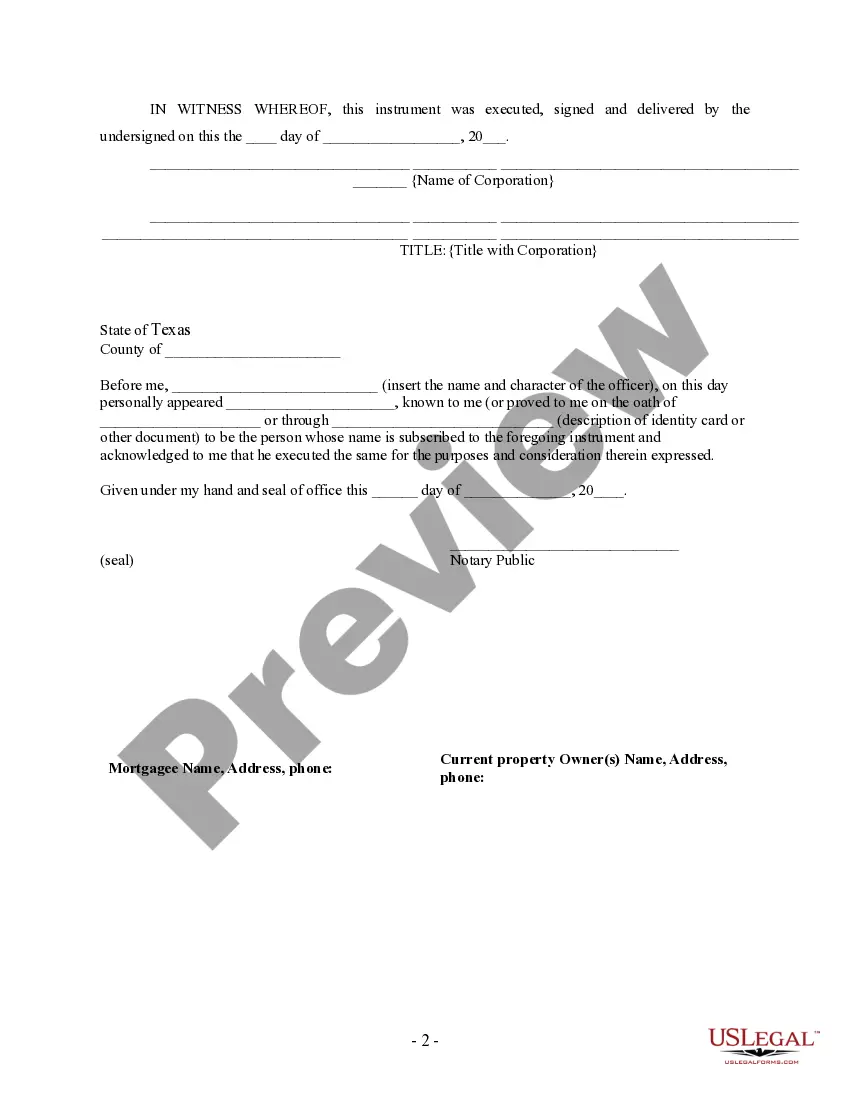

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Title: Understanding the Dallas Texas Partial Release of Property From Deed of Trust for Corporations Keywords: Dallas Texas, partial release, property, deed of trust, corporation, legal document, mortgage, collateral, loan modification Introduction: The Dallas Texas Partial Release of Property From Deed of Trust for Corporations is a legal document that facilitates the release of a portion of the property from a deed of trust held by a corporation. This document is an essential tool in loan modifications, as it allows corporations to free up specific assets and properties from the mortgage or collateral securing a loan. This article will provide a detailed description of the Dallas Texas Partial Release of Property from Deed of Trust for Corporations, exploring its significance, types, and key elements. 1. Purpose and Importance: The primary purpose of the Partial Release of Property From Deed of Trust for Corporations in Dallas Texas is to permit corporations to remove specific assets or properties from the securement of a loan. It allows corporations to modify existing loans, provide additional collateral, or address changes in business needs. 2. Types of Dallas Texas Partial Release of Property From Deed of Trust for Corporations: There are various types of partial releases of property from deed of trust for corporations in Dallas Texas. Some common subtypes include: a) Partial Release of Individual Property: This type allows a corporation to release specific assets or properties from the deed of trust, only affecting those selected properties. b) Partial Release of Property Portfolio: A corporation can release a group of properties from the deed of trust, providing flexibility in managing multiple assets simultaneously. c) Partial Release for Loan Modification: This type facilitates the release of specific properties to modify the terms of an existing loan, allowing corporations to adjust their mortgage agreement. 3. Key Elements of a Dallas Texas Partial Release of Property From Deed of Trust for Corporations: A typical Partial Release of Property From Deed of Trust for Corporations in Dallas Texas should include the following key elements: a) Identification: Accurately identifying the corporation and the lender involved in the release. b) Property Description: Precisely describing the asset or property being released from the deed of trust, including its address, legal description, and any relevant identifiers. c) Consideration: Mentioning the consideration provided by the corporation in exchange for the partial release. d) Lien Position: Stating the lien position and priority of the remaining properties after the release. e) Terms and Conditions: Outlining any additional terms and conditions necessary to govern the release and its effects. Conclusion: The Dallas Texas Partial Release of Property From Deed of Trust for Corporations is a crucial legal document that allows corporations to modify loan agreements or adjust collateral arrangements. By selectively releasing properties or assets, corporations can adapt their financial arrangements to meet changing business requirements. It is vital for corporations to understand the specific type of partial release they require and ensure compliance with all legal aspects when drafting or executing this document.Title: Understanding the Dallas Texas Partial Release of Property From Deed of Trust for Corporations Keywords: Dallas Texas, partial release, property, deed of trust, corporation, legal document, mortgage, collateral, loan modification Introduction: The Dallas Texas Partial Release of Property From Deed of Trust for Corporations is a legal document that facilitates the release of a portion of the property from a deed of trust held by a corporation. This document is an essential tool in loan modifications, as it allows corporations to free up specific assets and properties from the mortgage or collateral securing a loan. This article will provide a detailed description of the Dallas Texas Partial Release of Property from Deed of Trust for Corporations, exploring its significance, types, and key elements. 1. Purpose and Importance: The primary purpose of the Partial Release of Property From Deed of Trust for Corporations in Dallas Texas is to permit corporations to remove specific assets or properties from the securement of a loan. It allows corporations to modify existing loans, provide additional collateral, or address changes in business needs. 2. Types of Dallas Texas Partial Release of Property From Deed of Trust for Corporations: There are various types of partial releases of property from deed of trust for corporations in Dallas Texas. Some common subtypes include: a) Partial Release of Individual Property: This type allows a corporation to release specific assets or properties from the deed of trust, only affecting those selected properties. b) Partial Release of Property Portfolio: A corporation can release a group of properties from the deed of trust, providing flexibility in managing multiple assets simultaneously. c) Partial Release for Loan Modification: This type facilitates the release of specific properties to modify the terms of an existing loan, allowing corporations to adjust their mortgage agreement. 3. Key Elements of a Dallas Texas Partial Release of Property From Deed of Trust for Corporations: A typical Partial Release of Property From Deed of Trust for Corporations in Dallas Texas should include the following key elements: a) Identification: Accurately identifying the corporation and the lender involved in the release. b) Property Description: Precisely describing the asset or property being released from the deed of trust, including its address, legal description, and any relevant identifiers. c) Consideration: Mentioning the consideration provided by the corporation in exchange for the partial release. d) Lien Position: Stating the lien position and priority of the remaining properties after the release. e) Terms and Conditions: Outlining any additional terms and conditions necessary to govern the release and its effects. Conclusion: The Dallas Texas Partial Release of Property From Deed of Trust for Corporations is a crucial legal document that allows corporations to modify loan agreements or adjust collateral arrangements. By selectively releasing properties or assets, corporations can adapt their financial arrangements to meet changing business requirements. It is vital for corporations to understand the specific type of partial release they require and ensure compliance with all legal aspects when drafting or executing this document.