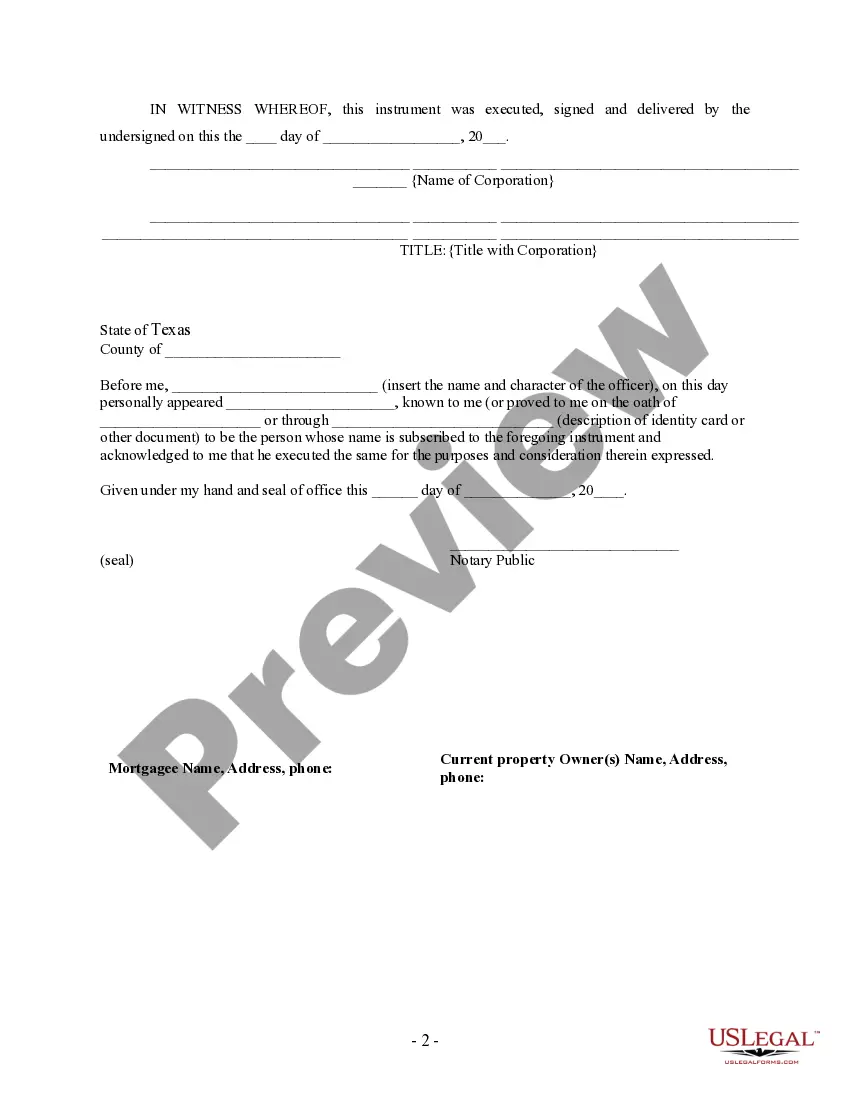

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

A Harris Texas Partial Release of Property From Deed of Trust for Corporation is a legal document that allows a corporation to release certain portions of a property from a previously established deed of trust. This release can be executed for various purposes, including refinancing, property development, or to remove a property from the secured loan agreement. In Harris County, Texas, there are two types of Partial Releases of Property From Deed of Trust for Corporation: 1. Harris Texas Partial Release of Property From Deed of Trust for Corporation — Refinancing: This type of partial release is commonly used when a corporation wants to refinance its existing loan on a property. By releasing a portion of the property from the original deed of trust, the corporation can secure a new loan agreement with better terms or a lower interest rate, while still keeping a portion of the property as collateral. Keywords: Harris Texas, partial release, property, deed of trust, corporation, refinancing, loan agreement, collateral. 2. Harris Texas Partial Release of Property From Deed of Trust for Corporation — Property Development: This type of partial release of property is typically utilized when a corporation intends to develop or sell a portion of its property while keeping the remaining area as collateral. By releasing the designated portion from the original deed of trust, the corporation can obtain the necessary financing for the development project or facilitate the sale of the released portion independently. Keywords: Harris Texas, partial release, property, deed of trust, corporation, property development, financing, sale. Both types of Partial Releases of Property From Deed of Trust for Corporation are significant legal measures that enable corporations in Harris County, Texas, to exercise control over their properties and financial affairs effectively. It is essential for corporations to consult with a qualified attorney specializing in real estate law to ensure the proper documentation and comply with all legal requirements during the partial release process.A Harris Texas Partial Release of Property From Deed of Trust for Corporation is a legal document that allows a corporation to release certain portions of a property from a previously established deed of trust. This release can be executed for various purposes, including refinancing, property development, or to remove a property from the secured loan agreement. In Harris County, Texas, there are two types of Partial Releases of Property From Deed of Trust for Corporation: 1. Harris Texas Partial Release of Property From Deed of Trust for Corporation — Refinancing: This type of partial release is commonly used when a corporation wants to refinance its existing loan on a property. By releasing a portion of the property from the original deed of trust, the corporation can secure a new loan agreement with better terms or a lower interest rate, while still keeping a portion of the property as collateral. Keywords: Harris Texas, partial release, property, deed of trust, corporation, refinancing, loan agreement, collateral. 2. Harris Texas Partial Release of Property From Deed of Trust for Corporation — Property Development: This type of partial release of property is typically utilized when a corporation intends to develop or sell a portion of its property while keeping the remaining area as collateral. By releasing the designated portion from the original deed of trust, the corporation can obtain the necessary financing for the development project or facilitate the sale of the released portion independently. Keywords: Harris Texas, partial release, property, deed of trust, corporation, property development, financing, sale. Both types of Partial Releases of Property From Deed of Trust for Corporation are significant legal measures that enable corporations in Harris County, Texas, to exercise control over their properties and financial affairs effectively. It is essential for corporations to consult with a qualified attorney specializing in real estate law to ensure the proper documentation and comply with all legal requirements during the partial release process.