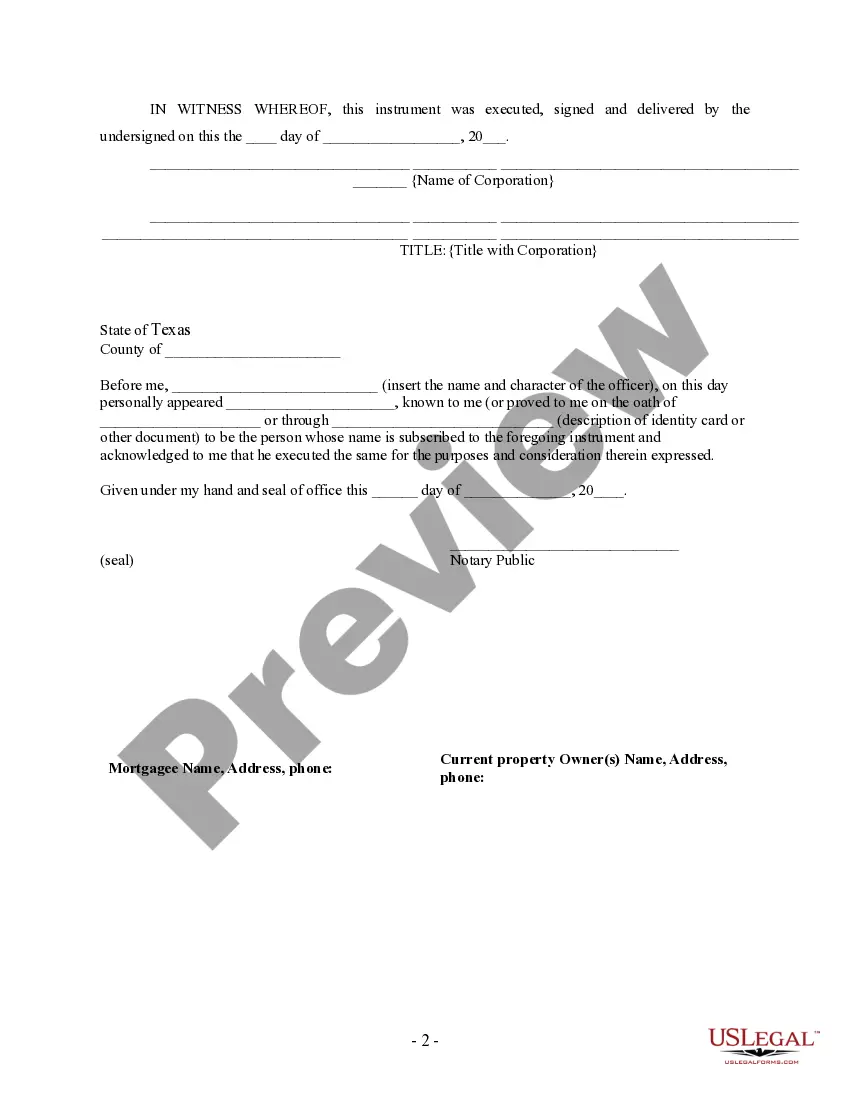

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Description: Tarrant Texas Partial Release of Property From Deed of Trust for Corporation In Tarrant County, Texas, a Partial Release of Property From Deed of Trust for Corporation is an essential legal document that allows a corporation to release a portion of the property that was previously used as collateral for a deed of trust. This release relinquishes the corporation's rights and interests in the specific part of the property, freeing it from any encumbrances related to the original loan. A Partial Release of Property From Deed of Trust for Corporation is typically required when the corporation wants to sell or transfer a portion of the property while still maintaining the existing loan agreement for the remaining portion. It enables the corporation to reduce its encumbrances without affecting the entire property and any ongoing loan obligations. There may be various types of Tarrant Texas Partial Release of Property From Deed of Trust for Corporation based on specific circumstances or requirements. Some key types or scenarios that might require a partial release include: 1. Partial Release for Subdivision Purposes: When a corporation wishes to subdivide a larger property into smaller lots or parcels, it may need to release specific sections of the property to facilitate the subdivision process. 2. Partial Release for Sale or Lease: If a corporation plans to sell or lease a portion of the property while still holding a loan agreement for the remaining part, a partial release becomes necessary. This type of release is common when a corporation wants to monetize a particular portion of the property without fully releasing it from the original deed of trust. 3. Partial Release for Development Projects: In certain cases, a corporation may require a partial release to carry out development activities such as constructing buildings or making improvements on a specific section of the property. This enables the corporation to use the released portion separately while maintaining the loan obligations for the remaining property. By obtaining a Tarrant Texas Partial Release of Property From Deed of Trust for Corporation, the corporation ensures that it retains ownership, control, and flexibility over the property while addressing its specific needs. It is crucial to consult with legal professionals familiar with the Tarrant County regulations and requirements to properly execute this legal document.Description: Tarrant Texas Partial Release of Property From Deed of Trust for Corporation In Tarrant County, Texas, a Partial Release of Property From Deed of Trust for Corporation is an essential legal document that allows a corporation to release a portion of the property that was previously used as collateral for a deed of trust. This release relinquishes the corporation's rights and interests in the specific part of the property, freeing it from any encumbrances related to the original loan. A Partial Release of Property From Deed of Trust for Corporation is typically required when the corporation wants to sell or transfer a portion of the property while still maintaining the existing loan agreement for the remaining portion. It enables the corporation to reduce its encumbrances without affecting the entire property and any ongoing loan obligations. There may be various types of Tarrant Texas Partial Release of Property From Deed of Trust for Corporation based on specific circumstances or requirements. Some key types or scenarios that might require a partial release include: 1. Partial Release for Subdivision Purposes: When a corporation wishes to subdivide a larger property into smaller lots or parcels, it may need to release specific sections of the property to facilitate the subdivision process. 2. Partial Release for Sale or Lease: If a corporation plans to sell or lease a portion of the property while still holding a loan agreement for the remaining part, a partial release becomes necessary. This type of release is common when a corporation wants to monetize a particular portion of the property without fully releasing it from the original deed of trust. 3. Partial Release for Development Projects: In certain cases, a corporation may require a partial release to carry out development activities such as constructing buildings or making improvements on a specific section of the property. This enables the corporation to use the released portion separately while maintaining the loan obligations for the remaining property. By obtaining a Tarrant Texas Partial Release of Property From Deed of Trust for Corporation, the corporation ensures that it retains ownership, control, and flexibility over the property while addressing its specific needs. It is crucial to consult with legal professionals familiar with the Tarrant County regulations and requirements to properly execute this legal document.