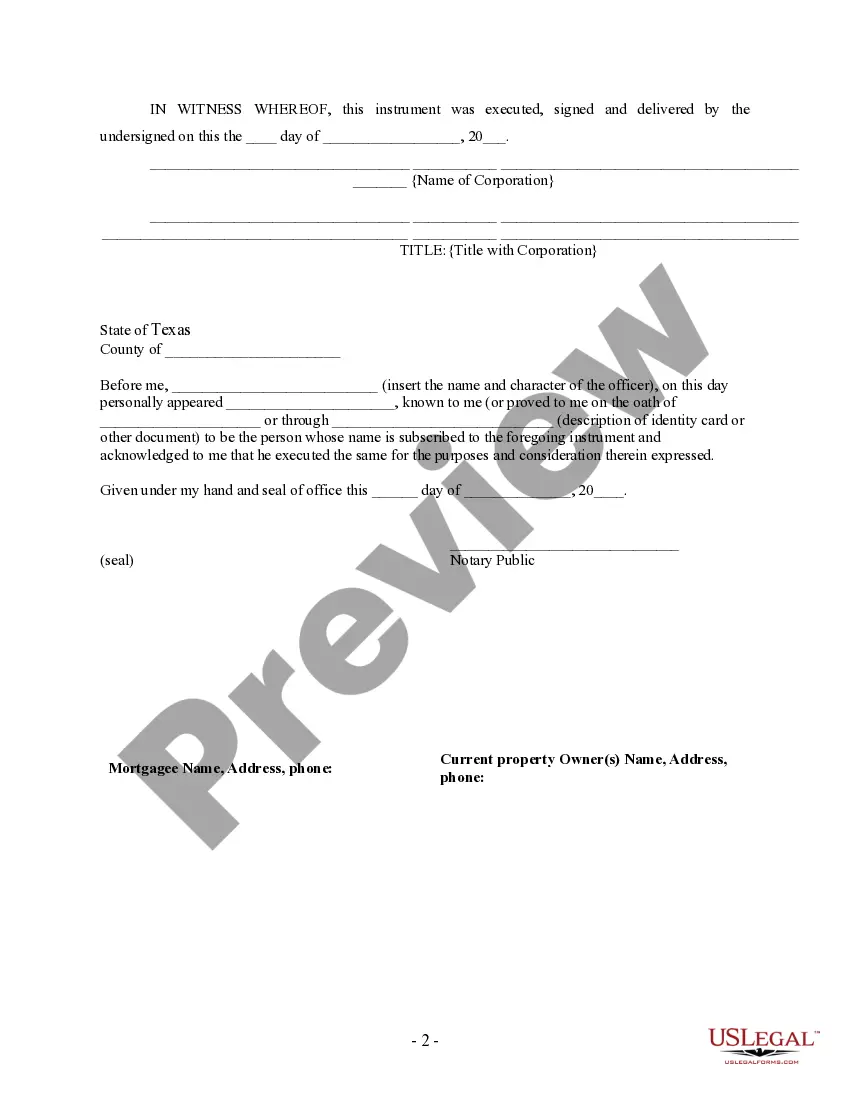

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Travis Texas Partial Release of Property From Deed of Trust for Corporation is an essential legal document that allows a corporation to release a portion of a property from a previously executed Deed of Trust. This release is typically undertaken when the corporation has fulfilled a certain condition or met a specific requirement in relation to the property. The Partial Release of Property From Deed of Trust for Corporation confirms the corporation's intent to discharge a portion of the property from the encumbrances imposed by the Deed of Trust, effectively reducing the property that is still subject to the trust. This release is significant as it grants the corporation more flexibility and options with the remaining portion of the property. In Travis County, Texas, there are various types of Partial Release of Property From Deed of Trust for Corporation, each catering to specific circumstances or conditions. Some different types may include: 1. Conditional Partial Release: This type of release is executed when the corporation has fulfilled specific conditions mentioned in the original Deed of Trust. These conditions may include payment of a certain amount, completion of improvements, or satisfaction of other obligations. 2. Voluntary Partial Release: This release is initiated by the corporation voluntarily when it wants to free a portion of the property from the encumbrances of the Deed of Trust. This allows the corporation to take advantage of opportunities such as selling or developing the released portion separately. 3. Planned Development Partial Release: In cases where the corporation intends to develop the property in phases, a Planned Development Partial Release is executed. This allows the corporation to release specific portions of the property as the development progresses, providing flexibility in financing and sales. When preparing a Travis Texas Partial Release of Property From Deed of Trust for Corporation, it is crucial to include essential information such as the legal description of the property being released, the amount of the release, and any conditions or requirements that need to be met to execute the release. It is highly recommended consulting with a qualified attorney to ensure compliance with state laws and regulations, as well as to tailor the document to the specific needs and circumstances of the corporation. Note: It is important to conduct thorough research and consult with a legal professional to obtain accurate and up-to-date information regarding Travis Texas Partial Release of Property From Deed of Trust for Corporation, as laws and regulations can vary and change over time.Travis Texas Partial Release of Property From Deed of Trust for Corporation is an essential legal document that allows a corporation to release a portion of a property from a previously executed Deed of Trust. This release is typically undertaken when the corporation has fulfilled a certain condition or met a specific requirement in relation to the property. The Partial Release of Property From Deed of Trust for Corporation confirms the corporation's intent to discharge a portion of the property from the encumbrances imposed by the Deed of Trust, effectively reducing the property that is still subject to the trust. This release is significant as it grants the corporation more flexibility and options with the remaining portion of the property. In Travis County, Texas, there are various types of Partial Release of Property From Deed of Trust for Corporation, each catering to specific circumstances or conditions. Some different types may include: 1. Conditional Partial Release: This type of release is executed when the corporation has fulfilled specific conditions mentioned in the original Deed of Trust. These conditions may include payment of a certain amount, completion of improvements, or satisfaction of other obligations. 2. Voluntary Partial Release: This release is initiated by the corporation voluntarily when it wants to free a portion of the property from the encumbrances of the Deed of Trust. This allows the corporation to take advantage of opportunities such as selling or developing the released portion separately. 3. Planned Development Partial Release: In cases where the corporation intends to develop the property in phases, a Planned Development Partial Release is executed. This allows the corporation to release specific portions of the property as the development progresses, providing flexibility in financing and sales. When preparing a Travis Texas Partial Release of Property From Deed of Trust for Corporation, it is crucial to include essential information such as the legal description of the property being released, the amount of the release, and any conditions or requirements that need to be met to execute the release. It is highly recommended consulting with a qualified attorney to ensure compliance with state laws and regulations, as well as to tailor the document to the specific needs and circumstances of the corporation. Note: It is important to conduct thorough research and consult with a legal professional to obtain accurate and up-to-date information regarding Travis Texas Partial Release of Property From Deed of Trust for Corporation, as laws and regulations can vary and change over time.