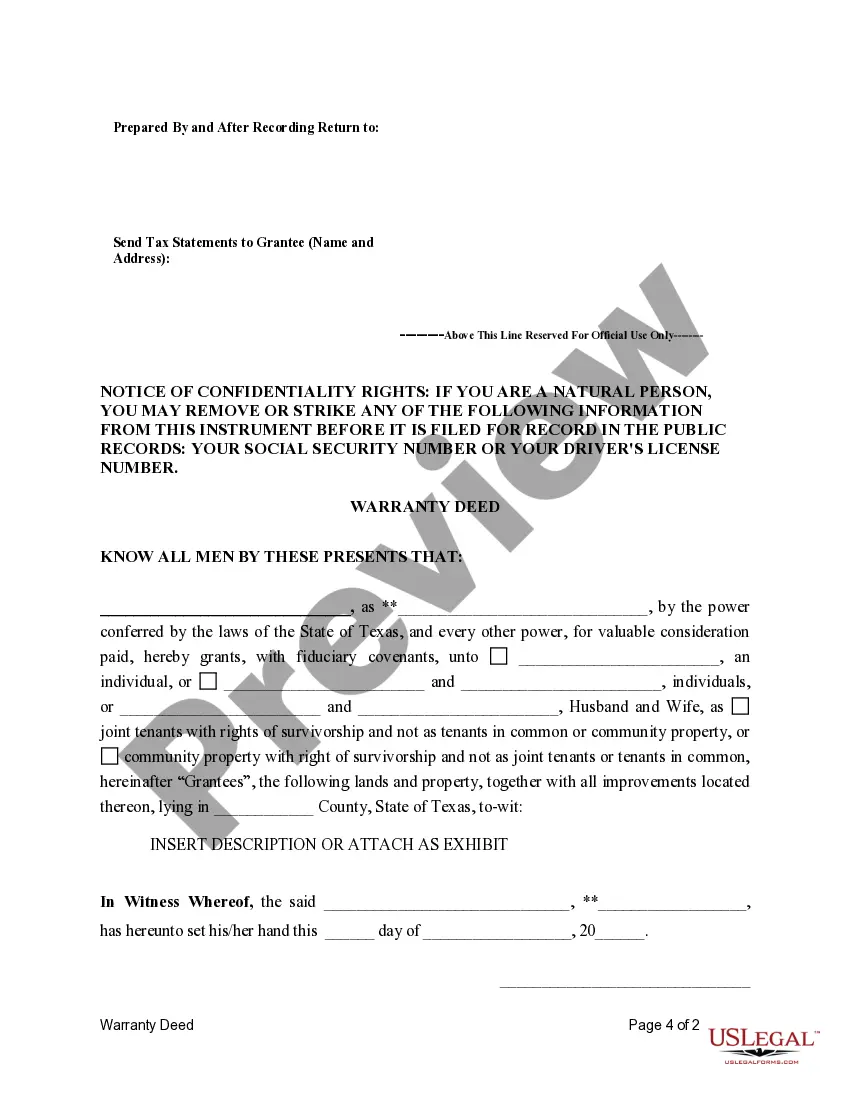

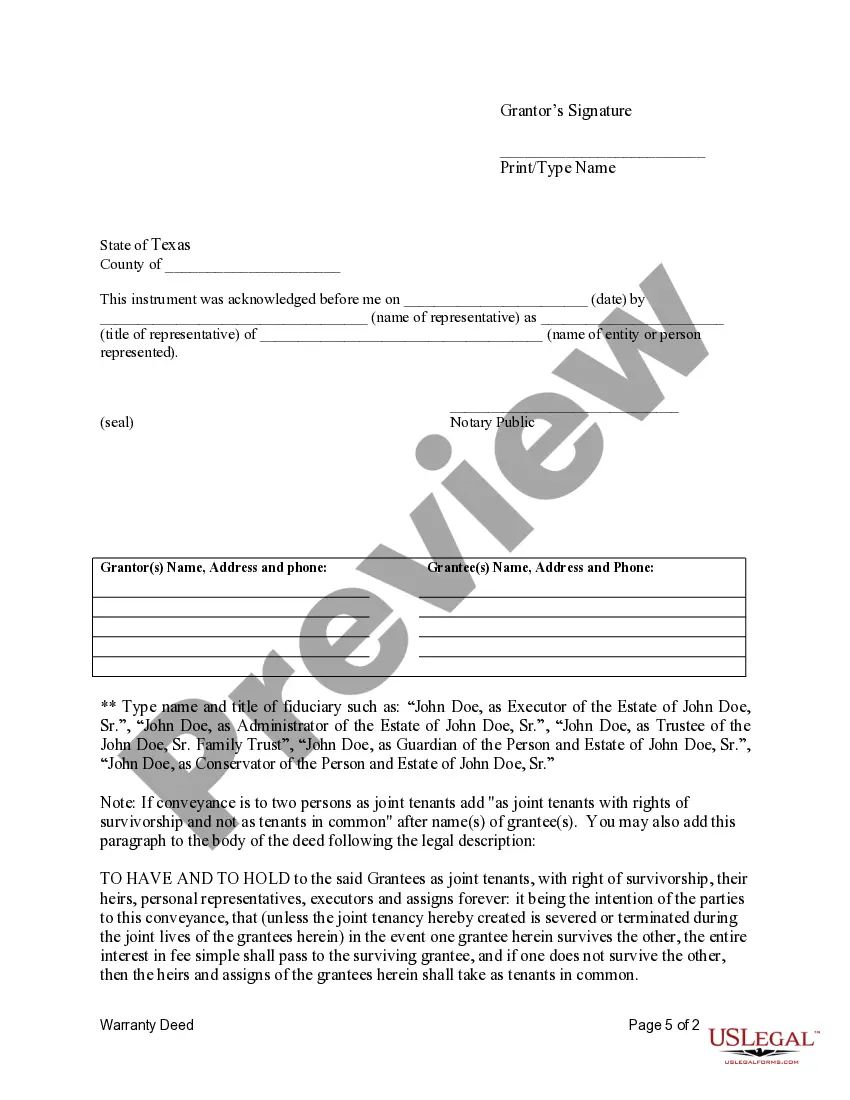

This form is a Fiduciary Deed where the grantor may be an executor of a will, trustee, guardian, or conservator.

The Austin Texas Fiduciary Deed is a legal document that serves as a means for Executors, Trustees, Trustees, Administrators, and other Fiduciaries to transfer real property in Austin, Texas. This specialized type of deed is designed to facilitate the transfer of property from a fiduciary to a beneficiary, ensuring that all legal requirements are met and that the transaction is conducted in accordance with the applicable laws and regulations. The Fiduciary Deed is typically used in situations where a fiduciary, such as an Executor or Trustee, needs to transfer property that is held in a trust or estate to a beneficiary. It is crucial in such cases to ensure that the transfer is done in a legally valid and proper manner, as fiduciaries have a legal duty to act in the best interests of the beneficiaries. When it comes to the various types of Fiduciary Deeds in Austin, Texas, several terms may be used interchangeably to describe similar concepts. These terms include Executor's Deed, Trustee's Deed, Administrator's Deed, and Fiduciary Deed. While the fundamental purpose of each type remains the same, they may differ based on the specific fiduciary involved. For instance, an Executor's Deed is used by the Executor of an estate to transfer property to a beneficiary as part of the probate process. A Trustee's Deed, on the other hand, is employed when a Trustee wishes to transfer property held in a trust to a beneficiary. Similarly, an Administrator's Deed is used by an Administrator appointed by the court to transfer property from an intestate estate (where no will is present) to rightful heirs. Regardless of the type or specific name given to the Fiduciary Deed, the goal remains constant — to establish a clear transfer of real property rights from the fiduciary to the intended beneficiary. The deed must be executed with the necessary legal formalities and recorded with the appropriate county office to ensure it is properly documented and legally binding. To summarize, the Austin Texas Fiduciary Deed is a crucial legal instrument that enables Executors, Trustees, Trustees, Administrators, and other Fiduciaries to transfer real property in compliance with applicable laws and regulations. However, it is important to consult with a legal professional familiar with estate and trust matters to determine the specific type of Fiduciary Deed required for the given fiduciary role and circumstances.