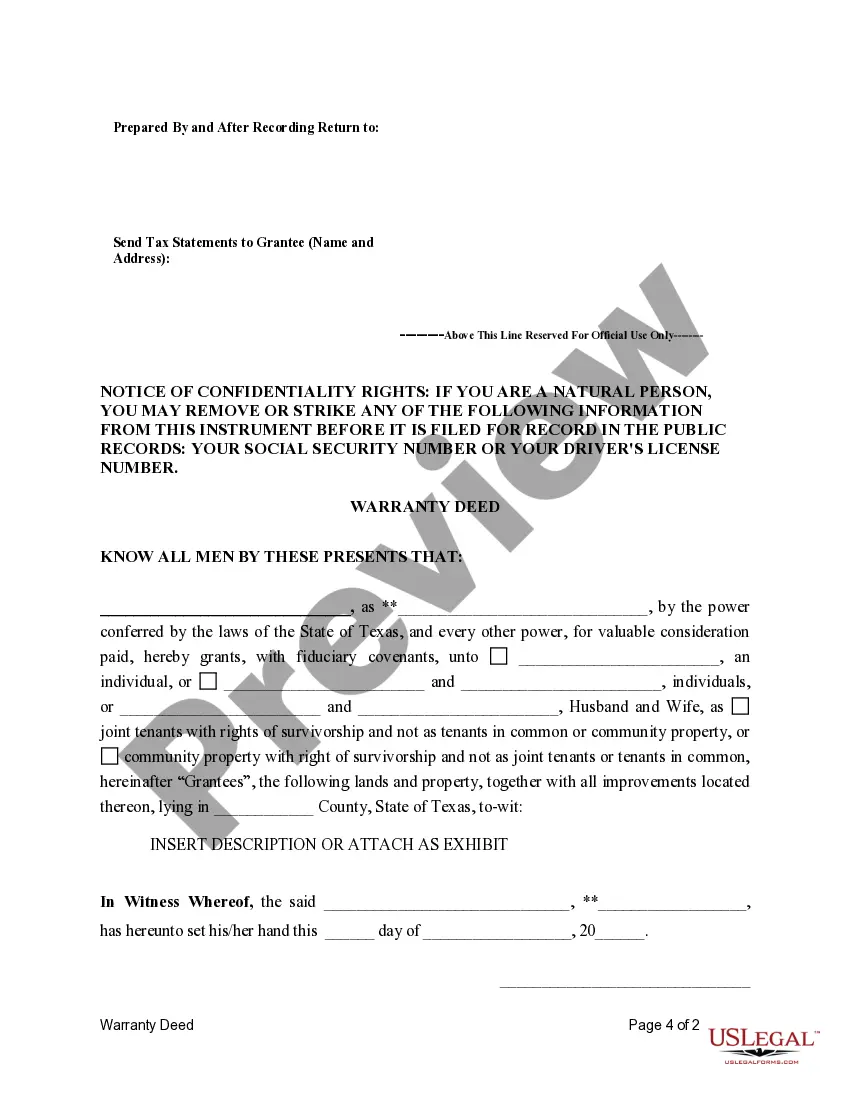

This form is a Fiduciary Deed where the grantor may be an executor of a will, trustee, guardian, or conservator.

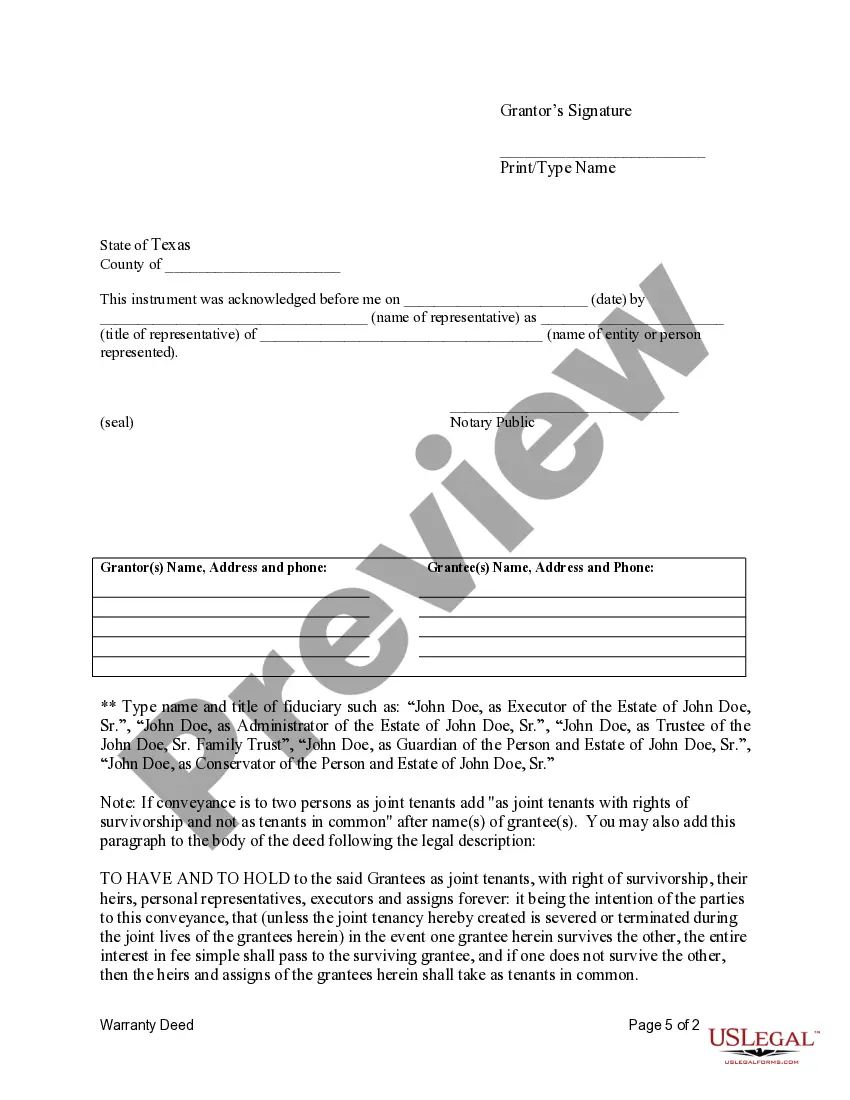

The Bexar Texas Fiduciary Deed is a legal document specifically designed for use by Executors, Trustees, Trustees, Administrators, and other Fiduciaries to transfer property ownership rights in Bexar County, Texas. This detailed description will provide a comprehensive overview of this deed type, its purpose, and the different variations available. A fiduciary is an individual or entity appointed by a court or specified in a will or trust document to manage the assets and affairs of another person or estate. The Bexar Texas Fiduciary Deed allows fiduciaries to transfer property titles while fulfilling their legal obligations and duties. The Bexar Texas Fiduciary Deed can be categorized into several types based on the specific role of the fiduciary involved. Some common variations of the Bexar Texas Fiduciary Deed include: 1. Executor's Deed: This type of fiduciary deed is used when an Executor, named in a deceased person's will, wishes to transfer property ownership to the designated beneficiaries or fulfill other obligations outlined in the will. 2. Trustee's Deed: Trustees, who are appointed to manage assets in a trust, utilize this fiduciary deed to transfer property from the trust to individuals or entities as specified in the trust agreement. 3. Administrator's Deed: Administrators are typically appointed by the court to manage the estate of someone who has died without a valid will (intestate). They employ this deed to transfer property title to rightful beneficiaries or sell the property to settle the estate's debts or distribute the proceeds. 4. Trust or's Deed: Trustees, who are individuals or entities that create a trust, may use this deed to transfer property into the trust, typically before or during their lifetime. This allows the trust to hold legal ownership of the property and avoid probate proceedings upon the trust or's death. Each variation of the Bexar Texas Fiduciary Deed serves a specific purpose and must be carefully executed to ensure compliance with the relevant laws and regulations in Bexar County, Texas. Fiduciaries must follow the guidelines established by the Bexar County Clerk's Office to complete and record these deeds accurately. When preparing a Bexar Texas Fiduciary Deed, fiduciaries should consult with legal professionals specializing in estate and property law to ensure compliance with all legal requirements and to address any specific nuances related to the various fiduciary roles. By utilizing the appropriate Bexar Texas Fiduciary Deed, Executors, Trustees, Trustees, Administrators, and other Fiduciaries can effectively transfer property ownership in a manner consistent with their fiduciary responsibilities, thereby facilitating the orderly transfer of assets and fulfilling the wishes of the deceased or granter.