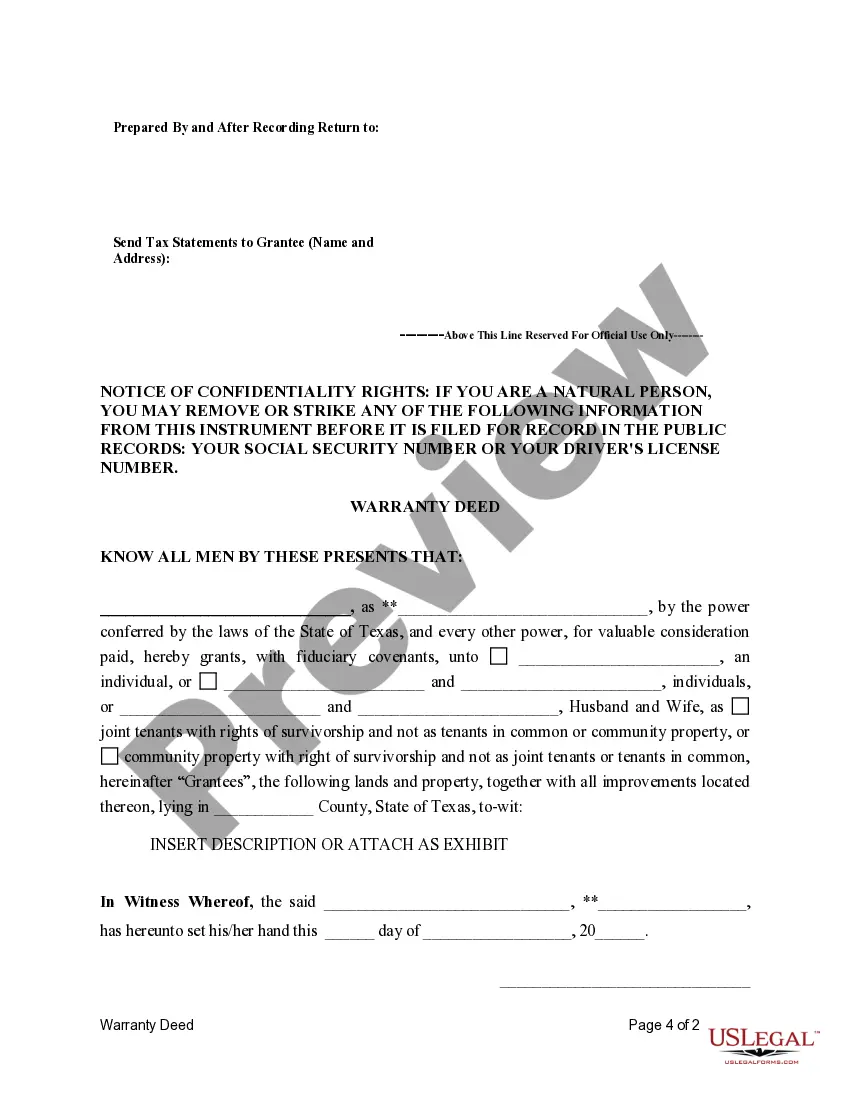

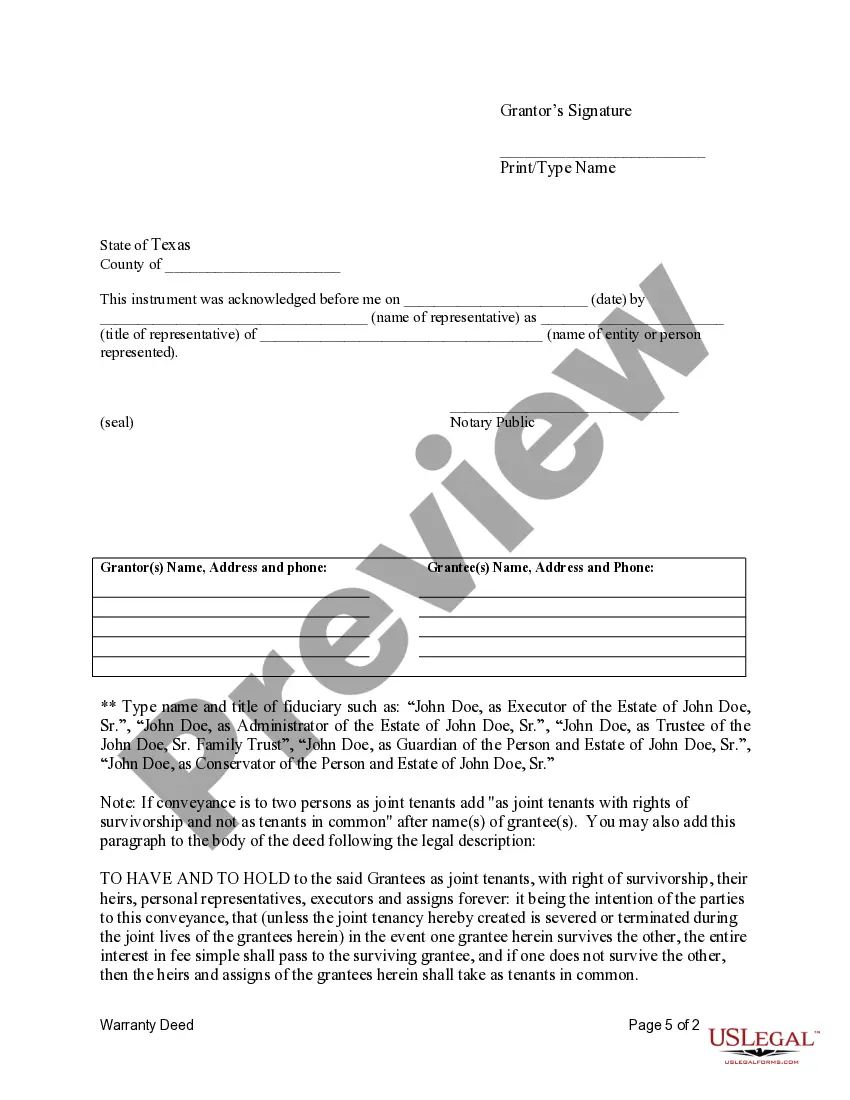

This form is a Fiduciary Deed where the grantor may be an executor of a will, trustee, guardian, or conservator.

What is a Brownsville Texas Fiduciary Deed? A Brownsville Texas Fiduciary Deed is a legal document that is used by Executors, Trustees, Trustees, Administrators, and other Fiduciaries to transfer real property (land or real estate) from the estate of a deceased individual to the rightful beneficiaries. This type of deed ensures that the transfer of ownership is conducted in a legal and transparent manner, following the specific rules and regulations of Texas probate law. Executors and Administrators are individuals appointed by a court to oversee the distribution of assets and manage the affairs of a deceased person's estate. Trustees, on the other hand, are responsible for managing and protecting assets on behalf of someone else, typically outlined in a trust agreement. Trustees are the creators of the trust who transfer their assets into the trust for protection and eventual distribution. Different types of Brownsville Texas Fiduciary Deeds may include: 1. Executor's Deed: This deed is used when the Executor of a deceased person's estate is transferring property to the beneficiaries or heirs as specified in the decedent's will. 2. Administrator's Deed: Similar to an Executor's Deed, this document is used when an Administrator, appointed by the court in cases where there is no will or appointed Executor, transfers the property to the rightful beneficiaries. 3. Trustee's Deed: This type of Fiduciary Deed is utilized by a Trustee when they are transferring property held within a trust to the designated beneficiaries as outlined in the trust agreement. It is crucial for Executors, Trustees, Trustees, Administrators, and other Fiduciaries to ensure that they follow all legal procedures and requirements when executing a Brownsville Texas Fiduciary Deed. The deed must accurately reflect the intentions of the deceased individual or the terms laid out in the trust agreement. It is advised to consult with an attorney experienced in Texas probate law to navigate the complexities involved in the transfer of property through a Fiduciary Deed.What is a Brownsville Texas Fiduciary Deed? A Brownsville Texas Fiduciary Deed is a legal document that is used by Executors, Trustees, Trustees, Administrators, and other Fiduciaries to transfer real property (land or real estate) from the estate of a deceased individual to the rightful beneficiaries. This type of deed ensures that the transfer of ownership is conducted in a legal and transparent manner, following the specific rules and regulations of Texas probate law. Executors and Administrators are individuals appointed by a court to oversee the distribution of assets and manage the affairs of a deceased person's estate. Trustees, on the other hand, are responsible for managing and protecting assets on behalf of someone else, typically outlined in a trust agreement. Trustees are the creators of the trust who transfer their assets into the trust for protection and eventual distribution. Different types of Brownsville Texas Fiduciary Deeds may include: 1. Executor's Deed: This deed is used when the Executor of a deceased person's estate is transferring property to the beneficiaries or heirs as specified in the decedent's will. 2. Administrator's Deed: Similar to an Executor's Deed, this document is used when an Administrator, appointed by the court in cases where there is no will or appointed Executor, transfers the property to the rightful beneficiaries. 3. Trustee's Deed: This type of Fiduciary Deed is utilized by a Trustee when they are transferring property held within a trust to the designated beneficiaries as outlined in the trust agreement. It is crucial for Executors, Trustees, Trustees, Administrators, and other Fiduciaries to ensure that they follow all legal procedures and requirements when executing a Brownsville Texas Fiduciary Deed. The deed must accurately reflect the intentions of the deceased individual or the terms laid out in the trust agreement. It is advised to consult with an attorney experienced in Texas probate law to navigate the complexities involved in the transfer of property through a Fiduciary Deed.