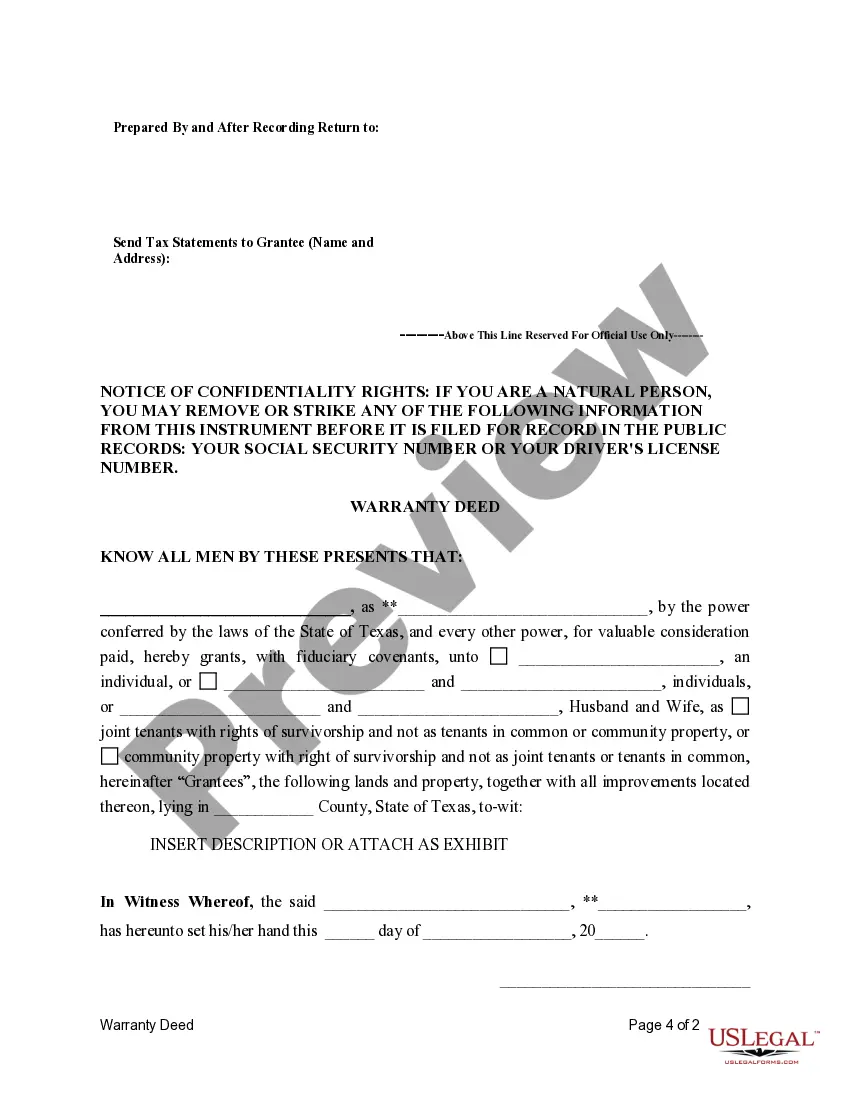

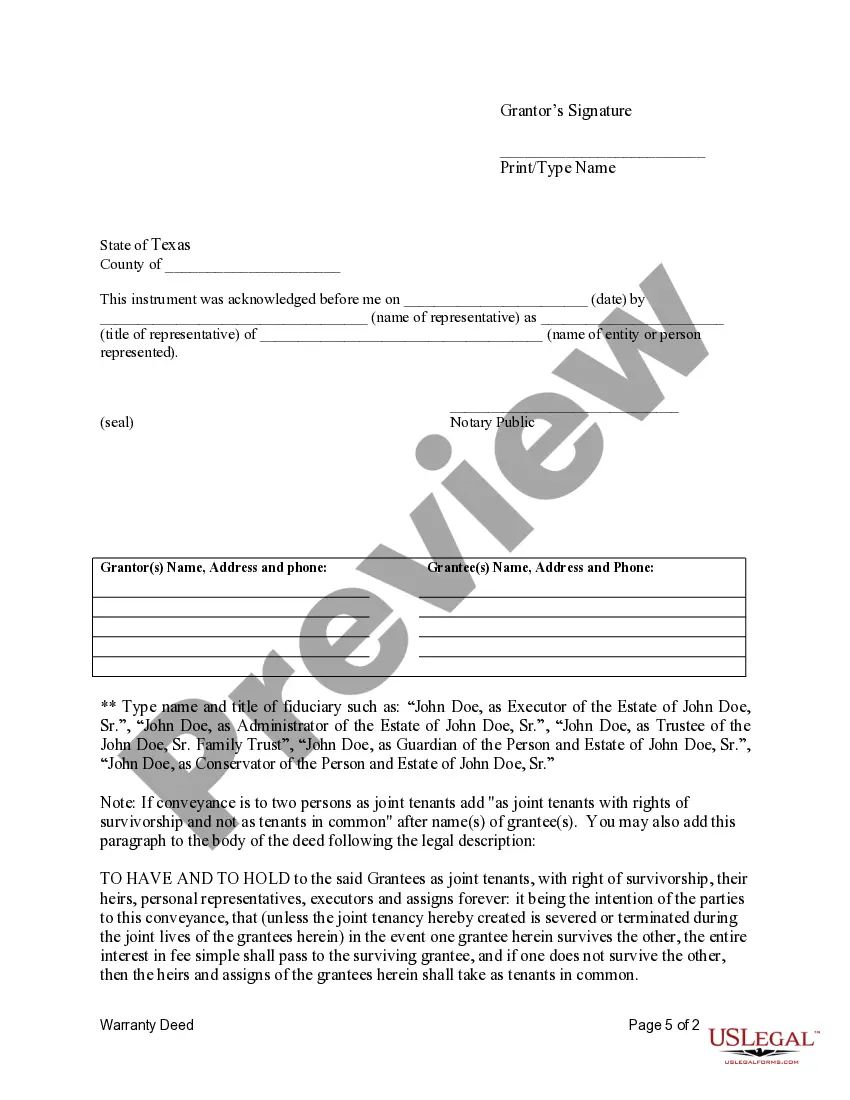

This form is a Fiduciary Deed where the grantor may be an executor of a will, trustee, guardian, or conservator.

A Collin Texas Fiduciary Deed is a legal document specifically designed for use by Executors, Trustees, Trustees, Administrators, and other Fiduciaries involved in the management and transfer of assets in Collin County, Texas. This deed serves as a means to transfer ownership of a property from the fiduciary to a designated beneficiary or entity. One type of Collin Texas Fiduciary Deed is the Executor's Deed. This specific document is used by an executor, who is appointed in a deceased individual's will, to transfer the property to the named beneficiaries. The Executor's Deed ensures that the property is properly distributed according to the decedent's wishes as expressed in the will. Another type is the Trustee's Deed, which is used by a trustee responsible for administering a trust to transfer a property vested in the trust. A trust can be established for various purposes, such as asset protection, estate planning, or charitable giving. The Trustee's Deed facilitates the transfer of the property based on the terms outlined in the trust agreement. The Administrators' Deed is another variant of the Collin Texas Fiduciary Deed. This document is used by an administrator when managing and transferring a property in cases where the deceased individual did not leave a valid will. The administrator is appointed by the court, and their role is to settle the estate and distribute assets according to the Texas intestacy laws. It is important to note that regardless of the specific type of Collin Texas Fiduciary Deed being used, the fiduciary must ensure that the deed complies with all relevant legal requirements, including proper execution and recording. Additionally, fiduciaries must act in the best interests of the beneficiaries and adhere to their fiduciary duties, which include loyalty, fairness, and prudence. In summary, the Collin Texas Fiduciary Deed serves as a crucial legal tool for Executors, Trustees, Trustees, Administrators, and other Fiduciaries involved in the transfer of assets in Collin County, Texas. By using the appropriate fiduciary deed, these individuals can facilitate the proper distribution of property while adhering to their legal obligations.A Collin Texas Fiduciary Deed is a legal document specifically designed for use by Executors, Trustees, Trustees, Administrators, and other Fiduciaries involved in the management and transfer of assets in Collin County, Texas. This deed serves as a means to transfer ownership of a property from the fiduciary to a designated beneficiary or entity. One type of Collin Texas Fiduciary Deed is the Executor's Deed. This specific document is used by an executor, who is appointed in a deceased individual's will, to transfer the property to the named beneficiaries. The Executor's Deed ensures that the property is properly distributed according to the decedent's wishes as expressed in the will. Another type is the Trustee's Deed, which is used by a trustee responsible for administering a trust to transfer a property vested in the trust. A trust can be established for various purposes, such as asset protection, estate planning, or charitable giving. The Trustee's Deed facilitates the transfer of the property based on the terms outlined in the trust agreement. The Administrators' Deed is another variant of the Collin Texas Fiduciary Deed. This document is used by an administrator when managing and transferring a property in cases where the deceased individual did not leave a valid will. The administrator is appointed by the court, and their role is to settle the estate and distribute assets according to the Texas intestacy laws. It is important to note that regardless of the specific type of Collin Texas Fiduciary Deed being used, the fiduciary must ensure that the deed complies with all relevant legal requirements, including proper execution and recording. Additionally, fiduciaries must act in the best interests of the beneficiaries and adhere to their fiduciary duties, which include loyalty, fairness, and prudence. In summary, the Collin Texas Fiduciary Deed serves as a crucial legal tool for Executors, Trustees, Trustees, Administrators, and other Fiduciaries involved in the transfer of assets in Collin County, Texas. By using the appropriate fiduciary deed, these individuals can facilitate the proper distribution of property while adhering to their legal obligations.