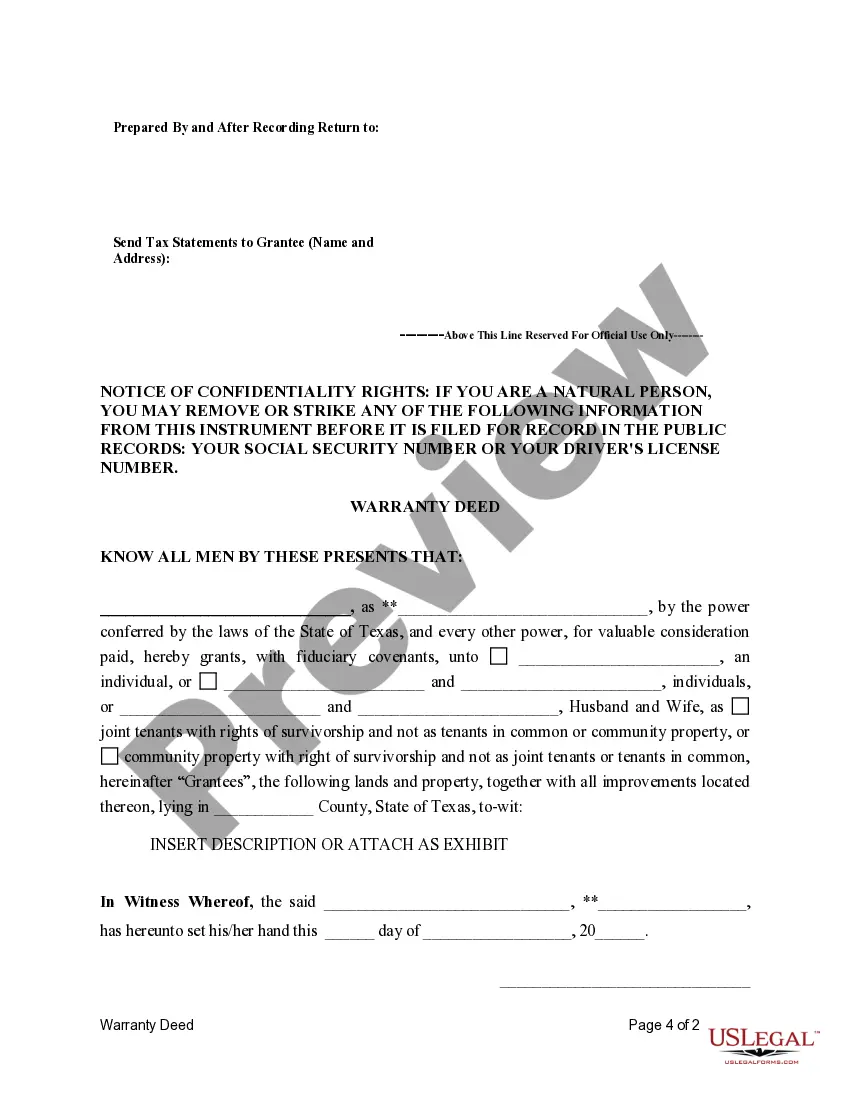

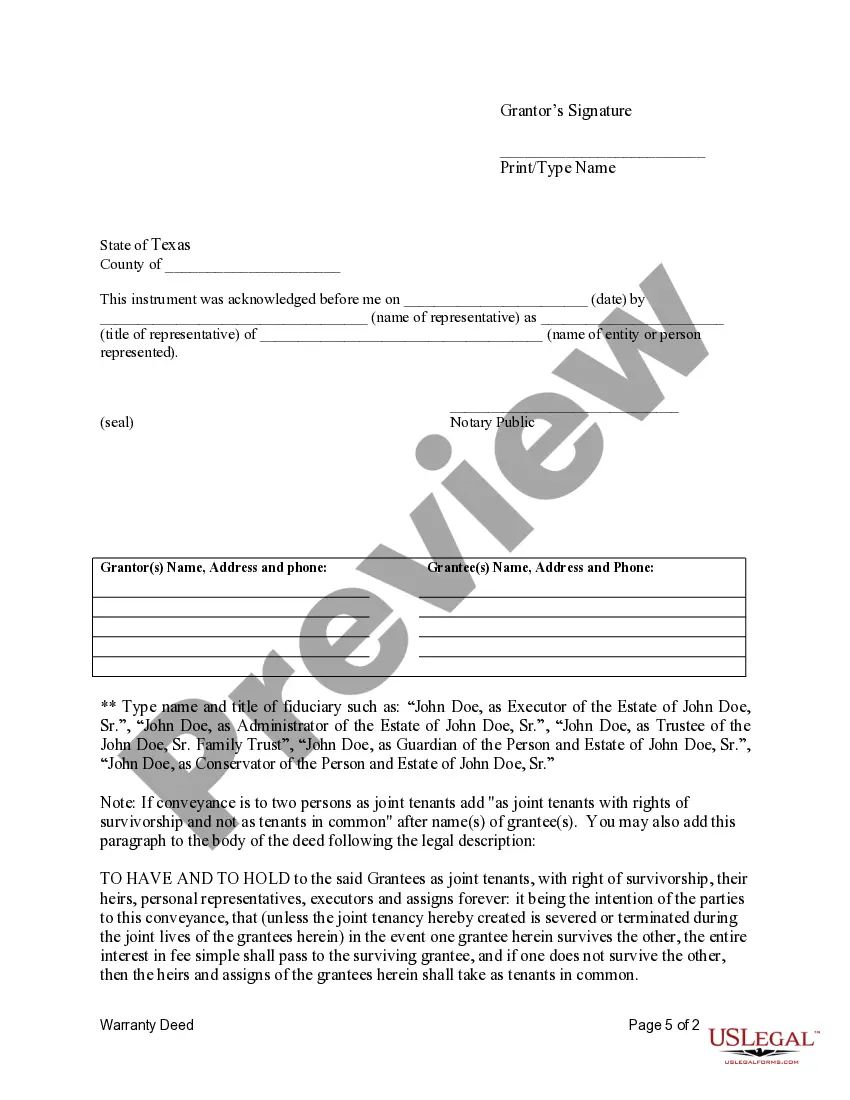

This form is a Fiduciary Deed where the grantor may be an executor of a will, trustee, guardian, or conservator.

Edinburg Texas Fiduciary Deed is a legal document that serves as a crucial tool for Executors, Trustees, Trustees, Administrators, and other Fiduciaries involved in real estate transactions within Edinburg, Texas. This formal document grants authority and outlines the responsibilities of fiduciaries when dealing with property matters. It ensures the proper transfer of property ownership and protects the interests of beneficiaries and individuals involved. The Edinburg Texas Fiduciary Deed is mainly used by executors appointed through a will, trustees managing trust assets, trustees initiating the creation of a trust, administrators handling estates without a will, and other fiduciaries acting on behalf of the property owner. It is important to note that different types of fiduciary deeds exist to cater to specific situations. These include: 1. Executor's Fiduciary Deed: This type of fiduciary deed is utilized when an executor is named in a decedent's will to administer the estate and transfer ownership of the property to the designated beneficiaries. 2. Trustee's Fiduciary Deed: Trustees use this type of fiduciary deed to facilitate the transfer of property ownership, following the terms and conditions outlined in the trust agreement. This ensures trust assets are properly distributed to the intended beneficiaries. 3. Trust or's Fiduciary Deed: Trustees employ this fiduciary deed to establish a trust and transfer ownership of property into the trust's name. The trust or maintains control over the trust during their lifetime, defining how the property is managed and specifying the distribution of assets upon their death. 4. Administrator's Fiduciary Deed: In cases where a person dies without a will, an administrator is appointed by the court to handle the estate's administration. The administrator uses this fiduciary deed to transfer the decedent's property to rightful heirs or beneficiaries based on the laws of intestate succession. 5. Other Fiduciaries' Deed: This is a general term encompassing fiduciary deeds utilized by individuals or entities acting as a fiduciary, but not falling under the typical roles of executor, trustee, trust or, or administrator. Examples may include guardians appointed for minor heirs or conservators responsible for managing an individual's property due to incapacity. Keywords: Edinburg Texas, Fiduciary Deed, Executors, Trustees, Trustees, Administrators, Fiduciaries, real estate transactions, property ownership, beneficiaries, formal document, transfer of ownership, estate administration, trust agreement, trust assets, trustees, decedent's will, trust establishment, court-appointed administrator, heir distribution, intestate succession, minor heirs, property management, conservators, incapacity.Edinburg Texas Fiduciary Deed is a legal document that serves as a crucial tool for Executors, Trustees, Trustees, Administrators, and other Fiduciaries involved in real estate transactions within Edinburg, Texas. This formal document grants authority and outlines the responsibilities of fiduciaries when dealing with property matters. It ensures the proper transfer of property ownership and protects the interests of beneficiaries and individuals involved. The Edinburg Texas Fiduciary Deed is mainly used by executors appointed through a will, trustees managing trust assets, trustees initiating the creation of a trust, administrators handling estates without a will, and other fiduciaries acting on behalf of the property owner. It is important to note that different types of fiduciary deeds exist to cater to specific situations. These include: 1. Executor's Fiduciary Deed: This type of fiduciary deed is utilized when an executor is named in a decedent's will to administer the estate and transfer ownership of the property to the designated beneficiaries. 2. Trustee's Fiduciary Deed: Trustees use this type of fiduciary deed to facilitate the transfer of property ownership, following the terms and conditions outlined in the trust agreement. This ensures trust assets are properly distributed to the intended beneficiaries. 3. Trust or's Fiduciary Deed: Trustees employ this fiduciary deed to establish a trust and transfer ownership of property into the trust's name. The trust or maintains control over the trust during their lifetime, defining how the property is managed and specifying the distribution of assets upon their death. 4. Administrator's Fiduciary Deed: In cases where a person dies without a will, an administrator is appointed by the court to handle the estate's administration. The administrator uses this fiduciary deed to transfer the decedent's property to rightful heirs or beneficiaries based on the laws of intestate succession. 5. Other Fiduciaries' Deed: This is a general term encompassing fiduciary deeds utilized by individuals or entities acting as a fiduciary, but not falling under the typical roles of executor, trustee, trust or, or administrator. Examples may include guardians appointed for minor heirs or conservators responsible for managing an individual's property due to incapacity. Keywords: Edinburg Texas, Fiduciary Deed, Executors, Trustees, Trustees, Administrators, Fiduciaries, real estate transactions, property ownership, beneficiaries, formal document, transfer of ownership, estate administration, trust agreement, trust assets, trustees, decedent's will, trust establishment, court-appointed administrator, heir distribution, intestate succession, minor heirs, property management, conservators, incapacity.