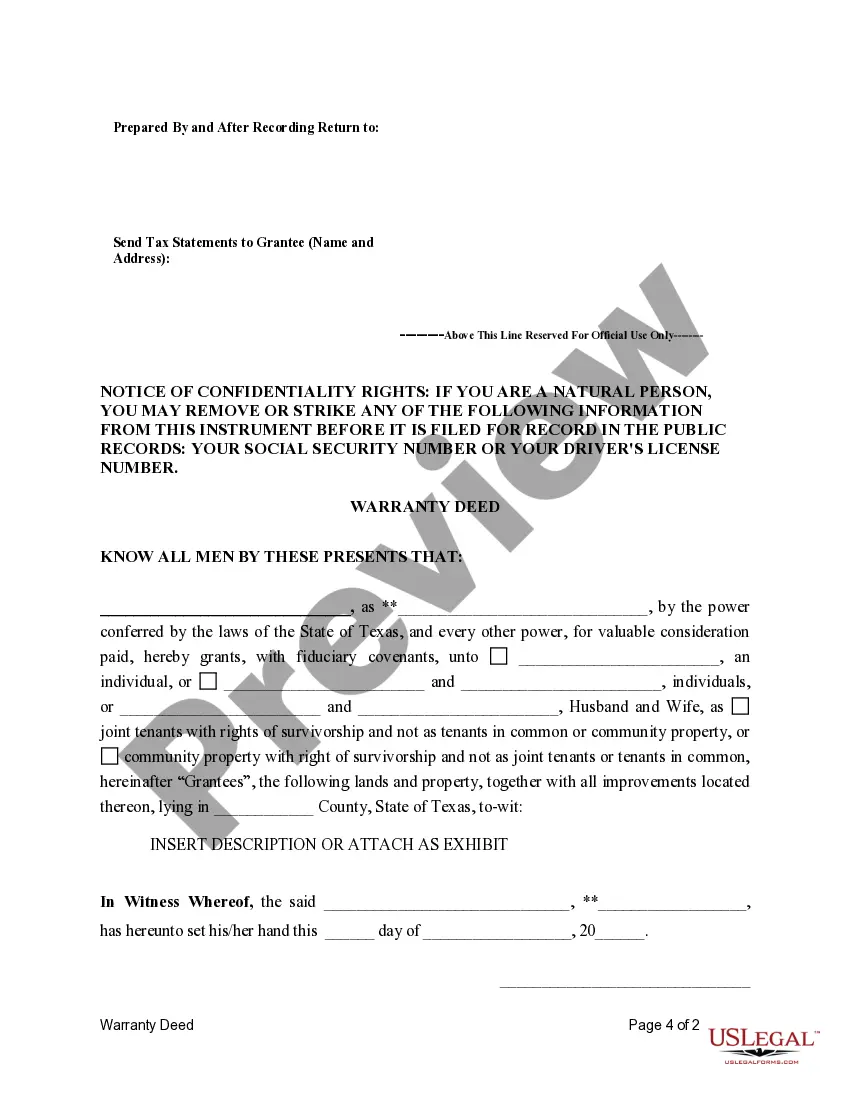

This form is a Fiduciary Deed where the grantor may be an executor of a will, trustee, guardian, or conservator.

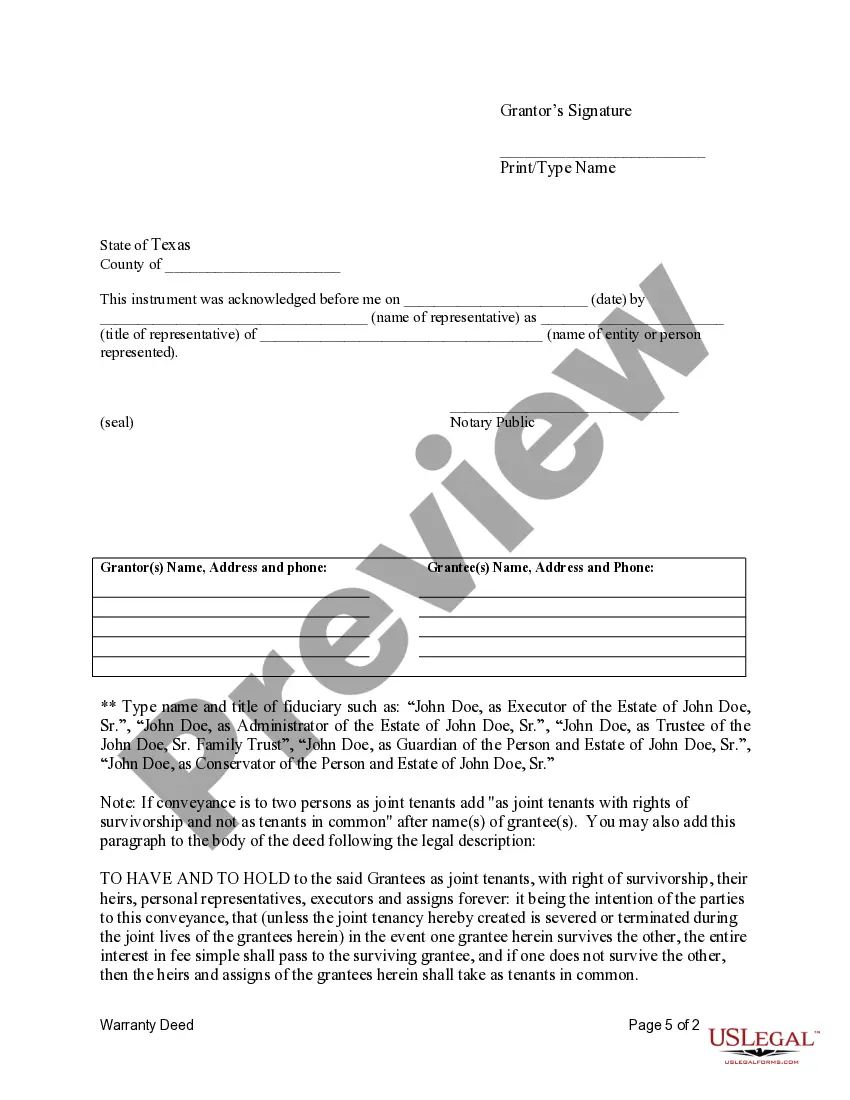

Round Rock Texas Fiduciary Deed: A Detailed Description for Executors, Trustees, Trustees, Administrators, and other Fiduciaries Keywords: Round Rock Texas, Fiduciary Deed, Executors, Trustees, Trustees, Administrators, Fiduciaries Introduction: In Round Rock, Texas, a Fiduciary Deed serves as a crucial legal document utilized by various individuals fulfilling fiduciary roles such as Executors, Trustees, Trustees, Administrators, and other Fiduciaries. This detailed description aims to provide an in-depth understanding of the Round Rock Texas Fiduciary Deed, its purpose, requirements, and any potential variations associated with different fiduciary roles. Description: A Round Rock Texas Fiduciary Deed is a legal instrument executed by a fiduciary, acting under the authority of a probate court or a trust agreement, to convey ownership of real property held within an estate or trust. This document facilitates the transfer of property interests from the deceased (or trust or) to the intended beneficiary or any other interested party. Different Types of Round Rock Texas Fiduciary Deeds: 1. Executor's Fiduciary Deed: When an individual is named as an executor in a decedent's will, they are responsible for managing and distributing the deceased person's assets, including real property. The Executor's Fiduciary Deed allows the executor to transfer the title of the property to the designated heirs or beneficiaries as specified in the will. 2. Trustee's Fiduciary Deed: Trustees oversee the administration and distribution of assets held in a trust. A Trustee's Fiduciary Deed is used when a trust or designates a trustee to convey trust property to the trust's beneficiaries according to the terms of the trust agreement. 3. Administrator's Fiduciary Deed: In cases where an individual passes away without leaving a valid will or trust, the court appoints an administrator to handle the distribution of the deceased's estate. The Administrator's Fiduciary Deed enables the court-appointed administrator to transfer real property to the rightful heirs based on the state's laws of intestate succession. Requirements for Round Rock Texas Fiduciary Deed: — Identify the fiduciary role: Clearly state whether the individual executing the deed is an Executor, Trustee, Administrator, or other Fiduciary. — Accurate property description: Provide an accurate legal description of the property being conveyed. This includes the property's address, lot and block information, and any other relevant details necessary for a complete description. — Fiduciary powers: The Fiduciary Deed should explicitly state the fiduciary's authority to sell or transfer the property and any limitations or conditions imposed by the court or trust agreement. — Notarization and witnessing: The Fiduciary Deed must be notarized and witnessed by two disinterested parties to ensure its validity and compliance with legal requirements. Conclusion: The Round Rock Texas Fiduciary Deed serves as a vital legal tool that enables Executors, Trustees, Trustees, Administrators, and other Fiduciaries to transfer real property to rightful beneficiaries or interested parties. Whether it's the Executor's Fiduciary Deed, Trustee's Fiduciary Deed, or Administrator's Fiduciary Deed, each type fulfills a specific purpose aligned with the fiduciary's role. By understanding the requirements and functions of these deeds, fiduciaries can effectively fulfill their obligations while ensuring a smooth transfer of property ownership within the Round Rock, Texas jurisdiction.Round Rock Texas Fiduciary Deed: A Detailed Description for Executors, Trustees, Trustees, Administrators, and other Fiduciaries Keywords: Round Rock Texas, Fiduciary Deed, Executors, Trustees, Trustees, Administrators, Fiduciaries Introduction: In Round Rock, Texas, a Fiduciary Deed serves as a crucial legal document utilized by various individuals fulfilling fiduciary roles such as Executors, Trustees, Trustees, Administrators, and other Fiduciaries. This detailed description aims to provide an in-depth understanding of the Round Rock Texas Fiduciary Deed, its purpose, requirements, and any potential variations associated with different fiduciary roles. Description: A Round Rock Texas Fiduciary Deed is a legal instrument executed by a fiduciary, acting under the authority of a probate court or a trust agreement, to convey ownership of real property held within an estate or trust. This document facilitates the transfer of property interests from the deceased (or trust or) to the intended beneficiary or any other interested party. Different Types of Round Rock Texas Fiduciary Deeds: 1. Executor's Fiduciary Deed: When an individual is named as an executor in a decedent's will, they are responsible for managing and distributing the deceased person's assets, including real property. The Executor's Fiduciary Deed allows the executor to transfer the title of the property to the designated heirs or beneficiaries as specified in the will. 2. Trustee's Fiduciary Deed: Trustees oversee the administration and distribution of assets held in a trust. A Trustee's Fiduciary Deed is used when a trust or designates a trustee to convey trust property to the trust's beneficiaries according to the terms of the trust agreement. 3. Administrator's Fiduciary Deed: In cases where an individual passes away without leaving a valid will or trust, the court appoints an administrator to handle the distribution of the deceased's estate. The Administrator's Fiduciary Deed enables the court-appointed administrator to transfer real property to the rightful heirs based on the state's laws of intestate succession. Requirements for Round Rock Texas Fiduciary Deed: — Identify the fiduciary role: Clearly state whether the individual executing the deed is an Executor, Trustee, Administrator, or other Fiduciary. — Accurate property description: Provide an accurate legal description of the property being conveyed. This includes the property's address, lot and block information, and any other relevant details necessary for a complete description. — Fiduciary powers: The Fiduciary Deed should explicitly state the fiduciary's authority to sell or transfer the property and any limitations or conditions imposed by the court or trust agreement. — Notarization and witnessing: The Fiduciary Deed must be notarized and witnessed by two disinterested parties to ensure its validity and compliance with legal requirements. Conclusion: The Round Rock Texas Fiduciary Deed serves as a vital legal tool that enables Executors, Trustees, Trustees, Administrators, and other Fiduciaries to transfer real property to rightful beneficiaries or interested parties. Whether it's the Executor's Fiduciary Deed, Trustee's Fiduciary Deed, or Administrator's Fiduciary Deed, each type fulfills a specific purpose aligned with the fiduciary's role. By understanding the requirements and functions of these deeds, fiduciaries can effectively fulfill their obligations while ensuring a smooth transfer of property ownership within the Round Rock, Texas jurisdiction.