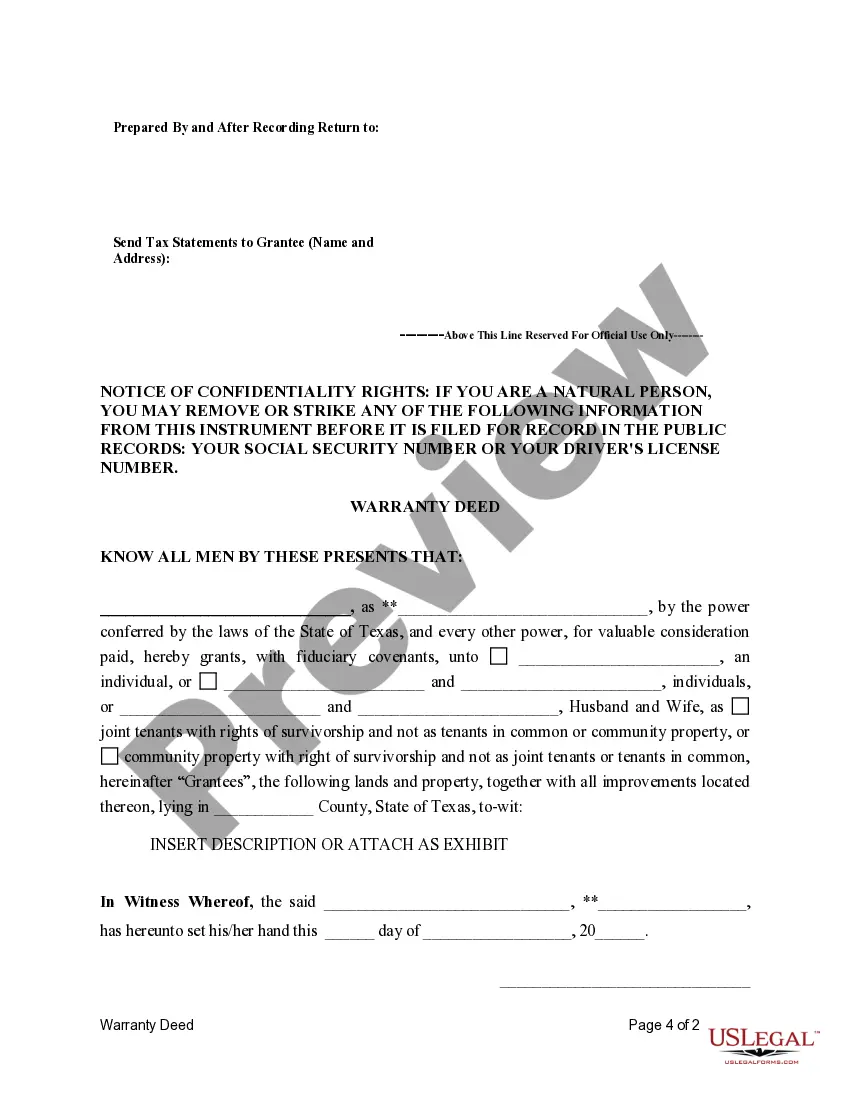

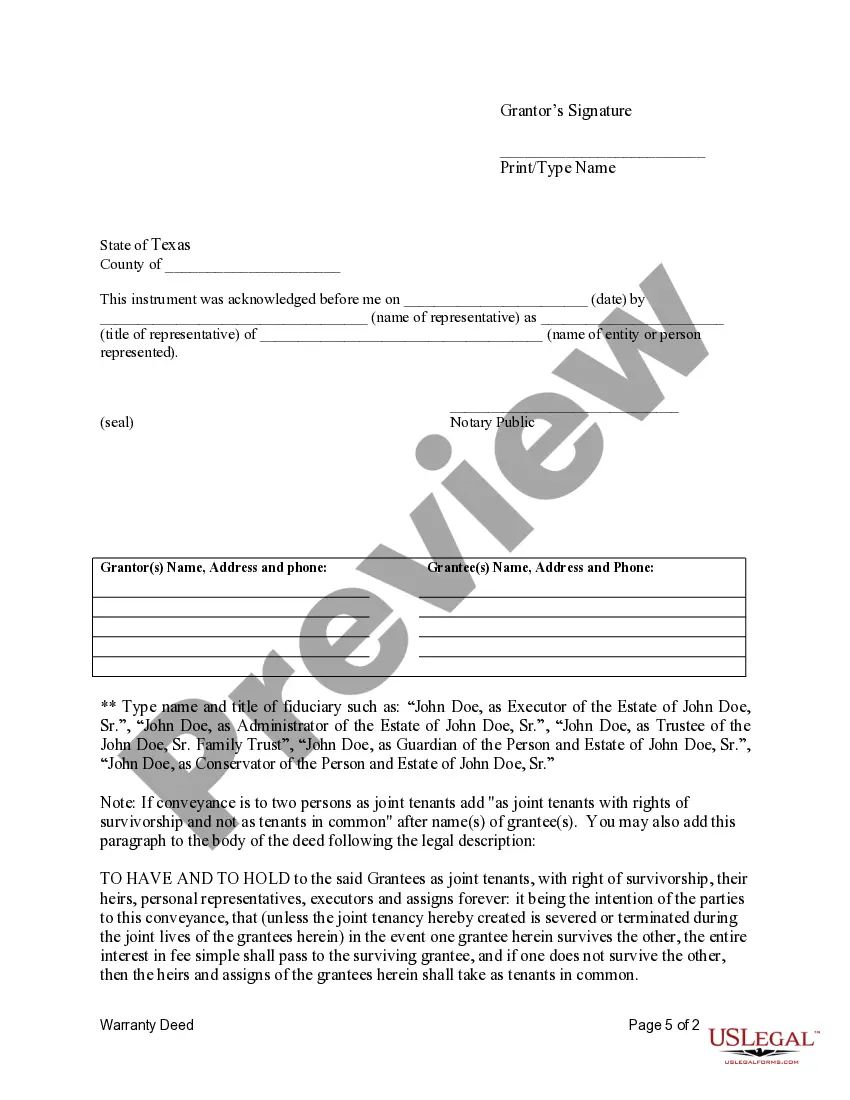

This form is a Fiduciary Deed where the grantor may be an executor of a will, trustee, guardian, or conservator.

A San Antonio Texas Fiduciary Deed is a legal document that allows executors, trustees, trustees, administrators, and other fiduciaries to transfer property to another party. This deed is used specifically in the city of San Antonio, Texas. As fiduciaries, these individuals are entrusted with managing and administering property on behalf of another person or entity, such as an estate or trust. The fiduciary deed provides a means for these individuals to ensure the transfer of property is conducted in accordance with their fiduciary duties and responsibilities. There may be different types of San Antonio Texas Fiduciary Deeds, depending on the purpose and circumstances of the transfer. Some common types include: 1. Executor's Deed: This type of fiduciary deed is used by an executor, who is appointed in a will to manage and distribute the assets of a deceased person's estate. An executor's deed transfers real estate owned by the deceased person to the beneficiaries or heirs of the estate. 2. Trustee's Deed: A trustee's deed is used when a trustee, who is appointed to manage property held in a trust, transfers real estate from the trust to a beneficiary or another party as directed by the terms of the trust agreement. This document ensures the legal transfer of property ownership while upholding the fiduciary duties of the trustee. 3. Administrator's Deed: In cases where a deceased person did not leave a will or appointed an executor, an administrator may be appointed by the court to handle the estate. An administrator's deed allows the administrator to transfer real estate owned by the deceased person to the heirs or beneficiaries as determined by Texas intestate succession laws. 4. Other Fiduciary Deeds: Depending on the specific circumstances, there may be other types of fiduciary deeds used by different fiduciaries, such as conservators or guardians appointed by the court to manage property on behalf of minors or incapacitated individuals. These San Antonio Texas Fiduciary Deeds are crucial legal instruments that ensure the proper transfer of property from fiduciaries to rightful recipients. They help to protect the interests of all parties involved and ensure that the transfer adheres to the applicable laws and regulations.