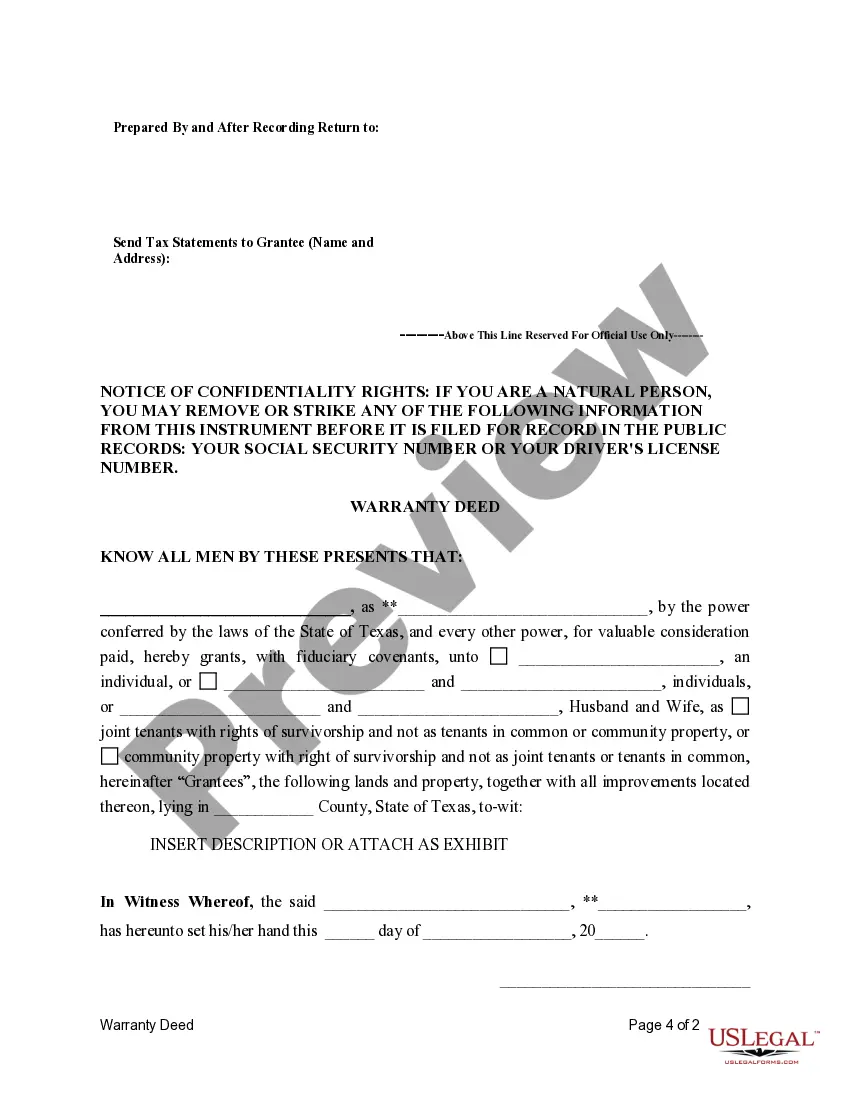

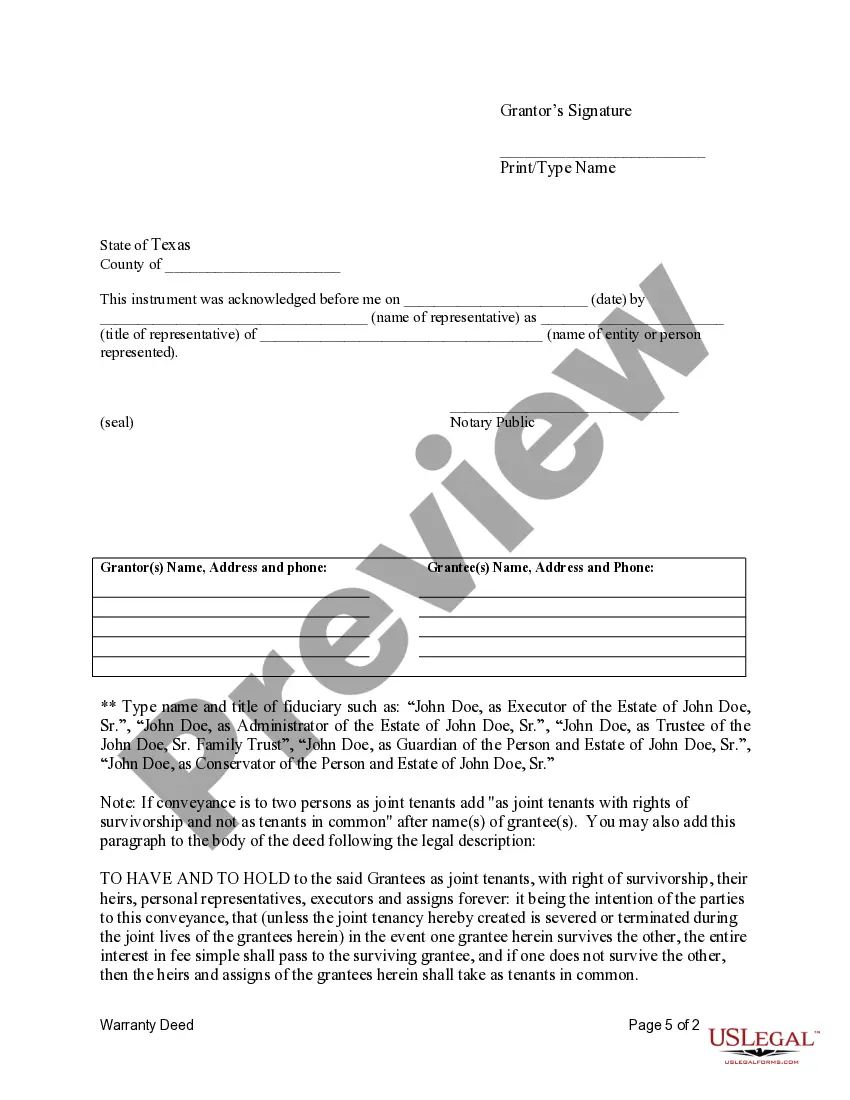

This form is a Fiduciary Deed where the grantor may be an executor of a will, trustee, guardian, or conservator.

A Sugar Land Texas Fiduciary Deed is a legal document used by executors, trustees, trustees, administrators, and other fiduciaries involved in real estate matters in the Sugar Land area. This particular type of deed helps facilitate the transfer of property ownership from the fiduciary to the rightful beneficiaries or interested parties. Executors, who are responsible for managing the estate of a deceased person, may use a Sugar Land Texas Fiduciary Deed to transfer title to real estate properties to the heirs or beneficiaries named in the deceased's will. This deed ensures a smooth transition of ownership while adhering to the requirements set forth by the state of Texas. Trustees, entrusted with managing assets within a trust, may also require a Sugar Land Texas Fiduciary Deed when transferring real estate property held in the trust to the designated beneficiaries. This deed helps to uphold the terms of the trust and protects the interests of the beneficiaries. Trustees, the original owners of a property who have placed it in a trust, may need a Sugar Land Texas Fiduciary Deed to convey the property from the trust to a new owner or beneficiary. This deed ensures a legally binding transfer of property rights while maintaining compliance with Texas laws. Administrators, when handling the estate of a person who passed away without a will (intestate), may utilize a Sugar Land Texas Fiduciary Deed to allocate the deceased's real estate assets to the rightful heirs. This deed assists in proper distribution and avoidance of any potential disputes among interested parties. Different types of Sugar Land Texas Fiduciary Deeds for use by Executors, Trustees, Trustees, Administrators, and other Fiduciaries may include: 1. Executor's Fiduciary Deed: Used by executors to transfer property from the deceased's estate to the beneficiaries or heirs named in the will. 2. Trustee's Fiduciary Deed: A deed utilized by trustees to transfer real estate property from a trust to the designated beneficiaries stipulated within the trust agreement. 3. Trust or's Fiduciary Deed: Employed by trustees to convey property from the trust back to themselves or to another beneficiary or new owner. 4. Administrator's Fiduciary Deed: Utilized by administrators handling an intestate estate to distribute real estate assets to the rightful heirs as determined by Texas probate laws. In summary, a Sugar Land Texas Fiduciary Deed is a crucial legal instrument used by various fiduciaries in the Sugar Land area to ensure the proper and lawful transfer of real estate property to beneficiaries, heirs, or new owners.