This form is a Warranty Deed where the grantor and/or grantee could be a limited partnership or LLC.

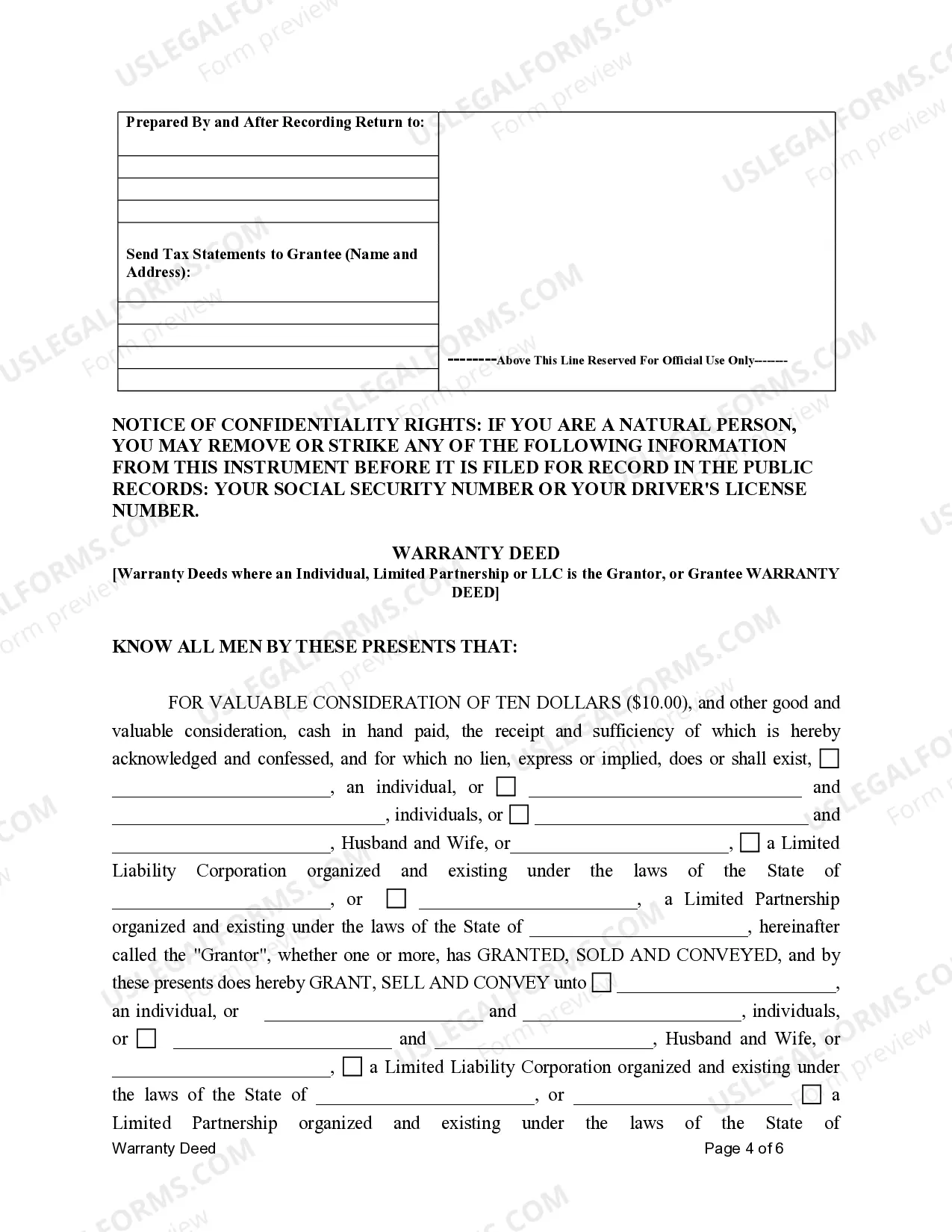

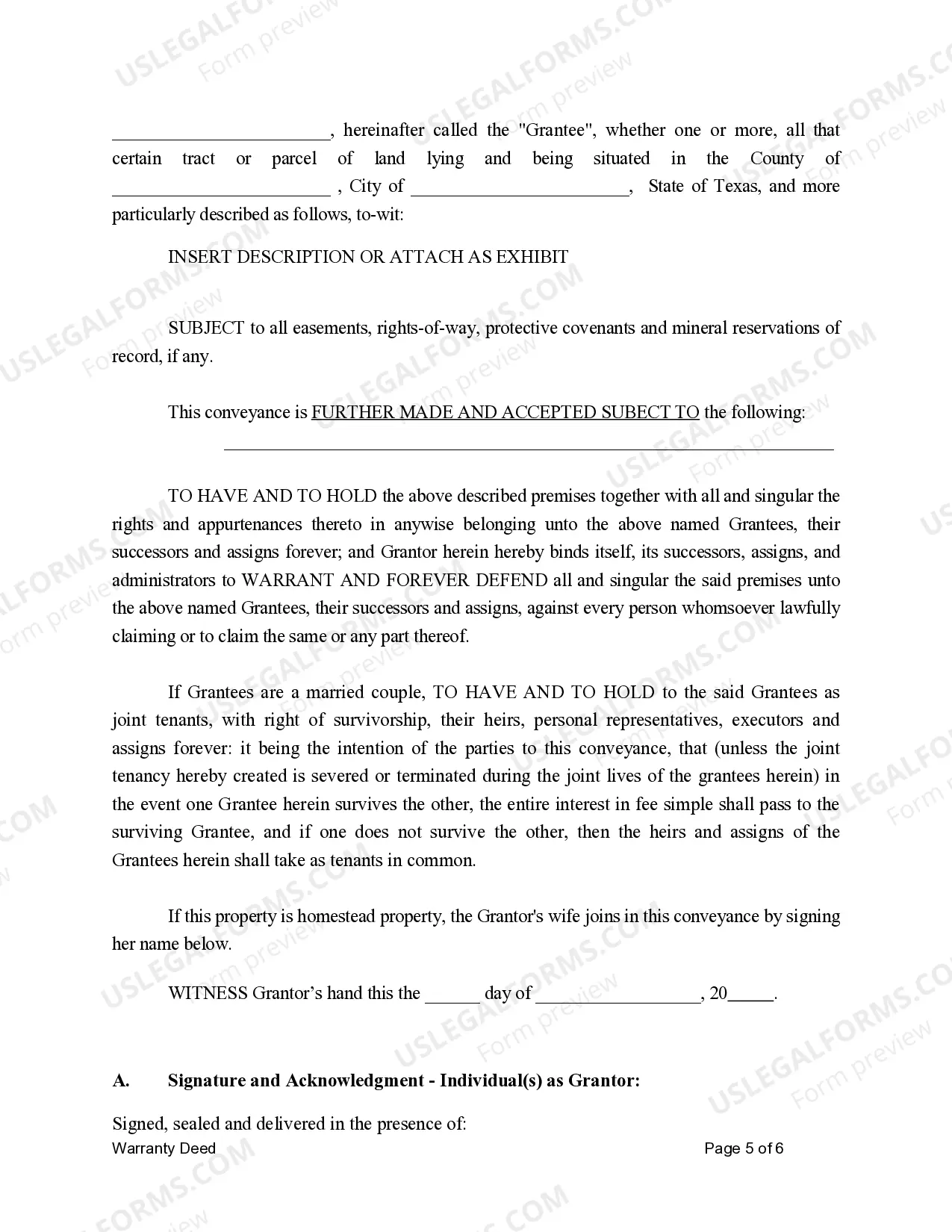

A Tarrant Texas Warranty Deed is a legal document used in real estate transactions where a Limited Partnership or Limited Liability Company (LLC) acts as the Granter or Grantee. This type of deed ensures that the grantee (individual or entity receiving the property) receives the property free and clear of any encumbrances or claims to ownership. It provides a warranty of title, indicating that the granter holds legal ownership of the property and has the right to transfer it. There are several variations of Tarrant Texas Warranty Deeds specifically tailored to different scenarios involving Limited Partnerships or LCS. These variations include: 1. Tarrant Texas Warranty Deed for Limited Partnership as the Granter: This type of deed is used when a limited partnership is transferring real estate assets it owns to another party. The limited partnership, acting as the granter, warranties the title to the property being conveyed. 2. Tarrant Texas Warranty Deed for Limited Partnership as the Grantee: In this case, a limited partnership is the recipient of real estate from another party. The granter, who could be an individual or entity, conveys the property and provides a warranty of title to the limited partnership. 3. Tarrant Texas Warranty Deed for LLC as the Granter: This deed is used when an LLC is transferring property it owns to another party. The LLC, acting as the granter, guarantees the title to the property. 4. Tarrant Texas Warranty Deed for LLC as the Grantee: When an LLC acquires property from another party, this type of deed is used. The granter transfers ownership to the LLC and warrants the title's integrity. Tarrant Texas Warranty Deeds for Limited Partnerships or LCS are crucial for ensuring a smooth transfer of real estate assets while providing legal protection to both the granter and grantee. These deeds establish a comprehensive warranty of title, giving assurance that the property is free from any undisclosed claims, liens, or encumbrances. It is essential for all parties involved in real estate transactions to consult with a legal professional to ensure proper execution of these deeds and to address any potential complexities that may arise.A Tarrant Texas Warranty Deed is a legal document used in real estate transactions where a Limited Partnership or Limited Liability Company (LLC) acts as the Granter or Grantee. This type of deed ensures that the grantee (individual or entity receiving the property) receives the property free and clear of any encumbrances or claims to ownership. It provides a warranty of title, indicating that the granter holds legal ownership of the property and has the right to transfer it. There are several variations of Tarrant Texas Warranty Deeds specifically tailored to different scenarios involving Limited Partnerships or LCS. These variations include: 1. Tarrant Texas Warranty Deed for Limited Partnership as the Granter: This type of deed is used when a limited partnership is transferring real estate assets it owns to another party. The limited partnership, acting as the granter, warranties the title to the property being conveyed. 2. Tarrant Texas Warranty Deed for Limited Partnership as the Grantee: In this case, a limited partnership is the recipient of real estate from another party. The granter, who could be an individual or entity, conveys the property and provides a warranty of title to the limited partnership. 3. Tarrant Texas Warranty Deed for LLC as the Granter: This deed is used when an LLC is transferring property it owns to another party. The LLC, acting as the granter, guarantees the title to the property. 4. Tarrant Texas Warranty Deed for LLC as the Grantee: When an LLC acquires property from another party, this type of deed is used. The granter transfers ownership to the LLC and warrants the title's integrity. Tarrant Texas Warranty Deeds for Limited Partnerships or LCS are crucial for ensuring a smooth transfer of real estate assets while providing legal protection to both the granter and grantee. These deeds establish a comprehensive warranty of title, giving assurance that the property is free from any undisclosed claims, liens, or encumbrances. It is essential for all parties involved in real estate transactions to consult with a legal professional to ensure proper execution of these deeds and to address any potential complexities that may arise.