This form is a Quitclaim Deed where the grantors are four individuals and the grantee is one individual.

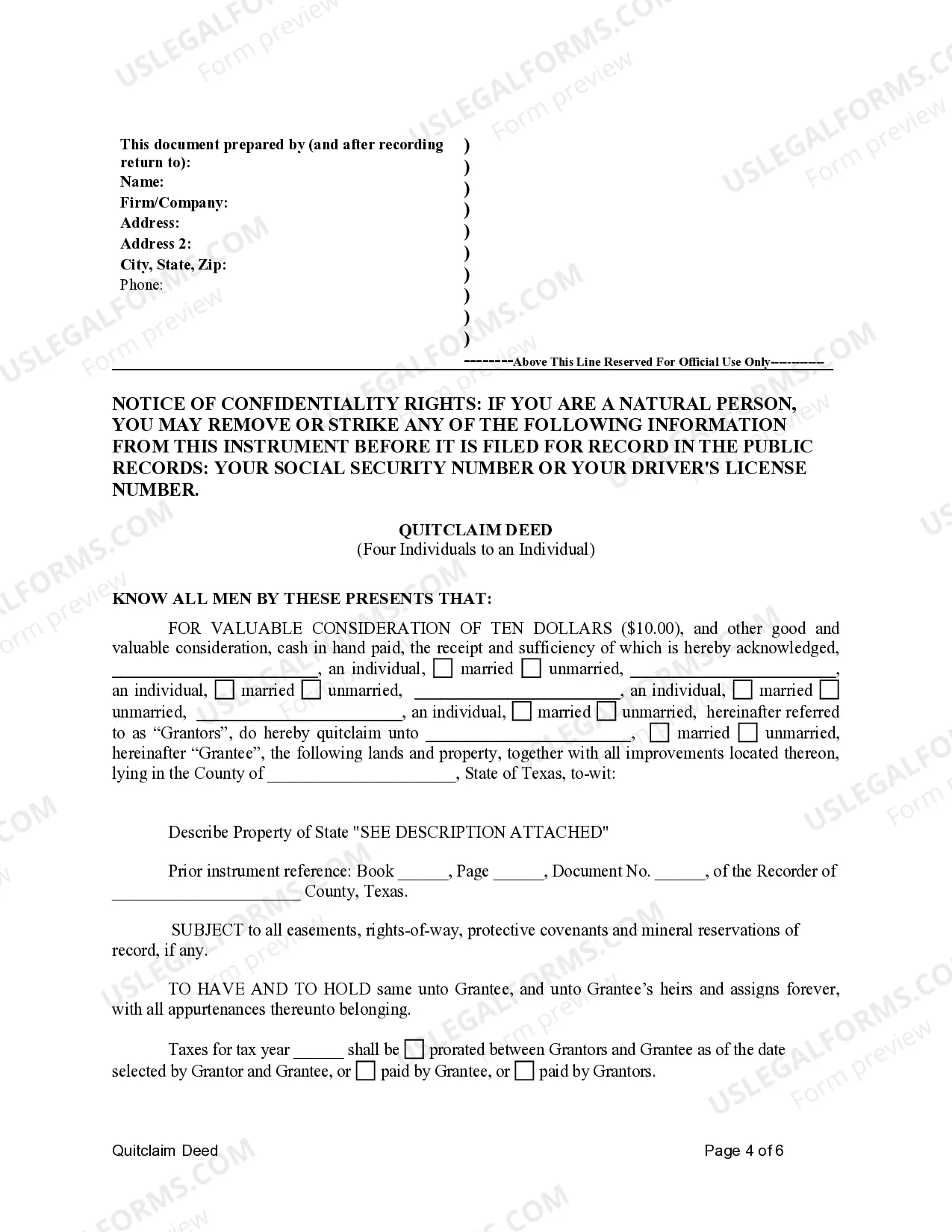

A Tarrant Texas quitclaim deed is a legal document that allows four individuals, known as granters, to transfer their ownership interest in a property to an individual, referred to as the grantee. This type of deed is commonly used in real estate transactions when the granters want to transfer their interest in a property without making any warranties or guarantees regarding the property's title. The main purpose of a quitclaim deed is to legally release any claims or interests the granters may have in the property to the grantee. It is an effective way for the granters to transfer their ownership interest to the grantee without going through a more complicated and time-consuming process such as a warranty deed or a special warranty deed. In Tarrant County, Texas, there are several types of quitclaim deeds that can be used depending on the specific circumstances of the transaction. These include: 1. Tarrant Texas Quitclaim Deed for Four Granters to an Individual with Survivorship Rights: This type of quitclaim deed allows the granters to transfer their ownership interest in the property to the grantee with the provision that if any of the granters pass away, their share of the property will automatically transfer to the surviving granters. 2. Tarrant Texas Quitclaim Deed for Four Granters to an Individual without Survivorship Rights: This type of quitclaim deed allows the granters to transfer their ownership interest in the property to the grantee without any survivorship rights. In the event that any of the granters pass away, their share of the property will not automatically transfer to the surviving granters. 3. Tarrant Texas Quitclaim Deed for Four Granters to an Individual with Specific Conditions: This type of quitclaim deed includes specific conditions or restrictions that the granters and the grantee agree upon. These conditions can range from usage restrictions to obligations for property maintenance or future property development. Regardless of the specific type of Tarrant Texas quitclaim deed used, it is crucial to consult with a qualified real estate attorney or title company to ensure that the deed is properly prepared, executed, and recorded.