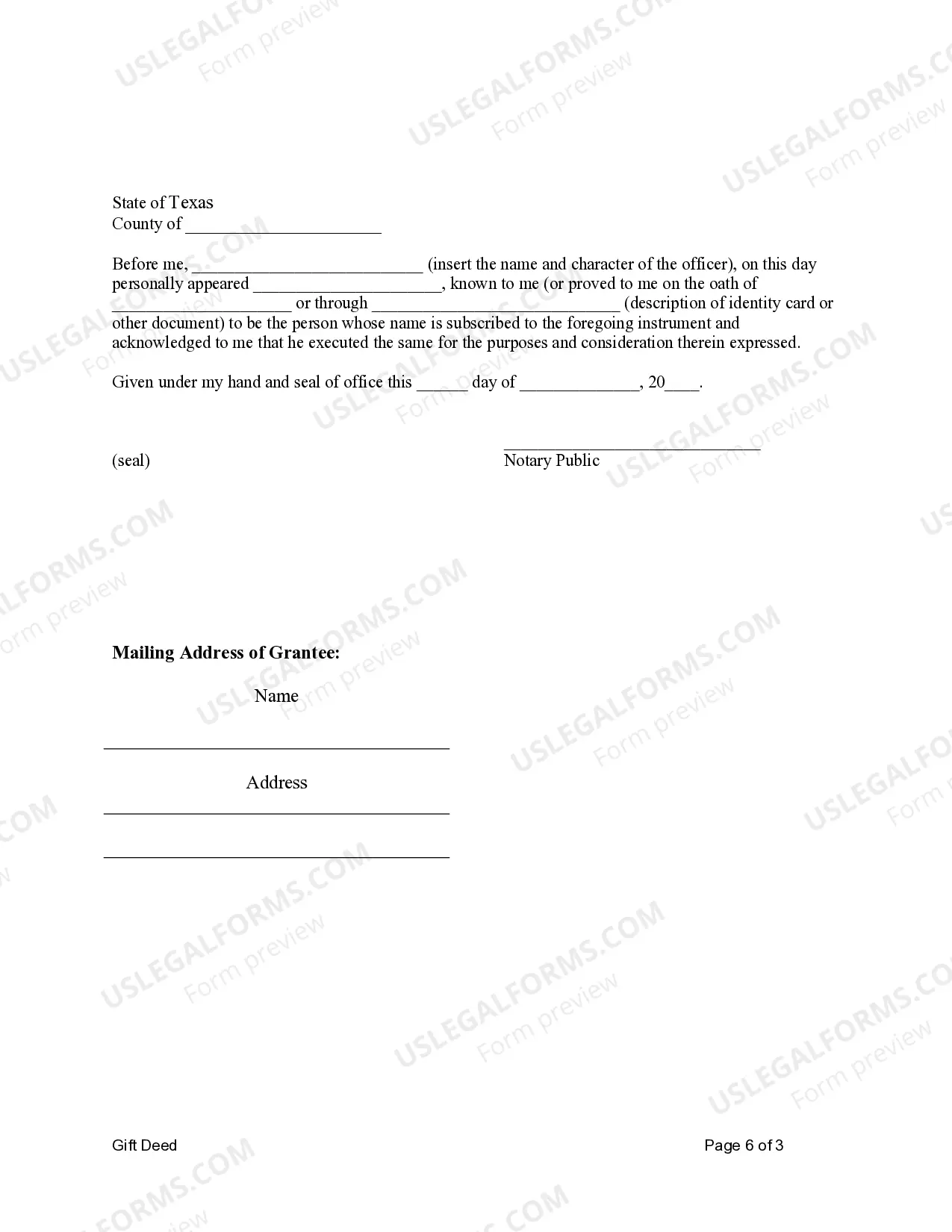

This form is a Gift Deed where the grantor is an individual and the grantees are two individuals holding title as joint tenants.

A Corpus Christi Texas Gift Deed for Individuals to Individuals as Joint Tenants is a legal document used to transfer ownership of a property between individuals in Corpus Christi, Texas, under the joint tenancy agreement. This type of deed signifies that the property is being gifted, meaning there is no exchange of money or consideration involved. Keywords: Corpus Christi Texas, Gift Deed, Individuals, Joint Tenants, property transfer, ownership, legal document, gift, exchange of money, consideration. There are two main types of Corpus Christi Texas Gift Deed for Individual to Individuals as Joint Tenants: 1. Corpus Christi Texas Gift Deed for Individual to Individuals as Joint Tenants with Right of Survivorship: This type of gift deed allows the joint tenants to hold equal shares in the property and provides for the right of survivorship. In the event that one joint tenant passes away, their share automatically transfers to the surviving joint tenant without the need for probate. 2. Corpus Christi Texas Gift Deed for Individual to Individuals as Joint Tenants without Right of Survivorship: This gift deed option also allows for joint tenants to hold equal shares in the property. However, in the event of a joint tenant's death, their share will not transfer to the surviving joint tenant automatically. Instead, it will be subject to the deceased tenant's will or intestate laws, requiring probate proceedings. It is essential to consult with a licensed attorney or a real estate professional specializing in gift deeds to ensure the proper procedure is followed and the deed accurately reflects the intent and desires of the parties involved. A gift deed, once executed and recorded, becomes a legally binding document that permanently transfers ownership rights of a property from the donor to the recipient(s). Transferring property through a gift deed in Corpus Christi, Texas, can have various implications, including tax consequences and potential liabilities. Therefore, seeking professional advice is highly recommended navigating the legal complexities and ensure compliance with local laws and regulations. Keywords: Corpus Christi Texas, Gift Deed, Individuals, Joint Tenants, property transfer, ownership, legal document, gift, exchange of money, consideration, right of survivorship, probate, licensed attorney, real estate professional, tax consequences, liabilities, local laws, regulations.A Corpus Christi Texas Gift Deed for Individuals to Individuals as Joint Tenants is a legal document used to transfer ownership of a property between individuals in Corpus Christi, Texas, under the joint tenancy agreement. This type of deed signifies that the property is being gifted, meaning there is no exchange of money or consideration involved. Keywords: Corpus Christi Texas, Gift Deed, Individuals, Joint Tenants, property transfer, ownership, legal document, gift, exchange of money, consideration. There are two main types of Corpus Christi Texas Gift Deed for Individual to Individuals as Joint Tenants: 1. Corpus Christi Texas Gift Deed for Individual to Individuals as Joint Tenants with Right of Survivorship: This type of gift deed allows the joint tenants to hold equal shares in the property and provides for the right of survivorship. In the event that one joint tenant passes away, their share automatically transfers to the surviving joint tenant without the need for probate. 2. Corpus Christi Texas Gift Deed for Individual to Individuals as Joint Tenants without Right of Survivorship: This gift deed option also allows for joint tenants to hold equal shares in the property. However, in the event of a joint tenant's death, their share will not transfer to the surviving joint tenant automatically. Instead, it will be subject to the deceased tenant's will or intestate laws, requiring probate proceedings. It is essential to consult with a licensed attorney or a real estate professional specializing in gift deeds to ensure the proper procedure is followed and the deed accurately reflects the intent and desires of the parties involved. A gift deed, once executed and recorded, becomes a legally binding document that permanently transfers ownership rights of a property from the donor to the recipient(s). Transferring property through a gift deed in Corpus Christi, Texas, can have various implications, including tax consequences and potential liabilities. Therefore, seeking professional advice is highly recommended navigating the legal complexities and ensure compliance with local laws and regulations. Keywords: Corpus Christi Texas, Gift Deed, Individuals, Joint Tenants, property transfer, ownership, legal document, gift, exchange of money, consideration, right of survivorship, probate, licensed attorney, real estate professional, tax consequences, liabilities, local laws, regulations.