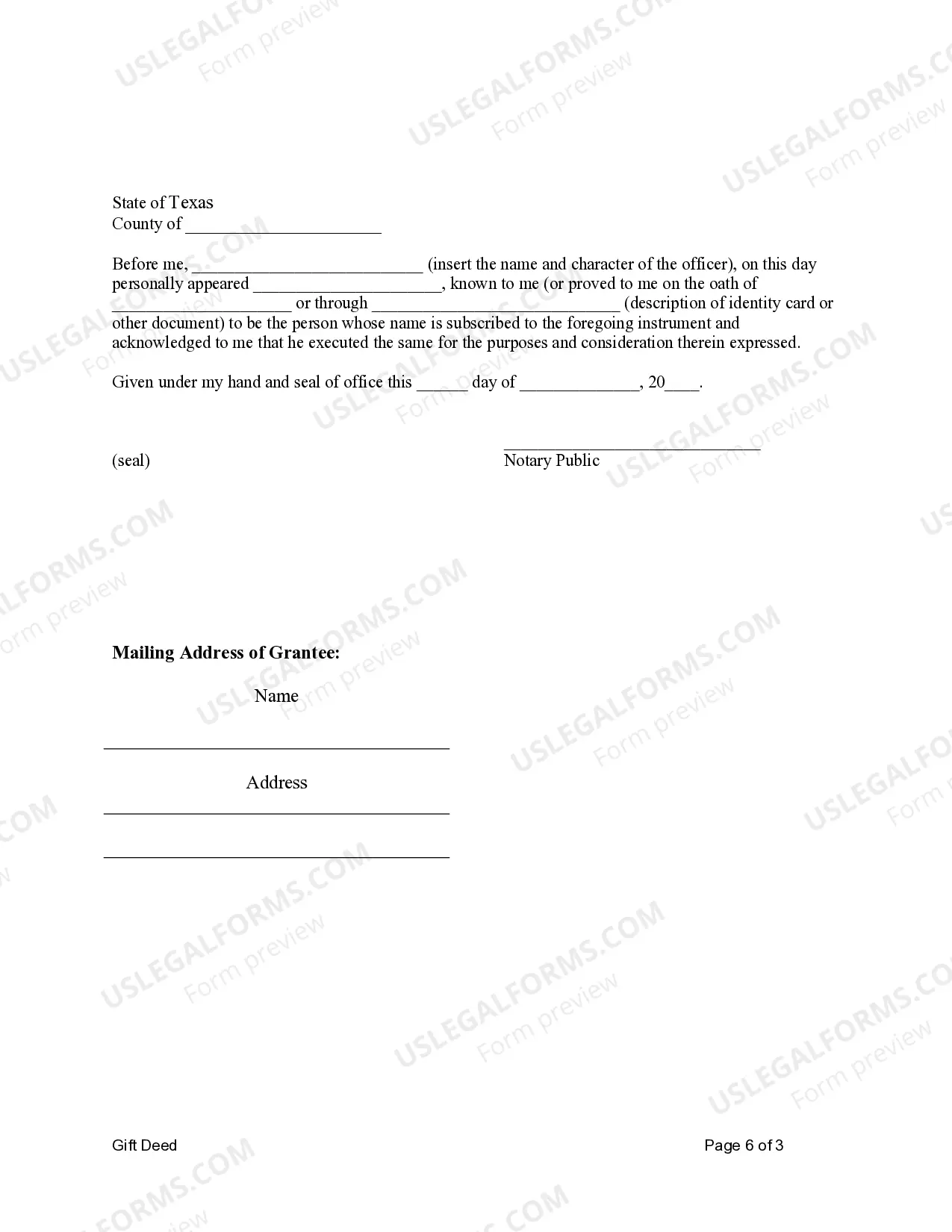

This form is a Gift Deed where the grantor is an individual and the grantees are two individuals holding title as joint tenants.

A Houston Texas Gift Deed for Individual to Individuals as Joint Tenants is a legal document that allows an individual to transfer ownership of real property as a gift to another individual or individuals in joint tenancy. This type of gift deed creates a shared ownership interest between the recipients, where each individual has an undivided interest in the property. The gift deed must comply with the specific laws and requirements of Houston, Texas, and typically includes key information such as the names and addresses of both the granter (the person giving the gift) and the grantees (the individuals receiving the gift). It should also provide a clear and accurate legal description of the property being transferred. Additionally, the deed should outline the terms and conditions of the gift, including any restrictions or limitations placed on the property. It should specify that the transfer is being made as a gift, without any consideration provided by the grantees. The purpose of a gift deed for individuals to individuals as joint tenants is to facilitate the transfer of ownership in a straightforward and legal manner, without the need for monetary exchange. This type of arrangement can be used in various situations, such as transferring property between family members, friends, or partners. It is important to note that there may be different variations or subsets of the Houston Texas Gift Deed for Individual to Individuals as Joint Tenants, including but not limited to: 1. Houston Texas Gift Deed with Right of Survivorship: This type of gift deed stipulates that in the event of the death of any joint tenant, their ownership interest automatically passes to the surviving joint tenants. 2. Houston Texas Gift Deed without Right of Survivorship: In contrast to the previous variation, this type of gift deed does not include the right of survivorship. If one joint tenant were to pass away, their ownership interest would not automatically transfer to the surviving joint tenants. Instead, it would be subject to the deceased tenant's estate planning or will. These different variations may be chosen based on the specific intentions and circumstances of the parties involved. It is advisable to consult with a legal professional experienced in real estate law to ensure compliance with applicable laws and to determine which type of gift deed is most appropriate for the situation.A Houston Texas Gift Deed for Individual to Individuals as Joint Tenants is a legal document that allows an individual to transfer ownership of real property as a gift to another individual or individuals in joint tenancy. This type of gift deed creates a shared ownership interest between the recipients, where each individual has an undivided interest in the property. The gift deed must comply with the specific laws and requirements of Houston, Texas, and typically includes key information such as the names and addresses of both the granter (the person giving the gift) and the grantees (the individuals receiving the gift). It should also provide a clear and accurate legal description of the property being transferred. Additionally, the deed should outline the terms and conditions of the gift, including any restrictions or limitations placed on the property. It should specify that the transfer is being made as a gift, without any consideration provided by the grantees. The purpose of a gift deed for individuals to individuals as joint tenants is to facilitate the transfer of ownership in a straightforward and legal manner, without the need for monetary exchange. This type of arrangement can be used in various situations, such as transferring property between family members, friends, or partners. It is important to note that there may be different variations or subsets of the Houston Texas Gift Deed for Individual to Individuals as Joint Tenants, including but not limited to: 1. Houston Texas Gift Deed with Right of Survivorship: This type of gift deed stipulates that in the event of the death of any joint tenant, their ownership interest automatically passes to the surviving joint tenants. 2. Houston Texas Gift Deed without Right of Survivorship: In contrast to the previous variation, this type of gift deed does not include the right of survivorship. If one joint tenant were to pass away, their ownership interest would not automatically transfer to the surviving joint tenants. Instead, it would be subject to the deceased tenant's estate planning or will. These different variations may be chosen based on the specific intentions and circumstances of the parties involved. It is advisable to consult with a legal professional experienced in real estate law to ensure compliance with applicable laws and to determine which type of gift deed is most appropriate for the situation.