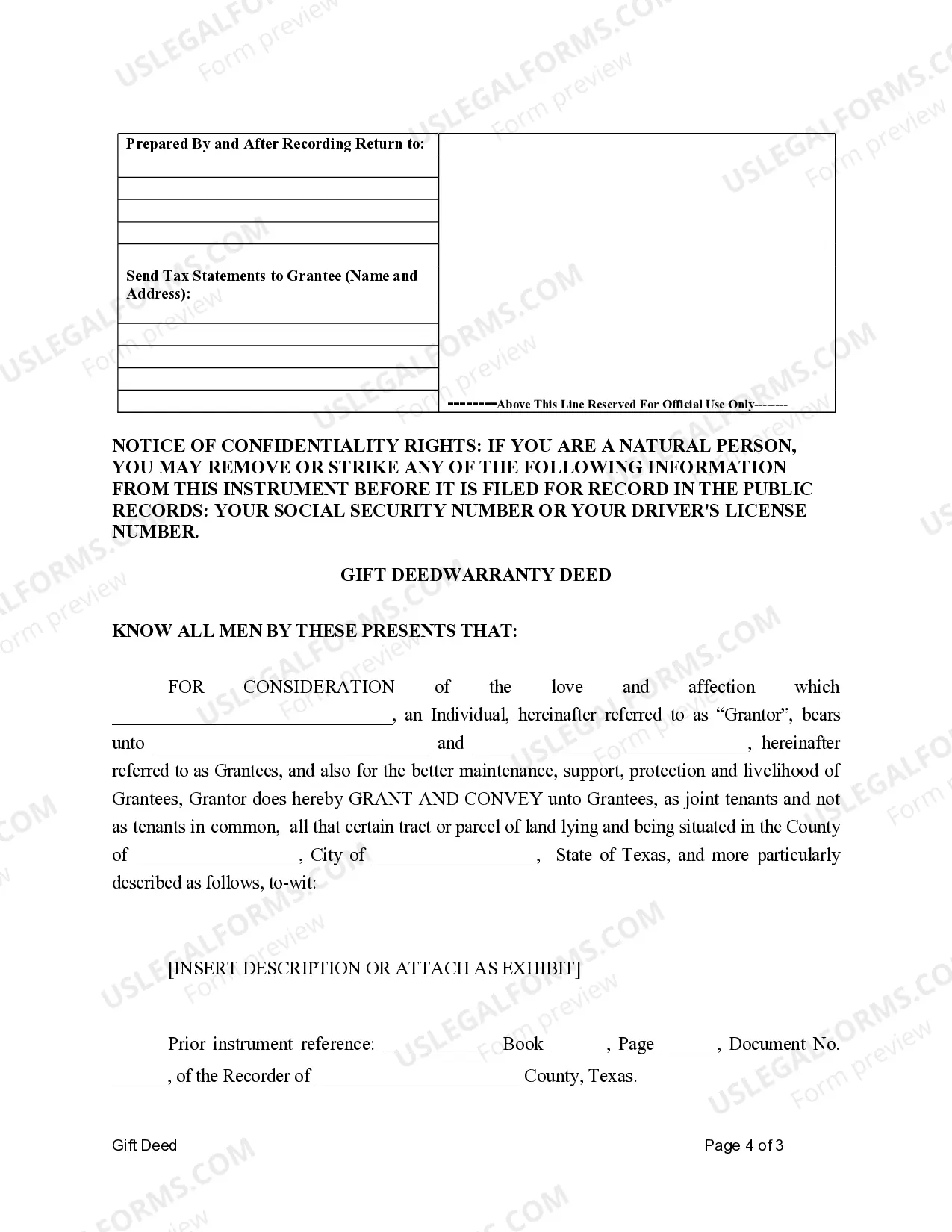

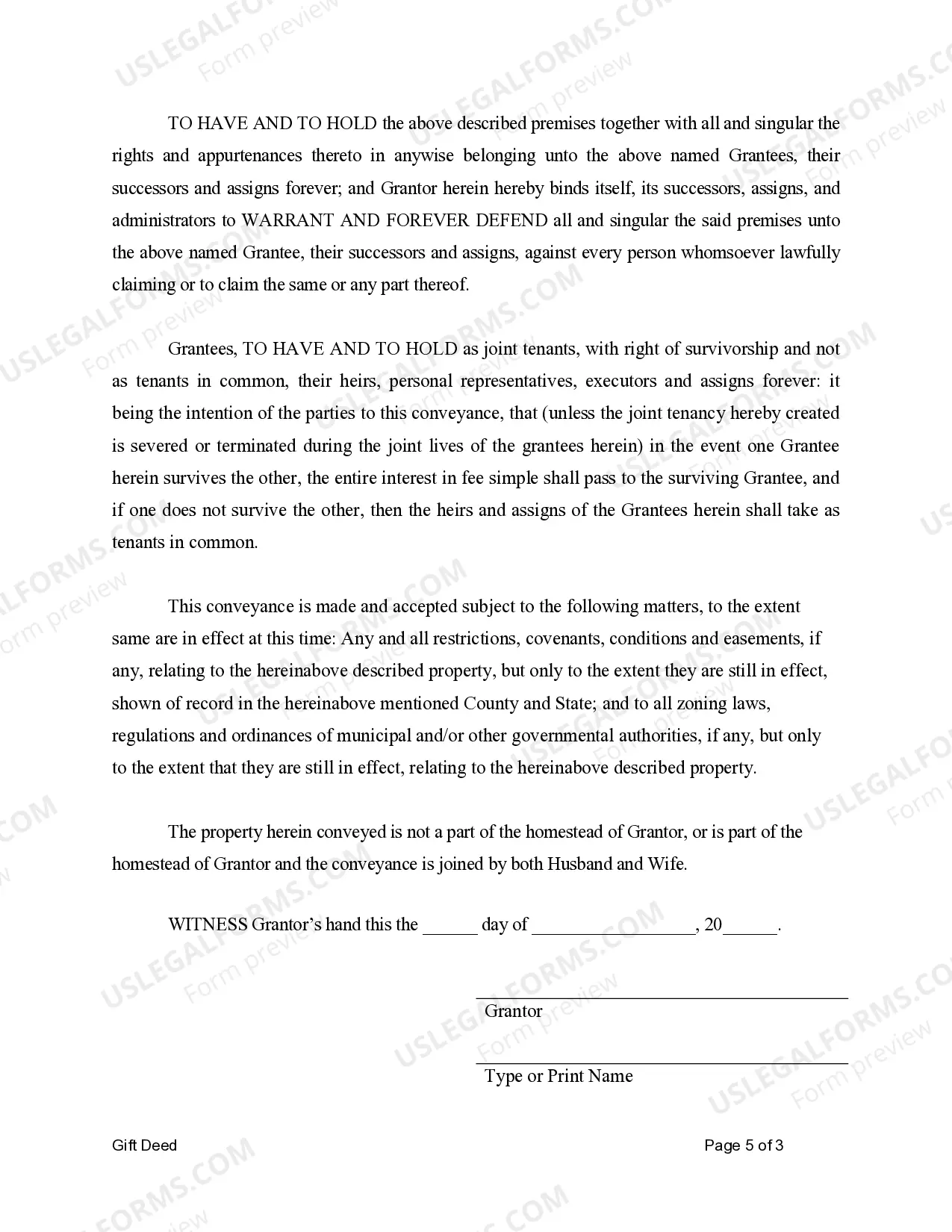

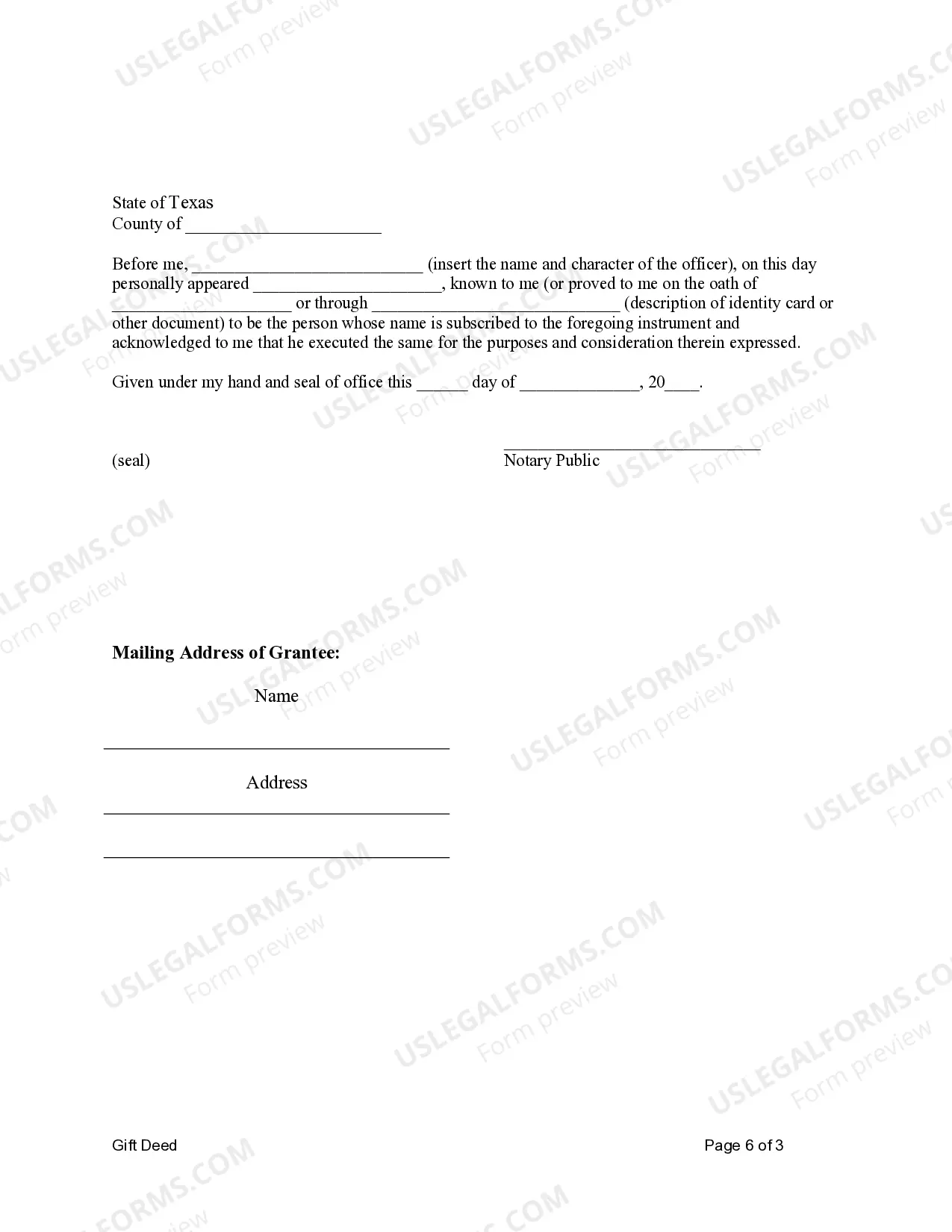

This form is a Gift Deed where the grantor is an individual and the grantees are two individuals holding title as joint tenants.

Killeen Texas Gift Deed for Individual to Individuals as Joint Tenants is a legal document that allows a person to transfer ownership of real estate to another individual or individuals as joint tenants. This type of deed is commonly used for gifting property to family members or close friends. In Killeen, Texas, the Gift Deed for Individual to Individuals as Joint Tenants must comply with state laws and requirements. It is essential to understand the specific provisions and conditions associated with this type of deed before executing it. The gift deed serves as proof of the transfer of property ownership from the donor, or the person giving the gift, to the recipients as joint tenants. Joint tenancy means that each co-owner has equal shares and rights in the property. If one owner passes away, their share automatically transfers to the surviving joint tenants. When preparing a Killeen Texas Gift Deed for Individual to Individuals as Joint Tenants, it is crucial to include relevant keywords such as: 1. Gift Deed: A legal instrument used to transfer property ownership as a gift. 2. Killeen, Texas: The specific location where the gift deed is being executed and must comply with state laws. 3. Individual to Individuals: Describes the transfer of property from one individual to multiple individuals. 4. Joint Tenants: The type of ownership structure where all joint tenants have equal shares and rights to the property. 5. Joint Tenancy with Right of Survivorship: Indicates that if a joint tenant passes away, their share automatically transfers to the surviving joint tenants. 6. Real Estate: Refers to the property being gifted, which can include land, houses, or any other type of real property. Different types of Killeen Texas Gift Deed for Individual to Individuals as Joint Tenants may include specific variations or additional provisions based on the parties involved or the property details, such as: 1. Family Gift Deed: Specifically designed for property transfers within a family, often used for gifting real estate to children or siblings. 2. Charitable Gift Deed: Used when a person wishes to donate or gift property to a charitable organization or institution. 3. Conditional Gift Deed: Includes certain conditions or restrictions on the gift, such as requiring the recipient to use the property for a particular purpose. 4. Restricted Gift Deed: Imposes limitations on the use or transfer of the gifted property, often used for conservation purposes or historical preservation. It is crucial to consult with a legal professional or a real estate attorney when drafting or executing a Killeen Texas Gift Deed for Individual to Individuals as Joint Tenants to ensure compliance with all applicable laws and to address any specific concerns or requirements related to the property or parties involved.Killeen Texas Gift Deed for Individual to Individuals as Joint Tenants is a legal document that allows a person to transfer ownership of real estate to another individual or individuals as joint tenants. This type of deed is commonly used for gifting property to family members or close friends. In Killeen, Texas, the Gift Deed for Individual to Individuals as Joint Tenants must comply with state laws and requirements. It is essential to understand the specific provisions and conditions associated with this type of deed before executing it. The gift deed serves as proof of the transfer of property ownership from the donor, or the person giving the gift, to the recipients as joint tenants. Joint tenancy means that each co-owner has equal shares and rights in the property. If one owner passes away, their share automatically transfers to the surviving joint tenants. When preparing a Killeen Texas Gift Deed for Individual to Individuals as Joint Tenants, it is crucial to include relevant keywords such as: 1. Gift Deed: A legal instrument used to transfer property ownership as a gift. 2. Killeen, Texas: The specific location where the gift deed is being executed and must comply with state laws. 3. Individual to Individuals: Describes the transfer of property from one individual to multiple individuals. 4. Joint Tenants: The type of ownership structure where all joint tenants have equal shares and rights to the property. 5. Joint Tenancy with Right of Survivorship: Indicates that if a joint tenant passes away, their share automatically transfers to the surviving joint tenants. 6. Real Estate: Refers to the property being gifted, which can include land, houses, or any other type of real property. Different types of Killeen Texas Gift Deed for Individual to Individuals as Joint Tenants may include specific variations or additional provisions based on the parties involved or the property details, such as: 1. Family Gift Deed: Specifically designed for property transfers within a family, often used for gifting real estate to children or siblings. 2. Charitable Gift Deed: Used when a person wishes to donate or gift property to a charitable organization or institution. 3. Conditional Gift Deed: Includes certain conditions or restrictions on the gift, such as requiring the recipient to use the property for a particular purpose. 4. Restricted Gift Deed: Imposes limitations on the use or transfer of the gifted property, often used for conservation purposes or historical preservation. It is crucial to consult with a legal professional or a real estate attorney when drafting or executing a Killeen Texas Gift Deed for Individual to Individuals as Joint Tenants to ensure compliance with all applicable laws and to address any specific concerns or requirements related to the property or parties involved.