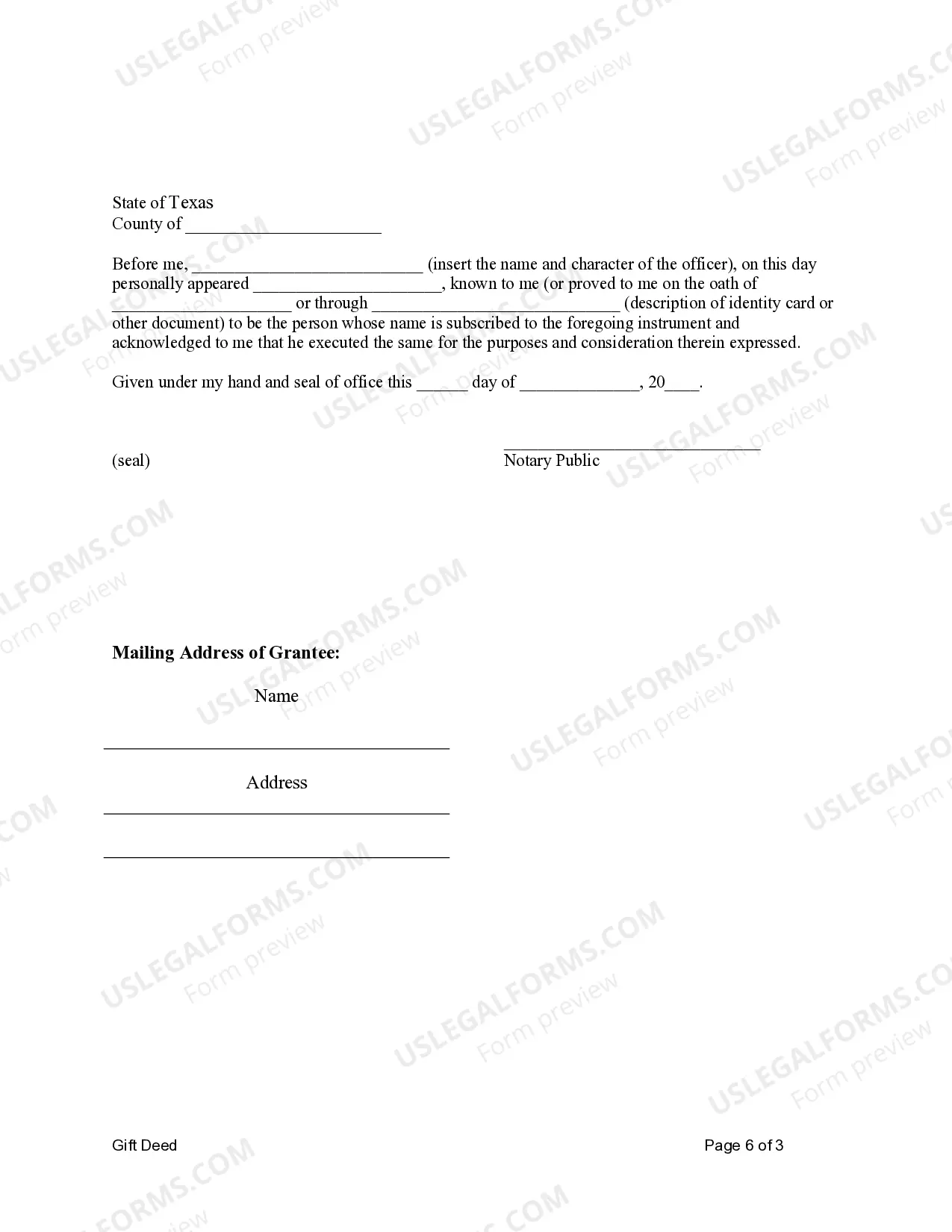

This form is a Gift Deed where the grantor is an individual and the grantees are two individuals holding title as joint tenants.

A Mesquite Texas Gift Deed for Individual to Individuals as Joint Tenants is a legal document used for transferring property ownership from one person (the donor) to another person or persons (the recipients) as joint tenants. This deed serves as evidence of the donor's intention to gift the property to the recipients without any monetary consideration. The primary purpose of a gift deed is to allow for the transfer of property ownership as a gift rather than a typical sale, enabling the donor to give their property to loved ones or individuals without expecting anything in return. By transferring the ownership as joint tenants, all recipients hold an equal and undivided interest in the property, sharing equal rights to use and enjoy the asset. Keywords: Mesquite Texas, Gift Deed, Individual to Individuals, Joint Tenants, property ownership, transfer, evidence, intention, gift, monetary consideration, loved ones, equal and undivided interest, rights, asset. Different types of Mesquite Texas Gift Deed for Individual to Individuals as Joint Tenants may include: 1. General Gift Deed: This is the most common type of gift deed, transferring ownership of property to multiple individuals as joint tenants without any specific restrictions or additional clauses. 2. Conditional Gift Deed: In certain cases, a donor may include conditional provisions within the gift deed, specifying that the recipients must fulfill certain obligations or conditions to retain ownership, or transferring the property back to the donor or someone else if conditions are not met. 3. Quitclaim Gift Deed: A quitclaim gift deed is used when the donor wants to transfer their interest or claim to the property without making any warranties or guarantees regarding the property's title or history. This type of deed is often used among family members or close friends. 4. Life Estate Gift Deed: With a life estate gift deed, the donor retains the right to occupy or use the property until their death, while transferring ownership to the recipients as joint tenants. After the donor's passing, the recipients automatically become the sole owners of the property. Note: It is always advisable to consult with a qualified real estate attorney or professional to ensure compliance with local laws and regulations when creating any type of gift deed.A Mesquite Texas Gift Deed for Individual to Individuals as Joint Tenants is a legal document used for transferring property ownership from one person (the donor) to another person or persons (the recipients) as joint tenants. This deed serves as evidence of the donor's intention to gift the property to the recipients without any monetary consideration. The primary purpose of a gift deed is to allow for the transfer of property ownership as a gift rather than a typical sale, enabling the donor to give their property to loved ones or individuals without expecting anything in return. By transferring the ownership as joint tenants, all recipients hold an equal and undivided interest in the property, sharing equal rights to use and enjoy the asset. Keywords: Mesquite Texas, Gift Deed, Individual to Individuals, Joint Tenants, property ownership, transfer, evidence, intention, gift, monetary consideration, loved ones, equal and undivided interest, rights, asset. Different types of Mesquite Texas Gift Deed for Individual to Individuals as Joint Tenants may include: 1. General Gift Deed: This is the most common type of gift deed, transferring ownership of property to multiple individuals as joint tenants without any specific restrictions or additional clauses. 2. Conditional Gift Deed: In certain cases, a donor may include conditional provisions within the gift deed, specifying that the recipients must fulfill certain obligations or conditions to retain ownership, or transferring the property back to the donor or someone else if conditions are not met. 3. Quitclaim Gift Deed: A quitclaim gift deed is used when the donor wants to transfer their interest or claim to the property without making any warranties or guarantees regarding the property's title or history. This type of deed is often used among family members or close friends. 4. Life Estate Gift Deed: With a life estate gift deed, the donor retains the right to occupy or use the property until their death, while transferring ownership to the recipients as joint tenants. After the donor's passing, the recipients automatically become the sole owners of the property. Note: It is always advisable to consult with a qualified real estate attorney or professional to ensure compliance with local laws and regulations when creating any type of gift deed.