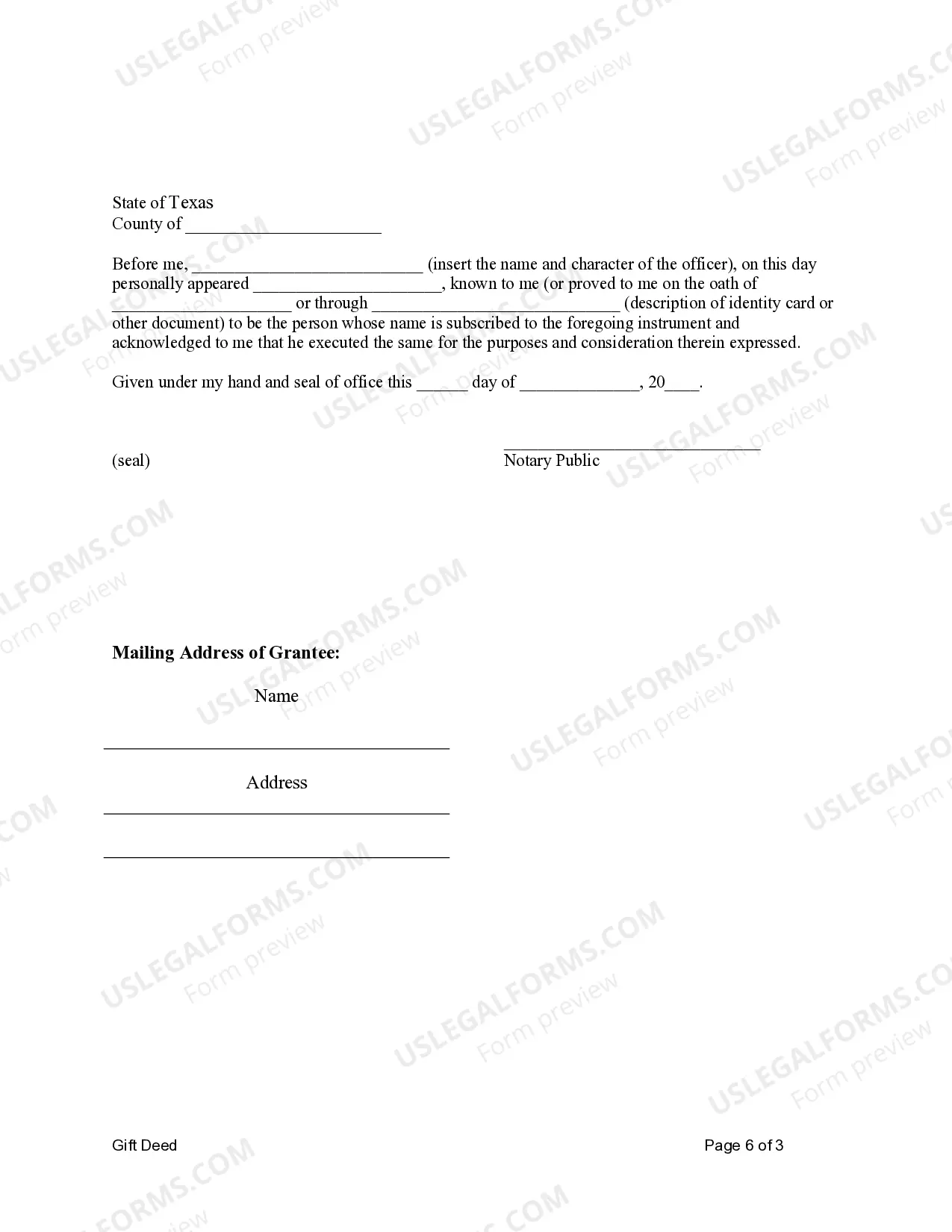

This form is a Gift Deed where the grantor is an individual and the grantees are two individuals holding title as joint tenants.

A Plano Texas Gift Deed for Individual to Individuals as Joint Tenants is a legal document used when transferring ownership of real estate property in Plano, Texas from one individual (the granter) to another (the grantee) as joint tenants. It signifies a generous act of gifting a property to someone, which can have significant implications for estate planning and tax purposes. This type of gift deed establishes joint tenancy, which means that both parties share equal ownership and have the right of survivorship. In the event of one party's death, the property automatically passes to the surviving joint tenant(s) without the need for probate. It is crucial to consult with a qualified attorney to understand the legal implications and ensure compliance with Texas state laws. There are several variations of Plano Texas Gift Deed for Individual to Individuals as Joint Tenants, each tailored to specific circumstances and needs. Some notable types include: 1. Plano Texas Gift Deed with Reservation of Life Estate: This deed allows the granter to gift the property but retain a life estate, which means they can continue living on the property until their death. After their passing, the remaining joint tenant(s) automatically inherit full ownership. 2. Plano Texas Gift Deed with Right to Revoke: This deed provides the granter the option to revoke or cancel the gift during their lifetime, usually within specific time frames or through specific conditions outlined in the deed. However, once revoked, the joint tenancy ceases to exist. 3. Plano Texas Gift Deed with Gift Over Provision: This type of gift deed includes a provision that specifies what happens to the property if the joint tenant(s) predeceases the granter. This provision outlines the beneficiary who will inherit the property in such circumstances. It is vital to consult with an experienced attorney who specializes in real estate law in Plano, Texas, to ensure the proper documentation of the selected gift deed, as well as the consideration of current state laws, tax implications, and any specific requirements for your situation. Key relevant keywords: Plano Texas, gift deed, individual to individuals, joint tenants, real estate, ownership transfer, estate planning, tax implications, right of survivorship, probate, life estate, right to revoke, gift over provision.A Plano Texas Gift Deed for Individual to Individuals as Joint Tenants is a legal document used when transferring ownership of real estate property in Plano, Texas from one individual (the granter) to another (the grantee) as joint tenants. It signifies a generous act of gifting a property to someone, which can have significant implications for estate planning and tax purposes. This type of gift deed establishes joint tenancy, which means that both parties share equal ownership and have the right of survivorship. In the event of one party's death, the property automatically passes to the surviving joint tenant(s) without the need for probate. It is crucial to consult with a qualified attorney to understand the legal implications and ensure compliance with Texas state laws. There are several variations of Plano Texas Gift Deed for Individual to Individuals as Joint Tenants, each tailored to specific circumstances and needs. Some notable types include: 1. Plano Texas Gift Deed with Reservation of Life Estate: This deed allows the granter to gift the property but retain a life estate, which means they can continue living on the property until their death. After their passing, the remaining joint tenant(s) automatically inherit full ownership. 2. Plano Texas Gift Deed with Right to Revoke: This deed provides the granter the option to revoke or cancel the gift during their lifetime, usually within specific time frames or through specific conditions outlined in the deed. However, once revoked, the joint tenancy ceases to exist. 3. Plano Texas Gift Deed with Gift Over Provision: This type of gift deed includes a provision that specifies what happens to the property if the joint tenant(s) predeceases the granter. This provision outlines the beneficiary who will inherit the property in such circumstances. It is vital to consult with an experienced attorney who specializes in real estate law in Plano, Texas, to ensure the proper documentation of the selected gift deed, as well as the consideration of current state laws, tax implications, and any specific requirements for your situation. Key relevant keywords: Plano Texas, gift deed, individual to individuals, joint tenants, real estate, ownership transfer, estate planning, tax implications, right of survivorship, probate, life estate, right to revoke, gift over provision.