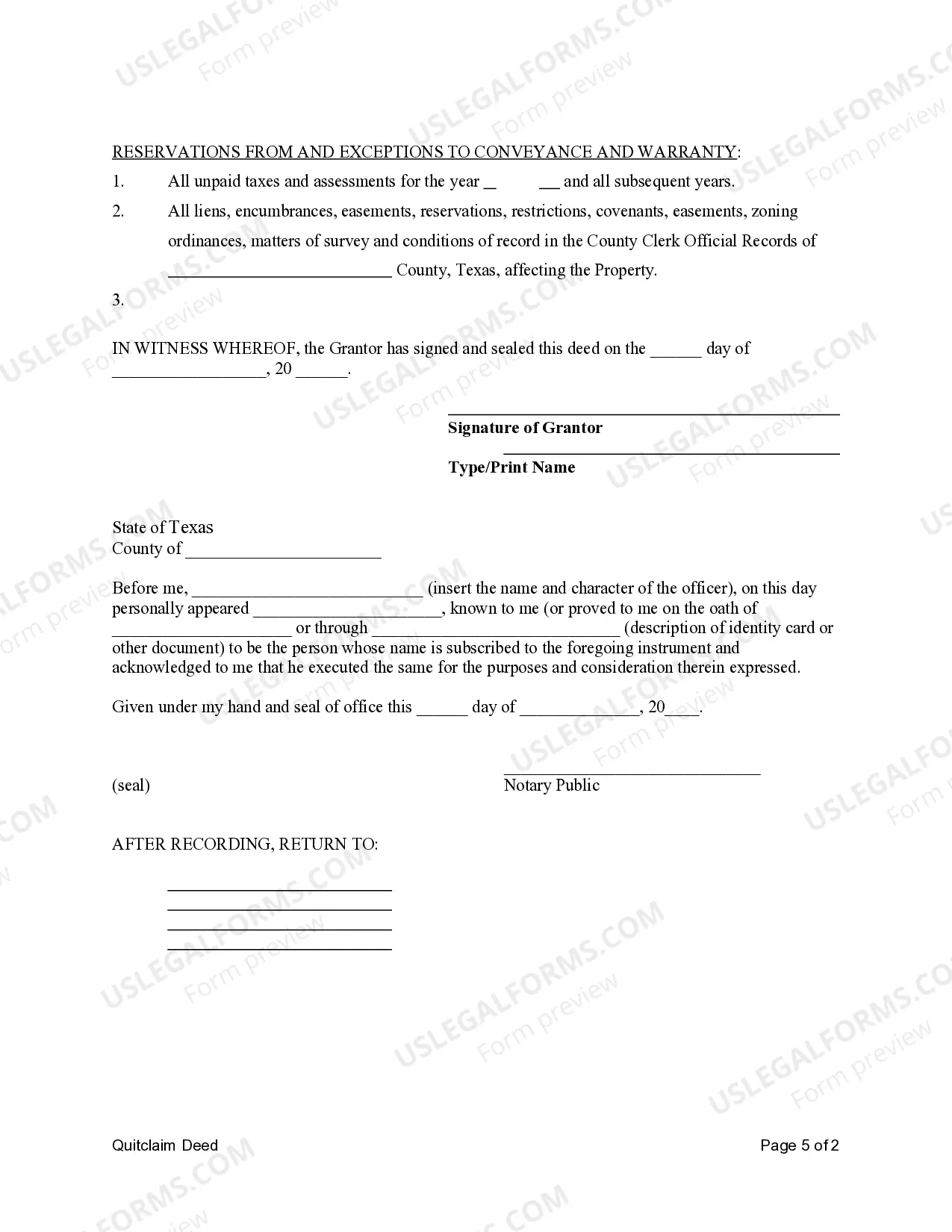

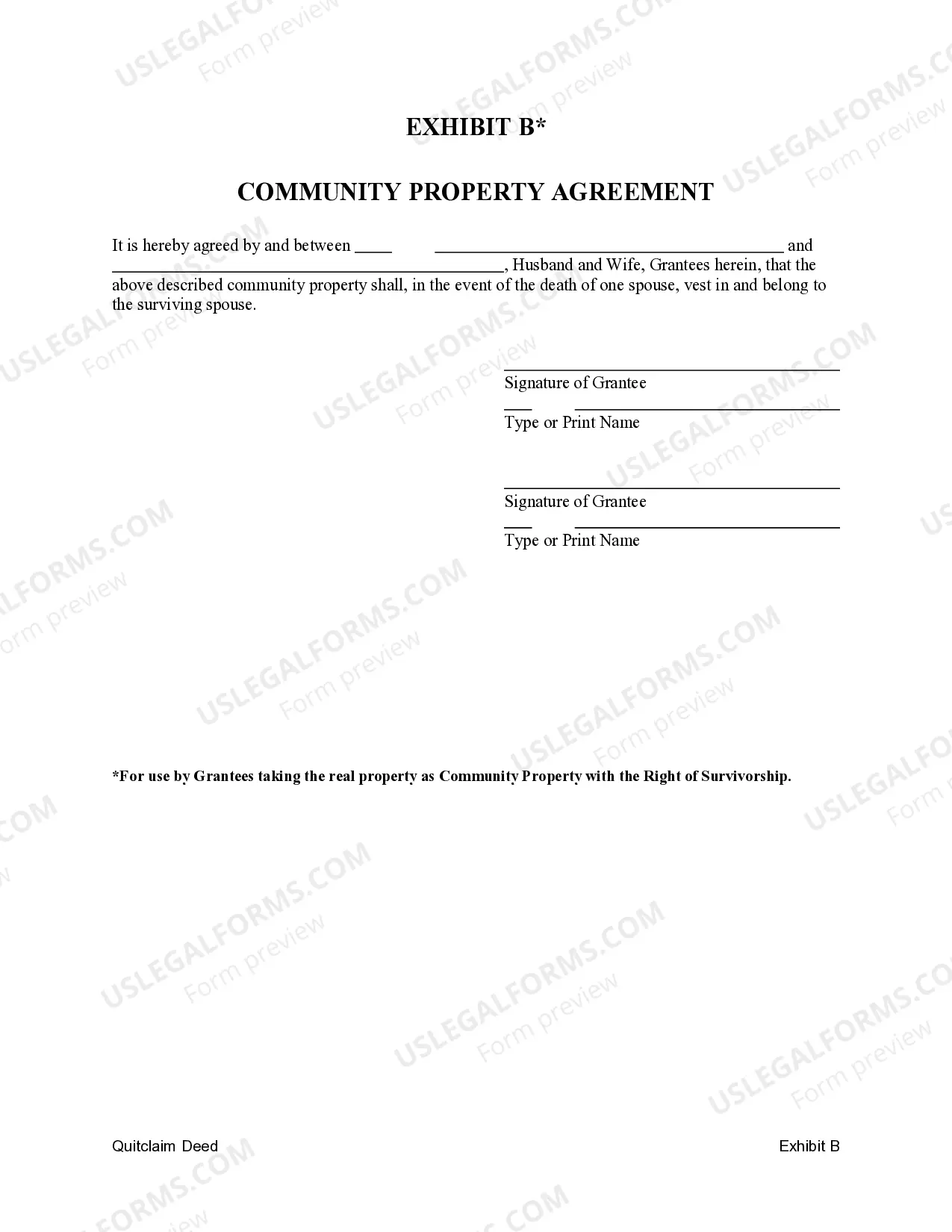

This form is a Quitclaim Deed where the grantor is a husband and the grantees are husband and wife. The grantees may hold title as community property or community property with the right of survivorship.

The Bexar Texas Quitclaim Deed for Husband to Husband and Wife as Community Property or Community Property with Right of Survivorship is a legal document that allows for the transfer of property ownership between a married couple residing in Bexar County, Texas. This specific deed is designed to facilitate the transfer of property in two different scenarios: community property and community property with the right of survivorship. In the case of community property, the deed establishes that the property is jointly owned by both husbands, and any assets acquired during the course of their marriage are considered marital property. This means that both spouses have an equal share and interest in the property. In the event of a divorce or dissolution of the marriage, the property will be divided equally between the spouses, unless they agree otherwise. On the other hand, community property with the right of survivorship ensures that if one spouse passes away, their share of the property automatically transfers to the surviving spouse without going through probate. This right of survivorship allows for a seamless transfer of ownership, avoiding potential complications and delays associated with probate proceedings. It's important to note that there may be various types of Bexar Texas Quitclaim Deeds available for husband to husband and wife as community property or community property with the right of survivorship. Some variations may depend on specific circumstances, such as whether the couple wishes to include additional terms or conditions in the deed. Examples of potential variations include: 1. Bexar Texas Quitclaim Deed with Enhanced Community Property Rights: This option could grant additional rights or privileges to either spouse, such as assigning one spouse as the primary decision-maker regarding property matters. 2. Bexar Texas Quitclaim Deed with Limitations on Survivorship Rights: This type of deed may include specific restrictions or conditions related to the transfer of ownership upon the death of one spouse. For instance, it could require the surviving spouse to meet certain criteria before gaining full ownership rights. 3. Bexar Texas Quitclaim Deed with Specific Property Allocation: This variation allows couples to specify certain properties or real estate assets that will fall under the community property or community property with the right of survivorship arrangement. Consulting with a legal professional experienced in Texas real estate law is crucial when considering the specific type of Bexar Texas Quitclaim Deed that suits the unique needs and circumstances of husband to husband and wife as community property or community property with the right of survivorship. This will ensure that the deed accurately reflects their intentions, providing a clear and legally binding transfer of property ownership.The Bexar Texas Quitclaim Deed for Husband to Husband and Wife as Community Property or Community Property with Right of Survivorship is a legal document that allows for the transfer of property ownership between a married couple residing in Bexar County, Texas. This specific deed is designed to facilitate the transfer of property in two different scenarios: community property and community property with the right of survivorship. In the case of community property, the deed establishes that the property is jointly owned by both husbands, and any assets acquired during the course of their marriage are considered marital property. This means that both spouses have an equal share and interest in the property. In the event of a divorce or dissolution of the marriage, the property will be divided equally between the spouses, unless they agree otherwise. On the other hand, community property with the right of survivorship ensures that if one spouse passes away, their share of the property automatically transfers to the surviving spouse without going through probate. This right of survivorship allows for a seamless transfer of ownership, avoiding potential complications and delays associated with probate proceedings. It's important to note that there may be various types of Bexar Texas Quitclaim Deeds available for husband to husband and wife as community property or community property with the right of survivorship. Some variations may depend on specific circumstances, such as whether the couple wishes to include additional terms or conditions in the deed. Examples of potential variations include: 1. Bexar Texas Quitclaim Deed with Enhanced Community Property Rights: This option could grant additional rights or privileges to either spouse, such as assigning one spouse as the primary decision-maker regarding property matters. 2. Bexar Texas Quitclaim Deed with Limitations on Survivorship Rights: This type of deed may include specific restrictions or conditions related to the transfer of ownership upon the death of one spouse. For instance, it could require the surviving spouse to meet certain criteria before gaining full ownership rights. 3. Bexar Texas Quitclaim Deed with Specific Property Allocation: This variation allows couples to specify certain properties or real estate assets that will fall under the community property or community property with the right of survivorship arrangement. Consulting with a legal professional experienced in Texas real estate law is crucial when considering the specific type of Bexar Texas Quitclaim Deed that suits the unique needs and circumstances of husband to husband and wife as community property or community property with the right of survivorship. This will ensure that the deed accurately reflects their intentions, providing a clear and legally binding transfer of property ownership.