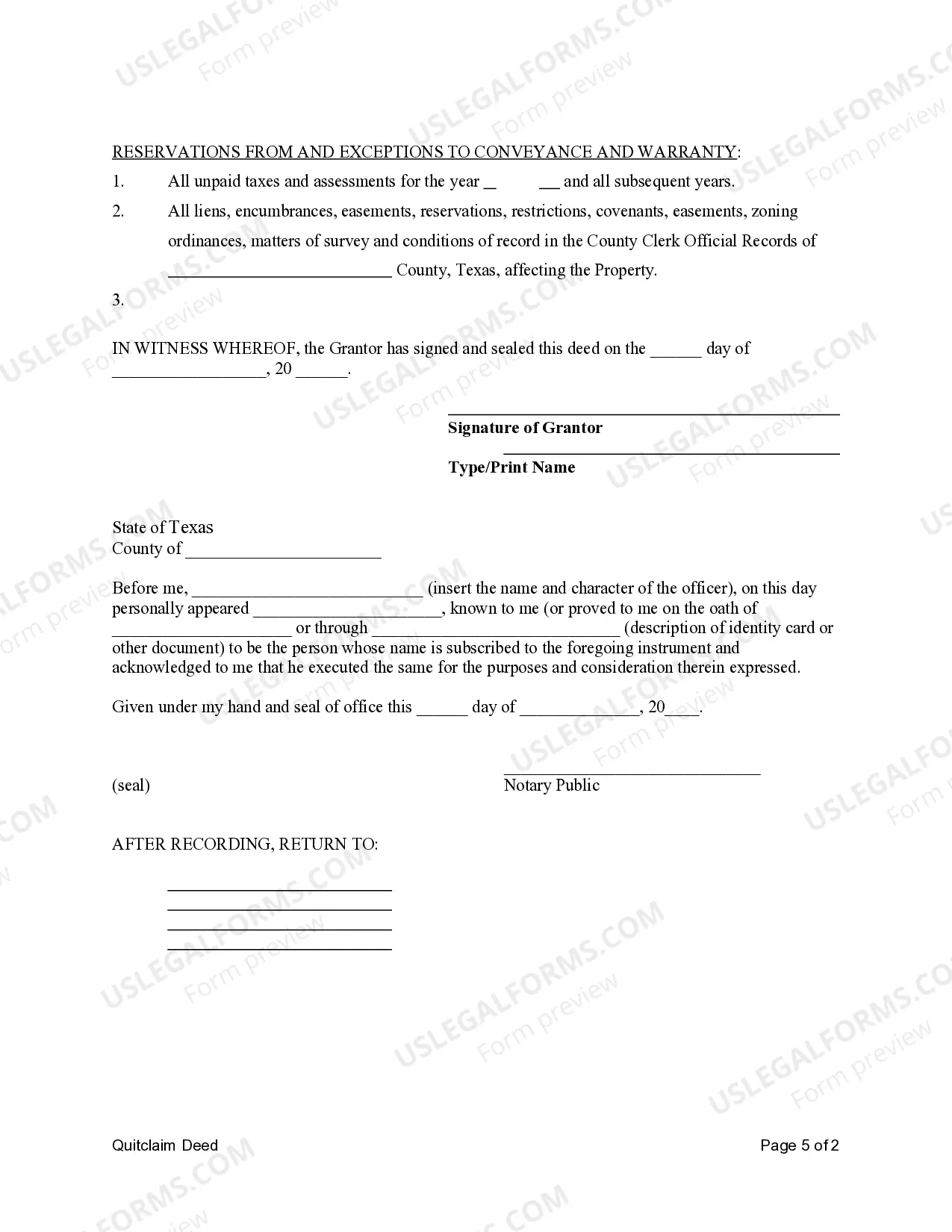

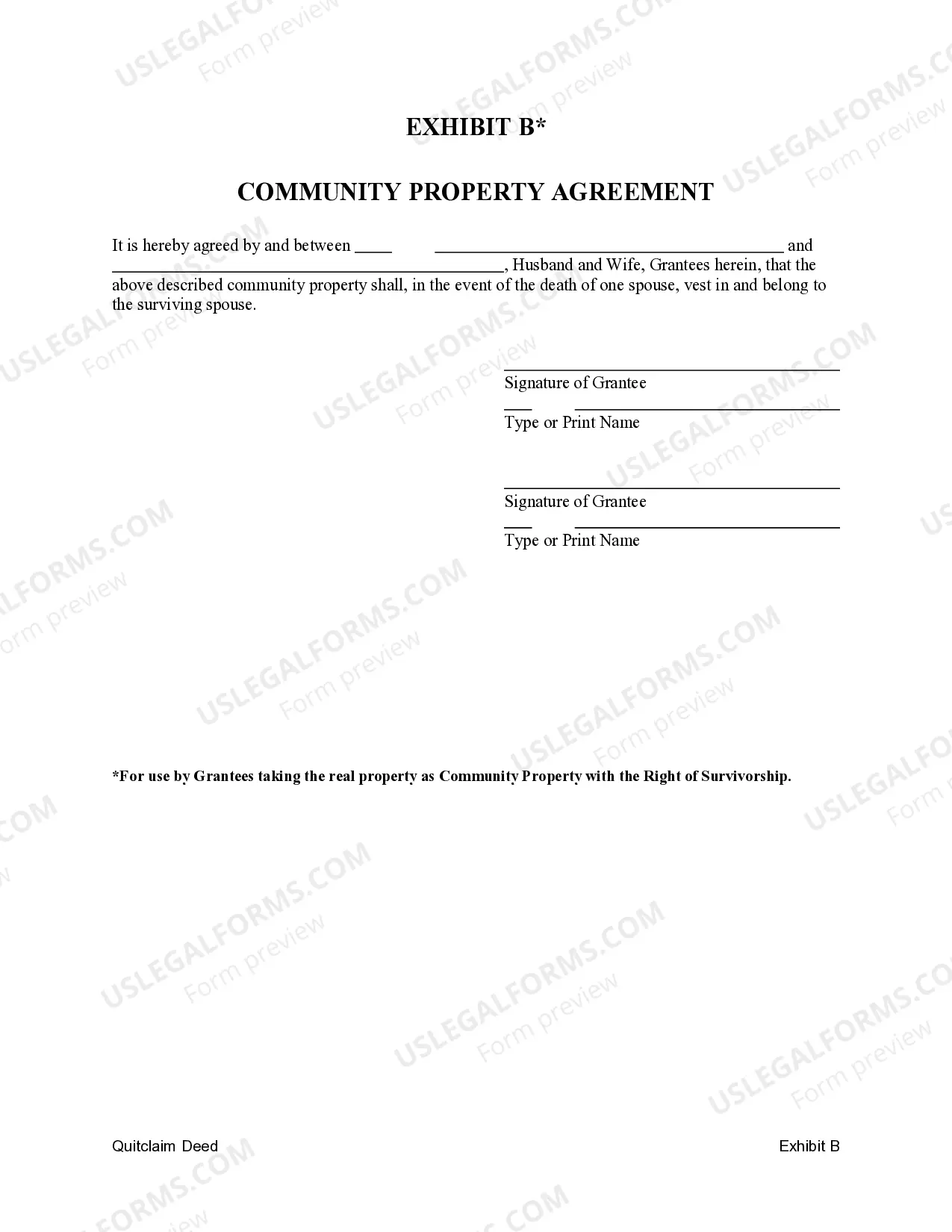

This form is a Quitclaim Deed where the grantor is a husband and the grantees are husband and wife. The grantees may hold title as community property or community property with the right of survivorship.

A Grand Prairie Texas Quitclaim Deed for Husband to Husband and Wife as Community Property or Community Property with Right of Survivorship is a legal document that transfers ownership of real estate from one husband to another husband and their wife, designating the property as community property. This type of deed ensures the property is jointly owned by both spouses and outlines their rights and entitlements. The Grand Prairie Texas Quitclaim Deed for Husband to Husband and Wife as Community Property allows both husbands and their wife to have equal rights to the property, regardless of financial contributions made by each spouse. The deed can also be created with an additional feature of the Right of Survivorship, which means that if one spouse passes away, the surviving spouse automatically receives full ownership of the property, without the need for probate. Different variations of the Grand Prairie Texas Quitclaim Deed for Husband to Husband and Wife as Community Property or Community Property with Right of Survivorship may include: 1. Grand Prairie Texas Quitclaim Deed for Husband to Husband and Wife as Community Property: This type of deed establishes the ownership of the property between two husbands and their wife, defining it as community property. 2. Grand Prairie Texas Quitclaim Deed for Husband to Husband and Wife as Community Property with Right of Survivorship: This version of the deed not only designates the property as community property but also includes the Right of Survivorship. It ensures that if one spouse passes away, the surviving spouse automatically inherits full ownership without the need for probate. It is important to note that specific legal advice should be sought to ensure the proper type of deed is selected and properly executed according to the laws of Grand Prairie, Texas. Consulting with a qualified attorney or real estate professional can provide additional guidance and advice tailored to your unique circumstances.A Grand Prairie Texas Quitclaim Deed for Husband to Husband and Wife as Community Property or Community Property with Right of Survivorship is a legal document that transfers ownership of real estate from one husband to another husband and their wife, designating the property as community property. This type of deed ensures the property is jointly owned by both spouses and outlines their rights and entitlements. The Grand Prairie Texas Quitclaim Deed for Husband to Husband and Wife as Community Property allows both husbands and their wife to have equal rights to the property, regardless of financial contributions made by each spouse. The deed can also be created with an additional feature of the Right of Survivorship, which means that if one spouse passes away, the surviving spouse automatically receives full ownership of the property, without the need for probate. Different variations of the Grand Prairie Texas Quitclaim Deed for Husband to Husband and Wife as Community Property or Community Property with Right of Survivorship may include: 1. Grand Prairie Texas Quitclaim Deed for Husband to Husband and Wife as Community Property: This type of deed establishes the ownership of the property between two husbands and their wife, defining it as community property. 2. Grand Prairie Texas Quitclaim Deed for Husband to Husband and Wife as Community Property with Right of Survivorship: This version of the deed not only designates the property as community property but also includes the Right of Survivorship. It ensures that if one spouse passes away, the surviving spouse automatically inherits full ownership without the need for probate. It is important to note that specific legal advice should be sought to ensure the proper type of deed is selected and properly executed according to the laws of Grand Prairie, Texas. Consulting with a qualified attorney or real estate professional can provide additional guidance and advice tailored to your unique circumstances.