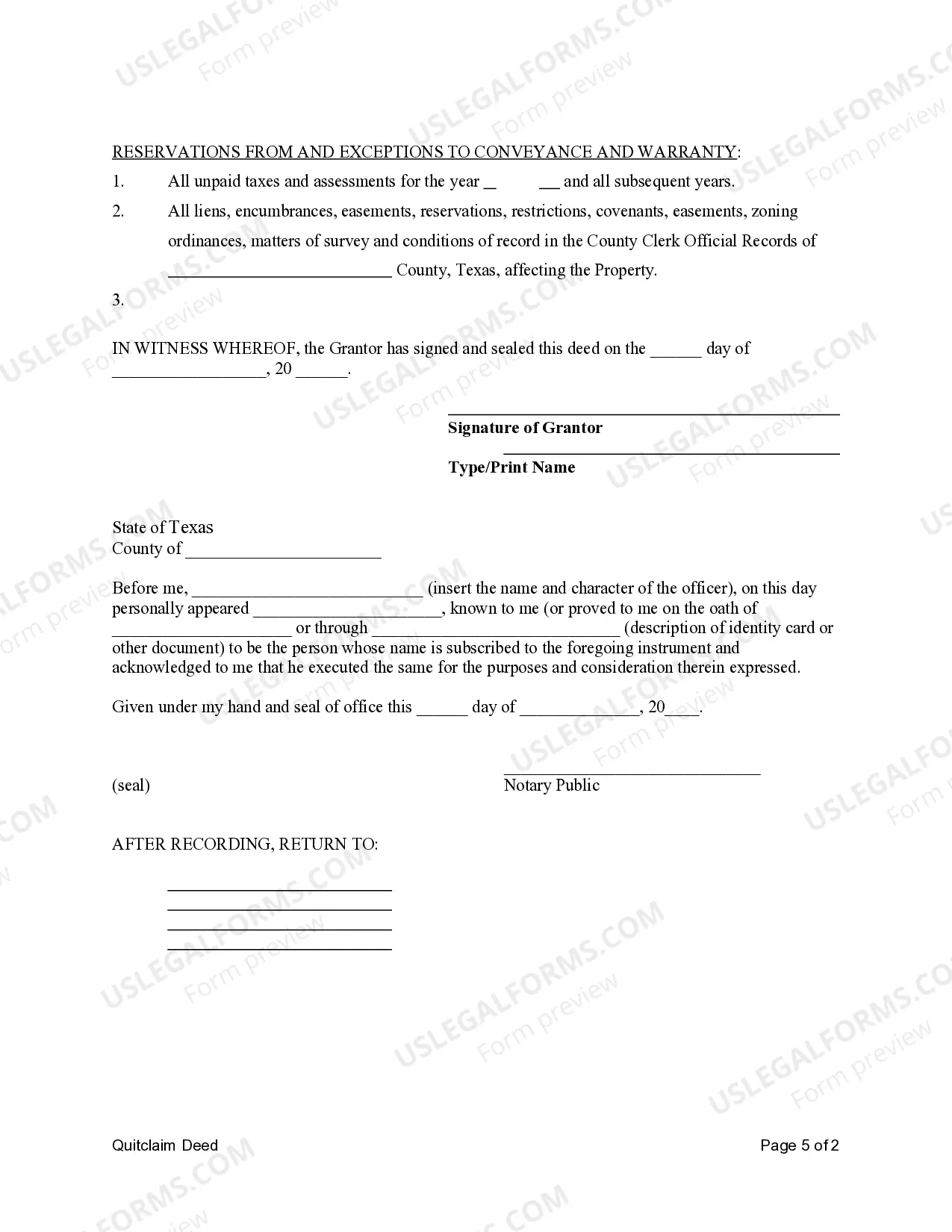

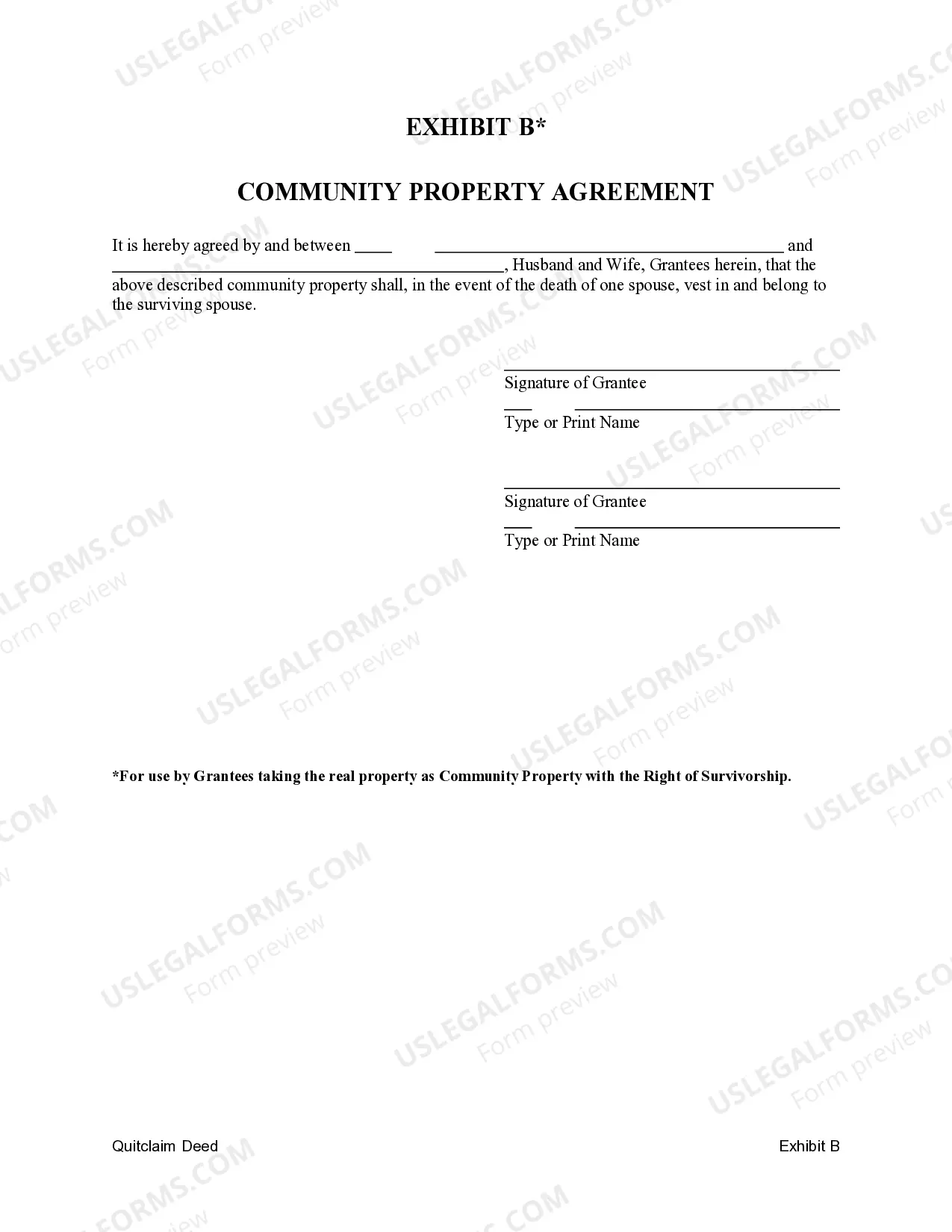

This form is a Quitclaim Deed where the grantor is a husband and the grantees are husband and wife. The grantees may hold title as community property or community property with the right of survivorship.

A Harris Texas Quitclaim Deed for Husband to Husband and Wife as Community Property or Community Property with Right of Survivorship is a legal document used to transfer ownership of real estate property in Harris County, Texas. This type of deed is specifically tailored for married same-sex couples who wish to jointly own property as community property or community property with the right of survivorship. In Texas, community property is a legal concept that states all property acquired by either spouse during the marriage is considered owned equally by both spouses. This means that any property acquired during the marriage becomes joint property, and upon divorce or death, it will be divided equally between the couple or transferred to the surviving spouse. A Quitclaim Deed is a type of property deed used to transfer the ownership interest or claim (if any) that one party has in a property to another party. It is important to note that a Quitclaim Deed does not guarantee clear title or provide warranty of the property. Harris Texas Quitclaim Deeds for Husband to Husband and Wife as Community Property or Community Property with Right of Survivorship can be further categorized into the following types: 1. Harris Texas Quitclaim Deed for Husband to Husband as Community Property: — This type of deed is used when same-sex spouses want to jointly own property acquired during their marriage as community property. — It ensures that both spouses have equal rights and interests in the property. 2. Harris Texas Quitclaim Deed for Husband to Husband and Wife as Community Property with Right of Survivorship: — This type of deed grants the right of survivorship to the couple, meaning that if one spouse passes away, their interest in the property automatically transfers to the surviving spouse without the need for probate or any other legal process. — It guarantees that the surviving spouse will inherit the deceased spouse's ownership interest in the property. It is essential to consult with a qualified attorney or a real estate professional to draft and execute the correct type of Harris Texas Quitclaim Deed that aligns with your specific needs and requirements. Properly executed and recorded Quitclaim Deeds ensure the legal transfer of property ownership and protect the rights of all parties involved.A Harris Texas Quitclaim Deed for Husband to Husband and Wife as Community Property or Community Property with Right of Survivorship is a legal document used to transfer ownership of real estate property in Harris County, Texas. This type of deed is specifically tailored for married same-sex couples who wish to jointly own property as community property or community property with the right of survivorship. In Texas, community property is a legal concept that states all property acquired by either spouse during the marriage is considered owned equally by both spouses. This means that any property acquired during the marriage becomes joint property, and upon divorce or death, it will be divided equally between the couple or transferred to the surviving spouse. A Quitclaim Deed is a type of property deed used to transfer the ownership interest or claim (if any) that one party has in a property to another party. It is important to note that a Quitclaim Deed does not guarantee clear title or provide warranty of the property. Harris Texas Quitclaim Deeds for Husband to Husband and Wife as Community Property or Community Property with Right of Survivorship can be further categorized into the following types: 1. Harris Texas Quitclaim Deed for Husband to Husband as Community Property: — This type of deed is used when same-sex spouses want to jointly own property acquired during their marriage as community property. — It ensures that both spouses have equal rights and interests in the property. 2. Harris Texas Quitclaim Deed for Husband to Husband and Wife as Community Property with Right of Survivorship: — This type of deed grants the right of survivorship to the couple, meaning that if one spouse passes away, their interest in the property automatically transfers to the surviving spouse without the need for probate or any other legal process. — It guarantees that the surviving spouse will inherit the deceased spouse's ownership interest in the property. It is essential to consult with a qualified attorney or a real estate professional to draft and execute the correct type of Harris Texas Quitclaim Deed that aligns with your specific needs and requirements. Properly executed and recorded Quitclaim Deeds ensure the legal transfer of property ownership and protect the rights of all parties involved.