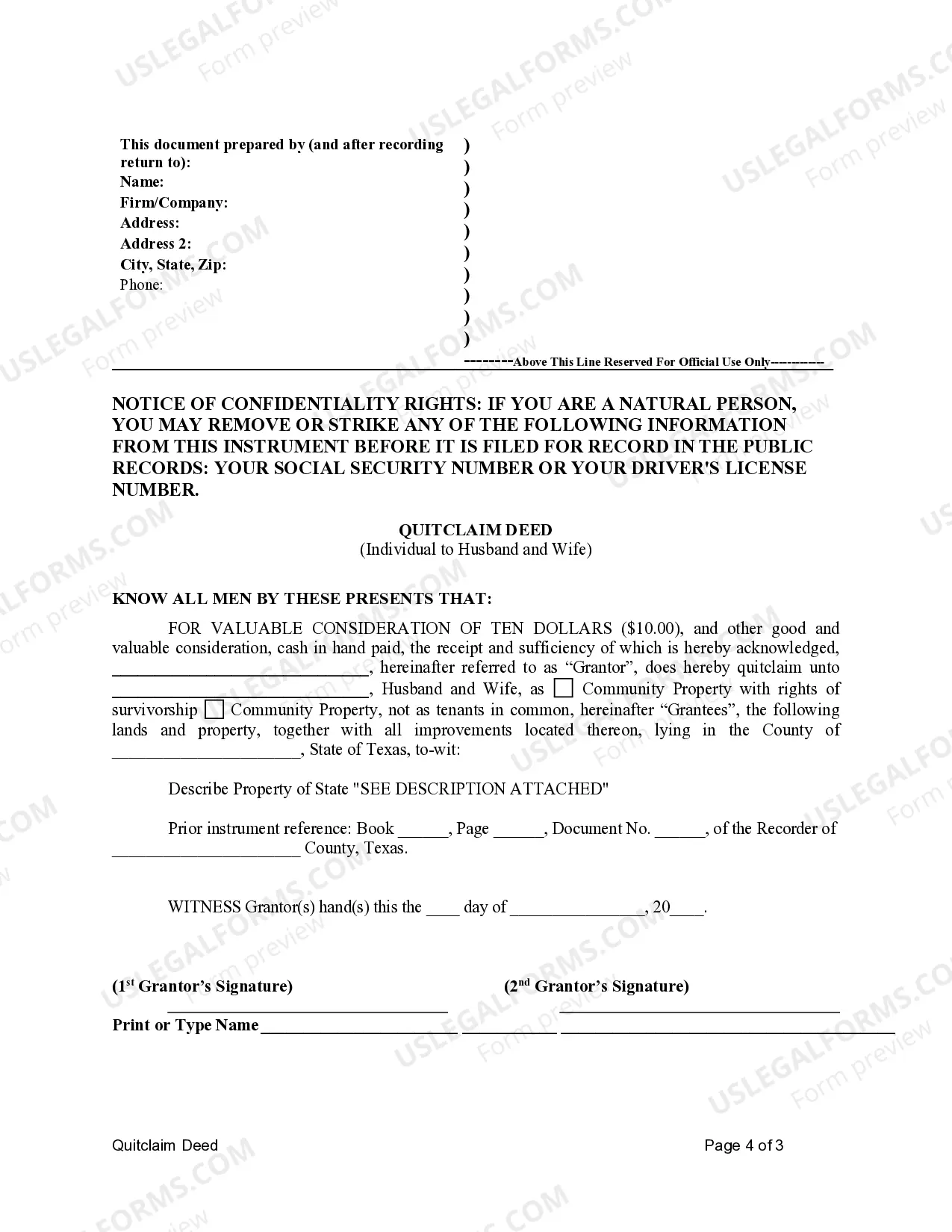

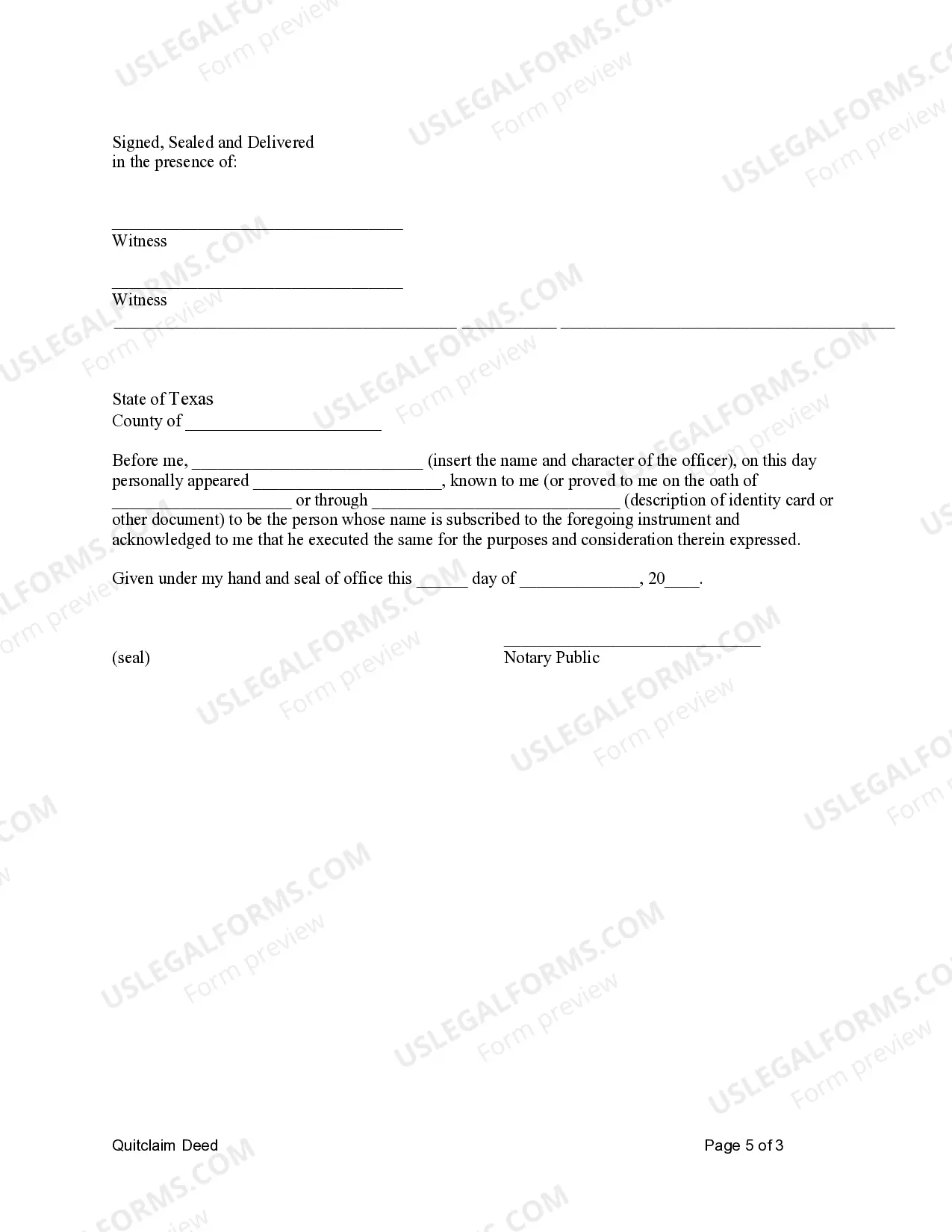

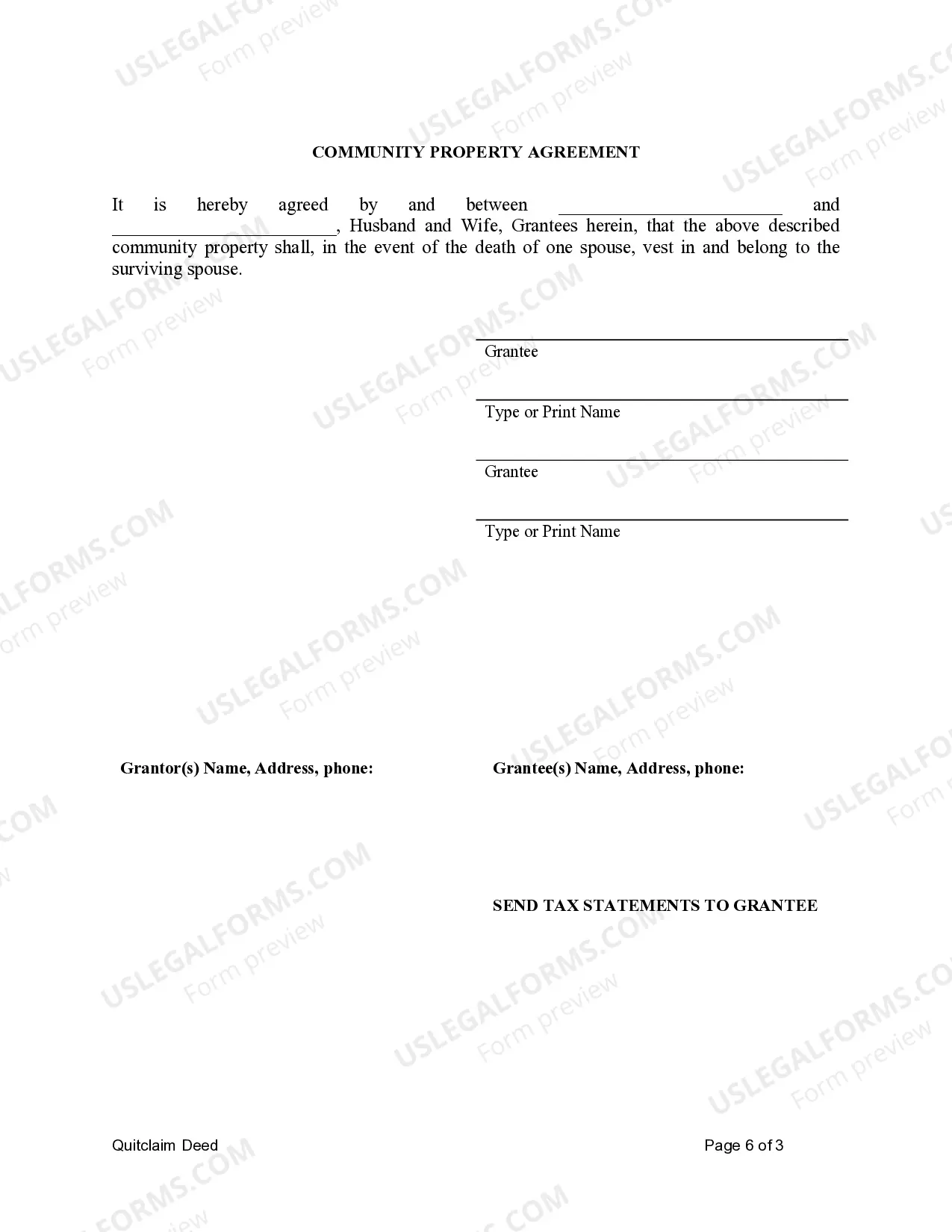

This form is a Quitclaim Deed where the grantor is an individual and the grantees are husband and wife. The grantees may hold title as community property or community property with right of survivorship.

A Brownsville Texas Quitclaim Deed for Individual to Husband and Wife as Community Property or Community Property with Right of Survivorship is a legal document used to transfer ownership of a property from an individual to a married couple. This specific type of deed is commonly used when the individual seller intends to transfer their interest in the property to both spouses as community property or community property with the right of survivorship. In the state of Texas, community property is a legal concept that considers all property acquired during a marriage to be jointly owned by both spouses. Community property with the right of survivorship ensures that if one spouse passes away, their share of the property automatically transfers to the surviving spouse, without the need for probate. This type of ownership provides added security for the surviving spouse and simplifies the transfer process in case of death. There are different variations of the Brownsville Texas Quitclaim Deed for Individual to Husband and Wife as Community Property or Community Property with Right of Survivorship, each serving specific purposes: 1. Brownsville Texas Quitclaim Deed for Individual to Husband and Wife as Community Property with Right of Survivorship: This variation transfers ownership of the property to the husband and wife as community property, with a provision that stipulates the right of survivorship. This means that if one spouse passes away, their share automatically transfers to the surviving spouse. 2. Brownsville Texas Quitclaim Deed for Individual to Husband and Wife as Community Property: This variation transfers the property to the husband and wife as community property without including the right of survivorship. In the event of the death of one spouse, the deceased spouse's share in the property will be distributed according to their will or based on Texas inheritance laws. It is crucial to consult with an experienced attorney or real estate professional familiar with Texas property laws and conveyancing processes to ensure the correct type of deed is utilized for your specific circumstances. Properly completing and filing the deed is essential for a legally binding transfer of ownership and protection of the parties involved.A Brownsville Texas Quitclaim Deed for Individual to Husband and Wife as Community Property or Community Property with Right of Survivorship is a legal document used to transfer ownership of a property from an individual to a married couple. This specific type of deed is commonly used when the individual seller intends to transfer their interest in the property to both spouses as community property or community property with the right of survivorship. In the state of Texas, community property is a legal concept that considers all property acquired during a marriage to be jointly owned by both spouses. Community property with the right of survivorship ensures that if one spouse passes away, their share of the property automatically transfers to the surviving spouse, without the need for probate. This type of ownership provides added security for the surviving spouse and simplifies the transfer process in case of death. There are different variations of the Brownsville Texas Quitclaim Deed for Individual to Husband and Wife as Community Property or Community Property with Right of Survivorship, each serving specific purposes: 1. Brownsville Texas Quitclaim Deed for Individual to Husband and Wife as Community Property with Right of Survivorship: This variation transfers ownership of the property to the husband and wife as community property, with a provision that stipulates the right of survivorship. This means that if one spouse passes away, their share automatically transfers to the surviving spouse. 2. Brownsville Texas Quitclaim Deed for Individual to Husband and Wife as Community Property: This variation transfers the property to the husband and wife as community property without including the right of survivorship. In the event of the death of one spouse, the deceased spouse's share in the property will be distributed according to their will or based on Texas inheritance laws. It is crucial to consult with an experienced attorney or real estate professional familiar with Texas property laws and conveyancing processes to ensure the correct type of deed is utilized for your specific circumstances. Properly completing and filing the deed is essential for a legally binding transfer of ownership and protection of the parties involved.