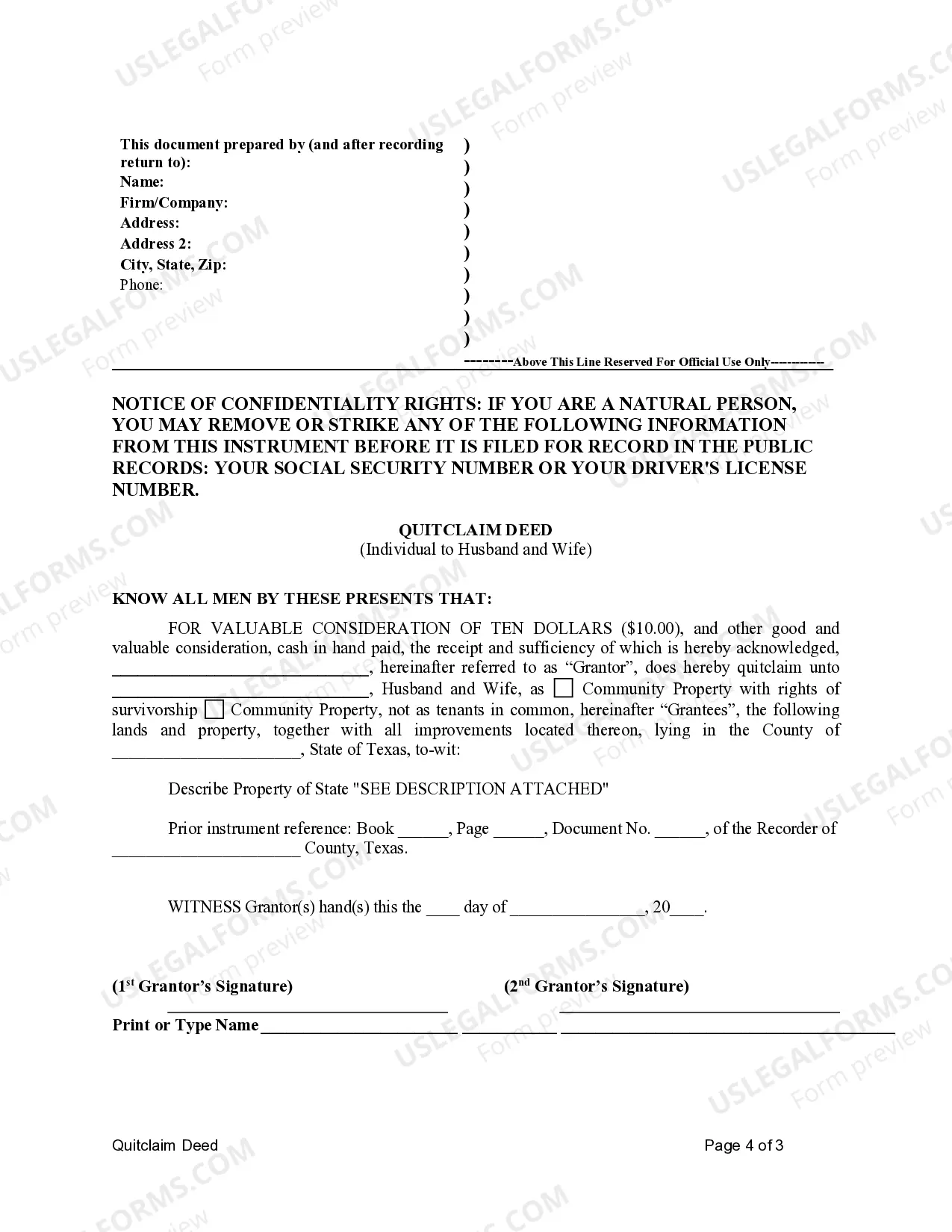

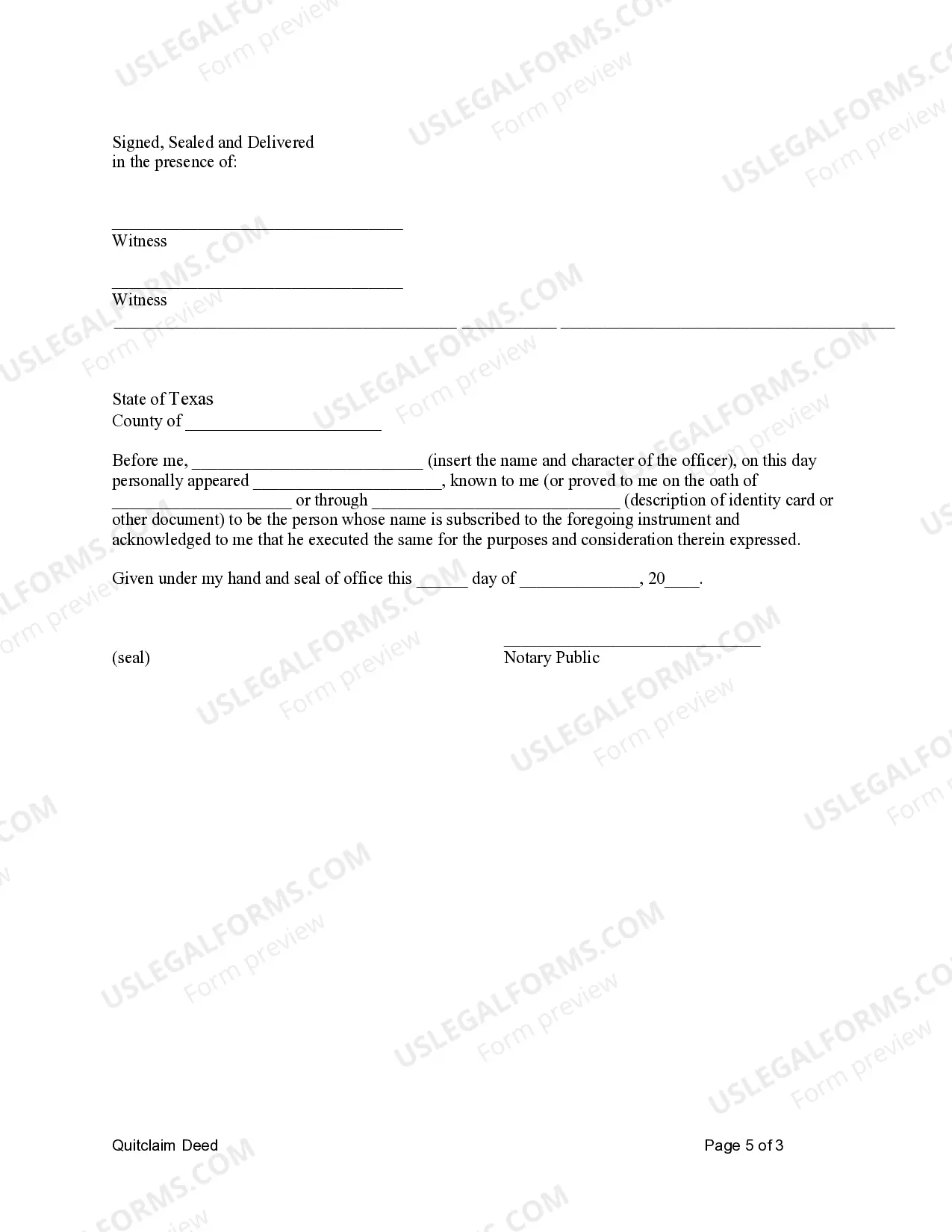

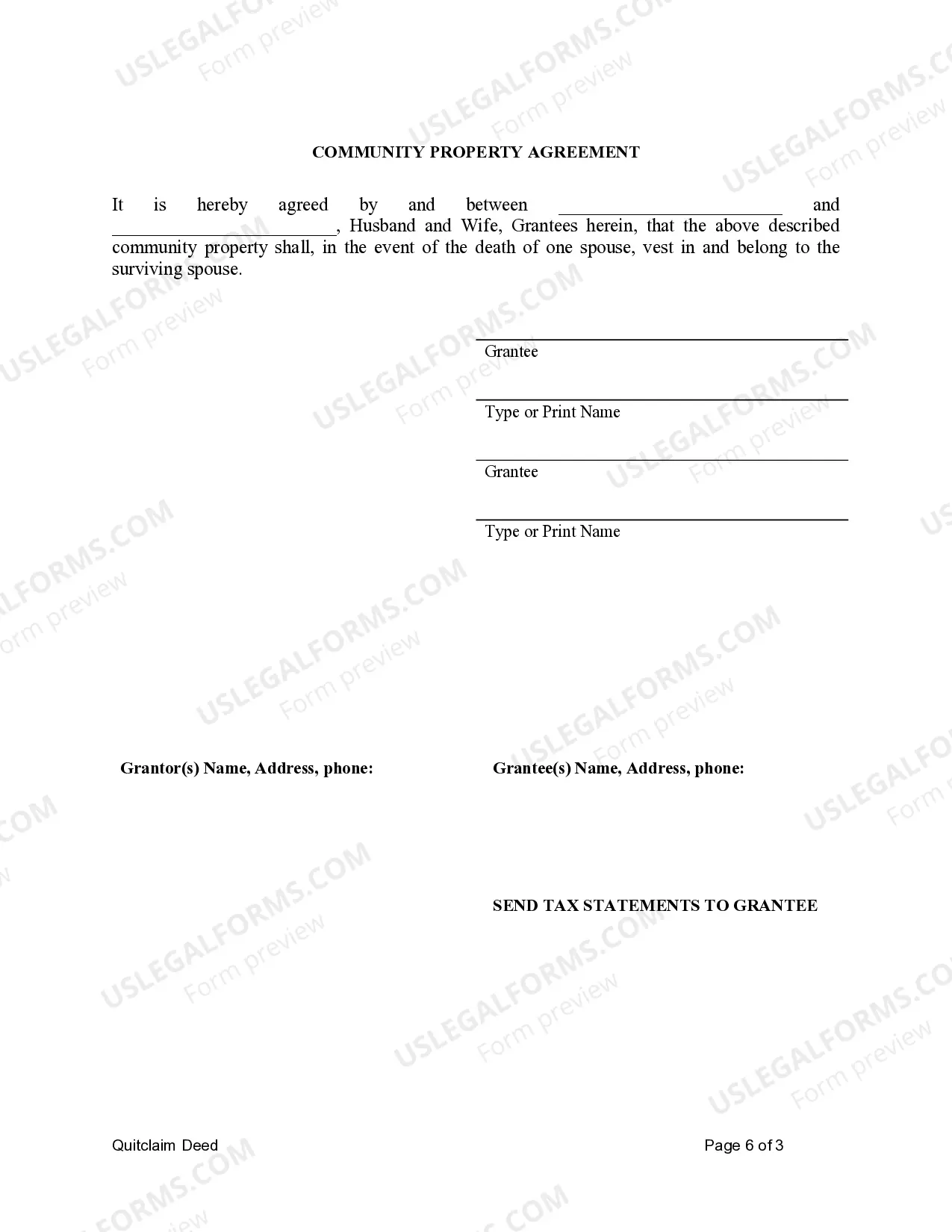

This form is a Quitclaim Deed where the grantor is an individual and the grantees are husband and wife. The grantees may hold title as community property or community property with right of survivorship.

A Collin Texas Quitclaim Deed for Individual to Husband and Wife as Community Property or Community Property with Right of Survivorship is a legal document used to transfer ownership of real property from an individual to a married couple. Specifically, it establishes the couple as joint owners of the property, either as community property or community property with the right of survivorship. In Collin County, Texas, there are two primary types of Collin Texas Quitclaim Deeds for Individual to Husband and Wife as Community Property or Community Property with Right of Survivorship: 1. Community Property: In this type of quitclaim deed, the property is considered community property, meaning that both husband and wife have an equal and undivided interest in the property. They share ownership to the property, including any income generated from it, as well as any debts or obligations related to the property. Upon the death of one spouse, their share of the property passes to the surviving spouse, without the need for probate. 2. Community Property with Right of Survivorship: This type of quitclaim deed grants ownership to the husband and wife as community property, with an added right of survivorship. Similar to community property, both spouses have equal and undivided interests in the property. However, the right of survivorship ensures that upon the death of one spouse, their share automatically transfers to the surviving spouse. This avoids the need for probate and provides a smooth transfer of ownership. The Collin Texas Quitclaim Deed for Individual to Husband and Wife as Community Property or Community Property with Right of Survivorship is an important legal instrument used in property transactions. It provides a clear and legally binding transfer of ownership, while also establishing the specific type of ownership arrangement between the individuals involved. It is crucial to consult with a qualified professional, such as a real estate attorney or title company, when preparing or executing such a deed to ensure compliance with Texas laws and regulations and to protect the rights and interests of all parties involved.A Collin Texas Quitclaim Deed for Individual to Husband and Wife as Community Property or Community Property with Right of Survivorship is a legal document used to transfer ownership of real property from an individual to a married couple. Specifically, it establishes the couple as joint owners of the property, either as community property or community property with the right of survivorship. In Collin County, Texas, there are two primary types of Collin Texas Quitclaim Deeds for Individual to Husband and Wife as Community Property or Community Property with Right of Survivorship: 1. Community Property: In this type of quitclaim deed, the property is considered community property, meaning that both husband and wife have an equal and undivided interest in the property. They share ownership to the property, including any income generated from it, as well as any debts or obligations related to the property. Upon the death of one spouse, their share of the property passes to the surviving spouse, without the need for probate. 2. Community Property with Right of Survivorship: This type of quitclaim deed grants ownership to the husband and wife as community property, with an added right of survivorship. Similar to community property, both spouses have equal and undivided interests in the property. However, the right of survivorship ensures that upon the death of one spouse, their share automatically transfers to the surviving spouse. This avoids the need for probate and provides a smooth transfer of ownership. The Collin Texas Quitclaim Deed for Individual to Husband and Wife as Community Property or Community Property with Right of Survivorship is an important legal instrument used in property transactions. It provides a clear and legally binding transfer of ownership, while also establishing the specific type of ownership arrangement between the individuals involved. It is crucial to consult with a qualified professional, such as a real estate attorney or title company, when preparing or executing such a deed to ensure compliance with Texas laws and regulations and to protect the rights and interests of all parties involved.