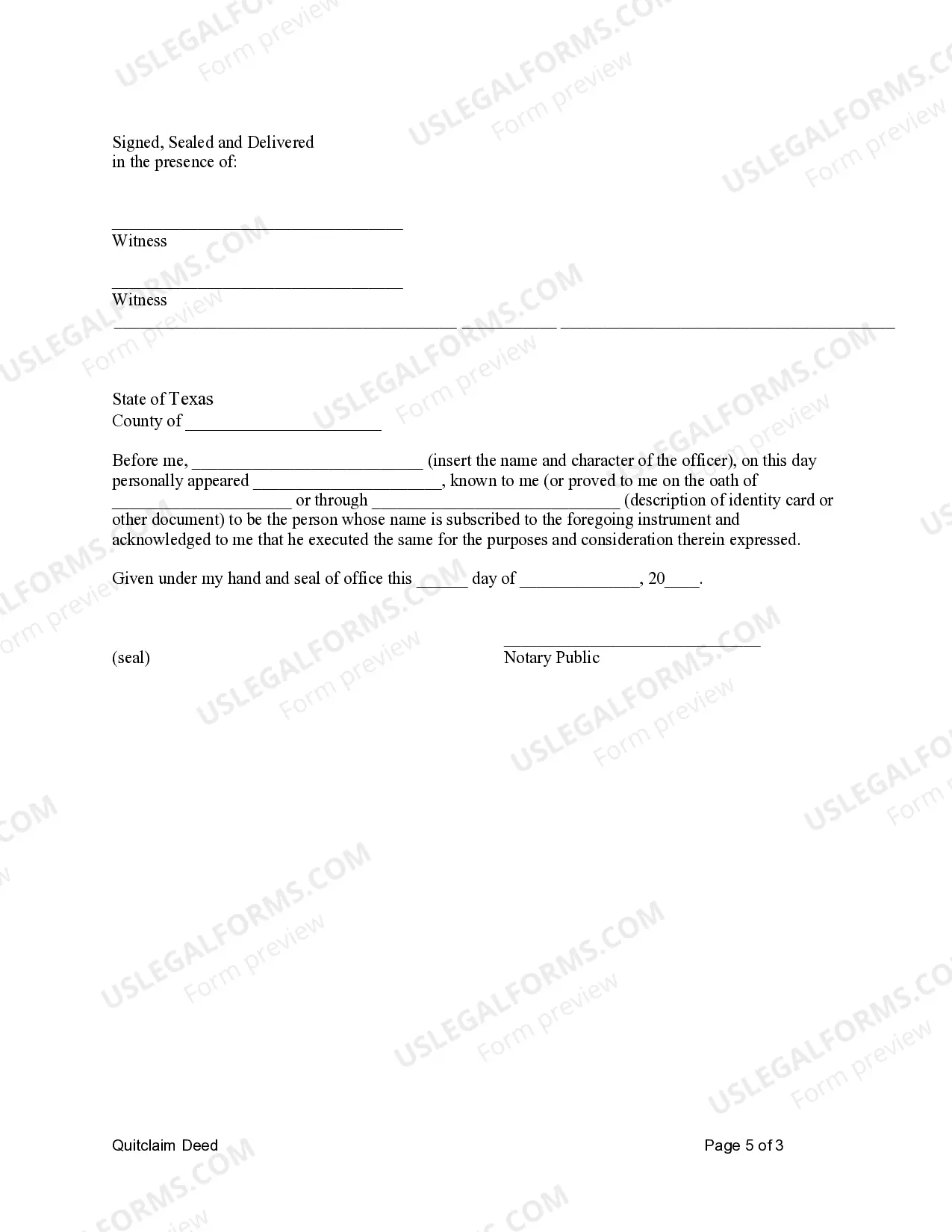

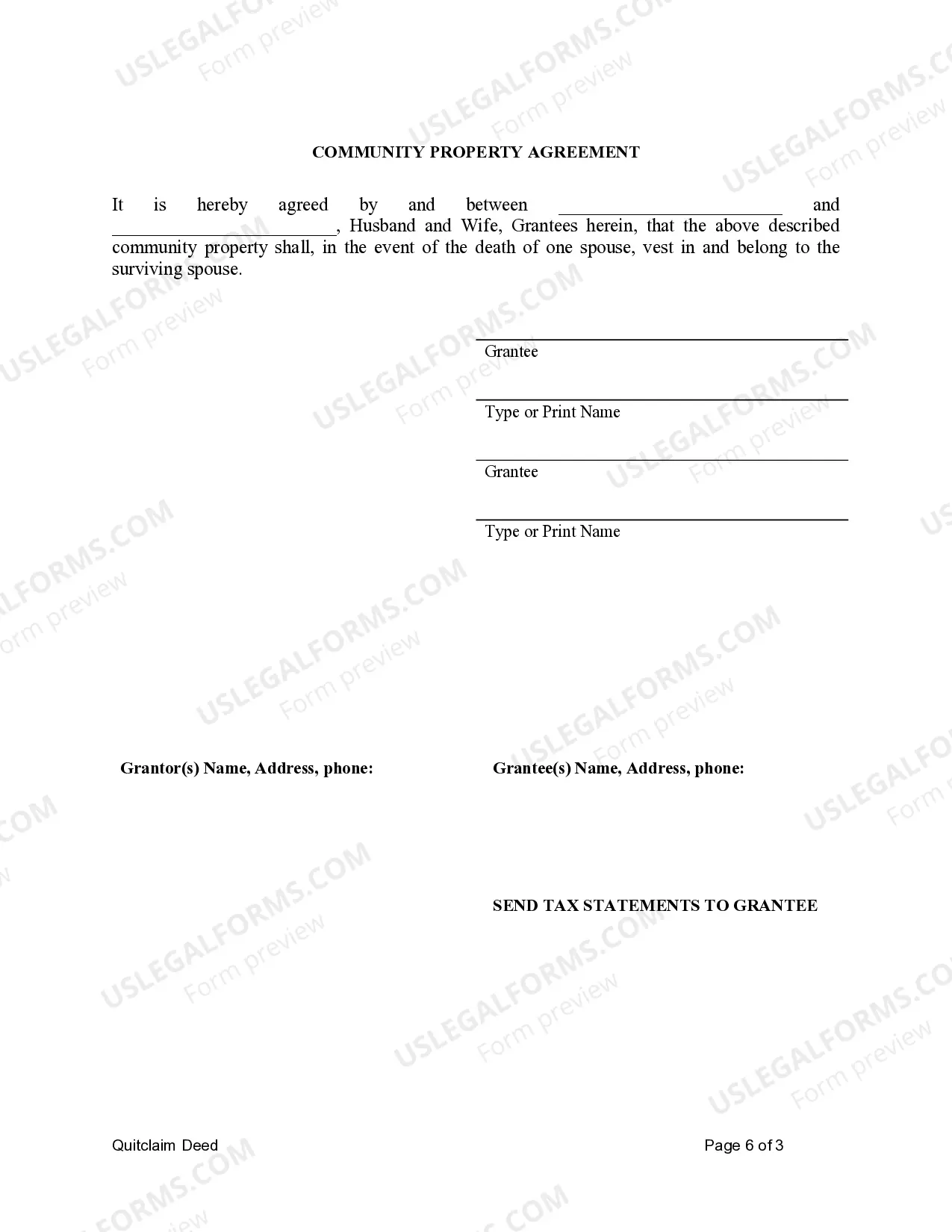

This form is a Quitclaim Deed where the grantor is an individual and the grantees are husband and wife. The grantees may hold title as community property or community property with right of survivorship.

A Harris Texas Quitclaim Deed for Individual to Husband and Wife as Community Property or Community Property with Right of Survivorship is a legal document used in the state of Texas to transfer ownership of property from an individual to a married couple as either community property or community property with the right of survivorship. This type of deed allows the couple to hold the property together, sharing equal ownership and the responsibility for any liabilities attached to it. In Texas, community property is defined as any property acquired by either spouse during the course of their marriage. This includes income earned, assets purchased, and debts accumulated. Community property allows both spouses to have an undivided interest in the property, meaning they each own 50% regardless of individual contributions or original ownership. The option to hold the property as community property with the right of survivorship provides additional benefits. If one spouse passes away, their share of the property automatically transfers to the surviving spouse without going through probate. This type of ownership ensures that the property remains with the surviving spouse and avoids potential complications in transferring the property in the event of death. It is important to note that there may be variations of the Harris Texas Quitclaim Deed for Individual to Husband and Wife as Community Property or Community Property with Right of Survivorship. While the basic concept remains the same, different versions may exist to accommodate specific circumstances or preferences of the parties involved. Examples of such variations may include: 1. Harris Texas Quitclaim Deed — Husband and Wife as Community Property: This form specifically designates the property as community property without the right of survivorship. It means that both spouses own an equal interest in the property while retaining their individual rights to transfer their share to any other party through will or other legal means. 2. Harris Texas Quitclaim Deed — Husband and Wife as Community Property with Right of Survivorship and Reserved Life Estate: This form not only grants ownership as community property with the right of survivorship but also reserves a life estate for one or both of the spouses. This means that one or both spouses retain the right to live in the property for the rest of their life, even after the death of the other spouse. 3. Harris Texas Quitclaim Deed — Husband and Wife as Community Property Alternative to Joint Tenancy: This form serves as an alternative to joint tenancy, a common form of co-ownership. It allows the property to be held as community property while providing the same right of survivorship benefits as joint tenancy. When considering a Harris Texas Quitclaim Deed for Individual to Husband and Wife as Community Property or Community Property with Right of Survivorship, it is crucial to consult with a legal professional well-versed in real estate laws in the state of Texas. They can provide guidance and ensure that the deed accurately reflects the intentions of the parties involved and complies with all relevant legal requirements.A Harris Texas Quitclaim Deed for Individual to Husband and Wife as Community Property or Community Property with Right of Survivorship is a legal document used in the state of Texas to transfer ownership of property from an individual to a married couple as either community property or community property with the right of survivorship. This type of deed allows the couple to hold the property together, sharing equal ownership and the responsibility for any liabilities attached to it. In Texas, community property is defined as any property acquired by either spouse during the course of their marriage. This includes income earned, assets purchased, and debts accumulated. Community property allows both spouses to have an undivided interest in the property, meaning they each own 50% regardless of individual contributions or original ownership. The option to hold the property as community property with the right of survivorship provides additional benefits. If one spouse passes away, their share of the property automatically transfers to the surviving spouse without going through probate. This type of ownership ensures that the property remains with the surviving spouse and avoids potential complications in transferring the property in the event of death. It is important to note that there may be variations of the Harris Texas Quitclaim Deed for Individual to Husband and Wife as Community Property or Community Property with Right of Survivorship. While the basic concept remains the same, different versions may exist to accommodate specific circumstances or preferences of the parties involved. Examples of such variations may include: 1. Harris Texas Quitclaim Deed — Husband and Wife as Community Property: This form specifically designates the property as community property without the right of survivorship. It means that both spouses own an equal interest in the property while retaining their individual rights to transfer their share to any other party through will or other legal means. 2. Harris Texas Quitclaim Deed — Husband and Wife as Community Property with Right of Survivorship and Reserved Life Estate: This form not only grants ownership as community property with the right of survivorship but also reserves a life estate for one or both of the spouses. This means that one or both spouses retain the right to live in the property for the rest of their life, even after the death of the other spouse. 3. Harris Texas Quitclaim Deed — Husband and Wife as Community Property Alternative to Joint Tenancy: This form serves as an alternative to joint tenancy, a common form of co-ownership. It allows the property to be held as community property while providing the same right of survivorship benefits as joint tenancy. When considering a Harris Texas Quitclaim Deed for Individual to Husband and Wife as Community Property or Community Property with Right of Survivorship, it is crucial to consult with a legal professional well-versed in real estate laws in the state of Texas. They can provide guidance and ensure that the deed accurately reflects the intentions of the parties involved and complies with all relevant legal requirements.