This form is a Quitclaim Deed where the grantor is an individual and the grantees are husband and wife. The grantees may hold title as community property or community property with right of survivorship.

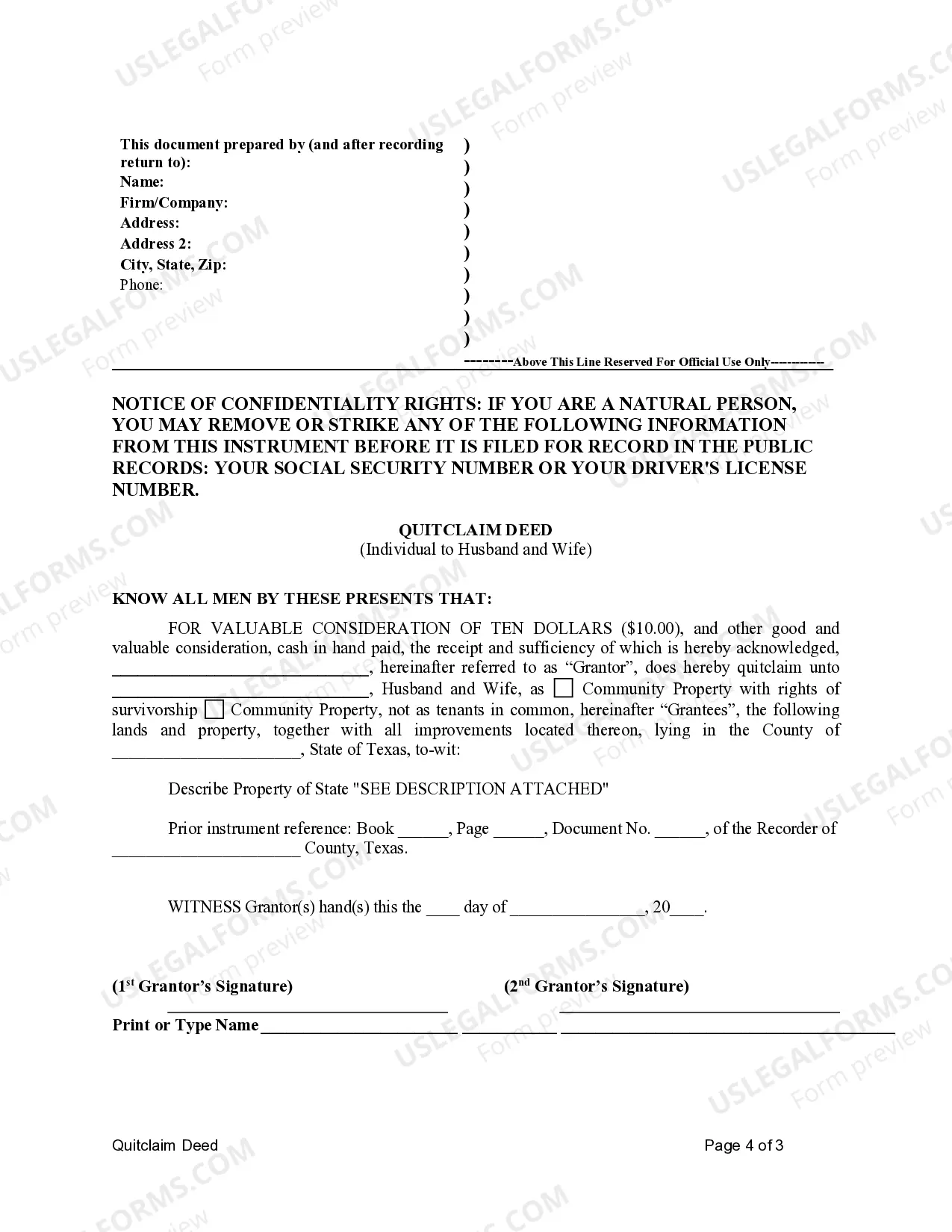

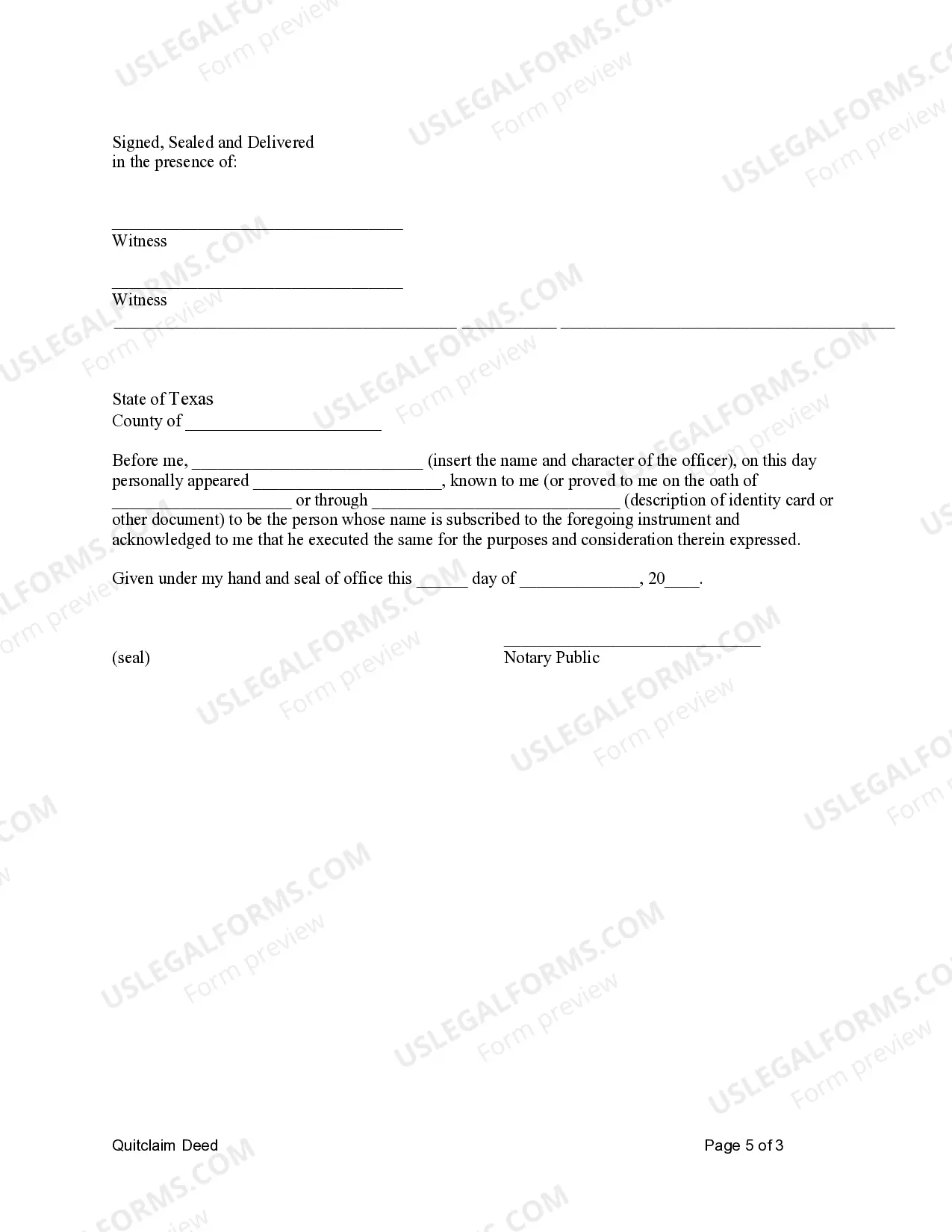

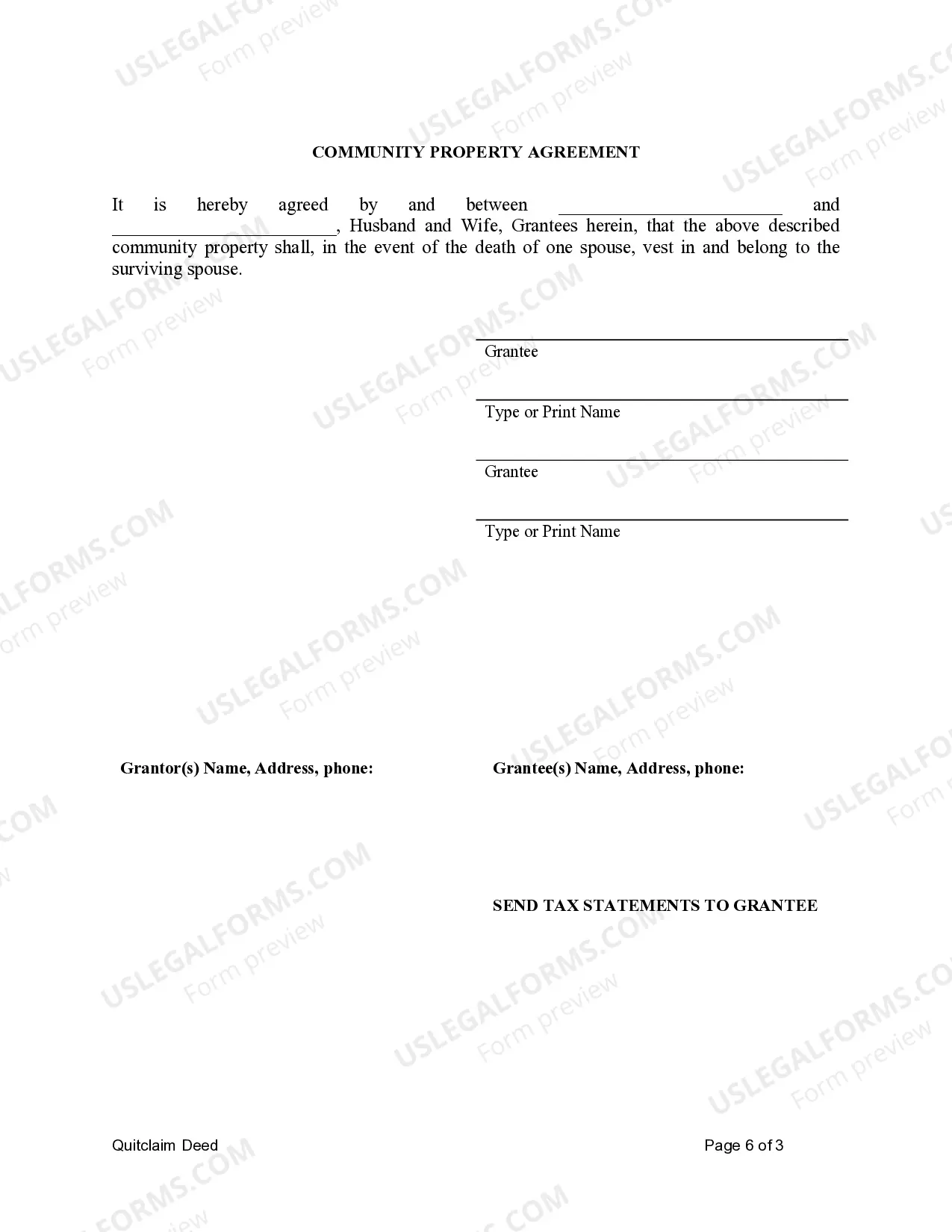

A Laredo Texas Quitclaim Deed for Individual to Husband and Wife as Community Property or Community Property with Right of Survivorship is a legally binding document that transfers ownership of a property from an individual to a married couple while designating it as community property or community property with the right of survivorship. This type of deed is commonly used when a spouse wishes to convey their interest in a property to both themselves and their partner. Community Property is a legal term that refers to property acquired by a married couple during their marriage. In Texas, community property laws state that any property obtained during the marriage is considered jointly owned by both spouses, regardless of who purchased or acquired it. By utilizing a Quitclaim Deed, an individual can transfer their share of ownership to the couple, establishing it as community property. A Quitclaim Deed for Individual to Husband and Wife as Community Property with Right of Survivorship is a slight variation to the aforementioned deed. This type of deed not only designates the property as community property but also ensures that upon the death of one spouse, the other automatically inherits full ownership without the need for probate. This right of survivorship allows for the seamless transfer of property between spouses, avoiding potentially lengthy legal processes. When drafting a Laredo Texas Quitclaim Deed for Individual to Husband and Wife as Community Property or Community Property with Right of Survivorship, there are several important considerations. The document should contain the legal description of the property, outlining its exact boundaries and location. It should also include specific details of the transfer, such as the name of the granting individual (granter) and the names of the recipients (grantees), both the husband and wife. Additionally, it is crucial to ensure the deed complies with all applicable Texas state laws and regulations. Consulting with a qualified real estate attorney or utilizing a reliable online legal service can help guarantee that the deed is properly executed and recorded. By following the correct procedures, the deed can be filed with the Laredo Texas County Clerk's Office to officially transfer ownership of the property. In conclusion, a Laredo Texas Quitclaim Deed for Individual to Husband and Wife as Community Property or Community Property with Right of Survivorship serves as a legal instrument to transfer property ownership from an individual to a married couple as community property or community property with the right of survivorship. This allows for shared ownership and potential inheritance rights, ensuring seamless transitions in the event of one spouse's death. Remember to adhere to Texas state laws and seek professional guidance when preparing and filing this important legal document.A Laredo Texas Quitclaim Deed for Individual to Husband and Wife as Community Property or Community Property with Right of Survivorship is a legally binding document that transfers ownership of a property from an individual to a married couple while designating it as community property or community property with the right of survivorship. This type of deed is commonly used when a spouse wishes to convey their interest in a property to both themselves and their partner. Community Property is a legal term that refers to property acquired by a married couple during their marriage. In Texas, community property laws state that any property obtained during the marriage is considered jointly owned by both spouses, regardless of who purchased or acquired it. By utilizing a Quitclaim Deed, an individual can transfer their share of ownership to the couple, establishing it as community property. A Quitclaim Deed for Individual to Husband and Wife as Community Property with Right of Survivorship is a slight variation to the aforementioned deed. This type of deed not only designates the property as community property but also ensures that upon the death of one spouse, the other automatically inherits full ownership without the need for probate. This right of survivorship allows for the seamless transfer of property between spouses, avoiding potentially lengthy legal processes. When drafting a Laredo Texas Quitclaim Deed for Individual to Husband and Wife as Community Property or Community Property with Right of Survivorship, there are several important considerations. The document should contain the legal description of the property, outlining its exact boundaries and location. It should also include specific details of the transfer, such as the name of the granting individual (granter) and the names of the recipients (grantees), both the husband and wife. Additionally, it is crucial to ensure the deed complies with all applicable Texas state laws and regulations. Consulting with a qualified real estate attorney or utilizing a reliable online legal service can help guarantee that the deed is properly executed and recorded. By following the correct procedures, the deed can be filed with the Laredo Texas County Clerk's Office to officially transfer ownership of the property. In conclusion, a Laredo Texas Quitclaim Deed for Individual to Husband and Wife as Community Property or Community Property with Right of Survivorship serves as a legal instrument to transfer property ownership from an individual to a married couple as community property or community property with the right of survivorship. This allows for shared ownership and potential inheritance rights, ensuring seamless transitions in the event of one spouse's death. Remember to adhere to Texas state laws and seek professional guidance when preparing and filing this important legal document.