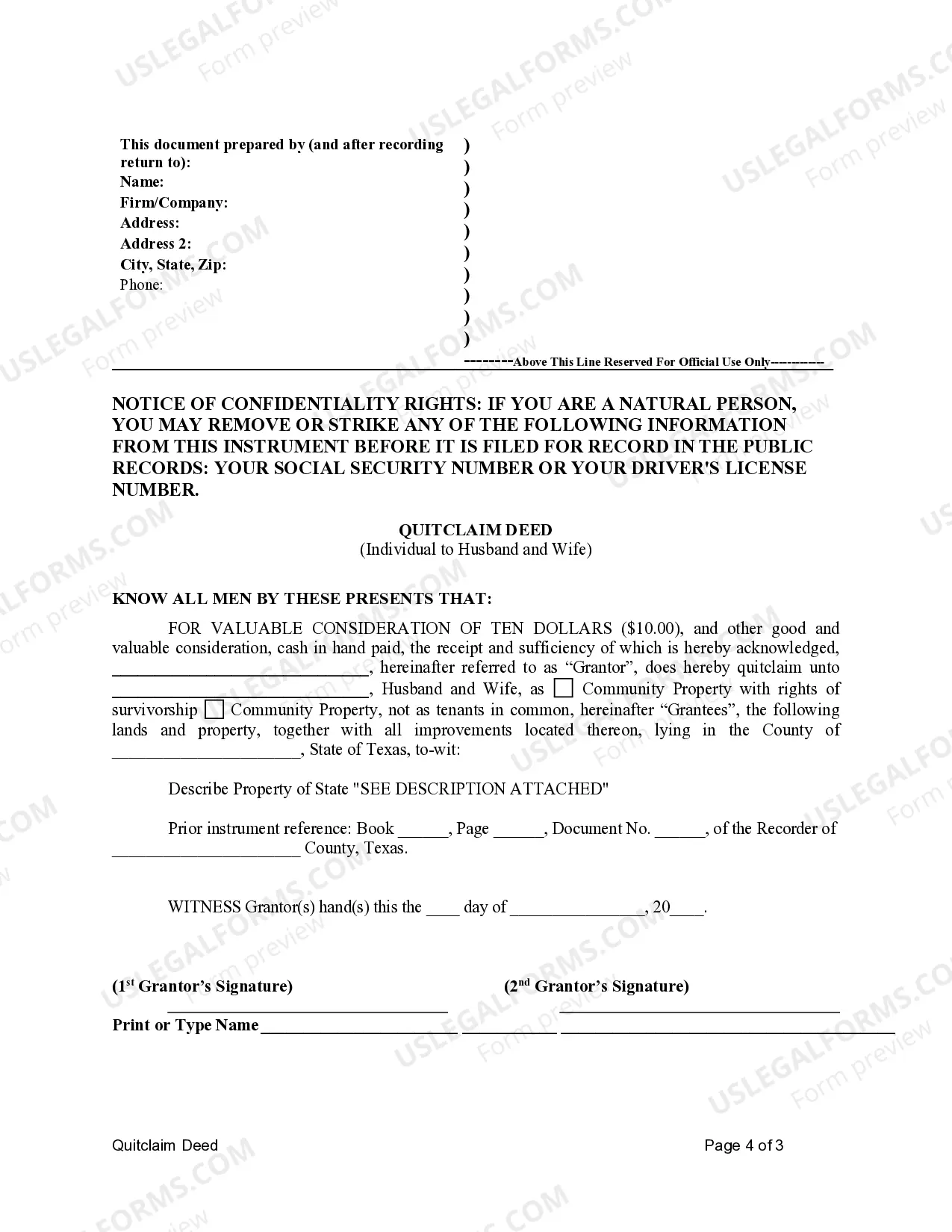

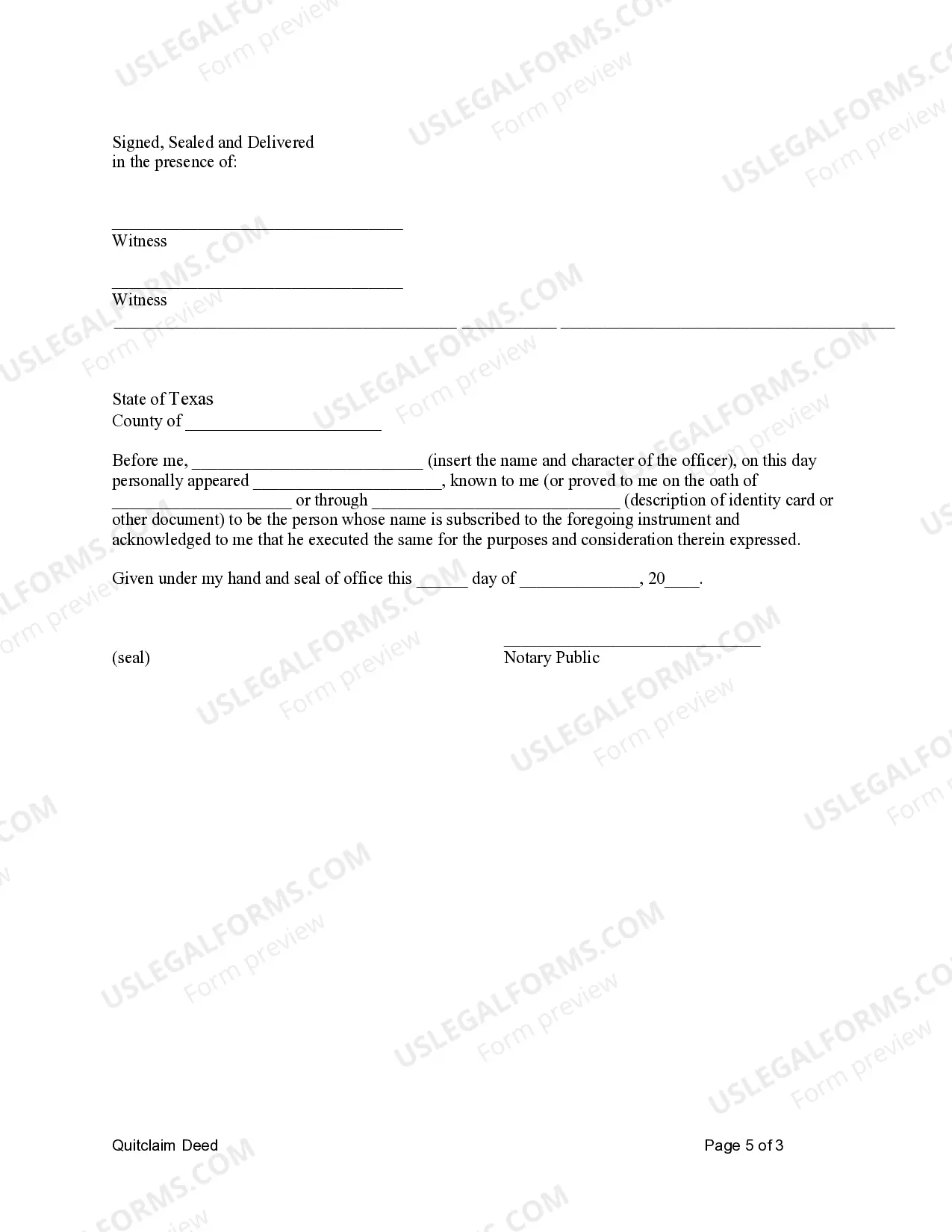

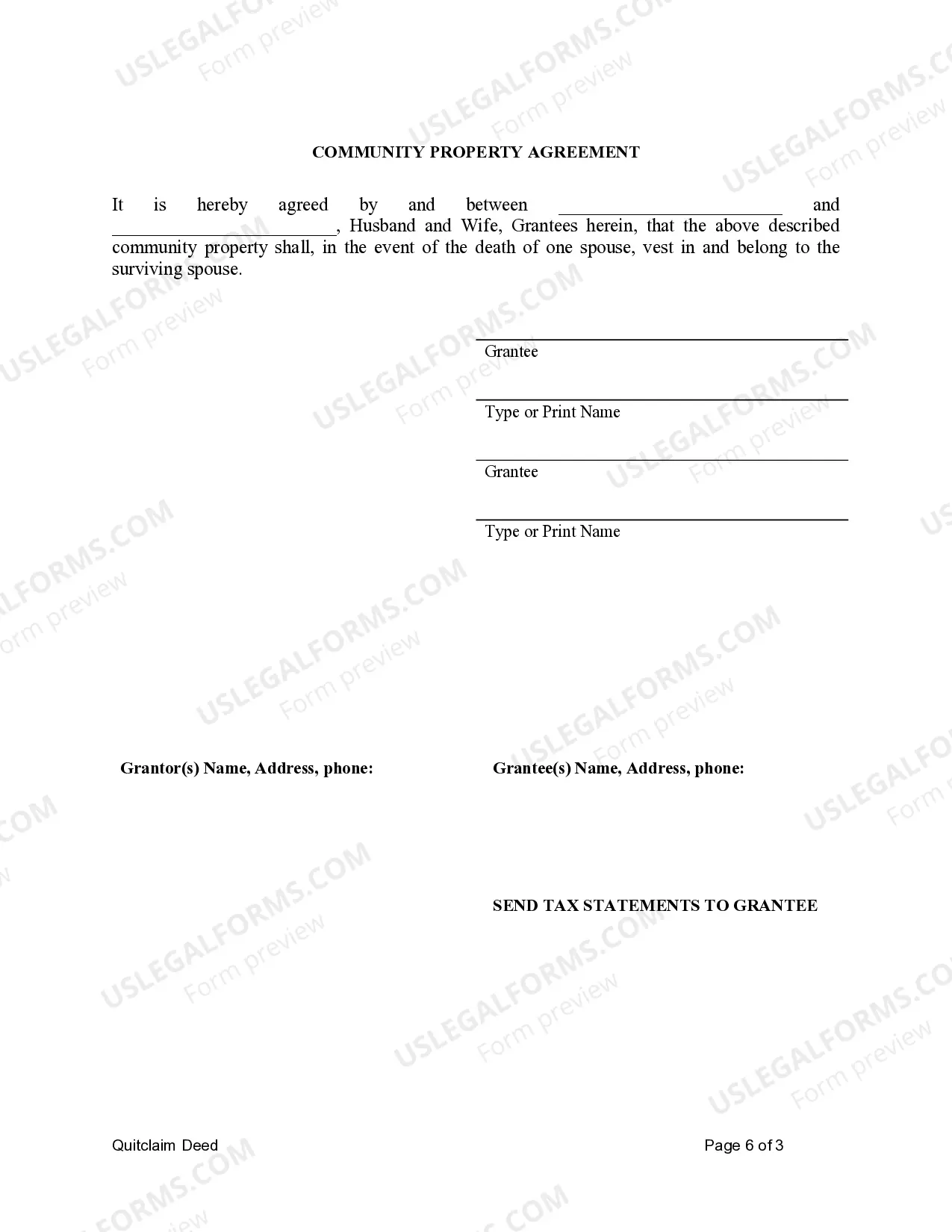

This form is a Quitclaim Deed where the grantor is an individual and the grantees are husband and wife. The grantees may hold title as community property or community property with right of survivorship.

A Mesquite Texas Quitclaim Deed for Individual to Husband and Wife as Community Property or Community Property with Right of Survivorship is a legal document used to transfer ownership of real estate from an individual to a married couple in Mesquite, Texas. This type of deed is commonly used when a property owner wishes to grant ownership rights to both spouses as community property. Mesquite is a growing city located in Dallas County, Texas, known for its residential areas and vibrant community life. For married couples in Mesquite who wish to hold property together, the Quitclaim Deed for Individual to Husband and Wife as Community Property or Community Property with Right of Survivorship provides a way to establish joint ownership rights and protect their interests. When it comes to this specific type of quitclaim deed in Mesquite, there are a few variations that couples can consider. The first option is a Quitclaim Deed for Individual to Husband and Wife as Community Property, where ownership is established as community property. Community property refers to assets or property acquired during the marriage, which is owned equally by both spouses, unless stated otherwise in an agreement. The second option is a Quitclaim Deed for Individual to Husband and Wife as Community Property with Right of Survivorship. In this case, the couple enjoys joint ownership of the property as community property, but with the added benefit of the right of survivorship. This means that if one spouse were to pass away, ownership of the property automatically transfers to the surviving spouse, bypassing the need for probate. Choosing between these two options depends on the couple's specific needs and circumstances. If they want both spouses to have equal ownership rights in the property and be able to manage it jointly, the Quitclaim Deed for Individual to Husband and Wife as Community Property would be suitable. On the other hand, if the couple wishes to ensure smooth transition of ownership in case of death, the Quitclaim Deed for Individual to Husband and Wife as Community Property with Right of Survivorship would be a wise choice. It is important to note that preparing a quitclaim deed for property transfer requires careful consideration and often necessitates the assistance of a legal professional or a qualified real estate agent. Additionally, couples should ensure compliance with Texas state laws regarding property transfers and consult with an attorney to address any specific questions or concerns. In summary, a Mesquite Texas Quitclaim Deed for Individual to Husband and Wife as Community Property or Community Property with Right of Survivorship is a legal document used to transfer ownership of real estate from an individual to a married couple in Mesquite, Texas. Couples have the option to choose between a Quitclaim Deed for Individual to Husband and Wife as Community Property or Community Property with Right of Survivorship, depending on their desired ownership structure and goals.A Mesquite Texas Quitclaim Deed for Individual to Husband and Wife as Community Property or Community Property with Right of Survivorship is a legal document used to transfer ownership of real estate from an individual to a married couple in Mesquite, Texas. This type of deed is commonly used when a property owner wishes to grant ownership rights to both spouses as community property. Mesquite is a growing city located in Dallas County, Texas, known for its residential areas and vibrant community life. For married couples in Mesquite who wish to hold property together, the Quitclaim Deed for Individual to Husband and Wife as Community Property or Community Property with Right of Survivorship provides a way to establish joint ownership rights and protect their interests. When it comes to this specific type of quitclaim deed in Mesquite, there are a few variations that couples can consider. The first option is a Quitclaim Deed for Individual to Husband and Wife as Community Property, where ownership is established as community property. Community property refers to assets or property acquired during the marriage, which is owned equally by both spouses, unless stated otherwise in an agreement. The second option is a Quitclaim Deed for Individual to Husband and Wife as Community Property with Right of Survivorship. In this case, the couple enjoys joint ownership of the property as community property, but with the added benefit of the right of survivorship. This means that if one spouse were to pass away, ownership of the property automatically transfers to the surviving spouse, bypassing the need for probate. Choosing between these two options depends on the couple's specific needs and circumstances. If they want both spouses to have equal ownership rights in the property and be able to manage it jointly, the Quitclaim Deed for Individual to Husband and Wife as Community Property would be suitable. On the other hand, if the couple wishes to ensure smooth transition of ownership in case of death, the Quitclaim Deed for Individual to Husband and Wife as Community Property with Right of Survivorship would be a wise choice. It is important to note that preparing a quitclaim deed for property transfer requires careful consideration and often necessitates the assistance of a legal professional or a qualified real estate agent. Additionally, couples should ensure compliance with Texas state laws regarding property transfers and consult with an attorney to address any specific questions or concerns. In summary, a Mesquite Texas Quitclaim Deed for Individual to Husband and Wife as Community Property or Community Property with Right of Survivorship is a legal document used to transfer ownership of real estate from an individual to a married couple in Mesquite, Texas. Couples have the option to choose between a Quitclaim Deed for Individual to Husband and Wife as Community Property or Community Property with Right of Survivorship, depending on their desired ownership structure and goals.