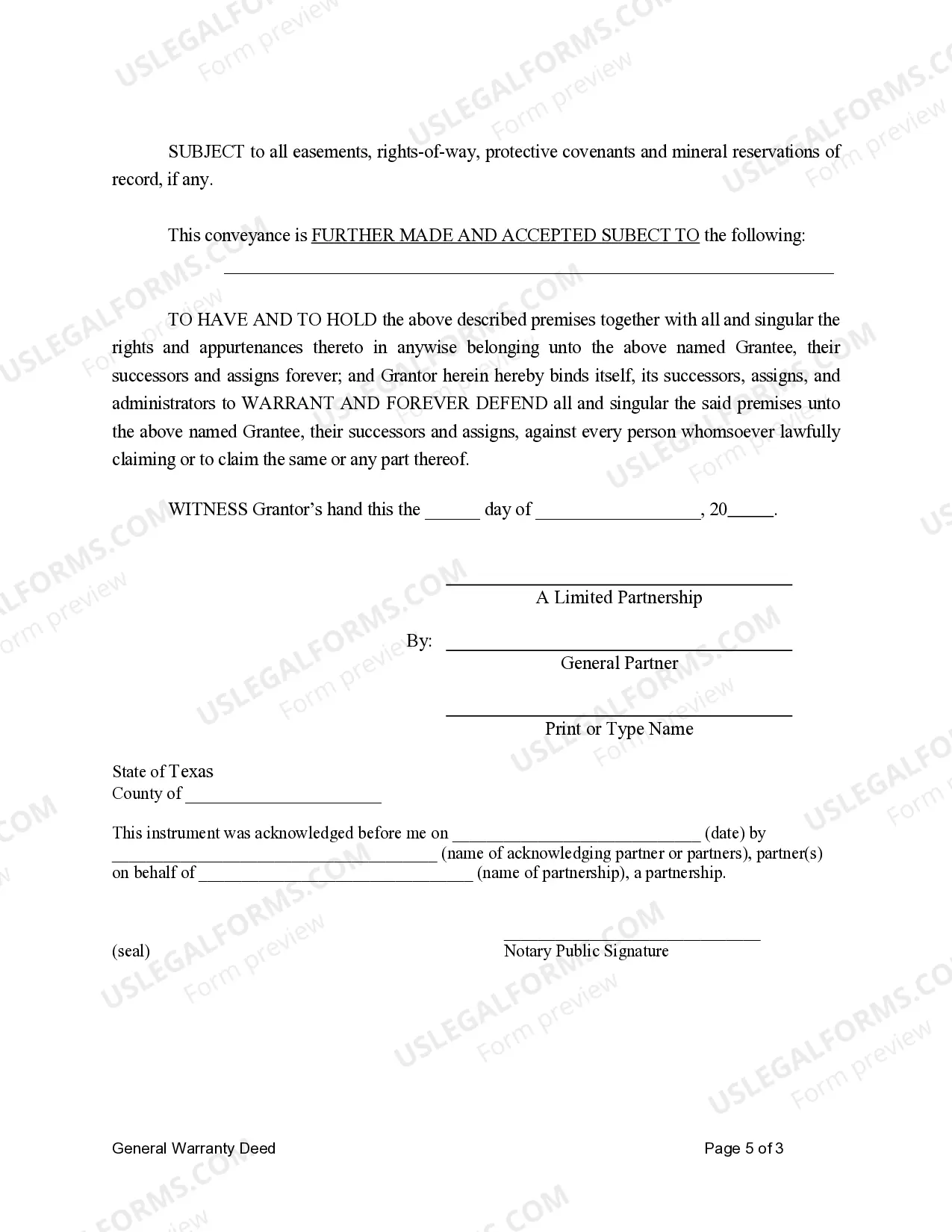

This form is a Warranty Deed where the grantor is a limited partnership and the grantee is a limited partnership.

A warranty deed is a legal document used in the state of Texas to transfer ownership of property from one limited partnership to another limited partnership. This type of deed provides a guarantee that the property is free from any undisclosed encumbrances or claims and that the granter has full authority to transfer the property. In McAllen, Texas, there are different types of warranty deeds for limited partnerships depending on the specific circumstances. 1. General Warranty Deed: This is the most common type of warranty deed used in McAllen, Texas. It provides the highest level of protection for the buyer since it guarantees the property against any title defects, whether they occurred before or during the ownership of the granter. It also assures that the granter will defend any claim to the property's title if necessary. 2. Special Warranty Deed: This type of deed is similar to a general warranty deed but provides a more limited warranty. With a special warranty deed, the granter only guarantees that they have not created or allowed any encumbrances on the property during their ownership. This means that the granter is not responsible for any title defects or claims that may have occurred prior to their ownership. 3. Quitclaim Deed: While not a warranty deed, a quitclaim deed may also be used for limited partnerships in McAllen, Texas. Unlike warranty deeds, a quitclaim deed provides no warranties or guarantees regarding the property's title. It simply transfers the granter's interest in the property to the grantee. This type of deed is often used in situations where the parties involved have an existing relationship or when there is no concern about potential title defects. It is important to consult with a qualified attorney or a real estate professional in McAllen, Texas, to determine the most appropriate type of warranty deed for a limited partnership to limited partnership transaction. They can provide specific guidance based on the unique circumstances and ensure a smooth and legally sound transfer of property ownership.A warranty deed is a legal document used in the state of Texas to transfer ownership of property from one limited partnership to another limited partnership. This type of deed provides a guarantee that the property is free from any undisclosed encumbrances or claims and that the granter has full authority to transfer the property. In McAllen, Texas, there are different types of warranty deeds for limited partnerships depending on the specific circumstances. 1. General Warranty Deed: This is the most common type of warranty deed used in McAllen, Texas. It provides the highest level of protection for the buyer since it guarantees the property against any title defects, whether they occurred before or during the ownership of the granter. It also assures that the granter will defend any claim to the property's title if necessary. 2. Special Warranty Deed: This type of deed is similar to a general warranty deed but provides a more limited warranty. With a special warranty deed, the granter only guarantees that they have not created or allowed any encumbrances on the property during their ownership. This means that the granter is not responsible for any title defects or claims that may have occurred prior to their ownership. 3. Quitclaim Deed: While not a warranty deed, a quitclaim deed may also be used for limited partnerships in McAllen, Texas. Unlike warranty deeds, a quitclaim deed provides no warranties or guarantees regarding the property's title. It simply transfers the granter's interest in the property to the grantee. This type of deed is often used in situations where the parties involved have an existing relationship or when there is no concern about potential title defects. It is important to consult with a qualified attorney or a real estate professional in McAllen, Texas, to determine the most appropriate type of warranty deed for a limited partnership to limited partnership transaction. They can provide specific guidance based on the unique circumstances and ensure a smooth and legally sound transfer of property ownership.