This form is a Quitclaim Deed where the grantors are two individuals and the grantee is one individual.

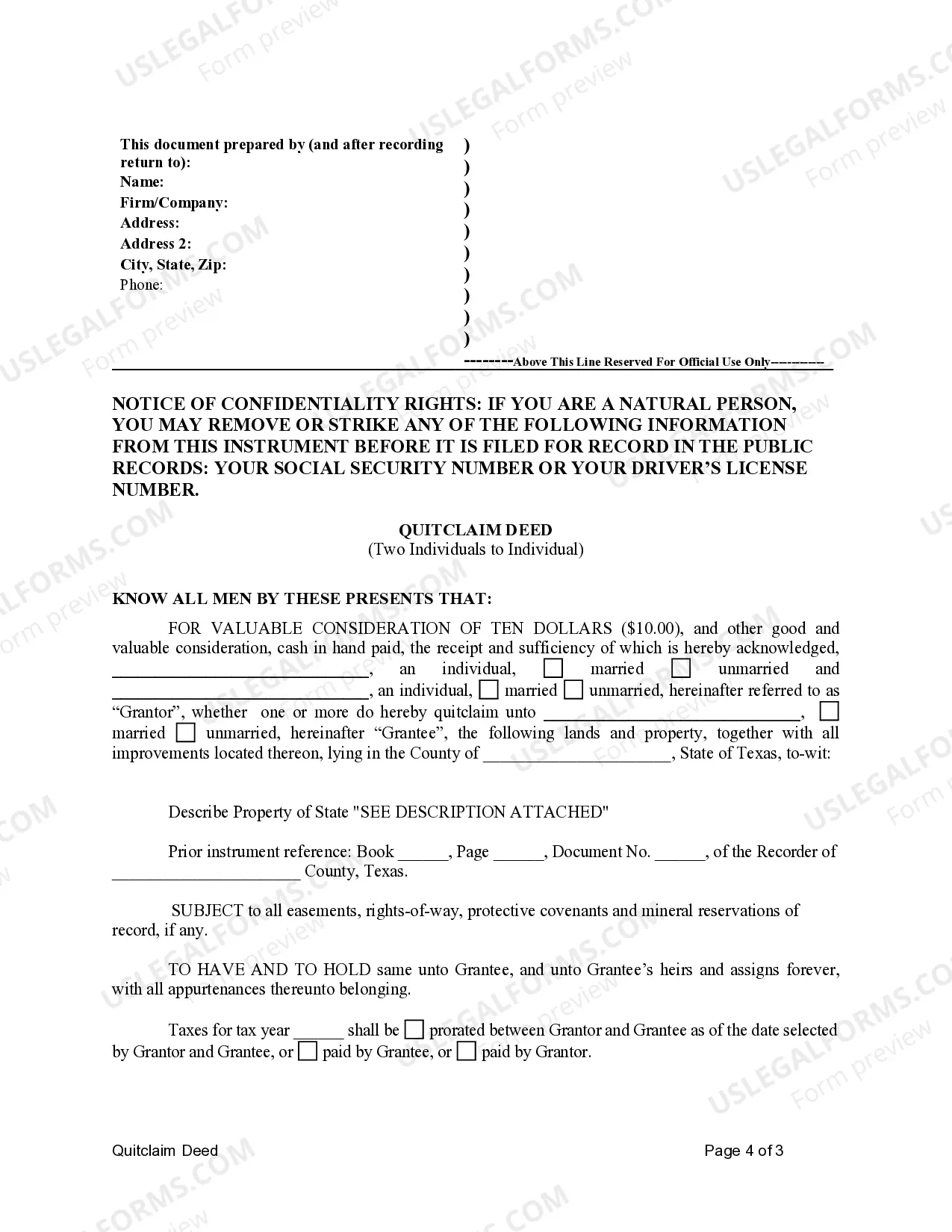

A Houston Texas Quitclaim Deed for Two Individuals to Individual is a legal document used to transfer the ownership of a property between two individuals to one individual. This type of deed is commonly used in real estate transactions, especially when there is a change in ownership or a transfer of property rights, and both parties agree to relinquish any claims to the property. A quitclaim deed offers a simple and straightforward way to transfer property, as it transfers the interest the granter (the individuals) has in the property to the grantee (one individual) without warranties or guarantees of title. It essentially conveys whatever ownership interest the granter has at the time of the transfer. There are generally two types of Houston Texas Quitclaim Deeds for Two Individuals to Individual: 1. Joint Tenancy with Right of Survivorship: This type of deed is commonly used by spouses or co-owners who want to ensure that if one of them passes away, the surviving owner automatically receives their share of the property. It allows seamless transfer of ownership upon death without the need for probate. 2. Tenants in Common: In this type of deed, each party holds a distinct percentage of ownership in the property, which may not necessarily be equal. Each owner has the right to sell, mortgage, or transfer their interest without the consent of the other owner(s). Upon the death of one owner, their interest passes according to their will or through the probate process. When filling out a Houston Texas Quitclaim Deed for Two Individuals to Individual, relevant keywords include the full legal names and addresses of both the granter (individuals) and the grantee (individual), a description of the property being transferred (such as the address and legal description), the consideration (monetary value exchanged or lack thereof), the effective date of the transfer, and the signatures of both the granter(s) and a notary public. It is important to note that a quitclaim deed does not guarantee clear title to the property, and it is advisable to seek legal advice and conduct a thorough title search before completing the transaction to ensure the property is free from any liens or encumbrances.