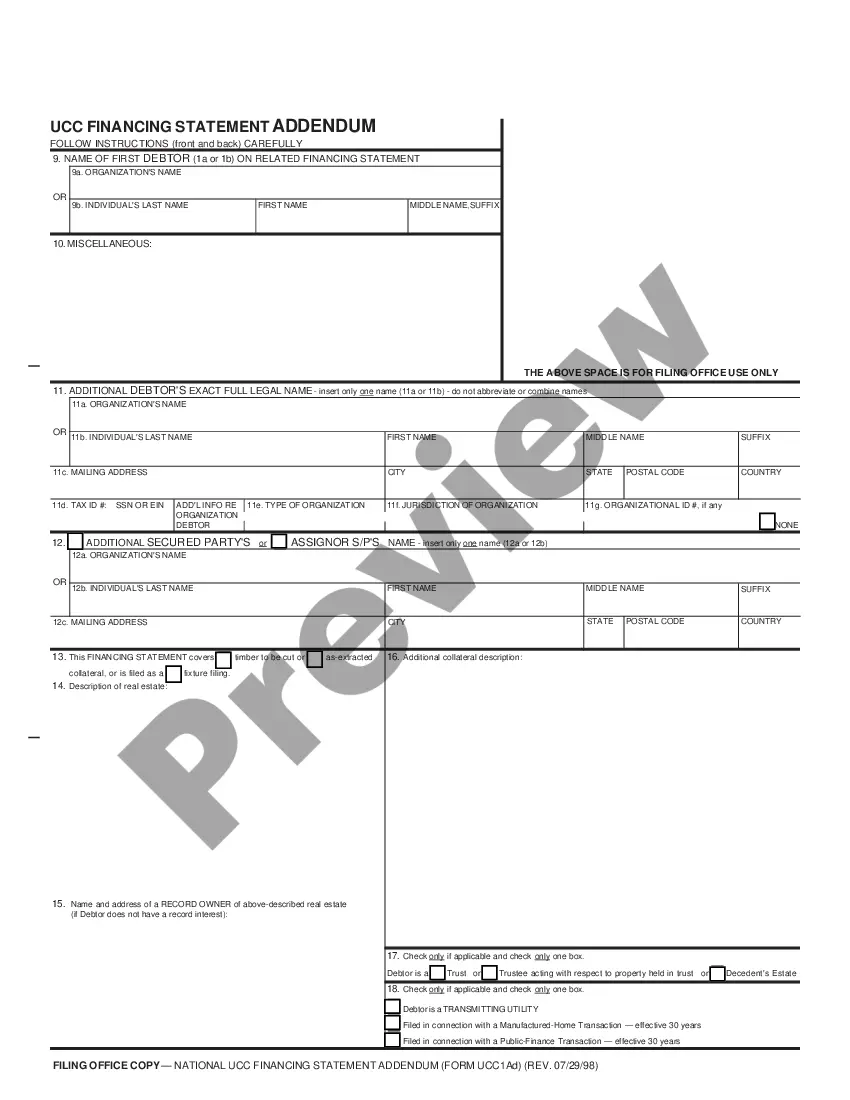

UCC1 - Financing Statement Addendum - Texas - For use after July 1, 2001. This form permits you to add an additional debtor if necessary to cover collateral as specified in the statement.

Dallas Texas UCC1 Financing Statement Addendum

Description

How to fill out Texas UCC1 Financing Statement Addendum?

If you have previously made use of our service, Log In to your account and save the Dallas Texas UCC1 Financing Statement Addendum onto your device by clicking the Download button. Ensure that your subscription is active. If not, renew it as per your billing plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have ongoing access to every document you have purchased: you can find it in your profile under the My documents menu whenever you wish to reuse it. Utilize the US Legal Forms service to effortlessly discover and save any template for your personal or professional requirements!

- Confirm you’ve found the correct document. Review the details and utilize the Preview feature, if available, to verify that it satisfies your requirements. If it doesn't fit, use the Search tab above to find the correct one.

- Purchase the template. Click the Buy Now button and choose either a monthly or annual subscription plan.

- Create an account and process your payment. Use your credit card information or the PayPal option to finalize the transaction.

- Obtain your Dallas Texas UCC1 Financing Statement Addendum. Choose the file format for your document and save it to your device.

- Fill out your template. Print it or use professional online editors to complete and sign it electronically.

Form popularity

FAQ

Filling out the UCC Financing Statement requires careful attention to detail. First, gather necessary information such as the debtor's name and address, the secured party's details, and the collateral description. Then, you can use the US Legal Forms platform, which offers the Dallas Texas UCC1 Financing Statement Addendum template to streamline the process. This tool ensures you complete the form accurately, efficiently, and confidently, helping you secure your financial interests.

A UCC fixture filing must also be submitted to the Secretary of State in Texas. Similar to the UCC-1 statement, you can file this document in person, by mail, or online. It is crucial to ensure that you provide accurate information about the fixtures involved to avoid complications. The USLegalForms platform offers resources that help you navigate the filing process for your Dallas Texas UCC1 Financing Statement Addendum.

To file a UCC financing statement amendment, you will need to complete a specific form designated for amendments. You can submit this amendment form to the same office where you filed your original UCC-1 statement. The amendment must be properly signed and dated. Using the USLegalForms platform can simplify this process by providing templates and guidance tailored to Dallas Texas UCC1 Financing Statement Addendum.

You need to file your UCC-1 statement with the Secretary of State in Texas. This is the official office that maintains records for financing statements. You can file in person, by mail, or online, depending on your preference. For added convenience, consider using the USLegalForms platform, which can help streamline your filing process.

To properly file a Dallas Texas UCC1 Financing Statement Addendum, certain details are essential. You need to include the names of the debtor and secured party, a description of the collateral, and comply with state-specific guidelines. It's important to ensure the accuracy of this information to prevent complications, and platforms like uslegalforms can assist you in navigating these requirements effectively.

The primary purpose of a Dallas Texas UCC1 Financing Statement Addendum is to publicly disclose a secured party's claim to collateral. This filing establishes a legal record that can protect creditors' rights and clarify the nature of the agreement. In doing so, it enhances transparency in transactions, benefiting all parties involved.

A Dallas Texas UCC1 Financing Statement Addendum can be beneficial for both creditors and debtors. For creditors, it secures their interest in collateral, reducing risk and providing legal backing. For debtors, a well-filed UCC can facilitate easier access to credit, as it proves the legitimacy of secured interests.

A Dallas Texas UCC1 Financing Statement Addendum serves to provide additional details about the original UCC filing. This addendum can clarify specific aspects of the collateral involved in a secured transaction. By using this addendum, you effectively ensure that the financing statement fully captures all necessary information, which can help protect your interests.

The UCC requirements include correctly filling out the financing statement, providing accurate debtor information, and specifying the collateral involved. It is essential to follow state-specific guidelines, as each jurisdiction may have unique rules. The Dallas Texas UCC1 Financing Statement Addendum must adhere to Texas laws to be legally effective. Using platforms like uslegalforms can simplify this process by providing templates and guidance tailored to ensure compliance with UCC requirements.

A UCC Financing Statement Amendment is used to make changes to an existing UCC-1 filing. This could involve updating the debtor's information, changing the collateral description, or adding more secured parties. It is important to file a Dallas Texas UCC1 Financing Statement Addendum when making these changes, as it ensures that the public record reflects accurate and current information. This process protects the creditor's rights and maintains clarity in secured transactions.