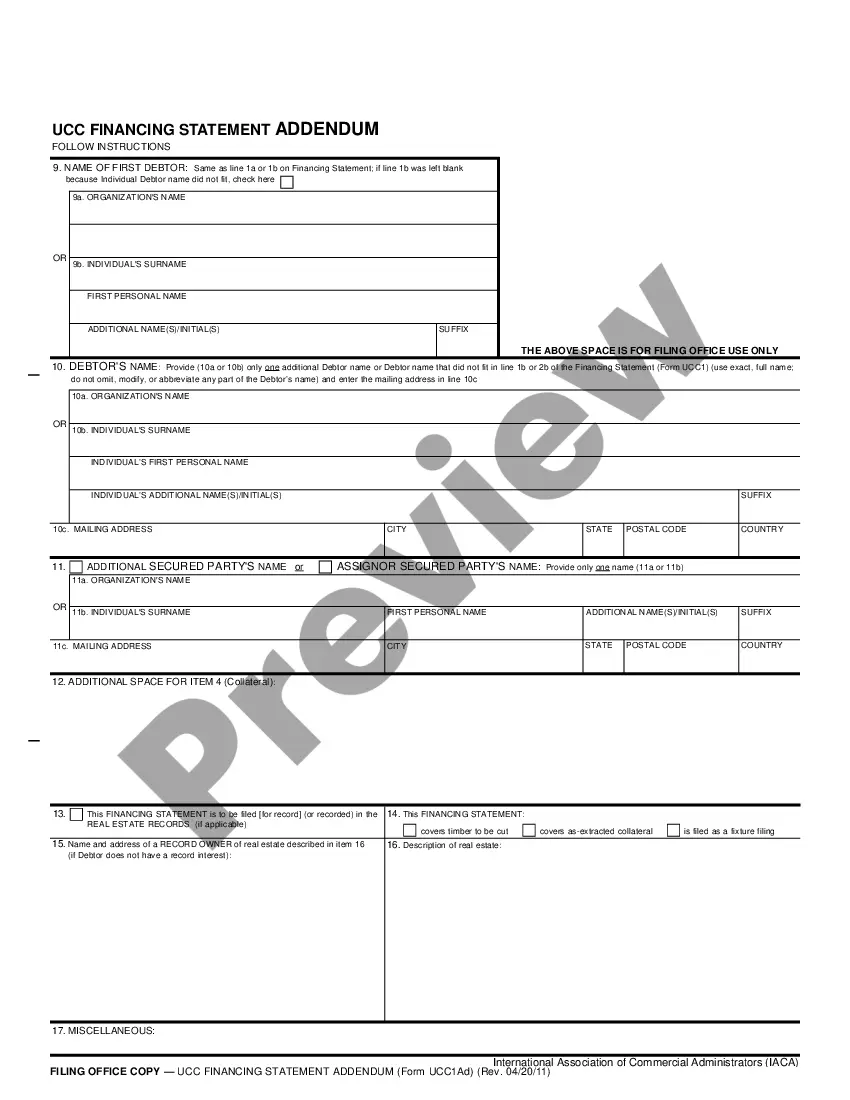

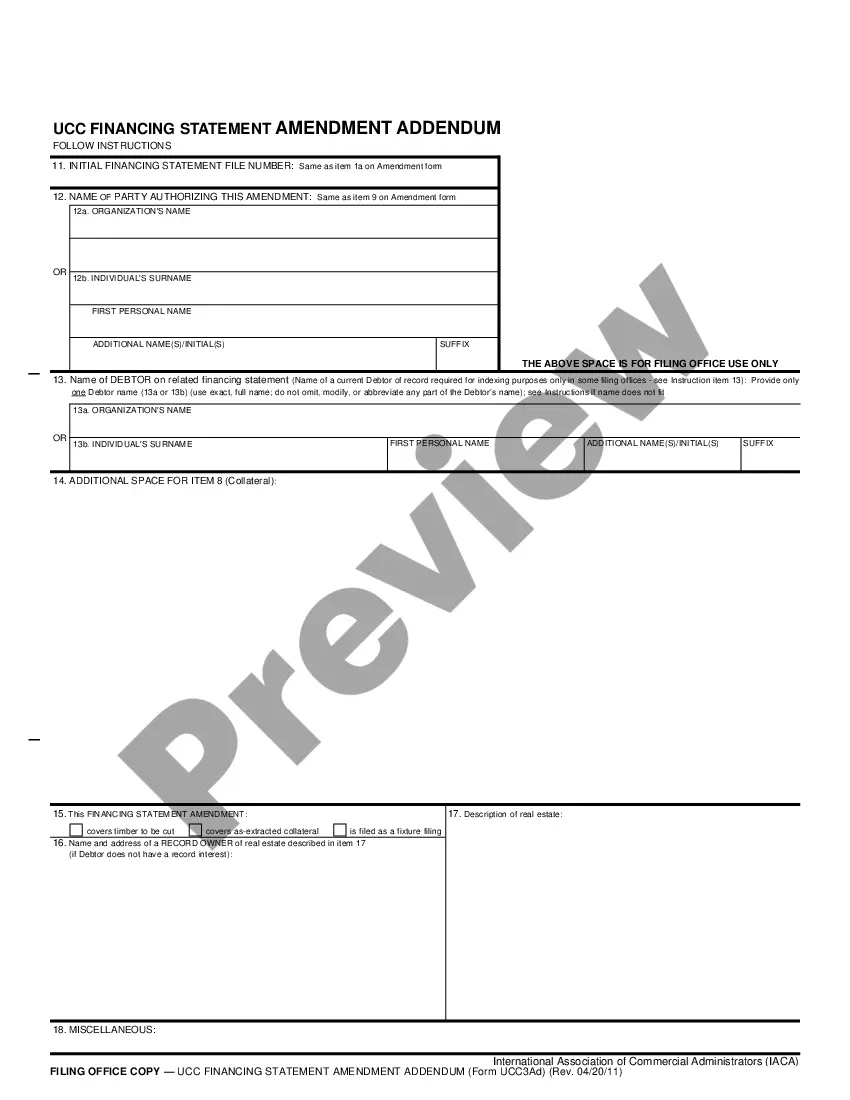

This Uniform Commercial Code form, a UCC1-AD - Financing Statement - Texas, is for use in the documentation of personal property as collateral for a loan, and related matters.

Mesquite Texas UCC1-AD - Financing Statement

Description

How to fill out Texas UCC1-AD - Financing Statement?

Regardless of your social or professional standing, completing legal documents is a regrettable requirement in the current landscape. Frequently, it’s nearly unfeasible for an individual without a legal background to develop such documentation from scratch, primarily due to the intricate language and legal subtleties involved.

This is where US Legal Forms comes in to assist. Our platform provides an extensive collection of over 85,000 state-specific forms that are suitable for nearly every legal situation. US Legal Forms also acts as a valuable resource for associates or legal advisors looking to conserve time utilizing our DIY forms.

Irrespective of whether you need the Mesquite Texas UCC1-AD - Financing Statement or any other document applicable to your state or region, US Legal Forms has everything readily available. Here’s how to obtain the Mesquite Texas UCC1-AD - Financing Statement within minutes using our reliable service. If you're already a subscriber, feel free to Log In to your account to download the required form.

You're all set! Now you can either print the form or fill it out online. Should you encounter any issues in locating your purchased forms, you can easily find them in the My documents tab.

Whatever issue you are trying to resolve, US Legal Forms has you covered. Give it a try today and experience it for yourself.

- Confirm that the form you have selected is appropriate for your location since the laws of one state or region do not apply to another.

- Examine the form and review any brief outline (if available) of situations in which the document can be utilized.

- If the form you chose does not fulfill your needs, you can start anew and search for the desired form.

- Click on Buy now and select the subscription option that suits you best.

- Log In using your account details or create a new account from scratch.

- Choose your payment method and proceed to download the Mesquite Texas UCC1-AD - Financing Statement once the payment has been finalized.

Form popularity

FAQ

A Texas UCC statement is a document that serves as notice of a secured transaction, outlining the creditor's claim to a debtor’s personal assets. This statement is critical in establishing a legal priority for creditors in the event of a bankruptcy or dispute. Utilizing tools like US Legal Forms can help you easily prepare and file your Mesquite Texas UCC1-AD - Financing Statement to secure your interests effectively.

1 financing statement is filed with the Secretary of State's office in the state where the debtor is located. For Mesquite Texas UCC1AD Financing Statement, you would file with the Texas Secretary of State. This filing process makes your secured interest known to the public, providing transparency in commercial transactions.

To get a copy of a UCC filing, you can access your state’s Secretary of State website or office, which typically maintains a registry of such documents. You may also consider using online services like US Legal Forms, which can simplify the process of retrieving Mesquite Texas UCC1-AD - Financing Statement documents. Ensure you have the necessary information, such as the debtor's name and the filing number, to facilitate your search.

A UCC financing statement in Texas is a legal document that a creditor files to publicly declare a secured interest in a debtor's personal property. This document is part of the Uniform Commercial Code, which provides a consistent framework for securing transactions. The Mesquite Texas UCC1-AD - Financing Statement serves to protect the creditor's rights by ensuring that their claim is recorded and can be accessed by potential lenders or buyers.

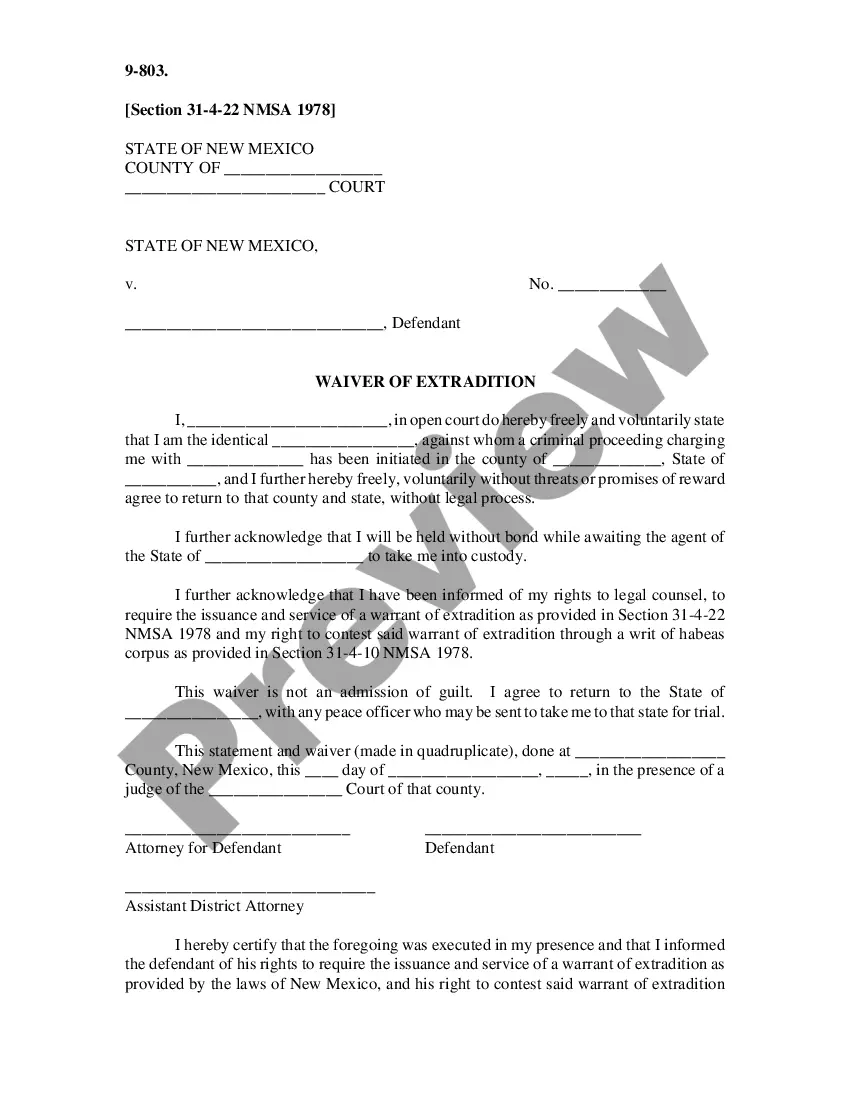

The IRS may file a UCC as part of their efforts to secure tax liabilities against a taxpayer's property. This filing serves to protect the government's interests in unpaid taxes and is documented through the Mesquite Texas UCC1-AD - Financing Statement. If you find yourself in this situation, it is crucial to consult with a tax professional or a legal expert. Platforms like uslegalforms can also assist you in navigating the complexities of UCC filings.

The purpose of filing a UCC financing statement is to publicly declare a creditor's claim to a debtor's assets. This helps protect the lender's rights regarding the secured collateral, and it is part of the Mesquite Texas UCC1-AD - Financing Statement framework. By filing this statement, creditors can inform other parties about their interest in the assets, which is essential for enforcing their rights. For more details on the filing process, check out uslegalforms.

If you received a UCC statement, it indicates that a party has filed to establish a security interest in your property. This process is tied to the Mesquite Texas UCC1-AD - Financing Statement, which is a legal requirement in the business world. Understanding the reason behind this filing can help you determine your next steps. For further clarification, consider exploring resources available on uslegalforms.

Receiving a UCC financing statement means that a lender has registered a claim against your assets as collateral. This is part of the Mesquite Texas UCC1-AD - Financing Statement process to legally document this interest. It is important to review the details of the statement to ascertain the nature of the claim. If you have questions or need assistance, uslegalforms can provide the resources you need to clarify your situation.

A UCC filing can be viewed in both positive and negative lights depending on the circumstances. If you are the borrower, a Mesquite Texas UCC1-AD - Financing Statement shows that a lender has a secured interest in your assets, which can aid in obtaining financing. However, if someone files a UCC against your property, it may indicate outstanding debts. It's important to evaluate your situation to understand the implications.

You may have received a Texas UCC statement request form because someone is attempting to secure their interest in your property or assets. This form relates to the Mesquite Texas UCC1-AD - Financing Statement, which notifies you of a claim against your property. Understanding this request is essential to protect your rights and respond appropriately. If you need guidance, consider using a platform like uslegalforms to learn more about your options.