UCC3 - Financing Statement Amendment - Texas - For use after July 1, 2001. This amendment is to be filed in the real estate records. This Financing Statement complies with all applicable state statutes.

Bexar Texas UCC3 Financing Statement Amendment

Description

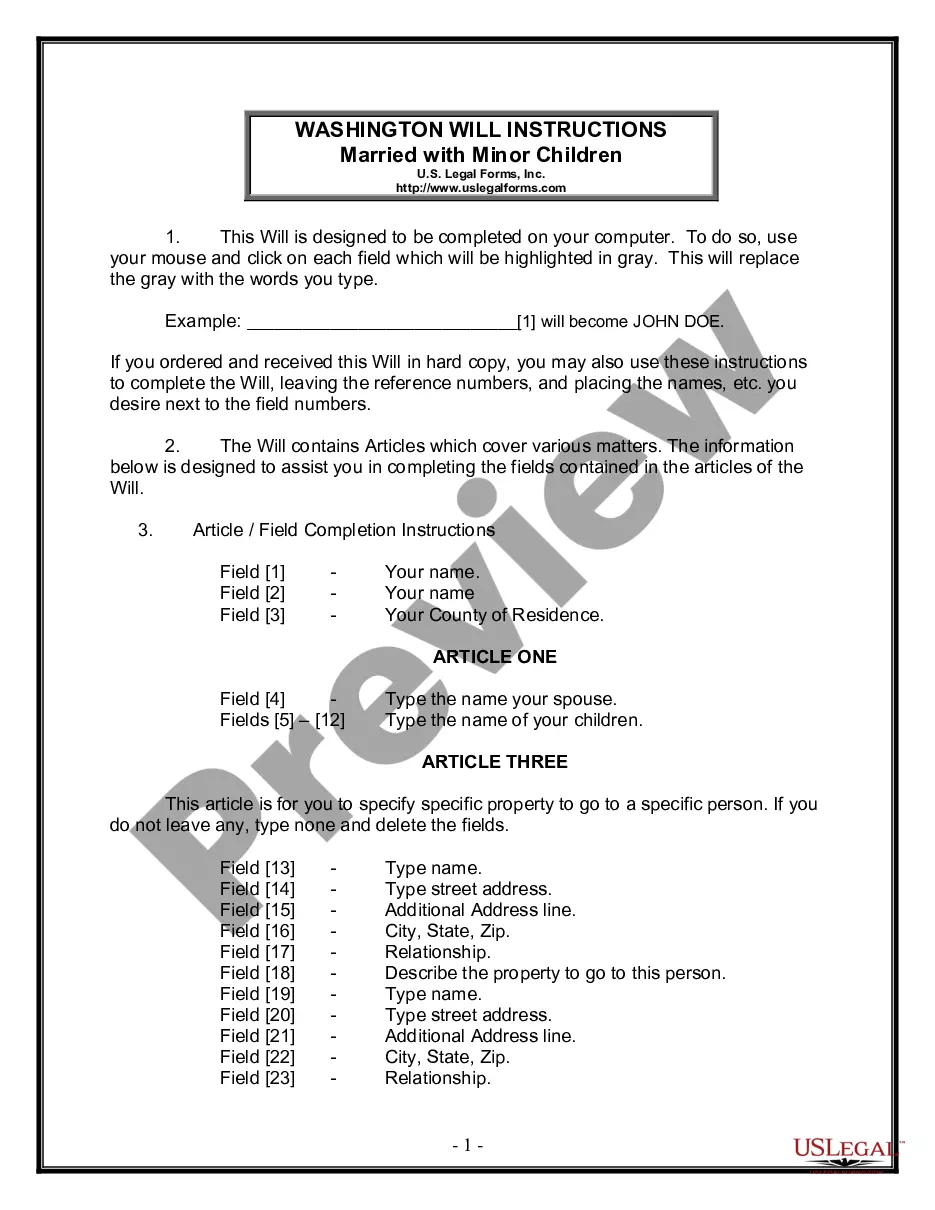

How to fill out Texas UCC3 Financing Statement Amendment?

If you are looking for an appropriate form, it's very challenging to select a more suitable platform than the US Legal Forms website – likely the most extensive collections available online.

With this collection, you can access thousands of document samples for both organizational and personal use by types and regions, or keywords.

Thanks to the superior search feature, locating the most current Bexar Texas UCC3 Financing Statement Amendment is as simple as 1-2-3.

Obtain the document. Choose the file format and save it to your device.

Make modifications. Fill out, edit, print, and sign the obtained Bexar Texas UCC3 Financing Statement Amendment.

- If you are already acquainted with our system and possess a registered account, all you need to do to obtain the Bexar Texas UCC3 Financing Statement Amendment is to Log In to your account and select the Download option.

- If you are using US Legal Forms for the first time, just adhere to the guidelines below.

- Ensure you have selected the form you require. Check its description and utilize the Preview feature (if available) to review its content. If it does not meet your requirements, use the Search option at the top of the screen to find the correct document.

- Confirm your choice. Click the Buy now button. Afterward, select your preferred pricing plan and provide the information to register for an account.

- Complete the payment. Use your credit card or PayPal account to finish the registration process.

Form popularity

FAQ

To file a UCC financing statement amendment in Bexar, Texas, you will use the same filing office where you submitted the original statement. This procedure ensures that all changes are officially documented. It's important to follow the proper steps to prevent any interruptions in your secured transactions. Uslegalforms can guide you through this process, making it easier to navigate the requirements.

In Bexar, Texas, UCC financing statements are typically filed with the Texas Secretary of State's office. You can also file them at the county level, depending on the type of collateral. Using the right filing location ensures proper public notice for your financing statement. For your convenience, uslegalforms offers user-friendly resources to assist you with the filing process.

If a financing statement is seriously misleading, it can hinder the effectiveness of your security interest. In Bexar, Texas, a UCC3 Financing Statement Amendment is crucial for correcting any errors that may mislead potential creditors. This situation can lead to legal disputes and financial losses. Therefore, addressing any misleading information promptly is essential to protect your interests.

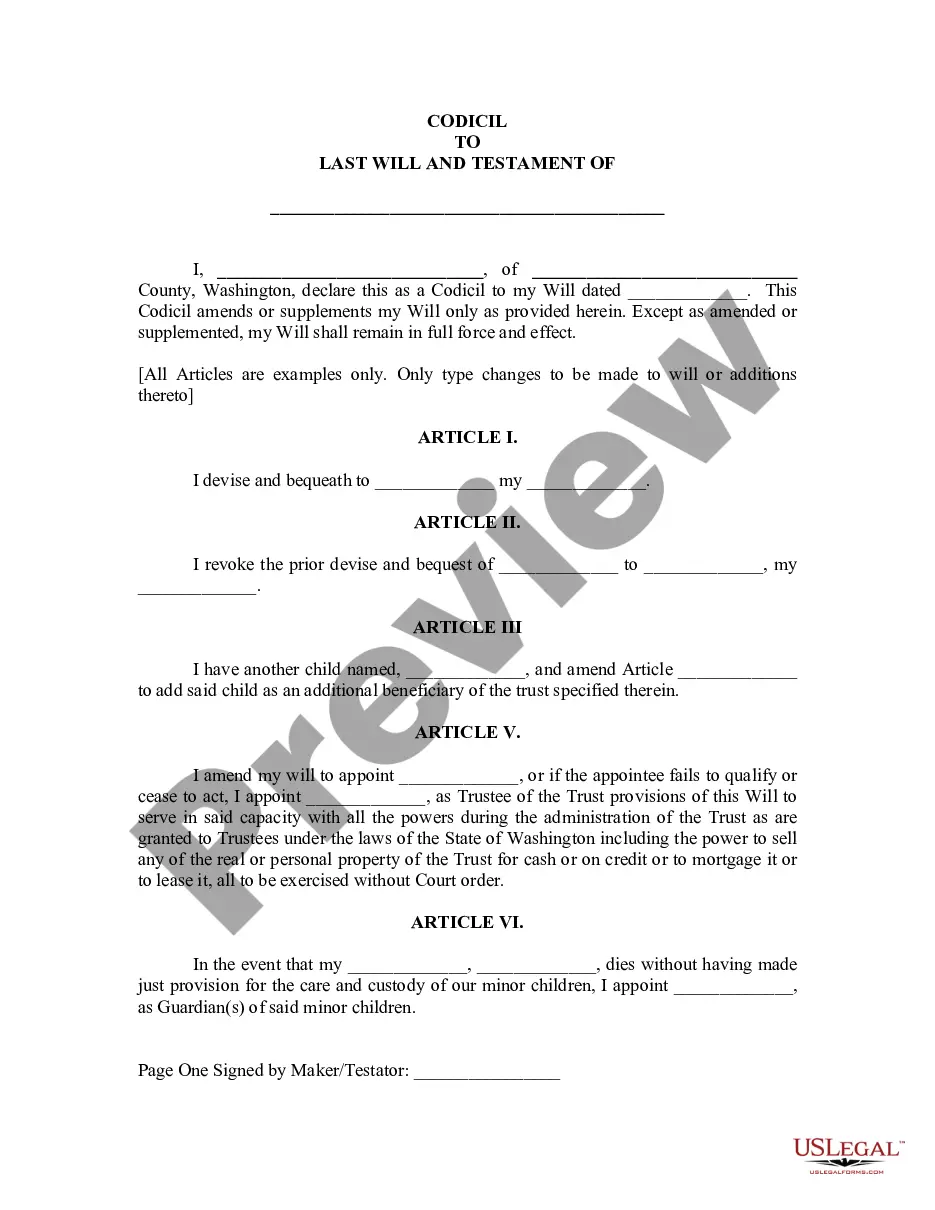

UCC-3 stands for the Uniform Commercial Code Financing Statement Amendment form. This form is crucial for making changes to an existing UCC-1 financing statement, which establishes a lender's security interest in a debtor's assets. If you are dealing with a Bexar Texas UCC3 Financing Statement Amendment, using the right form ensures your amendments are properly recorded. Understanding this process helps protect your interests when securing loans or credit.

3 amendment is a document that modifies an existing UCC1 financing statement. It is used to change information regarding the debtor, the secured party, or the property involved. When you need to make changes for a Bexar Texas UCC3 Financing Statement Amendment, utilizing resources like uslegalforms can help ensure you fill out the amendment correctly and efficiently.

UCC-3 refers to the specific form used for amending existing UCC filings. This form allows parties to update, extend, or terminate security interests in collateral. If you’re considering a Bexar Texas UCC3 Financing Statement Amendment, it’s vital to know that this form ensures your records reflect the current status of your security interests.

Filing a UCC statement helps to establish a legal claim on collateral in the event of a debtor’s default. This security interest can protect lenders and creditors when providing loans or credit. Understanding the importance of a Bexar Texas UCC3 Financing Statement Amendment is crucial for anyone involved in securing interests in commercial transactions.

To file a UCC financing statement amendment in Bexar Texas, you need to complete the UCC-3 form accurately and provide the necessary details. You can file it online through a state-approved platform or submit it by mail to the office that handles UCC filings. Using a service like uslegalforms can simplify this process, providing you with the right forms and guidance.

The UCC-3 amendment is a legal form used to make changes to an existing UCC financing statement. This amendment allows you to modify details such as debtor information, the secured party, or collateral. If you're dealing with Bexar Texas UCC3 Financing Statement Amendment, you should ensure that changes are accurately recorded to maintain compliance and clarity.

You may receive a UCC financing statement as part of a lender's process to secure their interests in your assets. This notice is designed to inform you about the financial agreements tied to your property. If you are unclear about the implications, consider reviewing the document thoroughly or consulting resources available through uslegalforms to understand your options, including filing a Bexar Texas UCC3 Financing Statement Amendment.