The Will you have found is for a single person with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions.

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

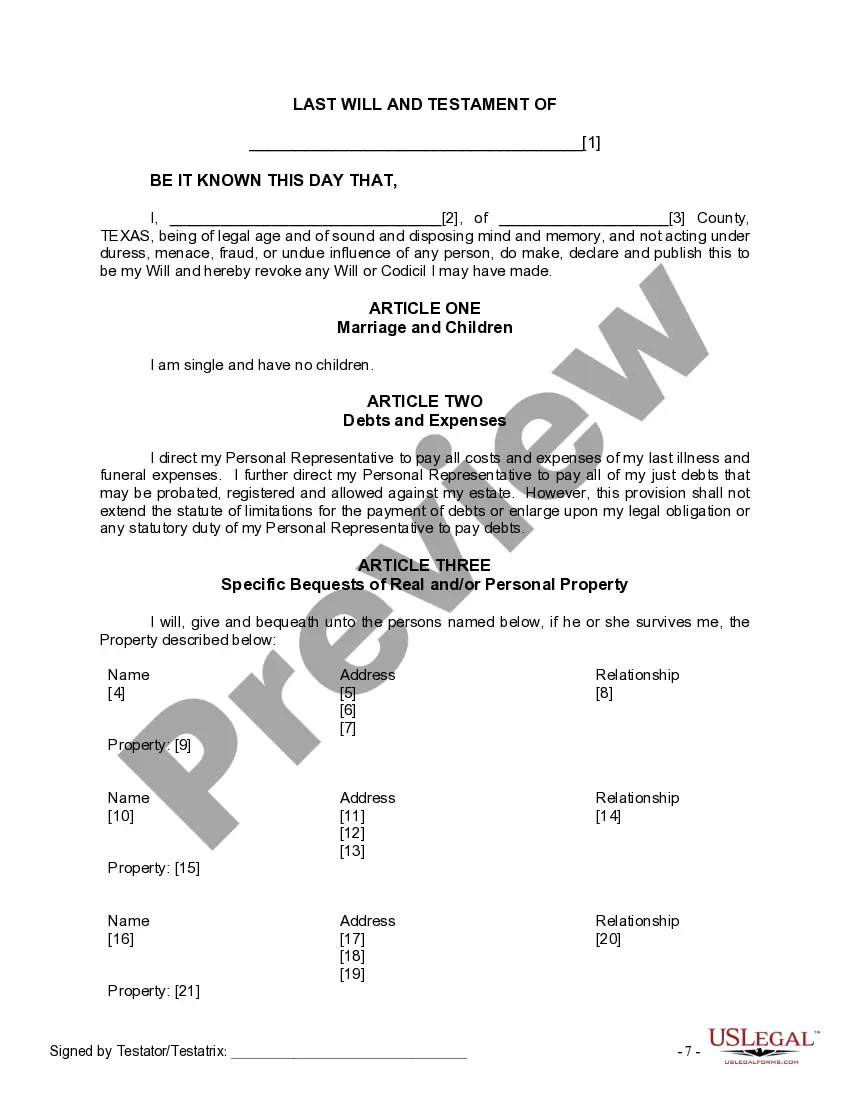

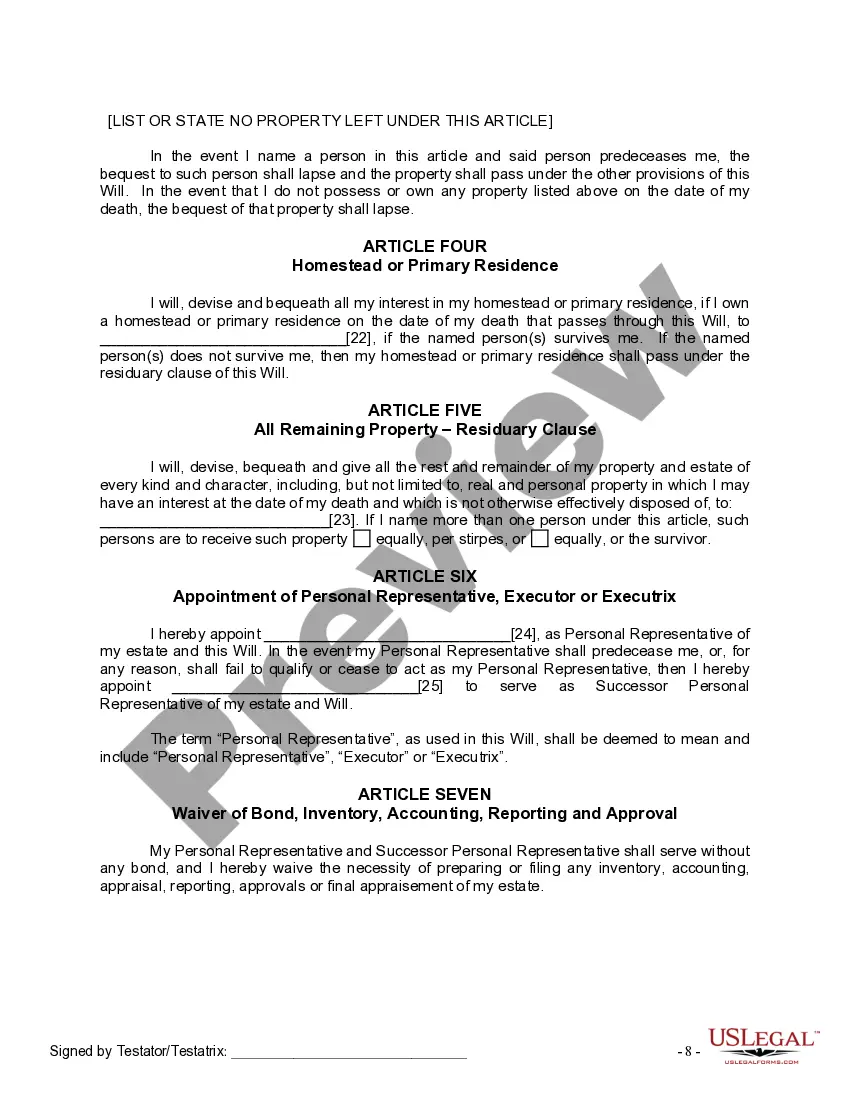

The Pasadena Texas Legal Last Will and Testament Form for a Single Person with No Children is a legal document that allows an individual to outline their final wishes and distribute their assets after their passing. It serves as an essential tool to ensure that one's estate is handled according to their desires and minimizes potential disputes or confusion among family members. This specific will form is designed for individuals residing in Pasadena, Texas, who are single and do not have any children. By using this document, an individual can express their preferences regarding the distribution of their property, including real estate, personal belongings, financial assets, and more. The Pasadena Texas Legal Last Will and Testament Form for Single Person with No Children covers various key elements, such as: 1. Executor/Personal Representative: This document allows the individual (referred to as the "Testator") to appoint a trusted person to serve as the executor or personal representative of the estate. This person will be responsible for managing the estate's affairs, including paying debts, filing taxes, and distributing assets per the instructions within the will. 2. Beneficiaries: The Testator can specify who will inherit their assets upon their death. In the absence of children, the form allows the Testator to name other family members, friends, or charitable organizations as beneficiaries. 3. Specific Bequests and General Distribution: The individual can make specific gifts of particular items or assets to specific individuals in the will. Additionally, they can outline how the remaining assets should be distributed, such as equally among beneficiaries or in percentages. 4. Alternate Beneficiaries: In case a named beneficiary predeceases the Testator, this form allows the Testator to designate alternate beneficiaries to inherit the assets. 5. Debts and Funeral Instructions: The Testator can outline arrangements and instructions concerning their funeral, burial, or cremation preferences. Additionally, they can address any outstanding debts owed by the estate, ensuring they are appropriately handled. It's important to note that while this description covers the general elements, there might be variations or additional clauses within different types of Pasadena Texas Legal Last Will and Testament Forms for Single Persons with No Children. These variations could depend on specific circumstances, such as complex asset distribution, business ownership, unique requests, or charitable intentions. It is advisable to consult with an attorney or legal professional to ensure that the will aligns with individual needs and complies with all relevant laws and regulations.The Pasadena Texas Legal Last Will and Testament Form for a Single Person with No Children is a legal document that allows an individual to outline their final wishes and distribute their assets after their passing. It serves as an essential tool to ensure that one's estate is handled according to their desires and minimizes potential disputes or confusion among family members. This specific will form is designed for individuals residing in Pasadena, Texas, who are single and do not have any children. By using this document, an individual can express their preferences regarding the distribution of their property, including real estate, personal belongings, financial assets, and more. The Pasadena Texas Legal Last Will and Testament Form for Single Person with No Children covers various key elements, such as: 1. Executor/Personal Representative: This document allows the individual (referred to as the "Testator") to appoint a trusted person to serve as the executor or personal representative of the estate. This person will be responsible for managing the estate's affairs, including paying debts, filing taxes, and distributing assets per the instructions within the will. 2. Beneficiaries: The Testator can specify who will inherit their assets upon their death. In the absence of children, the form allows the Testator to name other family members, friends, or charitable organizations as beneficiaries. 3. Specific Bequests and General Distribution: The individual can make specific gifts of particular items or assets to specific individuals in the will. Additionally, they can outline how the remaining assets should be distributed, such as equally among beneficiaries or in percentages. 4. Alternate Beneficiaries: In case a named beneficiary predeceases the Testator, this form allows the Testator to designate alternate beneficiaries to inherit the assets. 5. Debts and Funeral Instructions: The Testator can outline arrangements and instructions concerning their funeral, burial, or cremation preferences. Additionally, they can address any outstanding debts owed by the estate, ensuring they are appropriately handled. It's important to note that while this description covers the general elements, there might be variations or additional clauses within different types of Pasadena Texas Legal Last Will and Testament Forms for Single Persons with No Children. These variations could depend on specific circumstances, such as complex asset distribution, business ownership, unique requests, or charitable intentions. It is advisable to consult with an attorney or legal professional to ensure that the will aligns with individual needs and complies with all relevant laws and regulations.