The Will you have found is for a single person with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions.

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

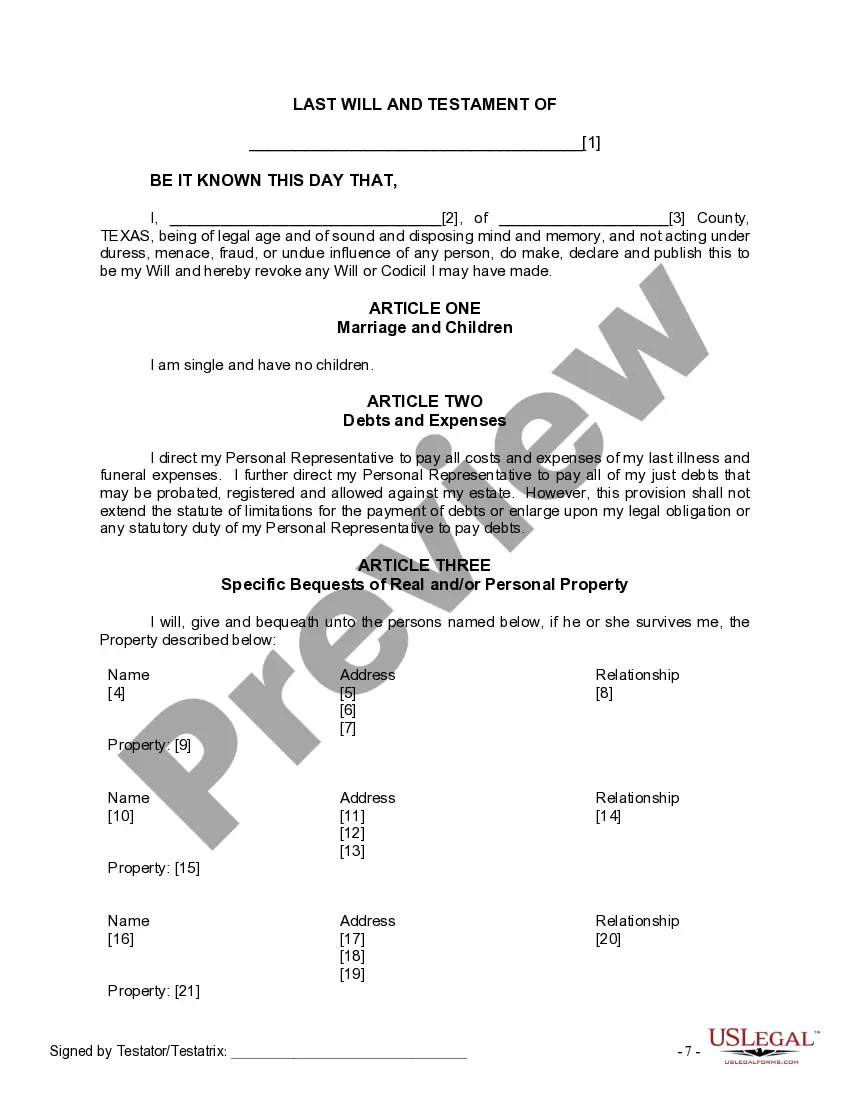

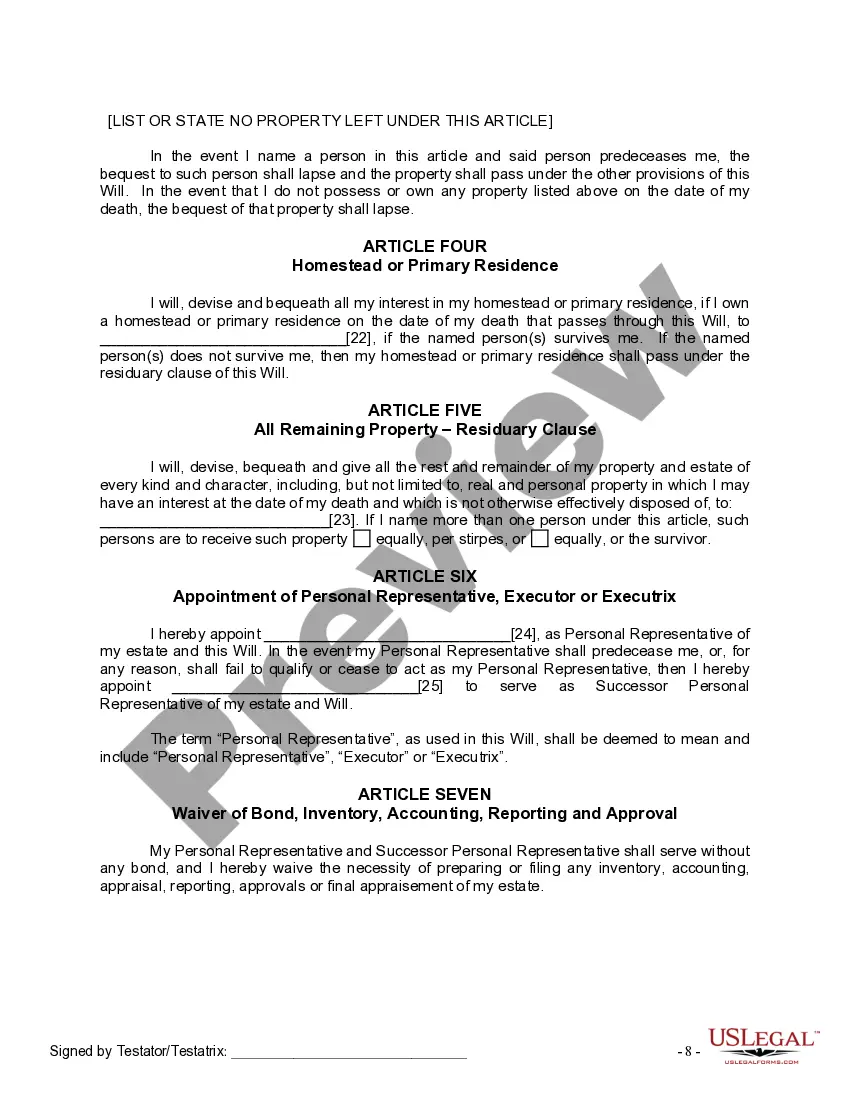

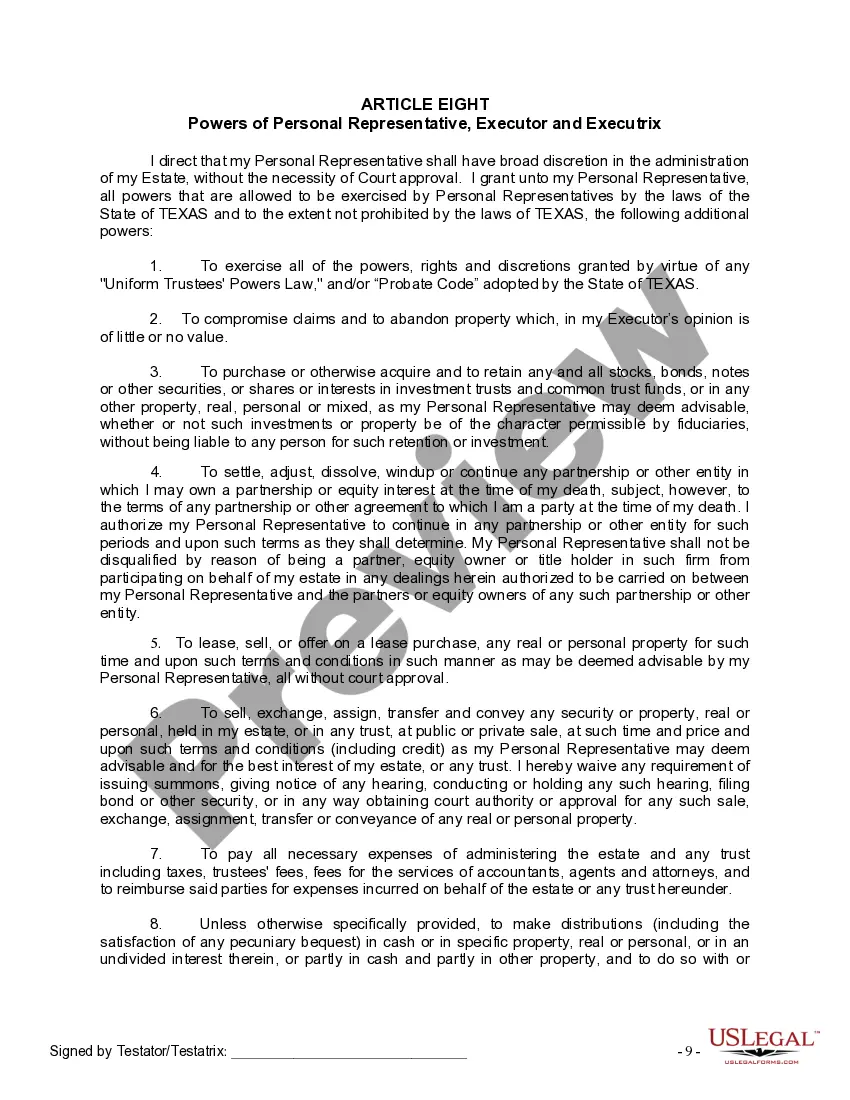

The Plano Texas Legal Last Will and Testament Form for Single Person with No Children is a legally binding document that allows individuals who are not married and do not have any children to specify their final wishes regarding the distribution of their assets and the appointment of an executor to carry out those wishes. This form is specifically designed for single individuals without children, as their estate planning needs may differ from those who are married or have children. It is important to note that if a person does have children, they should use a different Last Will and Testament form that caters to their circumstances. The Plano Texas Legal Last Will and Testament Form for Single Person with No Children typically includes the following key elements: 1. Declaration: This section identifies the document as the last will and testament of the individual and states their full legal name, address, and other identifying details. 2. Appointment of Executor: The form allows the individual to appoint an executor who will be responsible for managing and distributing their assets according to the will's instructions. It is vital to choose someone trustworthy and capable of fulfilling this important role. 3. Distribution of Assets: This section outlines how the individual's assets should be distributed after their death. It enumerates specific bequests to family members, friends, or charitable organizations, along with details of any conditions or restrictions they wish to impose. 4. Residuary Estate: The residuary estate consists of any remaining assets that were not specifically bequeathed. The individual can designate how these assets should be divided among beneficiaries or specify alternative arrangements. 5. Alternate Beneficiaries: It is prudent to name alternate beneficiaries who will inherit the assets if the primary beneficiaries predecease the testator (the person making the will) or are unable to inherit according to the will's instructions. 6. Powers of the Executor: This section grants the executor certain powers and authorities to carry out the instructions of the will, including paying debts, selling or managing property, and completing any necessary legal or financial transactions. 7. Witnesses and Signatures: The will must be signed by the testator in the presence of at least two witnesses who are not beneficiaries under the will. The witnesses must also sign the document to confirm its authenticity. Different variations of the Plano Texas Legal Last Will and Testament Form may exist depending on specific requirements or preferences. However, the key distinction is between individuals with and without children. It is crucial to select the appropriate form to ensure that the will accurately reflects the testator's intentions and complies with Texas state laws.The Plano Texas Legal Last Will and Testament Form for Single Person with No Children is a legally binding document that allows individuals who are not married and do not have any children to specify their final wishes regarding the distribution of their assets and the appointment of an executor to carry out those wishes. This form is specifically designed for single individuals without children, as their estate planning needs may differ from those who are married or have children. It is important to note that if a person does have children, they should use a different Last Will and Testament form that caters to their circumstances. The Plano Texas Legal Last Will and Testament Form for Single Person with No Children typically includes the following key elements: 1. Declaration: This section identifies the document as the last will and testament of the individual and states their full legal name, address, and other identifying details. 2. Appointment of Executor: The form allows the individual to appoint an executor who will be responsible for managing and distributing their assets according to the will's instructions. It is vital to choose someone trustworthy and capable of fulfilling this important role. 3. Distribution of Assets: This section outlines how the individual's assets should be distributed after their death. It enumerates specific bequests to family members, friends, or charitable organizations, along with details of any conditions or restrictions they wish to impose. 4. Residuary Estate: The residuary estate consists of any remaining assets that were not specifically bequeathed. The individual can designate how these assets should be divided among beneficiaries or specify alternative arrangements. 5. Alternate Beneficiaries: It is prudent to name alternate beneficiaries who will inherit the assets if the primary beneficiaries predecease the testator (the person making the will) or are unable to inherit according to the will's instructions. 6. Powers of the Executor: This section grants the executor certain powers and authorities to carry out the instructions of the will, including paying debts, selling or managing property, and completing any necessary legal or financial transactions. 7. Witnesses and Signatures: The will must be signed by the testator in the presence of at least two witnesses who are not beneficiaries under the will. The witnesses must also sign the document to confirm its authenticity. Different variations of the Plano Texas Legal Last Will and Testament Form may exist depending on specific requirements or preferences. However, the key distinction is between individuals with and without children. It is crucial to select the appropriate form to ensure that the will accurately reflects the testator's intentions and complies with Texas state laws.