The Will you have found is for a single person with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions.

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

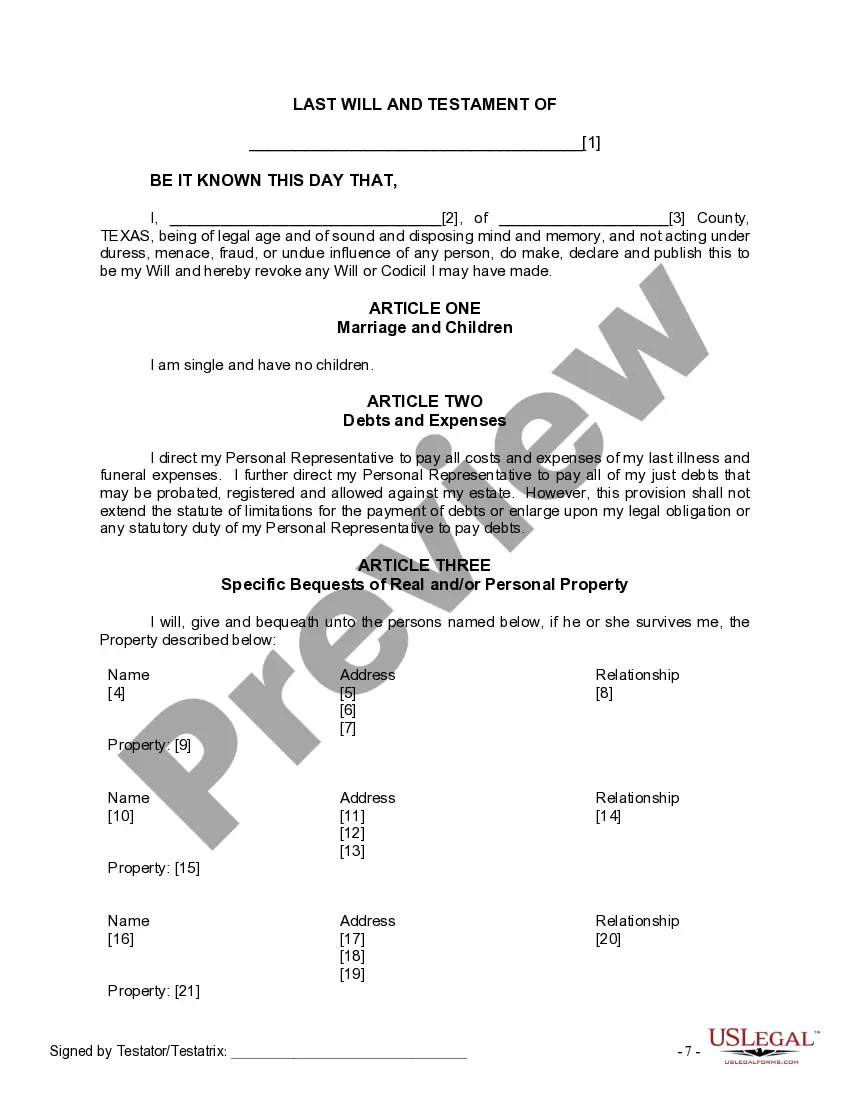

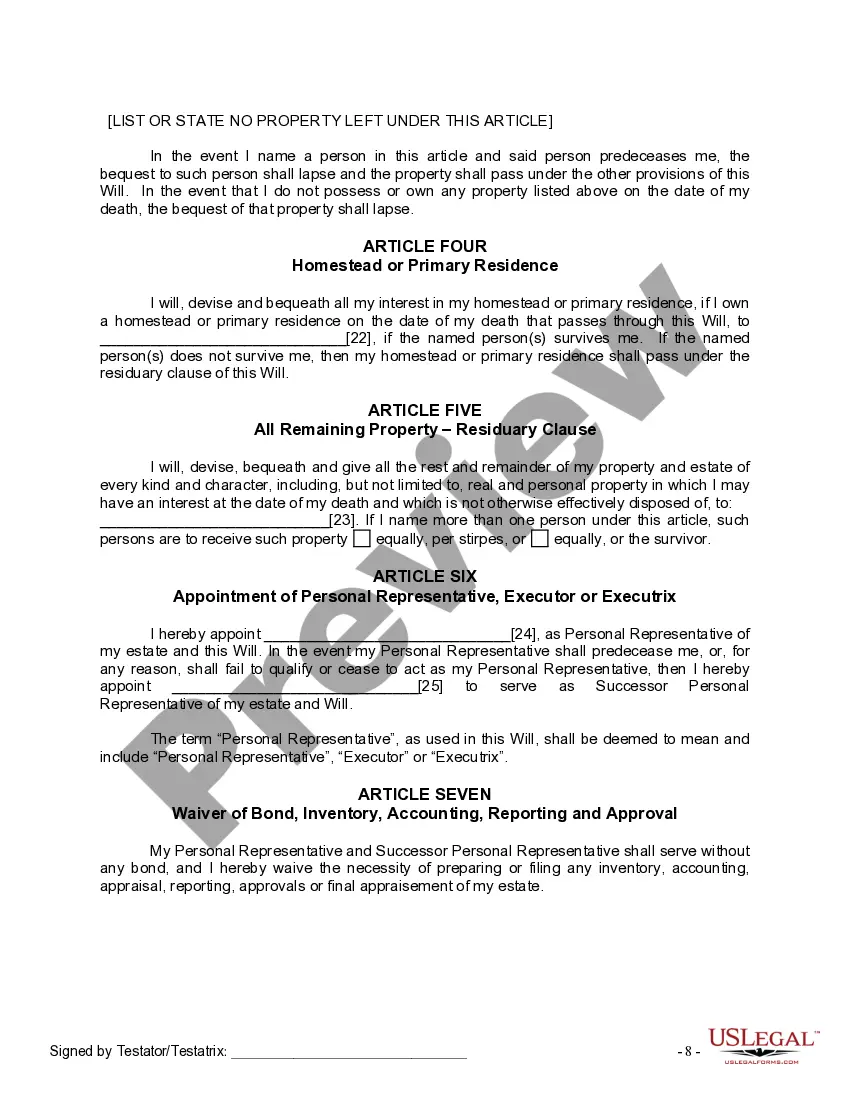

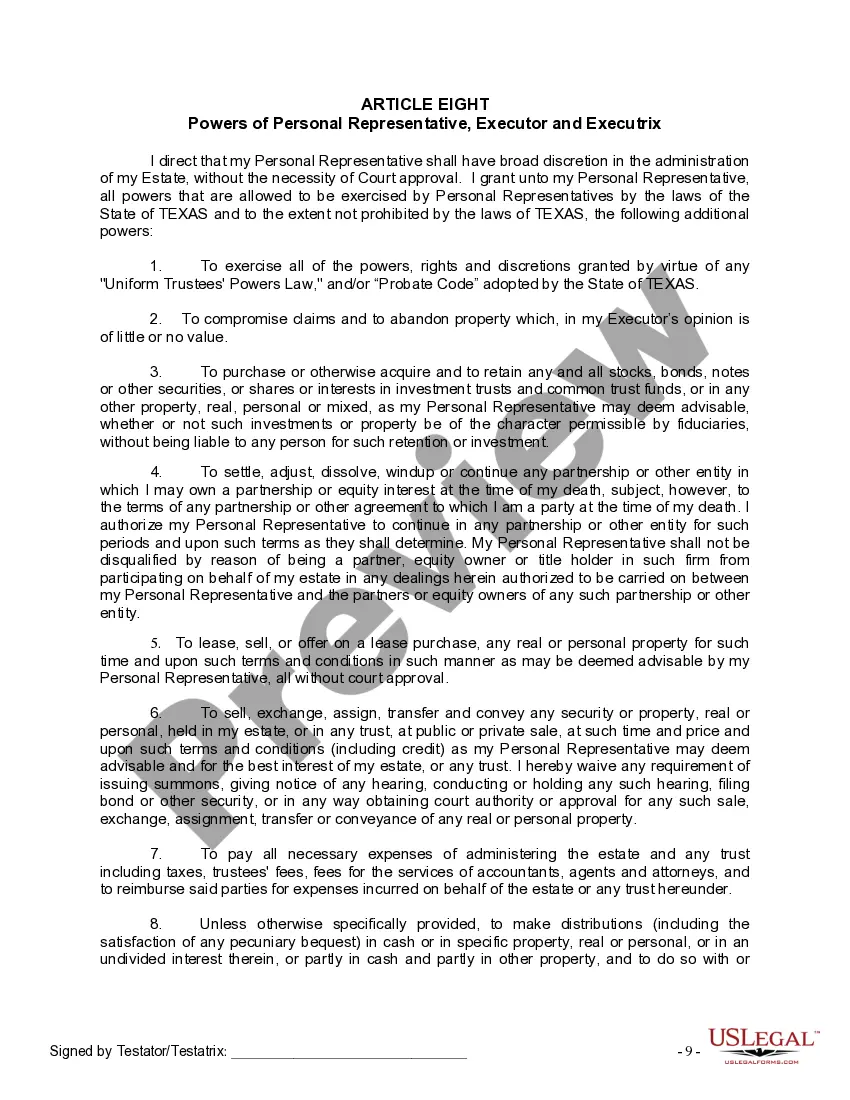

San Angelo Texas Legal Last Will and Testament Form for Single Person with No Children is a legal document that enables individuals in San Angelo, Texas to specify how their assets and estate will be distributed after their demise. This legally binding document ensures that your final wishes are carried out and helps prevent any disputes amongst family members or loved ones. The San Angelo Texas Legal Last Will and Testament Form for Single Person with No Children typically includes the following sections: 1. Personal Information: This section requires your full name, address, and contact details. 2. Appointment of Executor: Here, you can appoint an executor who will be responsible for managing your estate and ensuring your wishes are fulfilled. It is important to choose someone trustworthy and capable of handling legal and financial matters. 3. Distribution of Assets: In this section, you can itemize and allocate your assets such as real estate, bank accounts, investments, personal belongings, etc. You can specify how you want each asset to be distributed and to whom. 4. Naming Beneficiaries: Here, you can designate individuals or charitable organizations that will inherit specific assets or a percentage of your estate. If you have no children, you may choose to leave your assets to other family members, friends, or even favorite causes. 5. Guardianship: If you have any dependents such as minor children or pets, you can name a guardian who will be responsible for their care and well-being in the event of your passing. 6. Digital Assets: In today's digital age, it is important to address digital assets such as online accounts, social media profiles, and cryptocurrencies. You can provide instructions on how these should be handled or transferred to a trusted individual. 7. Disinheritance Clause: If you want to exclude certain individuals from inheriting any of your assets, you can include a clause to clearly state your intentions. 8. Alternate Beneficiaries: It is advisable to name alternate beneficiaries in case your primary beneficiaries pass away before you or are unable to inherit your estate. Some variations of San Angelo Texas Legal Last Will and Testament Forms for Single Person with No Children may include additional sections such as specific funeral arrangements, creation of trusts, or appointment of guardians for incapacitation scenarios. It is crucial to consult with a legal professional or an estate planning attorney to ensure that your Last Will and Testament complies with the laws of Texas and accurately reflects your wishes. They can also guide you on any special considerations or specific requirements in San Angelo, Texas.San Angelo Texas Legal Last Will and Testament Form for Single Person with No Children is a legal document that enables individuals in San Angelo, Texas to specify how their assets and estate will be distributed after their demise. This legally binding document ensures that your final wishes are carried out and helps prevent any disputes amongst family members or loved ones. The San Angelo Texas Legal Last Will and Testament Form for Single Person with No Children typically includes the following sections: 1. Personal Information: This section requires your full name, address, and contact details. 2. Appointment of Executor: Here, you can appoint an executor who will be responsible for managing your estate and ensuring your wishes are fulfilled. It is important to choose someone trustworthy and capable of handling legal and financial matters. 3. Distribution of Assets: In this section, you can itemize and allocate your assets such as real estate, bank accounts, investments, personal belongings, etc. You can specify how you want each asset to be distributed and to whom. 4. Naming Beneficiaries: Here, you can designate individuals or charitable organizations that will inherit specific assets or a percentage of your estate. If you have no children, you may choose to leave your assets to other family members, friends, or even favorite causes. 5. Guardianship: If you have any dependents such as minor children or pets, you can name a guardian who will be responsible for their care and well-being in the event of your passing. 6. Digital Assets: In today's digital age, it is important to address digital assets such as online accounts, social media profiles, and cryptocurrencies. You can provide instructions on how these should be handled or transferred to a trusted individual. 7. Disinheritance Clause: If you want to exclude certain individuals from inheriting any of your assets, you can include a clause to clearly state your intentions. 8. Alternate Beneficiaries: It is advisable to name alternate beneficiaries in case your primary beneficiaries pass away before you or are unable to inherit your estate. Some variations of San Angelo Texas Legal Last Will and Testament Forms for Single Person with No Children may include additional sections such as specific funeral arrangements, creation of trusts, or appointment of guardians for incapacitation scenarios. It is crucial to consult with a legal professional or an estate planning attorney to ensure that your Last Will and Testament complies with the laws of Texas and accurately reflects your wishes. They can also guide you on any special considerations or specific requirements in San Angelo, Texas.