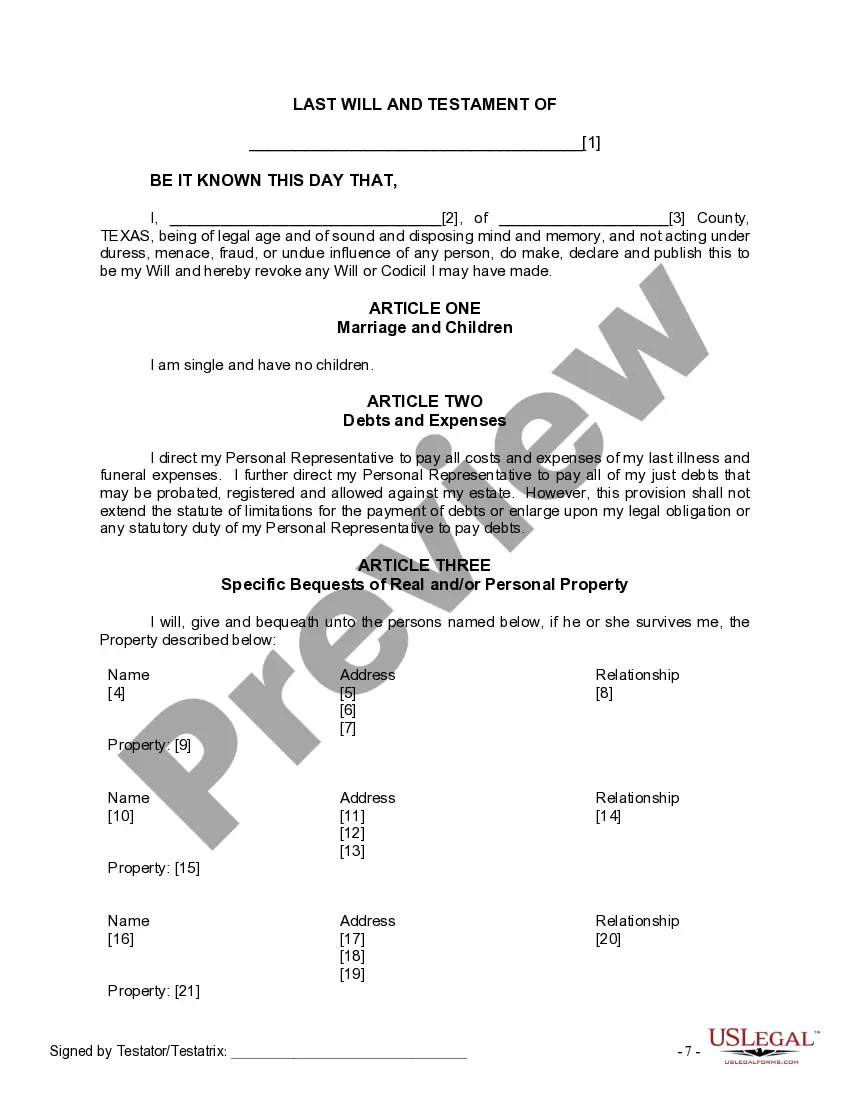

The Will you have found is for a single person with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions.

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

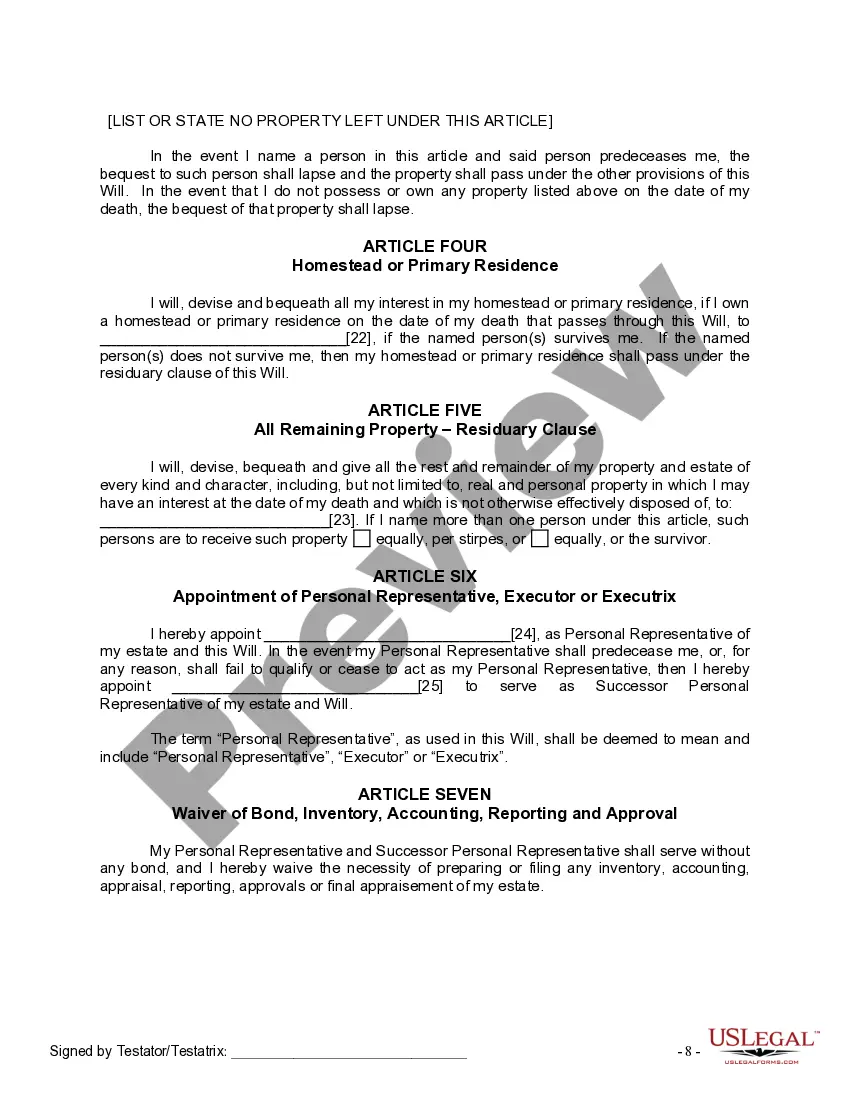

A Sugar Land Texas Legal Last Will and Testament Form for Single Person with No Children is a legal document that allows individuals in Sugar Land, Texas, who are single and have no children to outline their wishes regarding the distribution of their assets and the appointment of an executor after their passing. This form specifically caters to those who do not have a spouse or dependents. The Sugar Land Texas Legal Last Will and Testament Form for Single Person with No Children is designed to ensure that the individual's wishes are honored and their estate is distributed according to their preferences. It serves as a crucial tool for estate planning and can provide peace of mind knowing that one's assets will be handled correctly. Key elements of this form include: 1. Naming an executor: The individual can appoint a trusted person or entity as their executor, who will be responsible for managing and distributing their estate as per their wishes. 2. Asset distribution: The form provides a platform to specify how the individual wants their assets, such as property, finances, investments, and personal belongings, to be distributed among beneficiaries or charitable organizations. 3. Debts and liabilities: The form enables the individual to outline instructions regarding the payment of any outstanding debts or taxes from their estate's assets. 4. Alternative provisions: In case the primary beneficiaries predecease the individual or are unable to receive the assets for any reason, this form allows for the designation of alternative beneficiaries. Different variations or types of Sugar Land Texas Legal Last Will and Testament Forms for Single Person with No Children may exist based on their specific formatting or customization options, but the core purpose remains the same. It is always recommended consulting with a legal professional or attorney while creating a last will and testament to ensure its legality and validity. By utilizing the appropriate Sugar Land Texas Legal Last Will and Testament Form for Single Person with No Children, individuals can protect their assets, guarantee their intentions are met, provide for loved ones or charitable causes, and establish a clear plan for the distribution of their estate after their passing.A Sugar Land Texas Legal Last Will and Testament Form for Single Person with No Children is a legal document that allows individuals in Sugar Land, Texas, who are single and have no children to outline their wishes regarding the distribution of their assets and the appointment of an executor after their passing. This form specifically caters to those who do not have a spouse or dependents. The Sugar Land Texas Legal Last Will and Testament Form for Single Person with No Children is designed to ensure that the individual's wishes are honored and their estate is distributed according to their preferences. It serves as a crucial tool for estate planning and can provide peace of mind knowing that one's assets will be handled correctly. Key elements of this form include: 1. Naming an executor: The individual can appoint a trusted person or entity as their executor, who will be responsible for managing and distributing their estate as per their wishes. 2. Asset distribution: The form provides a platform to specify how the individual wants their assets, such as property, finances, investments, and personal belongings, to be distributed among beneficiaries or charitable organizations. 3. Debts and liabilities: The form enables the individual to outline instructions regarding the payment of any outstanding debts or taxes from their estate's assets. 4. Alternative provisions: In case the primary beneficiaries predecease the individual or are unable to receive the assets for any reason, this form allows for the designation of alternative beneficiaries. Different variations or types of Sugar Land Texas Legal Last Will and Testament Forms for Single Person with No Children may exist based on their specific formatting or customization options, but the core purpose remains the same. It is always recommended consulting with a legal professional or attorney while creating a last will and testament to ensure its legality and validity. By utilizing the appropriate Sugar Land Texas Legal Last Will and Testament Form for Single Person with No Children, individuals can protect their assets, guarantee their intentions are met, provide for loved ones or charitable causes, and establish a clear plan for the distribution of their estate after their passing.