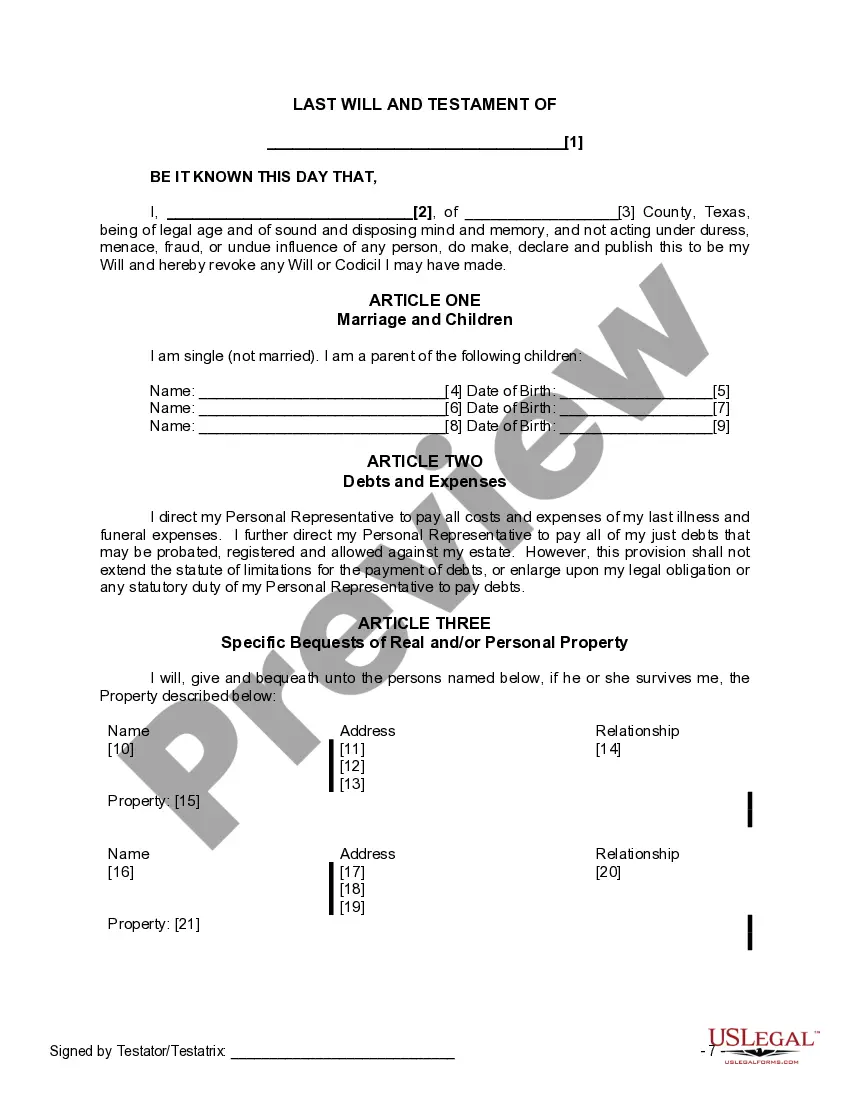

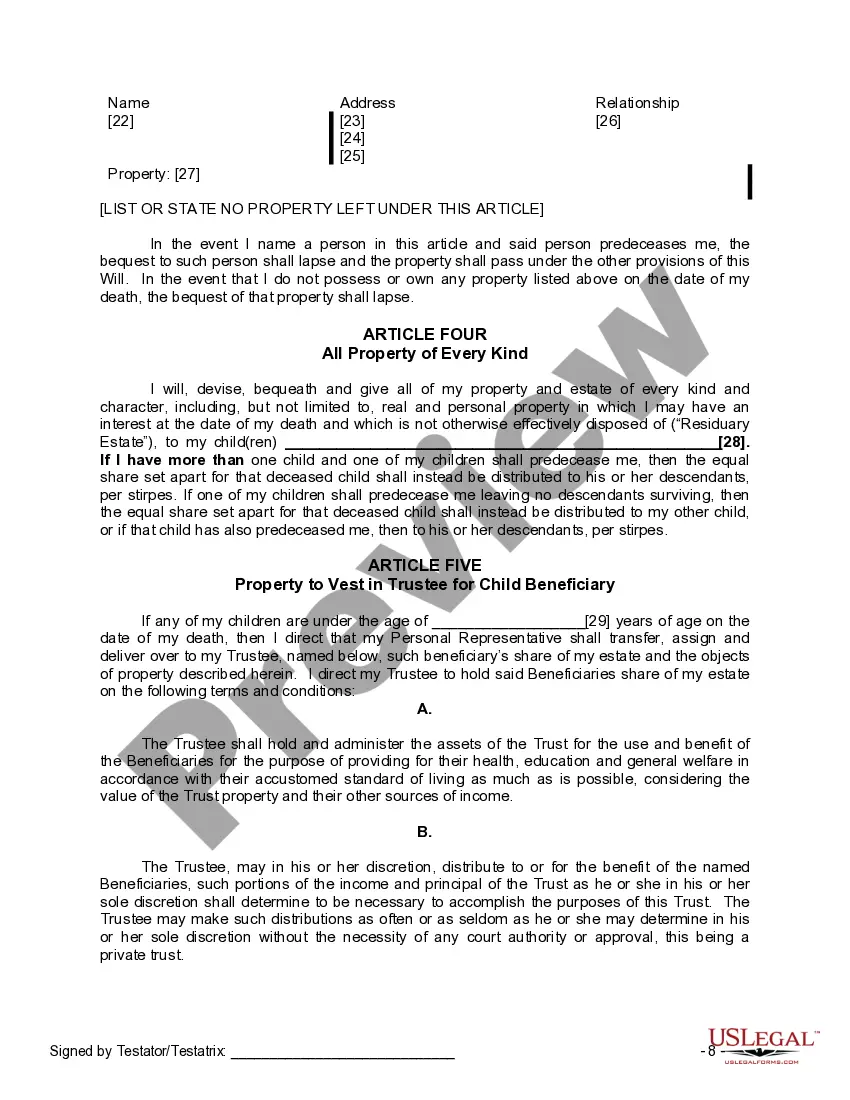

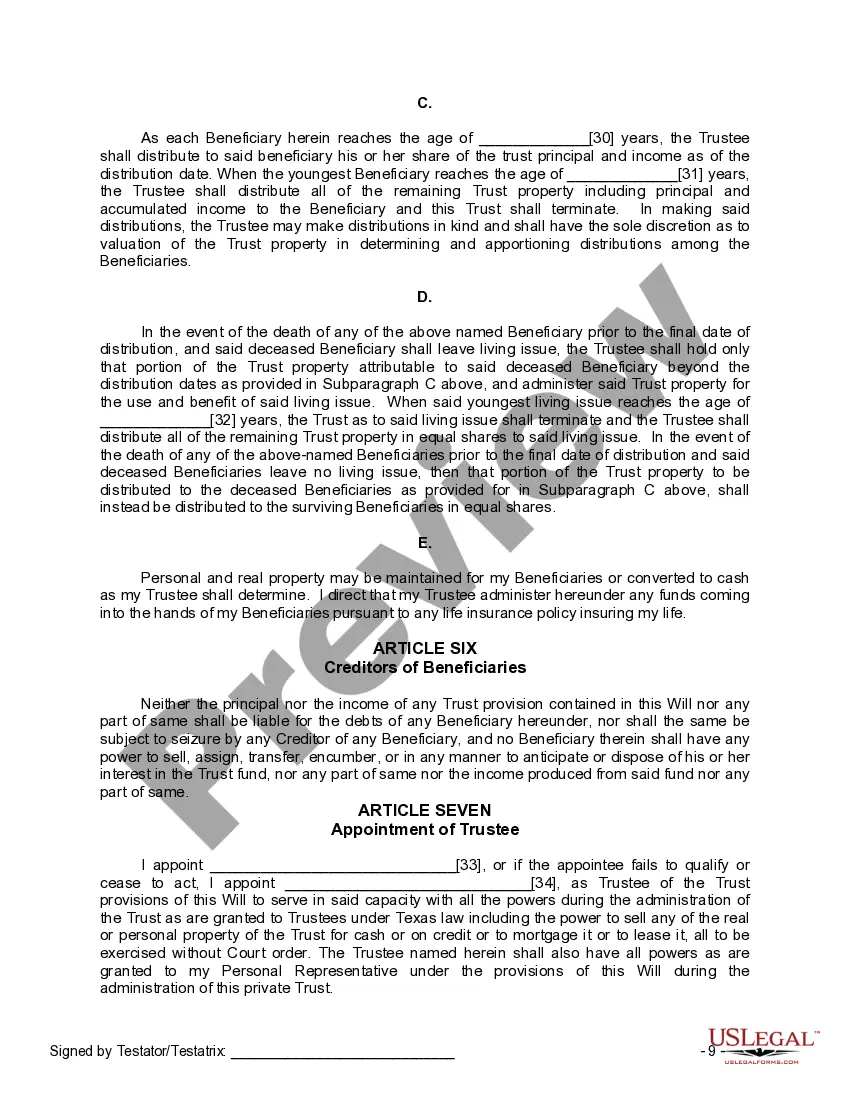

The Legal Last Will and Testament you have found, is for a single person with minor children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions, including provisions for your children. It also includes provisions for the appointment of a trustee for the estate of the minor children.

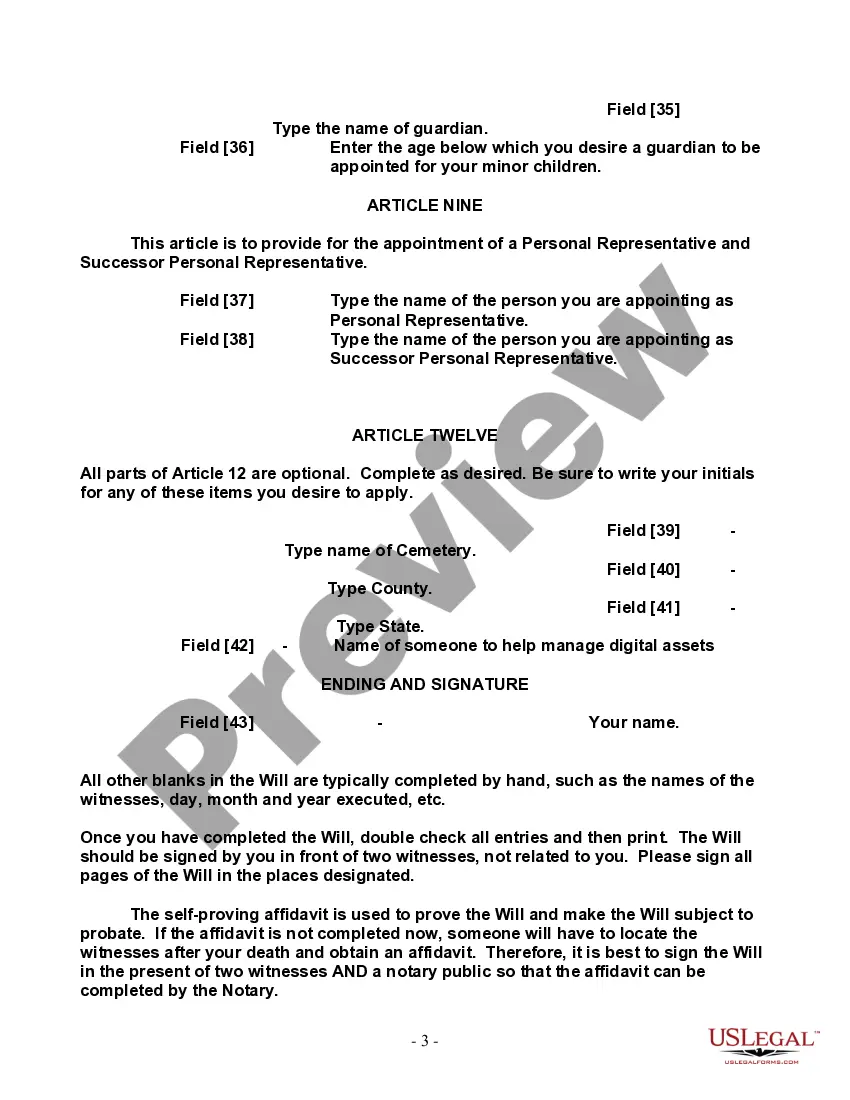

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

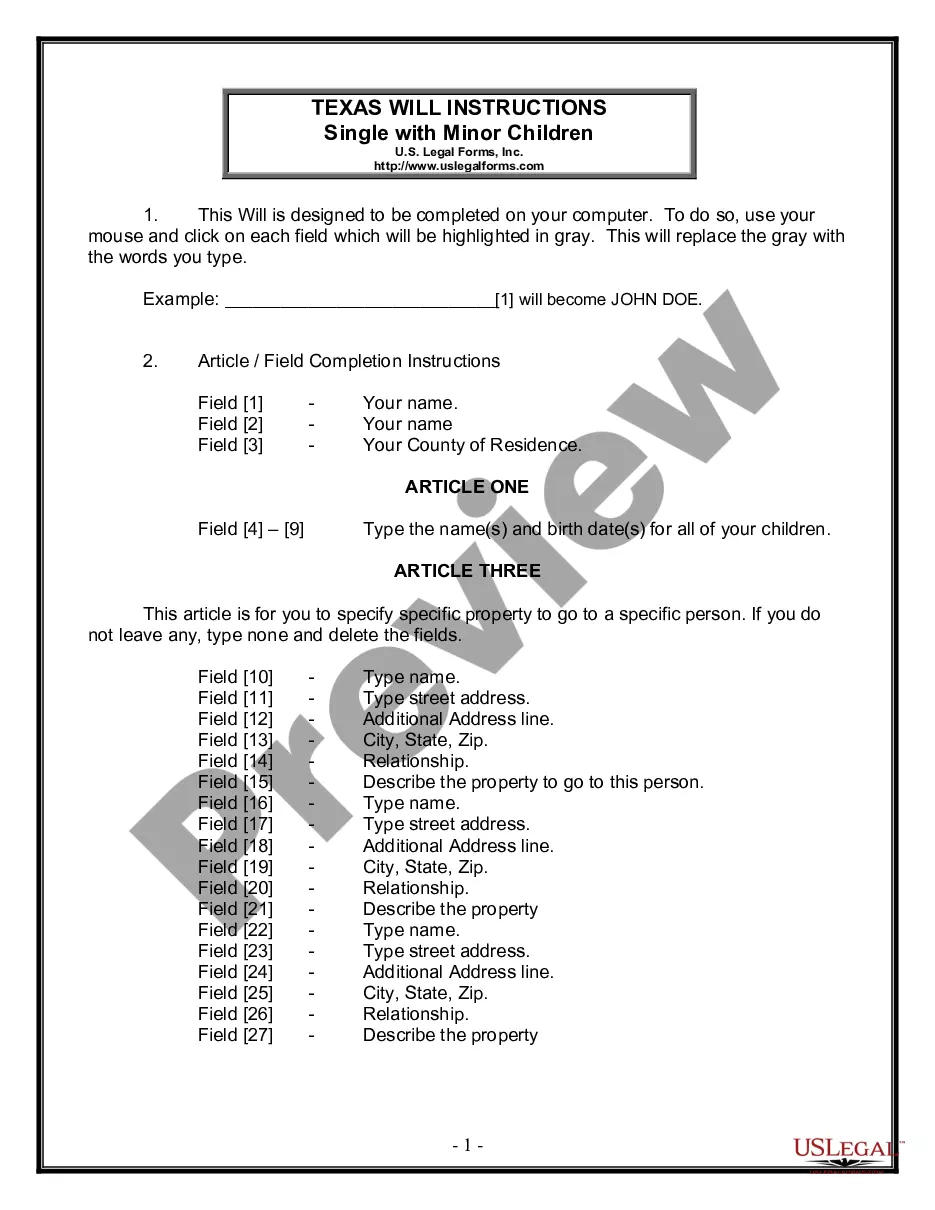

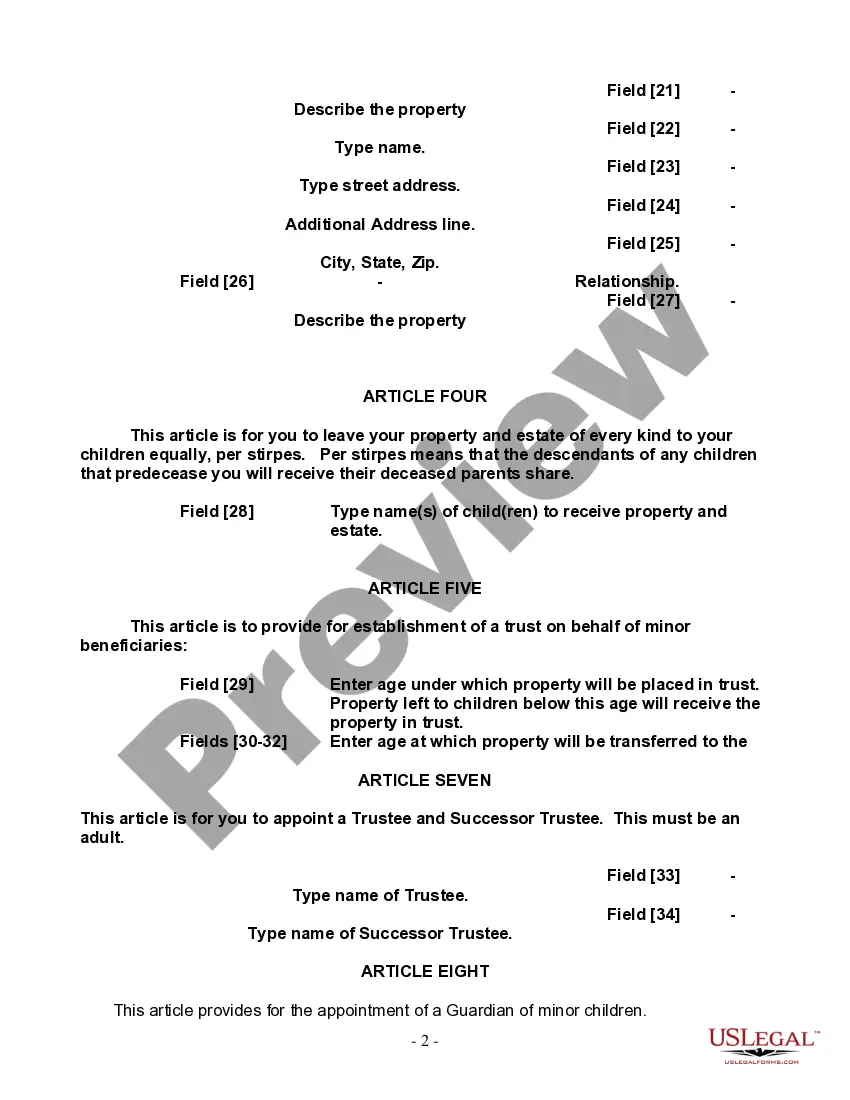

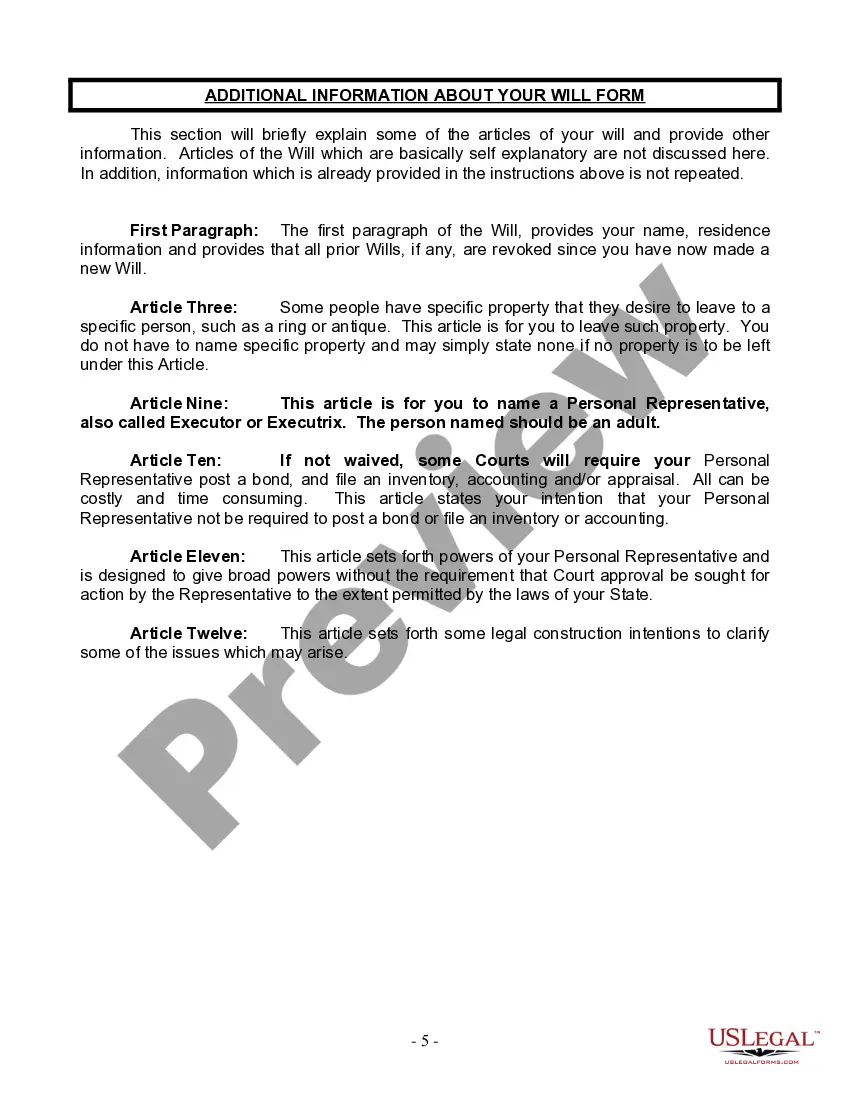

A Brownsville Texas Legal Last Will and Testament Form for a Single Person with Minor Children is a vital legal document that outlines the wishes and instructions of a single person who has minor children regarding the distribution of their assets and the care of their children after their passing. This form ensures that the person's wishes are protected and legally enforced. The Brownsville Texas Legal Last Will and Testament Form for a Single Person with Minor Children typically contains several sections that address various aspects of estate planning and child custody arrangements. Here are the relevant keywords and sections often found in this document: 1. Testamentary Executor: This section allows the single person to name an executor, who will be responsible for managing and distributing their assets according to the instructions provided in the will. The executor should be someone trustworthy and capable of handling the responsibilities effectively. 2. Asset Distribution: Here, the single person specifies how they want their assets, including real estate, bank accounts, investments, and personal belongings, to be distributed among their beneficiaries. They can allocate specific assets to particular individuals or divide them equally among their children. 3. Guardianship of Minor Children: This section is of utmost importance to single parents with minor children. It allows them to designate a guardian — a responsible and suitable person – who will assume the care and custody of their children after their demise. Multiple guardians can be named, with clear instructions on how the responsibilities should be divided. 4. Trusts and Inheritance: In some cases, single parents may choose to set up trusts to manage their children's inheritance until they reach a certain age or milestone. This section allows the person to specify trust details, such as the trustee's name and the conditions for distributing the funds within the trust. 5. Alternate Beneficiaries: It is prudent to include provisions for alternative beneficiaries in case the primary beneficiaries named in they will predecease the single person or are unable to accept the inheritance. This ensures that the assets are distributed according to the person's wishes even in unforeseen circumstances. It's important to note that while there may not be specific variations of the Brownsville Texas Legal Last Will and Testament Form for a Single Person with Minor Children, individuals may choose to customize certain aspects to meet their unique circumstances. However, it's recommended to consult with an attorney to ensure compliance with state laws and to address any specific concerns or considerations.A Brownsville Texas Legal Last Will and Testament Form for a Single Person with Minor Children is a vital legal document that outlines the wishes and instructions of a single person who has minor children regarding the distribution of their assets and the care of their children after their passing. This form ensures that the person's wishes are protected and legally enforced. The Brownsville Texas Legal Last Will and Testament Form for a Single Person with Minor Children typically contains several sections that address various aspects of estate planning and child custody arrangements. Here are the relevant keywords and sections often found in this document: 1. Testamentary Executor: This section allows the single person to name an executor, who will be responsible for managing and distributing their assets according to the instructions provided in the will. The executor should be someone trustworthy and capable of handling the responsibilities effectively. 2. Asset Distribution: Here, the single person specifies how they want their assets, including real estate, bank accounts, investments, and personal belongings, to be distributed among their beneficiaries. They can allocate specific assets to particular individuals or divide them equally among their children. 3. Guardianship of Minor Children: This section is of utmost importance to single parents with minor children. It allows them to designate a guardian — a responsible and suitable person – who will assume the care and custody of their children after their demise. Multiple guardians can be named, with clear instructions on how the responsibilities should be divided. 4. Trusts and Inheritance: In some cases, single parents may choose to set up trusts to manage their children's inheritance until they reach a certain age or milestone. This section allows the person to specify trust details, such as the trustee's name and the conditions for distributing the funds within the trust. 5. Alternate Beneficiaries: It is prudent to include provisions for alternative beneficiaries in case the primary beneficiaries named in they will predecease the single person or are unable to accept the inheritance. This ensures that the assets are distributed according to the person's wishes even in unforeseen circumstances. It's important to note that while there may not be specific variations of the Brownsville Texas Legal Last Will and Testament Form for a Single Person with Minor Children, individuals may choose to customize certain aspects to meet their unique circumstances. However, it's recommended to consult with an attorney to ensure compliance with state laws and to address any specific concerns or considerations.